IFRS 3 Business Combinations and Valuation

Introduction to IFRS 3 Business Combinations Valuation Training Guide

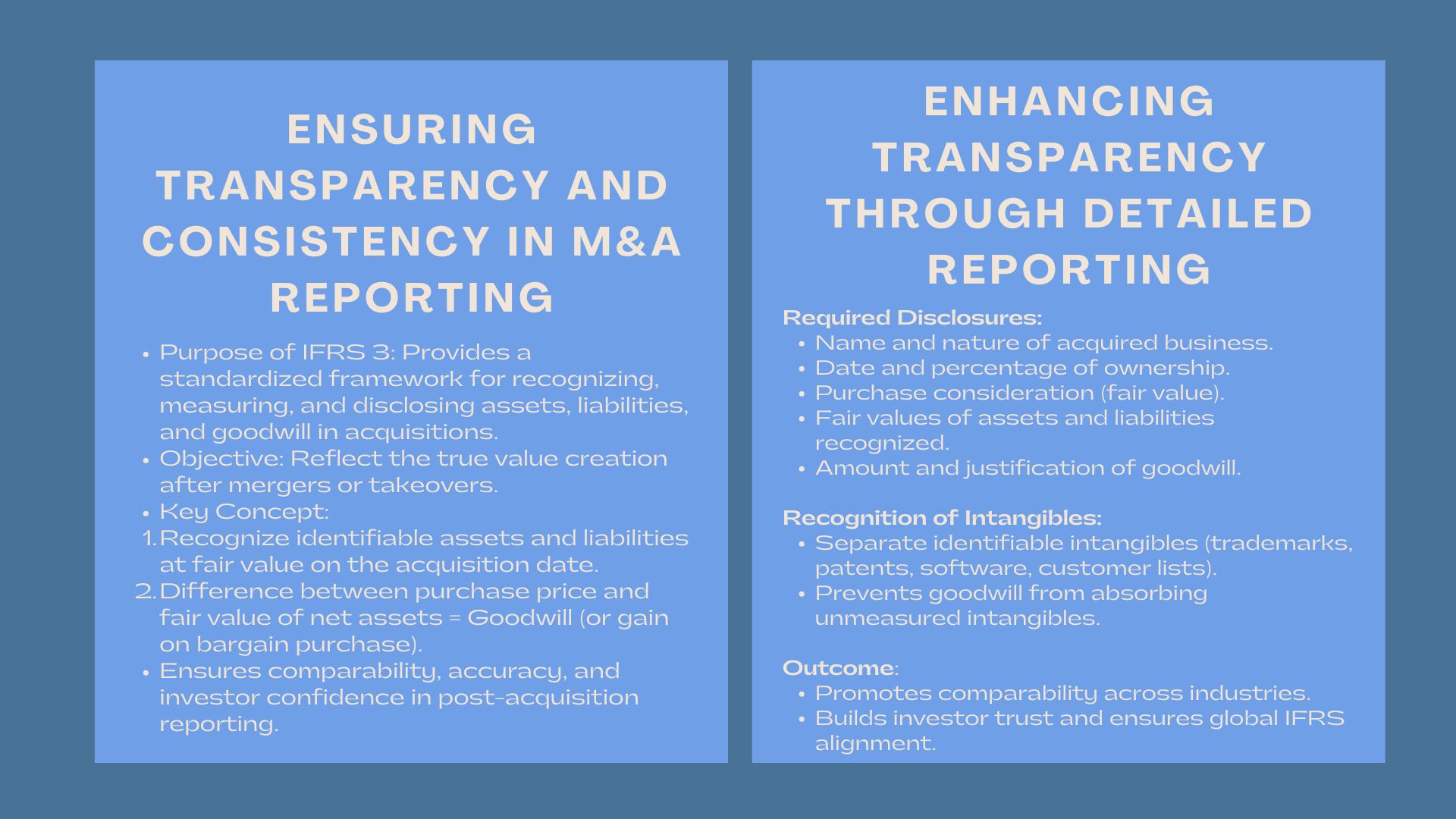

As two companies come together or one takes over the other, there is more than just change of ownership in the process, it is the strategic combination of assets, liabilities and potential future cash flow. In order to make such transactions transparent and comparable, the International Financial Reporting Standard (IFRS) 3 – Business Combinations offers a framework of recognizing, measuring and disclosing assets, liabilities and goodwill, which are a result of acquisitions.

This standard establishes the manner in which the purchase of companies should record identifiable net assets at fair value and an amount that remains as the difference between the two as goodwill or a gain of an under-priced purchase. Through the proper application of IFRS 3, organizations are always consistent in their reporting and provide the stakeholders with the actual value creation after the acquisition.

Business Valuation Principles in IFRS 3.

Business Valuation Principles in IFRS 3.

Determining the Acquired Assets and Liabilities.

Recognition of identifiable assets and liabilities of the acquiree is the first stage in a business combination. These are hard assets (property, plant, and equipment), and soft assets (trademarks, patents or customer relationships).

According to the rules of the IFRS 3, an acquirer should record such assets and liabilities on the date of acquisition, i.e. on the date on which the control is acquired, rather than when the transaction was commenced. All the identifiable assets should fulfill the separability requirement, i.e. they can be sold, transferred or licensed without the business.

This recognition step is essential since it has a direct effect on the overall value assigned in the process of acquisition. The omission of the assets or their incorrect classification can alter the balance sheet of the company, influence the subsequent depreciation or amortization, and finally, the goodwill misrepresentation.

Acquisition-Date Fair Value Measurement.

Upon establishment of an asset and liability, they should be determined at a fair value as of the date of acquisition. Fair value is the price at which an asset would be sold or a liability disposed in an usual trade between the market participants.

The principle is used to make sure that all the recognized items are used to reflect the current market conditions instead of the historical costs. The acquirer has to determine not just the fair value of physical properties but also of the intangibles like intellectual property or customer lists which in many cases constitute a significant part of the contemporary company.

Here, many firms rely on business combination valuation approaches under IFRS 3 for M&A transactions, which involve detailed modeling of each acquired component to ensure compliance and accuracy in valuation. These methods offer the basis of allocating the purchase price.

Handling of Contingent Liabilities.

The recognition of contingent liabilities is also covered in IFRS 3 because the obligation may be the result of previous incidents but the existence of the obligation is contingent upon the occurrence of future events. The acquirer should be aware of these where their fair values can be determined with considerable confidence.

To illustrate, in case the acquiree is experiencing potential litigation, the cost that is expected should be measured and incorporated in the measurement of fair value. Nevertheless, when the obligation is too uncertain or is not reliably estimable then it is disclosed instead of being recognized.

This meticulous treatment avoids exaggeration of liabilities and at the same time represents the investors and analysts with the appropriate depiction of potential risks.

Goodwill Valuation and Impairment.

How to Calculate Goodwill

Goodwill is the price-to-the-fair-value of identifiable net assets in a business combination. It represents some of the intangible factors like the reputation of the brand, market share, synergies, and its future profitability.

The goodwill calculation equation is:

Goodwill = Purchase Consideration + Non-Controling interest + Fair value of the previously held equity interest- Fair value of net identifiable assets.

As an illustration, in an acquisition of Company A by Company B whereby Company B was purchased at RM10 million then the fair value of the net identifiable assets of Company B is RM8 million; the goodwill is RM2 million. This residual value is the future benefits expected to be derived which cannot be clearly distinguished and quantified.

Goodwill should be calculated correctly to report accurately as goodwill will determine the presentation in the balance sheet as well as the impairment assessment in the future.

Annual Impairment Testing Requirements.

Goodwill does not depreciate over time as it is the case with tangible assets. Rather, annual testing of impairment is mandated by IFRS 3 and IAS 36 to make sure that the carrying amount of goodwill is not more than its recoverable amount.

Recoverable amount is determined as the highest of the fair value, less costs of disposal, and value in use (the present value of future cash flows).

In the event of carrying amount that is greater than the recoverable amount, impairment loss should be recorded in the income statement. This will guarantee that the balance sheet will show the actual worth of the goodwill and avoid exaggerated reporting of assets.

Impairment Loss Calculation-Example.

Suppose that the company X had bought Company Y two years ago and made good will of RM5 million. In the latest impairment test, the recoverable amount of the cash-generating unit (CGU) of Y was estimated to be RM4.2 million and the carrying amount was RM5 million.

The impairment loss of RM0.8 million has to be taken over now. This is done to ensure the integrity of reported financials such that goodwill does not exaggerate the true value of the company.

In practice, many firms use professional purchase price allocation and goodwill valuation under IFRS 3 to ensure that goodwill is accurately calculated and properly tested for impairment each year, complying with international accounting requirements.

Acquisition Asset Fair Value Measurement

Valuation Processes: Market, Income and Cost Approach.

In the fair value measurement in the IFRS 3, the measurement of the assets and liabilities is usually conducted in one or more of the three standard approaches:

- Market Approach: Relies upon the market transactions and associated prices of markets that have traded in the same or similar assets. An instance is that the value of property or listed securities can be determined by the recent sale of them in the market.

- Income Approach: Transforms the future cash flow or income streams into a present value, by means of discounting. This is commonly applied in valuing intangible assets, including customer relationship or brand name.

- Cost Approach: This calculates the money needed to restore the service capacity of an asset considering depreciation or obsolete assets. Special machinery and equipment are usually sold using this technique.

The two strategies are strong given the nature of the asset and availability of data. The professional valuation should select the most suitable model according to the credibility of market inputs and nature of the business that has been acquired.

Intangible Assets Recognition.

Among the key efforts of IFRS 3 is the need to separate identifiable intangible assets and goodwill. These are trademarks, technology, customer list and non-compete agreements, which are essential in goodwill and brand equity valuation under IFRS for intangibles to ensure accurate financial reporting and transparent business combinations.

A recognition and quantification of such assets ensures that goodwill is not the aggregation of unmeasured intangibles, but rather goodwill as a representation of true residual value. An example is that when a firm buys another technology company the its proprietary software and patents have to be valued separately with the help of suitable models like the relief-from-royalty use of model or multi-period excess earnings use of model.

This granular identification also gives investors a better insight into the assets that are going to contribute to the future profitability.

Financial Statement Disclosure Requirements.

IFRS 3 is based on transparency. The acquisition of entities should reveal specific information concerning the acquisition in their financial report, which includes:

- The acquired business names and descriptions.

- The date of acquisition and percentage of ownership acquired.

- The consideration transferred at fair value.

- The identified values of all the significant types of assets and liabilities.

- The amount and reasons of the goodwill recognition.

These disclosures give the stakeholders an understanding of the financial effects of the acquisition, which is better compared across entities and industries. Auditors can also use proper documentation to substantiate whether the combination was taken account of within the stipulations of the IFRS 3.

Conclusion

The IFRS 3 offers a clear structure of what to include with regards to business combinations in terms of recognizing, measuring and disclosure. It imposes a fair-value requirement on assets and liabilities and sets forth explicit parameters and mandates on goodwill recognition and impairment to ensure that transactions associated with acquisitions reflect an accurate picture of a company in terms of finances.

By means of the systematic use of fair value principles and strict disclosure activities, organizations increase investor trust and generate transparency. Regardless of the size of cross-border merger and the acquisition that a company is undertaking, IFRS 3 compliance would keep the financial reporting process good, compliant, and comparative in the international markets.