Case Study: Intangible Assets Valuation Supporting Financial Reporting and Strategic Clarity

Background on Intangible Assets Valuation Case Study

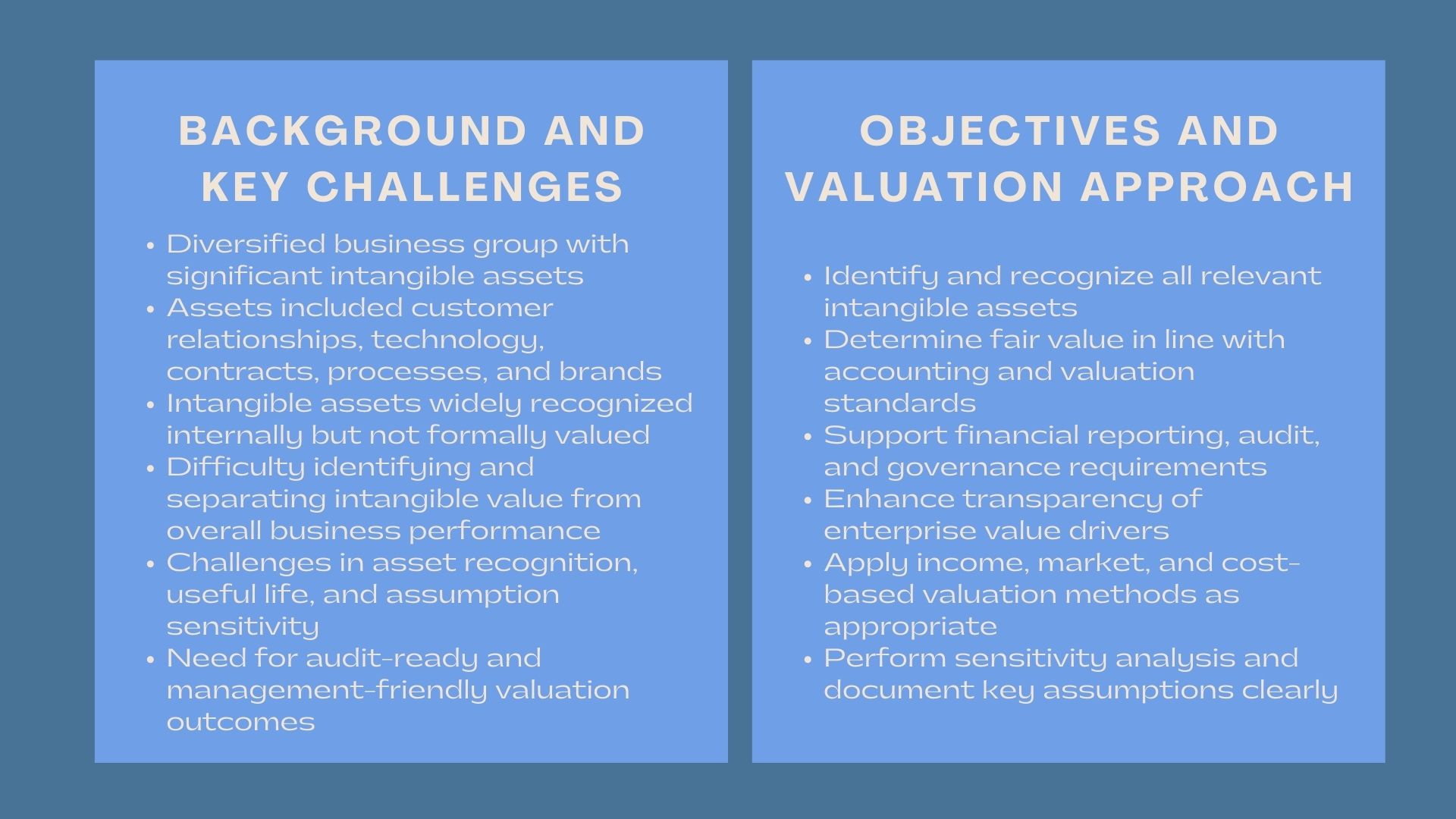

The competitive advantage and long term value addition of a business group that was diversified had over a period of time, established and gained various intangible assets which were laid at the core of its competitive advantage. These resources were customer relationships, technology related resources, proprietary processes, contractual rights and brand resources. These intangible assets were common sense among the internal stakeholders as significant value drivers, but the economic value had not been evaluated in a systematic manner.

When the group grew and management felt that the reporting and governance demands were more intricate, the management realized that there was a need to have a detailed valuation of the intangible assets. The valuation had to be used to support financial reporting, internal decision making and better transparency of the sources of enterprise value. The group had to respond to these requirements by calling our valuation team to provide an independent and sound intangible assets valuation.

Issues and Challenges

The inherent drawbacks of valuing intangible assets are the impossibility to physically hold them and identify their particular economic contributions. The client had numerous intangible assets embedded in the day-to-day operations, which is why it was difficult to define the value of those assets in respect to the value of tangible assets or the business performance.

The other issue regarding asset recognition and identification. Some intangible assets were in nature developed as a result of time and were not recorded in form of separate recognition and inclusion in financial statements. It was necessary to analyze contractual, legal, and economic features to be able to determine what the assets should be recognized separately.

The valuation also involved using assumptions that were highly judgmental as they encompassed asset-specific cash flows, useful-life, attrition rates, contributory asset charges, and discount rates. Such small variations in these assumptions may have a significant effect on the valuation results, and it is necessary to be more disciplined and document it in its system.

Lastly, the client needed a valuation result that would be controllable to audit examination and at the same time be interpretable to the top management and non technical stakeholders.

Objectives

The major aim of the engagement was to ascertain the fair value of identifiable intangible assets in a way that is consistent with the relevant accounting and valuation standards.

In particular, the client wanted to:

- Determine and list all pertinent intangible assets.

- Establish reasonable values of every recognized asset.

- Fulfill audit and financial reporting needs.

- Enhance value driver transparency.

- Inform the strategic planning and asset management decisions.

The interaction was structured in such a way that it provided technical precision and practical wisdom.

How We Helped

We have used a systematic and standards-based valuation of intangible assets stance that is structured to the business model and reporting needs of the client. We have started with a thorough examination of the work of the client, its operations, contracts, and intellectual property to find out all possible intangible assets.

We evaluated every one of the identified assets against recognition criteria in order to decide whether they were to be valued separately. This development has made it meet the accounting standards and also have clarity on the nature and purpose of each asset.

In the case of valuation, we used the right methodologies depending on the nature of the asset. The assets having identifiable cash flow contributions were treated using income based approaches and asset specific assumptions and risk profile. Where feasible and justifiable, cost-based and market-based methods were used.

Close collaboration with the management was undertaken to learn about business plans and match the assumptions with the realities in business operations without being biased or subjective. There was the use of sensitivity analyses to demonstrate how the results of valuation were affected by critical assumptions.

We delivered a valuation report that fully contained a clear documentation of methodologies, assumptions and conclusions, intended to assist in audit review and reference in the future.

Value Delivered

This interaction exhibited the role of professional intangible assets valuation services in introducing clarity to multifaceted and usually undervalued forms of value. We assisted the client to enhance transparency, minimize the audit risk, and enhance strategic decision-making by using rigorous methodologies and effective communication.

The Intangible Assets Valuation services provided by our firm offered a solid foundation to report in compliance, manage the assets and create long term sustainable values.