Renewable Energy Project Valuations – Singapore & Malaysia 2025 Insights

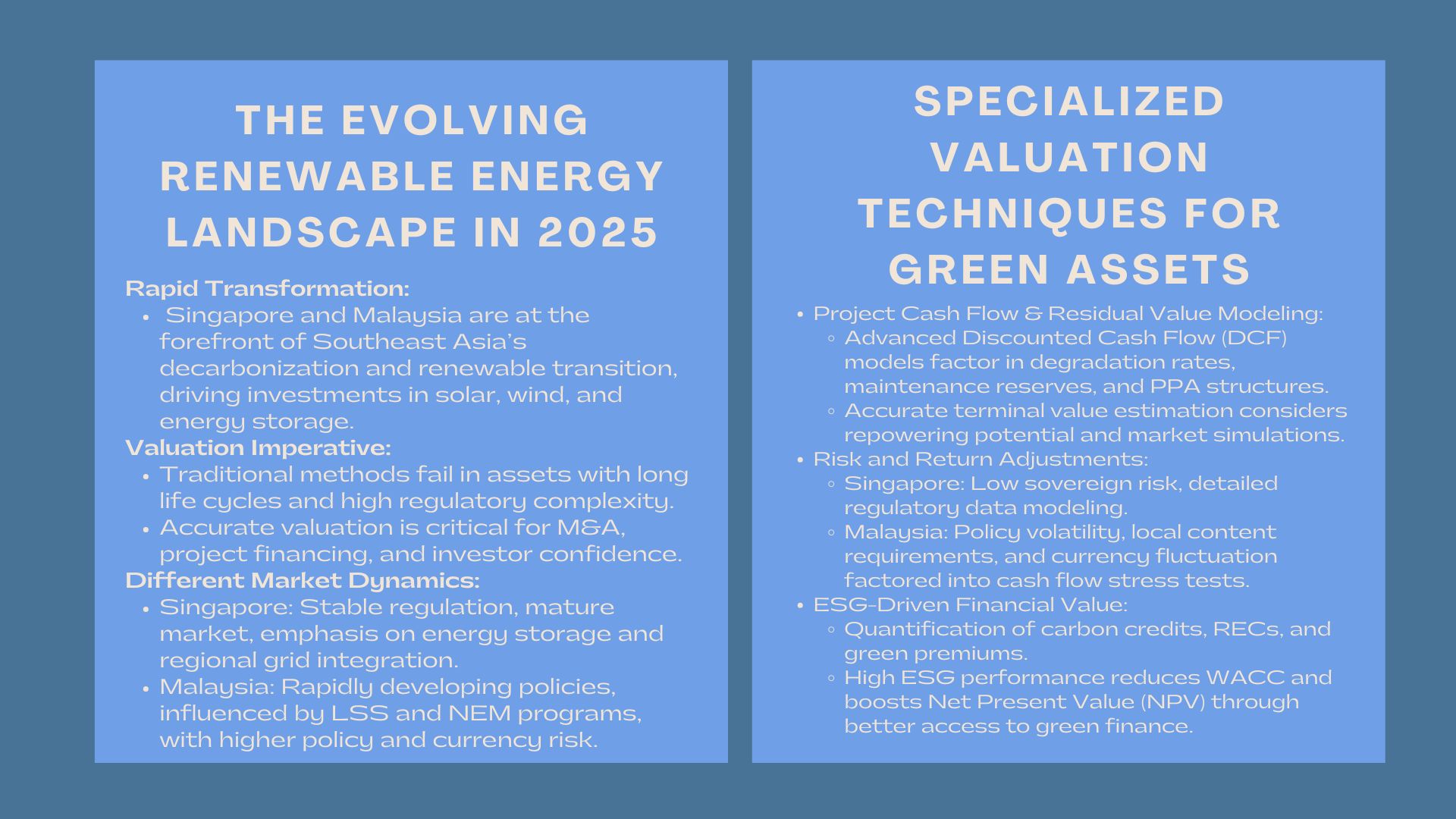

The energy picture in Singapore and Malaysia is changing radically and rapidly. The two countries have ambitious decarbonization and renewable energy uptake goals that are driving an avalanche of investments in solar farms, wind farms, and large-scale energy storage projects. To the financial institutions, infrastructure funds and the energy developers leading this multi-billion-dollar transition, the stakes are exceptionally high.

The models of traditional valuation applied to more conventional types of assets such as gas turbines or coal plants are simply inapplicable in a sector characterized by special regulatory risks, long asset lives and changing technology costs. Any successful transaction in renewable energy has its foundation in accurate and defensible valuation. It dictates the returns on investments, manages mergers and acquisitions (M&A), as well as it gets financing by the international lenders like development banks and export credit agencies.

In the future as the market matures in 2025 and beyond, experts who have mastered advanced, industry-specific valuation techniques start to become the most important actors. The current article offers the necessary understanding of the tricky valuation problems peculiar to Singapore and Malaysia and emphasizes the professionalism needed to navigate the dynamic, high-value investment space and ensure that the projects would reach maximum bankability.

In the Energy Hubs of ASEAN, it is the Valuation Nuances that have to be realized.

In the Energy Hubs of ASEAN, it is the Valuation Nuances that have to be realized.

Geographically adjacent, Singapore and Malaysia are two countries with vastly dissimilar risk profiles and regulatory environments which have significant effects on project valuation and cost of capital.

Risk Modelling of Singapore with High regulation.

The Singapore market is characterized by stable regulatory environment, competitive auctioning of power generation and a high emphasis on energy storage and regional power grid interconnectivity which is commonly synchronised by using complex cross border arrangements. Valuation here focuses on very accurate Discounted Cash Flow (DCF) modeling, taking a very careful look at long-term revenue forecasts based on sophisticated Power Purchase Agreements (PPAs) or electricity markets. The main issue is the effective measure of technological risks of the advanced storage solutions, required to ensure the stability of the grid, as well as the viability of the project within the stringent market environment.

Specialists acting as renewable energy valuation specialists for projects in Singapore and Malaysia must integrate granular data on market saturation, system losses, and the cost of capital specific to this mature, low-sovereign-risk environment, ensuring the valuation is robust enough for institutional investors and regulators like the Energy Market Authority (EMA). Moreover, the sustainability of the projects in the long-term will be to model carefully the land lease dynamics peculiar to the dense city of Singapore.

Malaysia takes into consideration its Developing Policy and Local Content.

The renewable energy industry in Malaysia is fuelled by the government initiatives such as the Large Scale Solar (LSS) tenders and Net Energy Metering (NEM) projects, yet many projects have been facing the challenge of an increased risk of development and inconsistent application of regulations among states. Risk-adjustment is extremely advanced in valuation. The valuers should analyze the project terms of the PPA, currency risk (fluctuation of the MYR) and regulatory changes very attentively as they directly affect the required rate of returning.

One of the key factors that should not be ignored is the influence of the local content requirements and supply chain complexities that are required by certain government programs and may influence the capital expenditure (CapEx) and operational expenditure (OpEx) forecasts. A specialist should be capable of using proper market and political risk premiums and stress-test cash flows in respect of any possible changes or delays in policy, in order to give a plausible valuation which would strike a balance between high growth potential and frontier market development exposures, and changing energy infrastructure requirements.

Green Assets and intangibles Special methodologies.

Most value in renewable energy projects is in not traditional or tangible property, and requires specialized valuation methods which go beyond the purview of general financial analysis.

Further Modeling of Project Cash Flows and Remainder Value.

The analysis of a utility-scale solar or wind farm is a task that demands some financial modeling expertise. In contrast to traditional power plants, green energy assets expire (usually at the expiration of the PPA term) and may have large residual value, especially in the case of long-life infrastructure. The experts have to compute the project cash flows throughout the contract period, and special care should be taken with the degradation rates, complex OpEx escalators, and maintenance reserve accounts that the lenders need.

Importantly, since this method demands future electricity prices and the structure of the specific PPA, to compute the correct terminal value, or the value of the project after the initial period of the PPA, makes it necessary to project future electricity prices, as well as PPA structures based on complex market simulations and long-term grid demand forecasts. Utilizing professional green energy project valuation consultants in Singapore and Malaysia ensures these intricate variables, including the potential for asset life extension through repowering, are accurately integrated into the valuation model, directly impacting the calculated Enterprise Value (EV).

Quantifying Environmental, Social, and Governance (ESG) Value

The value of a project today is more dependent on its Environmental, Social, and Governance (ESG) performance, usually in the form of quantifiable financial returns in 2025. Investors and lenders in Singapore and Malaysia have introduced a green premium or a brown premium on the basis of sustainability and corporate governance indicators. Valuation specialists will have to measure the variables like; the value of the carbon credit, the project contribution to Renewable Energy Certificates (RECs), and meeting international climate finance standards.

This includes simulating the financial value of high ESG performance in the future, which is capable of lowering the weighted average cost of capital (WACC) of the project as a result of enhanced access to cheaper green financing sources, directly boosting its Net Present Value (NPV) and competitive advantage when raising funds.

Strategic Focus: M&A, Compliance and Transaction Bankability.

Renewable energy appraisal is also part of capital administration, application of transactions and long term economic prosperity of the energy assets profile of the two countries.

M&A/ Portfolio Optimisation.

The M&A of renewable energy assets in Southeast Asia is a busy sector that is fueled by infrastructure funds in pursuit of securable long-term cash flows. The technical professionalism necessary to conduct such deals is offered by valuation specialists, such as carrying out a rigorous Purchase Price Allocation (PPA) of the financial reporting following an acquisition, and carrying out an effective due diligence that legitimizes all the technical, regulatory, and financial assumptions at the bottom.

In the case of established energy companies, frequent valuation assists in portfolio optimisation; which means retaining high-performing assets and disposing of non-core assets to maximize shareholder value and release funds to be invested in new greenfield projects.

Bankability and Procuring Project Financing.

Bankability- Its acceptability to senior lenders is the ultimate test of a renewable energy project valuation. The valuation report is the primary document, according to which debt sizing and credit risk analysis are carried out. Expert consultants guarantee the conformity of the valuation to the high standards of the international commercial banks and development finance institutions (DFIs), which offer assurance on the main project assumptions regarding the long-term PPA stability, operational efficiency, and insurance cover.

Developers can maximize the debt-to-equity ratio by obtaining larger loan facilities at excellent rates by having a strong, well-supported valuation, which is essential in terms of maximizing equity returns.

Conclusion: Renewable Energy Project Valuations

Singapore and Malaysia have a one-off, high growth investment frontier in the renewable energy field. Financial analysis is directly proportional to success. The generic valuation practices cannot be used because of intricate combination of regulatory risks, custom project finance vehicles, and the requirement to quantify intangible ESG value.

Through the use of professionals knowledgeable in sophisticated and sector-specific frameworks such as rNPV and complex DCF, investors and developers will be able to navigate the complexities of the regional market, reduce the impact of capital risk, and ensure the capital needed to facilitate the monumental energy shift that needs to occur throughout Southeast Asia.