Why Family Businesses in Singapore Need Regular Business Valuation

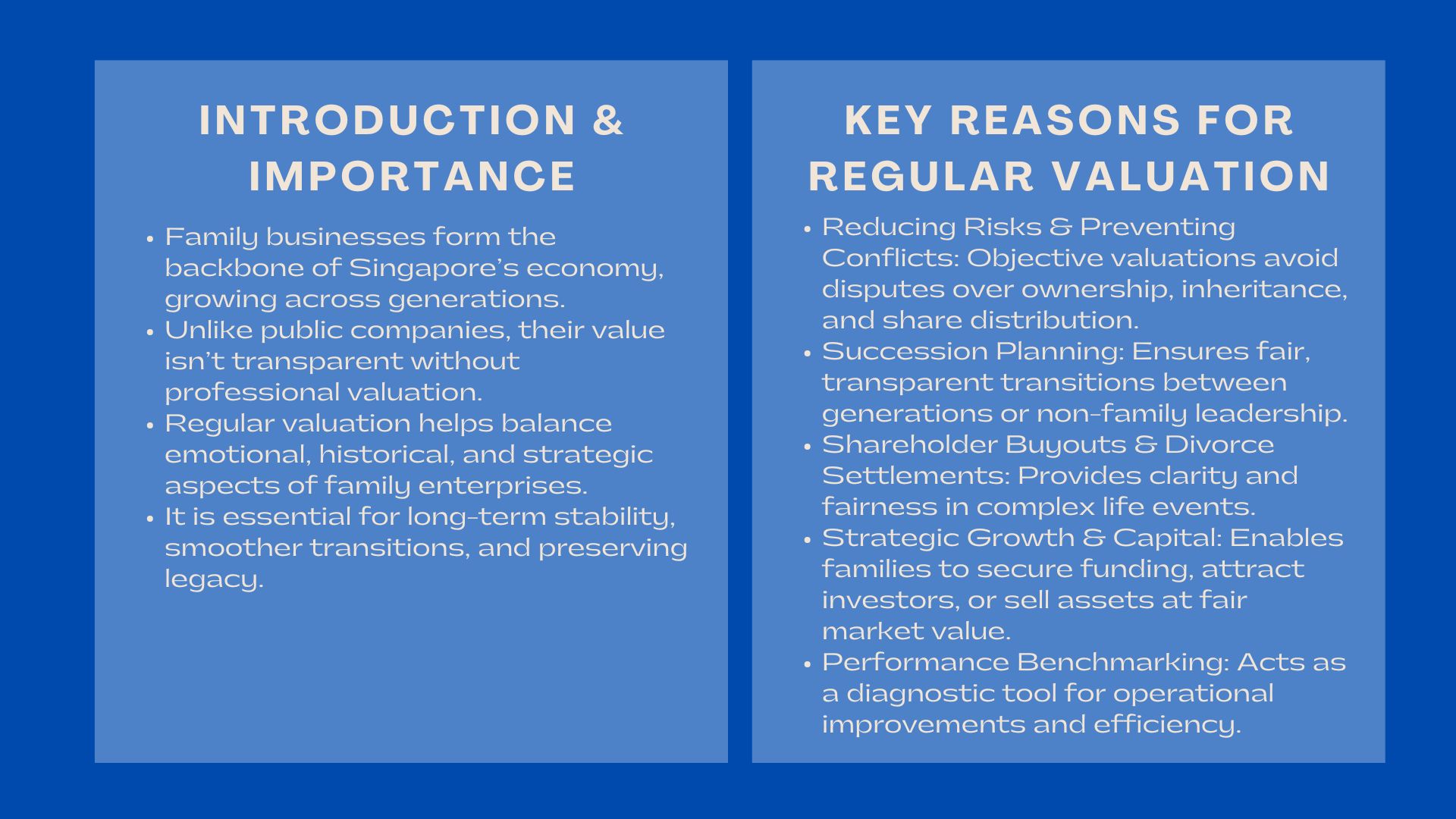

The Singapore economic environment is awash with family business, most of which are the back bone of the national economy, having risen above their simple origins to success stories of multi-generation. Out of prosperous hawker stalls turned restaurant chains to the production empires that run decades long, these businesses capture the spirit of long term growth and continuity.

Nevertheless, the peculiarities of family business organization, the blend of individual relations with corporate resources, introduces new challenges that require a certain degree of financial vision that is usually neglected: the necessity of periodic corporate valuation. The value of a private family business may not be transparent, unlike those of publicly listed companies that the market continually values, resulting in high risks without periodic and professional valuation.

We realize the complexity of dynamics that characterize family businesses at Valueteam.com.sg. We are not just number crunchers but see the emotional, historical and strategic layers that add to the value of a family enterprise. This article will explore the persuasive arguments as to why proactive and regular business valuation is not only good practice, but a fundamental requirement to long-term health, stability, and successful transition of the family-owned companies in Singapore. It will investigate the way routine valuations will reduce risks, open opportunities, and eventually conserve legacies through the generations.

Reducing Risks: Making it just and avoiding conflicts.

Reducing Risks: Making it just and avoiding conflicts.

Family and business are intertwined to present some unique vulnerabilities. The absence of objective and transparent financial evaluation may provide easy grounds of disagreements both at the familial level and at the business level.

Succession Planning Pitfalls to avoid.

The most significant junction that a family business can have is succession planning. Bringing new management (non family) or transferring ownership to the next generation, or even planning a subsequent sale, the correct valuation is essential. In the absence of a clear and agreed upon value, it is exceedingly hard to divide shares evenly among the heirs, and this results in accusations of favoritism, bad blood, and even an expensive court case.

To give an example, when one of the children had been actively engaged in the business and another had chosen an external career, which contributions and inheritances of theirs should be fairly valued? A professional valuation is a definite starting point, which allows transparency and trust. This preemptive measure highlights the importance of regular business valuation for family-owned companies in Singapore, enabling smooth transitions that protect both wealth and relationships.

Navigating Shareholder Buyouts and Divorce Settlements

Unforeseen complexities may be brought in by life events, unfortunately. The exit of a family member- retirement, wish to venture elsewhere, divorce etc- often requires the necessity to buy out the interest. In the absence of a recent, reputable valuation, negotiating a fair price of a buyout can become a bitter fight real fast, consuming resources and focus on actual business processes.

Likewise, when a key figure in a family goes through a divorce, business property is often used as the focal point of the negotiations. Professional valuation protects the business against being underestimated or overestimated in disputable legal cases, which results in a just decision by all parties and keeps the business financially sound. These benchmarks are kept up to date by regular valuations, so that the business will be ready to face any eventuality with clear and data-driven numbers.

Setting the Camel Ablaze: Strategy and Capital.

In addition to risk mitigation, regular valuation has invaluable insights that gives the family businesses the power to make sound strategic choices, such as raising new capital as well as maximizing their organizational structure.

Maximizing Strategic Decisions and External Capital.

In the competitive business environment in Singapore, family businesses find themselves in a situation whereby additional capital is required to propel growth, initiate innovation or even take over other firms. The strong and recent business valuation is nonbargainable whether it is bank loans one wants, venture capital or even in the case of investment in the form of private equity. It also shows financial maturity, offers plausible negotiation grounds and the confidence developed among prospective investors.

On the other hand in case the family resolves to sell a non-core asset or even the whole business, professional valuation makes sure that the family gets the right market value so as to get the maximum of their reward of generations of effort. As we have observed, those businesses whose valuation remains consistent are much better placed to take advantage of these opportunities of growth decisively. This proactive approach underscores the value of engaging trusted valuation advisors for family businesses in Singapore who understand both local market conditions and global investment standards.

Performance Benchmarking and Operational Improvement

A business valuation is not a picture but is a diagnostic tool. Frequent appraisals compel an objective examination of the financial results, efficiencies of its operations, and its placement within the industry relative to competitors. Using the drivers of value as defined in the valuation report as recurring revenue, strong brand equity, or efficient cost structures, family business leaders can identify areas where the operations may be improved, increase profitability, and actively create long-term sustainable value. This is a self-perpetuating feedback loop that enables the family to know what is actually adding up to their wealth to make decisions about capital allocation in the business and to see where strategic investments can make the most money.

Preserving Legacy: Securing Multi-Generational Success.

Finally, in the case of many family enterprises, the aim is not just the profit but also the continuation of the legacy and the security of the generations to come. Frequent valuation plays an important role in this accomplishment.

Easy Preparation of Estate planning and transfer of wealth.

Efficient estate planning is essential in order to have an easy, tax-efficient transition of wealth to the future generation. One of the elements in this is the awareness of the present value of the business. In its absence, the family would not be able to plan with accuracy on inheritance taxes, make fair distributions among the heirs (some of whom may not be in the business) and establish trusts and other wealth management instruments in place and adequately funded.

The clarity offered by regular valuations gives the family the ability to plan years ahead to reduce possible tax liabilities and also to avoid being caught unawares by bad situations. This futuristic safeguards the assets of the family, and their idea of how they want the business to be in the future is achieved.

Developing a Resilient Response and Emerging as a Change Agent.

The business environment is dynamic and the family business needs to evolve in order to stay afloat. Periodic valuation serves to provide a financial health test and thus compel the family to face the realities in the market, evaluate the competitive pressures and areas where innovation or restructuring may be required. It assists family leaders to know the actual economic returns to their investment in the business compared to other opportunities. This objective financial perspective enables the family to make difficult yet viable decisions that will keep the business afloat and competitive to the generations to come, which will be a legacy that they, with so much hard work, have created.

Conclusion: Why Family Businesses in Singapore Need Regular Business Valuation

Regular business valuation is much more than a compliance exercise and an imperative to family businesses in Singapore. It is a crucial means of risk mitigation, internal conflict prevention, growth capital and performance optimization and above all, a multi-generational legacy. Through proactive valuation, the family leaders will be able to manoeuvre through difficult transitions with ease and confidence, and their business organisations not only survive but flourish well into decades, still providing value to Singapore through its lively economy.