Understanding the IFRS 13 Fair Value Hierarchy: Levels 1, 2, and 3

Depth Understanding IFRS 13 Levels 1 2 3

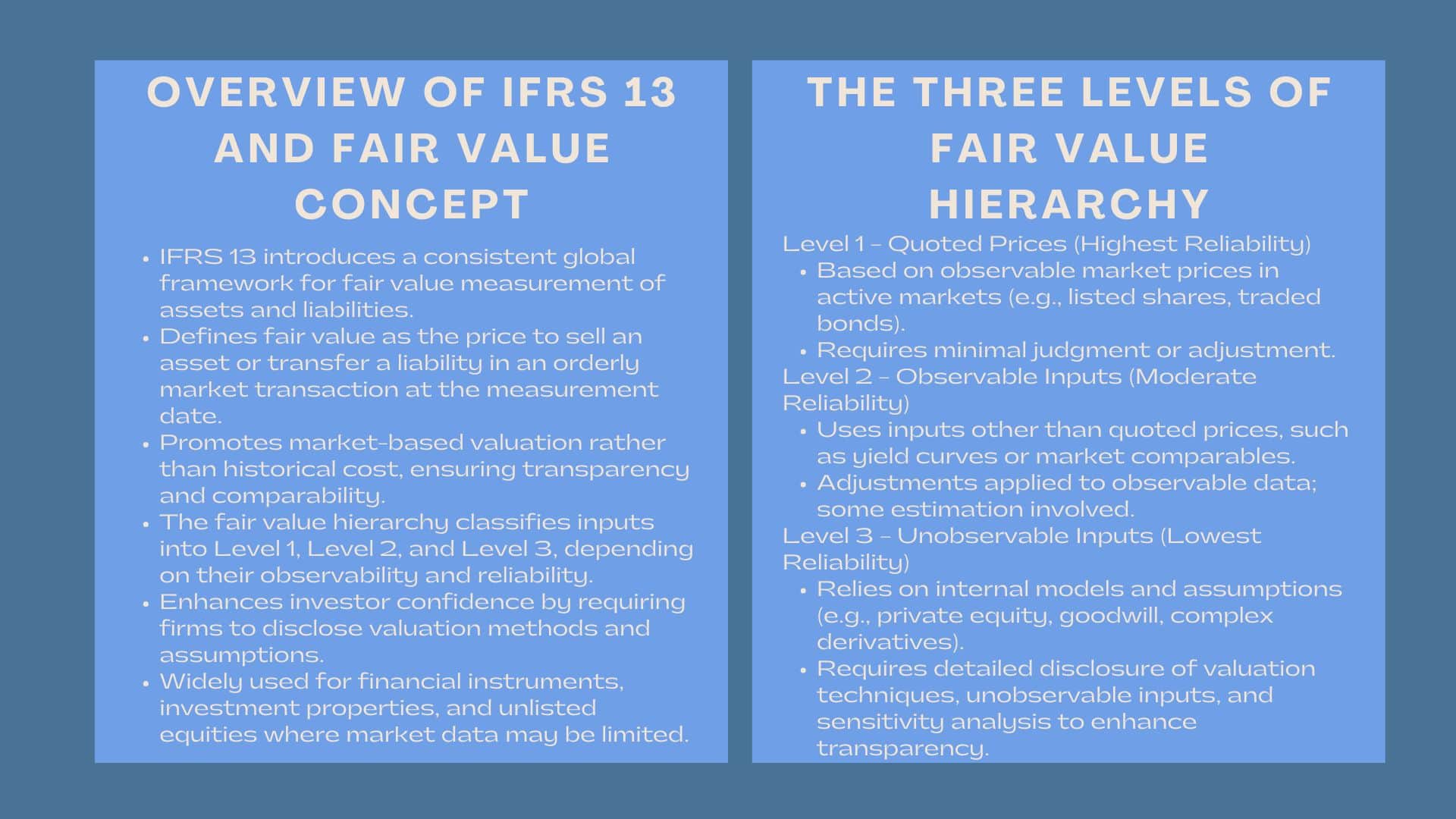

One of the most important concepts in the modern accounting and financial reporting is the fair value measurement under IFRS 13. It offers a uniform model of fair valuation of assets and liabilities, which is consistent and transparent in all industries. This standard aims at enabling investors, auditors, and regulators to know how companies derive reasonable value estimates especially in markets that are intricate and in which observable information might not be always accessible.

Introduction of fair value hierarchy by IFRS 13 is aimed at categorizing the inputs to valuation into three different levels including Level 1, Level 2 and Level 3 depending on the observability and reliability of the inputs used. This hierarchy enhances comparability because it ensures firms report on the basis and nature of their valuation assumptions, which enhances confidence of the stakeholders in reported values.

The Measurement of Fair Value: The Concept.

The Measurement of Fair Value: The Concept.

The IFRS 13 defines the fair value as the amount that would be obtained by selling an asset or paying to dispose a liability in an ordinary transaction between the market participants at the date of measuring the value of the asset. Fair value is also concerned with the market conditions unlike in historical cost accounting where past purchase prices are recorded.

The fair value measurement goal is to estimate the price that would be achieved in an actual market transaction based on the current circumstances and not by a forced sale or liquidation. As such, valuation professionals should take into account data of the market, assumptions of the market participants, and highest and best use of the asset when arriving at fair value.

This market based view is to make sure that the financial statements are seen as a realistic depiction of the economic value as opposed to old fashioned or hypothetical values.

Significance of Fair Value Hierarchy.

The IFRS 13 hierarchy forms the basis of fair value measurement as it forms a clear framework of prioritizing inputs by the basis of their reliability and observability. Measurable inputs, e.g. quoted market prices are desirable since they are verifiable and objective. Only in the event of unobservable data, e.g. internal forecasts or assumptions are employed.

The fair value hierarchy is a strategy that provides transparency in the financial reporting because the companies are obliged to reveal the level of inputs they utilized to value them. This enables investors to determine the credibility of reported fair values and levels of uncertainty in estimation.

It is especially applicable in complex financial instruments, investment property and unlisted equity investment where market information may not necessarily be available. This structure provides clarity for IFRS 13 fair value hierarchy levels explained for valuation professionals, ensuring consistent interpretation across different types of assets and entities.

Level 1: Active Market Quoted Prices.

The most credible and open inputs in the hierarchy are Level 1. They are quoted prices in active markets of the same assets or liabilities that an entity can retrieve at the date of measurement.

Examples of Level 1 inputs are:

- Traded on established stock markets (e.g. Singapore Exchange, London Stock Exchange).

- Bonds or commodities whose prices are easily available and actively traded.

- Mutual funds units that have net asset values that can be observed

Because Level 1 solely uses available market data, which is observable, very little or no subjectivity exists in establishing fair value. Firms that operate with Level 1 indirects usually report little information on valuation assumptions since market activity establishes the prices.

This level can however only be applied in the event that there is an active market. When market activity becomes sporadic or the prices are no longer accurate to reflect the prevailing market conditions, then the valuation professionals have to go down to Level 2 inputs.

Level 2: Other Quoted Price Observable Inputs.

Level 2 inputs are inputs which can be directly or indirectly observed on the asset or liability but which do not constitute Level 1. These entail market information in terms of interest rates, yield curves, credit spreads, and price of such related assets in less active markets.

Common examples include:

- Corporate bond valuation with the help of yields of the similar instruments.

- OTC derivatives valued on observable forward rates.

- Housing was priced based on similar deals in the market considering the locality and state differences.

Level 2 valuations are usually based on slight adjustment of observable data. These adjustments will bring in certain estimation but overall the valuation will still be based on external information that can be verified.

The difficulty on this level is to make sure that the adjustments are fair and are in tandem with market activity. The failure to make proper judgment on these adjustments may result in changes in reported fair value of the material level, particularly in volatile markets.

Level 3: Inputs which are unobservable and complex valuations.

The lowest level of the fair value hierarchy is the level 3 inputs, that are least observable and the most judgmental inputs. They are applied when there is no observable market data and valuation has to depend on internal models or assumptions in regard to future cash flows, discount rates and risk premiums.

Examples include:

- Passive markets of private equity investments.

- The goodwill and long-term intangible assets valuation in Singapore.

- The non-market complex derivative.

Level 3 inputs involved in valuations are highly management judgmental and their estimation uncertainty is usually higher. Thus, IFRS 13 requires Level 3 valuations to be much disclosed, such as description of valuation techniques applied, material unobservable inputs, and sensitivity tests of how varying assumptions influence fair value results.

Level 3 reporting is the area that the transparency is most important, and investors have to understand that the management has to be honest and rigorous in the process of reporting numbers.

This section highlights the difference between Level 1, Level 2, and Level 3 inputs under IFRS 13 valuation, which is vital for assessing the reliability of reported fair values in financial statements.

Techniques of valuation employed at Levels.

To create a consistency in the measurement of fair value, IFRS 13 indicates that three valuation approaches are common that can be used at any level of the hierarchy:

- Market Approach- Relies on market transactions prices and information of identical or similar assets.

- Income Approach – Fair value calculated under the present value of future cash flow discounted at a market based rate.

- Approach Cost – It reflects the cost of replacing the service capacity of an asset that has undergone depreciation and obsolescence.

Maximization of use of observable data should be used as inputs in applying these techniques. As an example, even in an income method, when there is availability of observable discount rates or growth rates, then they need to be reflected to ensure market consistency.

Transparency and Disclosure Requirements.

According to the IFRS 13, entities are to publish comprehensive data on the fair value measurements, particularly when it involves Level 3 inputs. Disclosures generally contain:

- The methodology and reason behind the choice of the valuation method.

- The valuation model was used to incorporate inputs and assumptions.

- Sensitivity analysis involving the effect of the fair value to changes in the key inputs.

Such disclosures will improve transparency and allow the financial statement users to assess the quality and fair-value estimates reliability. They also encourage accountability since the management is found out to explain the logic of its adopted approaches and assumptions.

Ordinary Difficulties in the Implementation of the Fair Value Hierarchy.

Although the fair value hierarchy is structured in nature, there are a number of issues when it comes to the application of the hierarchy. The problem with level 1 or Level 2 inputs may pose a challenge in the emerging markets because of the scarcity of market data, and Level 3 will have to be used.

In addition, the inconsistent fair value estimates of firms may arise due to variation in valuation models, discount rate assumptions, and the market comparables. To reduce such problems, auditors usually involve independent valuation professionals to test the complicated fair value measurements and IFRS 13 compliance.

The other widespread problem is in cases of volatile economic circumstances, when the market activity becomes weaker and the inputs which can be observed previously are not considered stable. The companies should then reevaluate their practices in classification and disclosure.

The Revolving nature of technology in Fair value measurement.

The use of technologies is redefining the process of measuring fair value. Valuation professionals can use automation, data analytics, and machine learning solutions to process large amounts of market data much efficiently and enhance the accuracy and reliability of fair value estimations.

These technologies also increase uniformity of applying the hierarchy by defining what happens in the market, make adjustments as a result of anomalies, and simulate sensitivity results. Consequently, the companies will be able to offer more timely and data-driven valuations, in line with the objectives of transparency as provided by the IFRS 13.

Conclusion

Fair value hierarchy offered by IFRS 13 is core in the process of making financial statements reflect the prevailing market realities. IFRS 13 enhances financial reporting transparency, comparability and trust by categorizing inputs in valuation into Level 1, Level 2 and Level 3.

The professionals, the investors, or the auditors should understand the nature of valuation input which can either be fully observed market prices or complex, judgment based estimates. Fair value measurement in IFRS 13 can be a foundation of a good financial reporting when it is carried out regularly and the information is reported publicly, and enhances the connection between accounting information and economic reality.