Independent valuers are specialists in property valuation and offer a range of services to the property market.

Independent valuer property

is not directly employed by lenders, but rather act as independent professionals who provide their own opinions on the value of a property. They can also advise clients on how best to obtain finance for their purchase.

It is important to remember that independent valuers do not offer advice on tax or legal matters, and should not be relied upon for this type of information.

The role of an independent business valuation is to provide an impartial valuation of the property for the purpose of insurance, mortgage or sale. Independent Valuer are usually associated with banks, building societies and other lenders who may require an independent valuation in order to lend on a property.

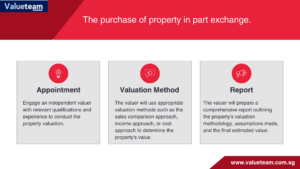

The method used is comparable sales analysis which involves analysing recent similar sales in the area and making adjustments for any differences between those properties and yours.

Independent valuers are experts in property or startup valuation, who are independent of the selling agent. They are not part of a chain, nor do they work for the bank or other lender. Independent valuers are often employed by the owner or their agent, to provide an independent valuation of their property.

An independent valuation is a professional opinion on the current market value of a property. It is an important factor in determining whether a property is worth more than what it is currently being offered for sale at, and can also be used to determine the amount of stamp duty payable on a new purchase.

In addition to providing business valuation services, we also provide property valuation services including residential properties, commercial properties and agricultural valuations.

business valuation singapore, Company Valuation, Business Valuation Services, all business valuation, company valuation share, ESOP Valuation, Convertible Instruments Valuation, Brand Valuation Services, Startup Valuation, sbxhrl, Intangibles Valuation, purchase price allocation, real estate valuation, how to value a company, valuer singapore, valuation value singapore business drivers net tangible assets value$ singapore agricultural companies use fair value for purposes of valuing crops. valuation of tangible assets.

As an independent valuer, we can help you to achieve your goals. Whether you are buying a property, selling a property or renting out a property, we can give you the best advice for your situation.

We have many years of experience in real estate investment and have worked with all types of properties from small flats to large commercial buildings. We have also been involved in many transactions where it was necessary to value properties for probate purposes or for inheritance tax purposes.

Our clients include individuals, companies and organisations who require professional advice on their property investments as well as solicitors and accountants who require us to act as their agent in buying or selling properties on their behalf.

Independent Valuers are a group of people who have been trained to assess property values and make reports on them. They work for a variety of organizations including banks, solicitors, insurance companies and local authorities.

1) The sale of a property.

This may be through private treaty or at auction. Independent valuers will often be employed to prepare an estimate of the price that the property could fetch on the open market. This is often used as a guide by both buyers and sellers.

2) The purchase of property in part exchange.

Buyers sometimes need another property to use as part payment for their new home but don’t want to pay full market value for it. In this case, an independent valuer will look at how much rent could be charged on similar properties in the area and then deduct that figure from the price of the house being bought. This will leave you with an idea of how much profit there would be if you sold your old home privately after moving into your new one!

Read More – how do you value a private company