Why Companies in Singapore Need a Fairness Opinion Before Major Deals

Introduction

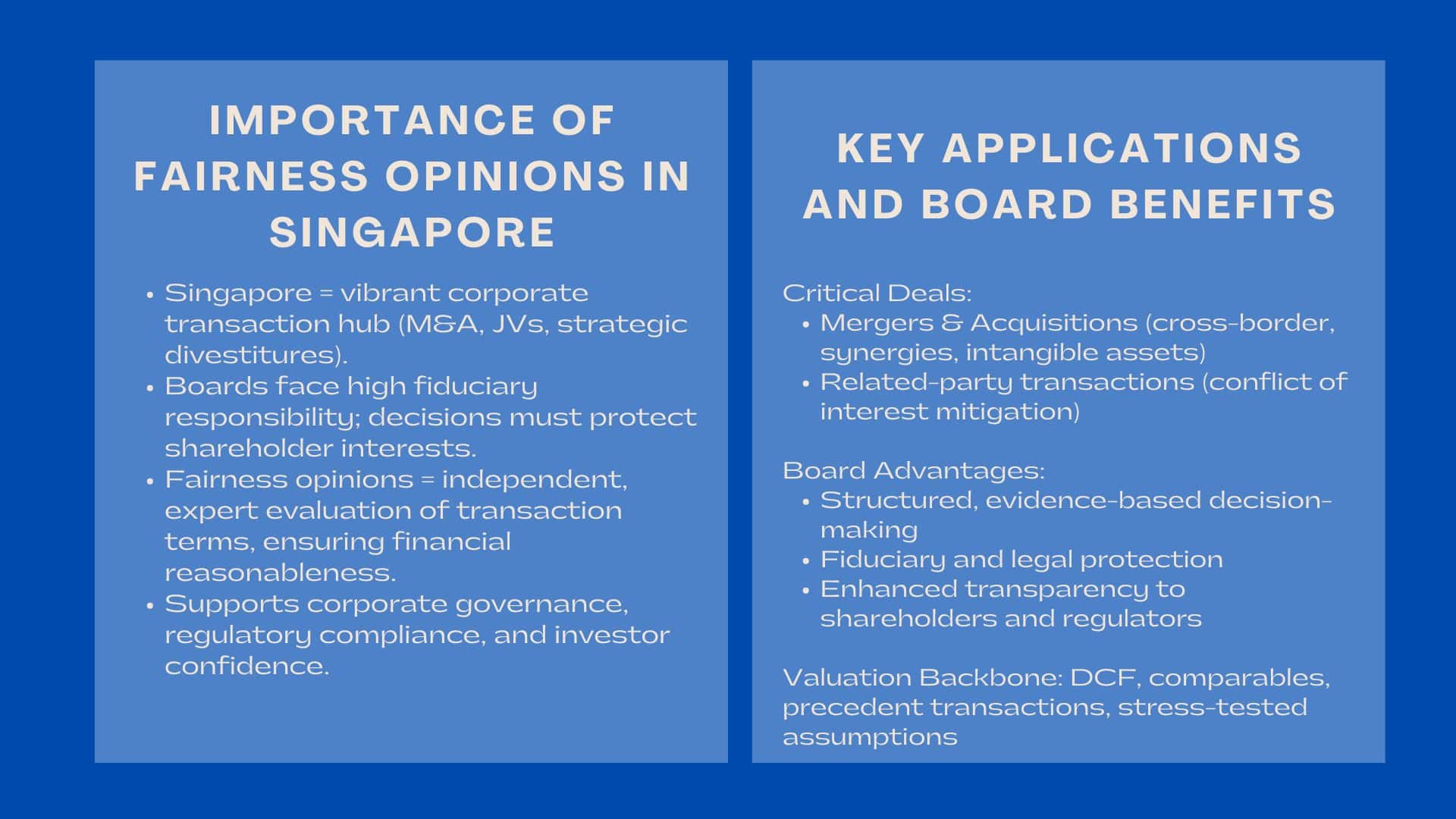

Singapore is one of the most vibrant corners in corporate transactions in Asia. Whether by mergers and acquisitions (M&A) or joint ventures and strategic divestitures, businesses throughout the industries are in a constant frenzy to build their strengths in the market. These transactions however have enormous financial and governance implications. The board of directors has a particularly high stake as it has a duty of making sure that all the decisions made are in the best interest of the shareholders.

The fairness opinion has been one of the tools that have been getting greater prominence in this environment. A fairness opinion is more than a formality because it gives independent and expert consideration to assessing the financial reasonableness of the terms of an intended transaction. Fairness opinions have emerged as an essential part of responsible deal making in Singapore, where facilitation of corporate governance and regulatory compliance is the primary focus of investor confidence.

The Increasing Applicability of Fairness opinions in Singapore.

The Increasing Applicability of Fairness opinions in Singapore.

Corporate Governance in the Limelight.

The reputation of Singapore as a reputable financial centre is based on sound governance structures. The Singapore Exchange (SGX) has strict disclosure and accountability requirements of companies listed therein. Boards should be ready to demonstrate that they have made their decisions transparently, as well as in good faith when a significant transaction is announced. The commitment is reinforced by independent assessments like fairness opinions which proves to the regulators and investors that the directors acted wisely.

Protecting Shareholder Confidence

Investor trust is a cornerstone of Singapore’s financial markets. Without reassurance, shareholders may question whether a transaction benefits them fairly. This is why companies in Singapore rely on fairness opinions before mergers. Through the use of independent advisors, boards have the ability to convey the message of the deal terms to have been vetted against market data and valuation standards. This is not only a proactive action that will safeguard the image of the company but also avoid disputes of shareholders that will spoil the deal.

Important Cases in which fairness Opinions are necessary.

Mergers and Acquisitions

M&A deals are not very easy, they include cross-border factors, intangible assets, and unrealized synergies. Boards need to make sure that the price negotiated is fair value. The fairness opinion assists in confirming these assumptions and thus directors work with more confidence. To illustrate, in a merge involving two technological companies fairness opinion may emphasis on customer retention, or cost saving projections, making them realistic.

Related-Party Transactions

The related-party transactions are very sensitive in Singapore where the transaction may suggest the conflict of interest. Fairness opinions are an independent protection whether it is an acquisition of a subsidiary by a parent company or a business transaction conducted between companies having common shareholders. They enable boards to prove that the terms are fair and justifiable as a way of shielding directors against the possible legal or reputational impact.

The Opinions of Fairness and the Enhancement of Board Responsibilities.

Improving the Processes of Decision-Making.

Boards tend to run out of time in assessment of transactions. Fairness opinion gives a systematic, evidence-based model that keeps the directors informed of all the issues before a deal is approved. This is a systematic method of accountability and the likelihood of the directors being charged with negligence is minimized.

Fiduciary Protection and Legal Protection.

Singaporean directors have fiduciary obligations towards their companies and shareholders. They are facing a lot of risks since they are approving a transaction without proper due diligence. The involvement of fairness opinion providers also introduces an element of legal safeguard, and it demonstrates that the decisions were taken in a responsible manner. Fairness opinions are commonly regarded by the courts and regulators as evidence that boards exercised care.

The Fairness Opinion Valuation Backbone.

Methodologies Used in Singapore Deals.

Valuation is at the heart of every opinion of fairness. Advisors can rely on discounted cash flow (DCF) models to evaluate future earnings, trade comparables to compare with similar companies, or examine previous transactions to ascertain consistency of the market. All approaches offer a different kind of insight and when united, they create a complex image of financial fairness.

Checking Assumptions against Reality.

Fairness opinions are not fixed reports. The assumptions that they need to be stress-tested include revenue growth, cost synergies and market risks. Through a rigorous application of scenario analyses, advisors would always make sure that directors are well aware of risks that are downside. This reinforces the importance of fairness opinion for major deals in Singapore, where transparency and prudence are central to board responsibilities.

Why Independent Advisory Matters

Preventing Conflicts of Interests.

Board members should not just trust transaction advisors who might be interested in the success of the deal. The provisers of s/he independent fairness opinion offer objectivity to the process and, therefore, their conclusions cannot be biased. Their autonomy raises the respectability of decisions made by the board and gives them confidence to the external stakeholders.

Creating Investor Trust by Transparency.

Nowadays, investors are demanding more transparency in decision-making in the boardrooms. When the companies engage an independent fairness opinion, it provides a strong indication that they cherish transparency. This does not only build investor confidence but also makes the company a governance leader in the Singapore competitive marketplace.

Issues with Fairness Opinions.

Strict Deadlines and Pressure of the Deals.

The opinions of fairness may often have to be prepared within a short time-period particularly when deal negotiations are of a fast-paced nature. Thorough analysis should not be compromised with efficiency because advisors need to be accurate. In turn, boards have to reserve ample time to examine the findings of the findings.

Dealing with Complex Deal Structures.

Singapore being a center of cross-border transactions implies that providers of fairness opinion, more often than not, consider cross-jurisdictional, cross-currency, and cross-regulatory transaction. These are complexities that demand superior skills and in-depth market knowledge. Otherwise, fairness opinions will tend to simplify key information.

Practical implications to Singapore Companies.

Benefits of the Investor Relations.

By including a fairness opinion, even when major deals are announced, companies are making a statement to the investors that they are transparent. This tends to result in less objectionable shareholders and less opposition of activist investors.

Long-Term Governance Value

In addition to individual transactions, fairness opinions help in a culture of responsibility. Firms that maintain the principle of independent advisory services develop the image of reliable and well managed firms, with the long time investors having confidence with such firms.

The Future of Fairness Opinions in Singapore.

The need of fairness opinions is also likely to increase with emergence of Singapore as a global deal maker. The regulatory atmosphere will be stricter, and shareholder activism will keep increasing. Those companies that take the initiative of embracing the fairness views will be in a better situation to sail through these changes as their deals will not just be financially healthy but also they will be in tandem with the governance best practices.

Technology will as well contribute to the formation of opinions of fairness. State-of-the-art analytics, artificial intelligence (AI)-based valuation models, and availability of real-time market information will improve the level and rapidity of independent evaluation. Those consultants who adopt such innovations will be reliable collaborators to boards throughout Singapore.

Conclusion: Why Companies in Singapore Need a Fairness Opinion Before Major Deals

It is no longer optional in the changing Singaporean M&A landscape that has fairness views. They are one of the critical instruments that boards should consider to strike a balance between shareholders, regulatory and fiduciary duties. Through independent assessment, business entities would be accountable, enhance trust in investors, and reduce risks in high stakes deals. In the case of Singaporean companies about to engage in a merger, acquisition or other related-party transactions, fairness opinions are a veil of transparency and a symbol of irresponsible governance.