IFRS Valuation of Intangible Assets

Intangible assets like brands, software, patents and customer relationship are important in determining the value and competitive advantage of a firm. These resources are not physical like tangible ones, but they are usually costly and yield great economic advantages in the long run. According to the international financial reporting standards (IFRS), intangible assets should be valued in order to have the financial statements reflect their actual economic value.

Difficulty with intangible assets is involved in their complexity. They may be as a result of internal growth, acquisitions, and legal rights, with each bringing with it distinct valuation factors. The IFRS offers a systematic approach of recognizing, measuring and testing these assets so as to have consistency, transparency and comparability of the financial reports across countries.

This article provides a practical manual on how to learn the principles and techniques of valuing intangible assets under the IFRS, specifically on the criteria used in the recognition, fair value measurement techniques, and post-recognition treatment of intangible assets including amortization and impairment.

Intangible Assets Recognition and Valuation.

Intangible Assets Recognition and Valuation.

IAS 38 Overview

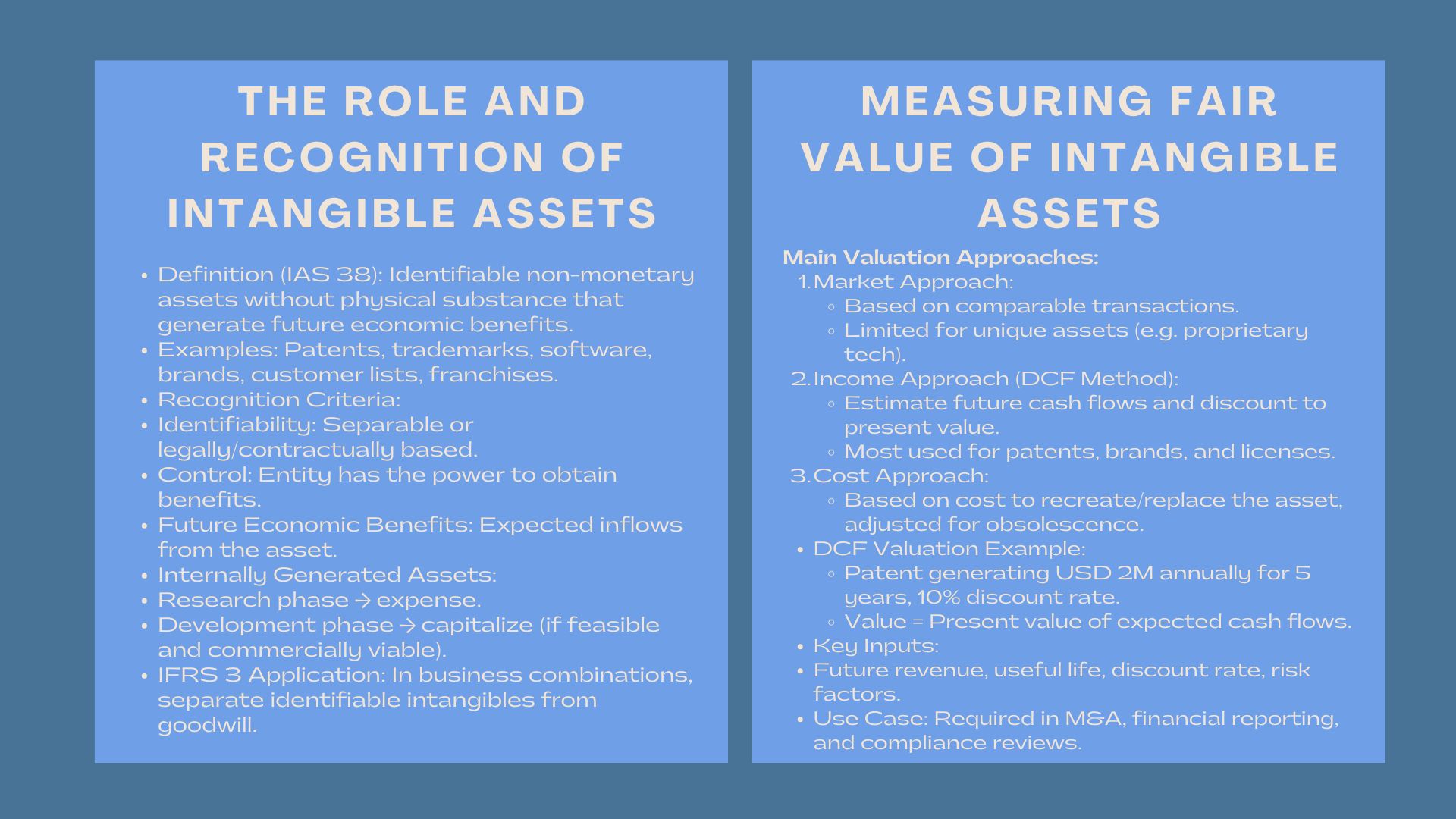

IAS 38, Intangible Assets is the primary accounting standard in IFRS that applies to intangible assets. It characterises intangible asset as a recognisable non-monetary asset that lacks physical existence and gives forthcoming economical advantages to an entity. Examples are patents, copyrights, customer lists, trademarks, franchise and proprietary software.

IAS 38 sets out a clear requirement on the instances of recognizing an intangible asset in financial statements. To be recognized, two major conditions have to be satisfied:

- Identifiability The asset has to be separable (must be able to be sold or transferred) or must be based on contract or law.

- Control and Future Benefits – The unit is to control the asset and anticipate likely future economic gains on it.

Criteria for Recognition

To be recognized as an intangible asset an asset must satisfy the following criteria:

- It is likely that the entity would be subject to future economic gains attributed to the asset.

- The price of asset can be measured with certainty.

With internally generated intangible resources, IAS 38 draws a distinction between the research and development stages. The cost incurred in the research phase has to be expensed, whereas the cost incurred in the development can be capitalized when certain conditions are satisfied (i.e. the technical feasibility and future commercial viability).

Examples: Software, Trademarks, Patents.

Patents offer the privilege of exclusive rights to produce or sell an invention and are usually regarded in monetary terms depending on how successful they are likely to be commercially. Another significant category of intangible assets (particularly with technology-driven firms) is software, which may either be internally developed or acquired. Customer recognition and loyalty are obtained through trademarks and brands, and thus, they are critical in M&A transactions and evaluation of fair value.

As an example, in case a company buys another corporation, IFRS 3 would mandate the segregation of identifiable intangible assets and goodwill that does not meet the recognition criteria. This is where intangible asset valuation methods under IFRS for business combinations are crucial to accurately determine the fair value of acquired intellectual property.

Fair Value Measurement of Patents and Trademarks

The process of valuing intangible assets dictates the application of professional judgment, financial modelling, and knowledge on the nature and future cash flow patterns of the asset. The IFRS does not dictate a single method and the entity is at liberty to adopt valuation methods that suit the nature and data at its disposal.

Income, Cost and Market Approaches.

Three commonly known methods of valuation are:

- Market Approach – It is a technique where the intangible asset is comparable to etc similar assets that have been sold or licensed in the market. It uses observable market data, and is best at times when there are active markets on similar assets. The method is however not always workable with special resources like proprietary technology where there is no close comparable.

- Income Approach – This is the most used approach where value of an intangible asset is estimated, by use of the present value of future cash flows anticipated to be earned by the asset. This technique is known as discounted cash flow (DCF) method and is specifically applicable to the assets such as patents or brand names which have a direct impact on revenue.

- Cost Approach – Cost Approach calculates value in terms of the cost necessary to reproduce or replace the asset with consideration of the obsolescence. This is normally employed where the future benefits remain uncertain or the asset itself is not generating revenues by itself (e.g. internal-use software).

Discounted Cash Flow Method

The best method of valuing intangible assets is the income method, and that is the DCF method. It entails estimating the future economic value of the returns which the asset is likely to yield and discounting the value of the returns to their current value through the application of a relevant discount rate.

The key steps include:

- Predicting cash flows – Predict future revenue or cost savings that can be credited to the asset.

- Determining useful life – State the time within which the asset will bring benefits.

- Choosing a discount rate – Rewards the time value of money and risks of the asset.

- Computation of the present value – Discounted cash flows- Use the discount rate to estimate fair value using future cash flows.

To illustrate, when one company has a patent which is anticipated to give it USD 2 million of cash flows every year over a period of five years, the discount rate is 10 percent then the fair value is the present value of the cash flows. The calculation is not only the expected returns but also the risks of technology obsolescence and competition in the market.

This process often requires the professional valuation of intellectual property and brand assets under IFRS, especially when used for financial reporting, M&A transactions, or regulatory compliance. Professional estimators make sure that assumptions made regarding cash flows, rate of growth and discount are set in consistency with market evidence and accounting principles.

Practical example Step by Step.

Take the case of a software license that is likely to bring about incremental revenue of USD 1.5 million every year during the next four years. The fair value of the software as intangible asset is determined using the present value of the cash flows expected in the future at a discount rate of 12%. In the event of the calculated value amounting to USD 4.8 million, this figure is recorded in the balance sheet, which will be amortized and assessed on impairment in future.

Value Amortization and Impairment.

An intangible asset should be recognized and valued then it should be reported over the useful life. IAS 38 is that amortization should be done in a systematic way and impairment tests should be taken periodically so that carrying amount of the asset can be recovered.

Useful Life Determination

Useful life of intangible asset can be limited or unlimited:

- Finite useful life – The asset is amortized against the expected period of benefits. Software licenses or patents that have expiration dates can be given as examples.

- Indefinite useful life – The asset is not amortised; however, it is assessed on impairment each year. This is applicable to the assets like some brand names or trademarks which are likely to generate cash flows at an indefinite time.

The management has to periodically assess the useful life of intangible assets with a view of taking into account such factors as legal protection, market tendencies and technological changes.

Amortization Methods

In the case of finite useful life assets, amortization is normally done in a straight-line basis in the useful life of the asset. Nevertheless, its use can be substituted with other approaches provided they are more appropriate in terms of capturing the consumption of economic benefits by the asset. An example is a falling balance approach that could be suitable in terms of technology that is becoming obsolete with current advancements.

Amortization expenses are recorded in profit or loss and the carrying amount of the asset is decreased over time. Established entities are required to report the amortization method and period to be amortized and any revisions in estimates which are important to the reported results, emphasizing understanding amortization for intangible assets.

Annual Impairment Testing

Intangible assets that upon amortization still remains must also undergo impairment testing whenever there are signs that the carrying value of the assets may not be recoverable. Annual impairment testing is required on assets that have indefinite useful lives or are yet to be put into use.

It is done in accordance to IAS 36 standards-the carrying amount of the asset is compared with the recoverable amount (higher between fair value and less value of disposal and value in use). In case the recoverable amount is less, impairment loss is identified.

Taking the case of a company whose trademark cost USD 5 million, the value of the trademark in question might be limited to USD 4.2 million because of the deterioration of market standing. The loss of USD 0.8 million is to be charged as an impairment loss and the profit at the period and carrying amount of the asset are decreased.

Conclusion: IFRS Valuation of Intangible Assets

The valuation of intangible asset as required in IFRS requires a combination of accounting knowledge, valuation experience, combined with the strategic insight into how the asset will generate the future benefits. IAS 38 gives a proper framework to the recognition, measurement and reporting of these assets so that they are reflective to their real economic value.

Companies can increase the transparency and reliability of financial statements by implementing proper valuation techniques such as market, income, and cost techniques, and ensuring strong post-recognition tests of financial statements with amortization and impairment testing.

Finally, a sound methodology of intangible assets valuation does not only assist in adhering to the IFRS, but also the value of the investor confidence by demonstrating the role of intangible drivers in the long-term enterprise value.