When to Revalue Assets: Accounting and Tax Implications

Introduction to Accredited Asset Revaluation Tax Training

One of the most important financial decisions that a business can make is re-evaluation of assets. How, when, and why things are revaluated can determine the difference between loan rejections and investor trust to liabilities and financial statements. Nonetheless, its influence is underestimated by many organisations, which know asset revaluation as a mere compliance activity instead of an instrument that directly influences business value in the long run.

In rapidly inflating markets, economic cycle changes, or in markets where regulatory changes occur, it is all the more important to know when to revalue the assets. The business executives, CFOs and finance departments must understand the right triggers, accounting treatment and tax consequences especially in jurisdictions like Singapore, where the financial reporting standards demand the application of the standards in a consistent and justifiable manner.

1. Comprehensive knowledge on the necessity of asset revaluation.

1. Comprehensive knowledge on the necessity of asset revaluation.

1.1 There are marked market developments that are impacting the asset fair value.

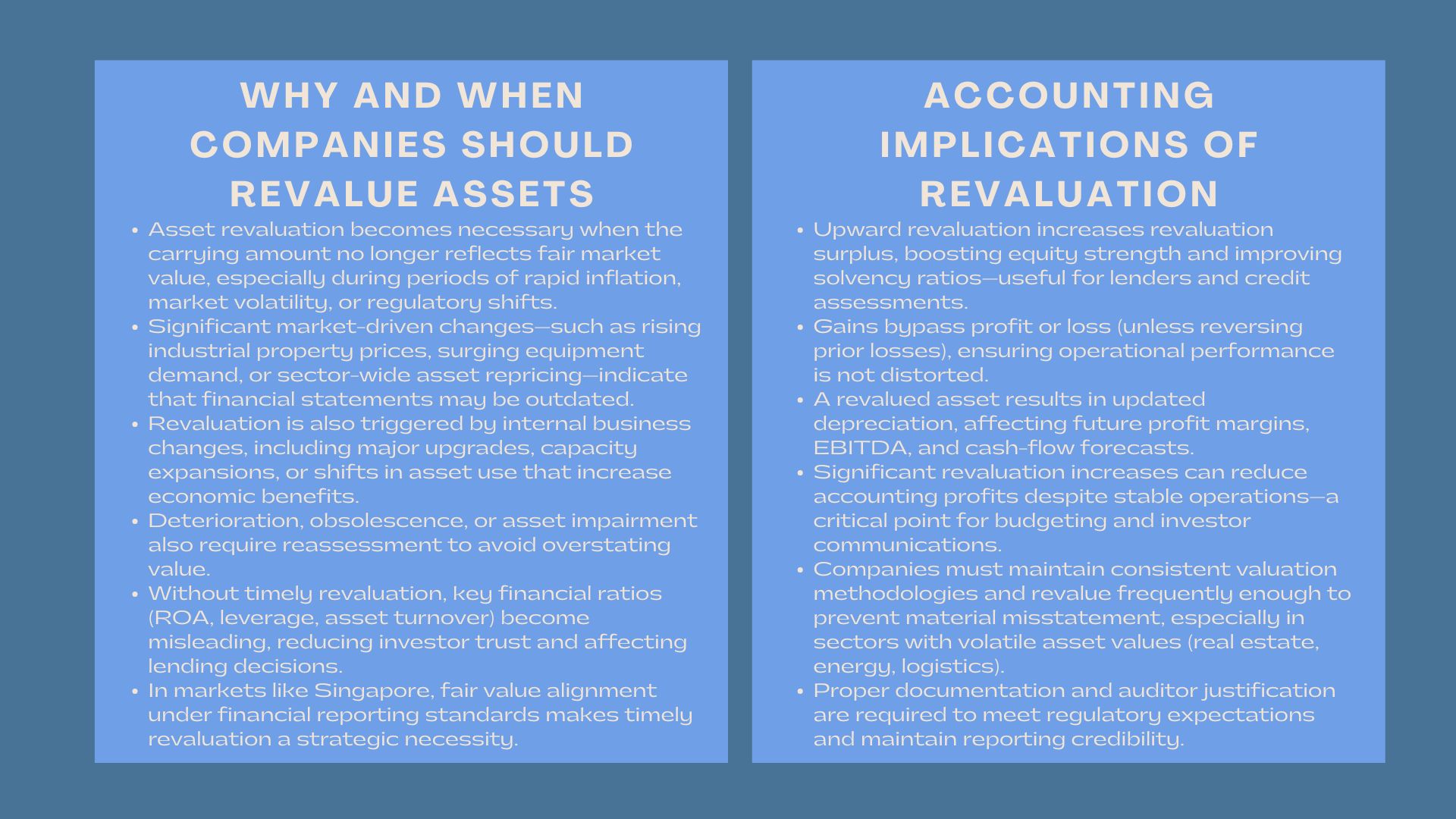

A material change in the market prices is one of the most prevalent causes of revaluation of assets. In the case where market-based fair value is considerably different than the carrying amount of the asset, the financial reports may cease to reflect an accurate value of the business. This is particularly applicable in the real estate, specialised manufacturing equipments and high-value plant assets that change with the demand swings.

An example of this is a logistics company that owns prime industrial warehouses which can see a steep rise in the value of assets at the time of a market boom. Depending on whether these assets are recorded at historical cost or not, the financial statements would underreport the financial strength of the company and misrepresent key ratios of the company like the return on assets (ROA) and debt-to-equity. In this situation, the revaluation should be timely to make financial reporting transparent and relevant.

1.2 Business externalities in internal changes in business uses or assets condition.

The reason why reevaluation is done is where major internal changes have taken place including upgrading of assets, expansion of assets or impairments. As assets are being refurbished significantly or reused in new business lines the economic value of the assets may no longer be equal to book value.

Take an example of a manufacturing SME which buys a production line with automation technology. As much as the historical cost reflects the original investment, it fails to reflect the increment in efficiency and competitiveness in the market due to the upgrade. In this scenario, a revaluation provides the stakeholders with the revised and more precise reflection of the asset productivity.

Moreover, deteriorating conditions of assets, such as old age, obsolescence, and inefficiency may also induce revaluations. Under these circumstances, the carrying value can be less than fair value which can result in the impairment review.

2. Assets Revaluation Accounting Implications.

2.1 The implication of the revaluation on the surplus of revaluation and equity

According to the revaluation model, revaluation surplus is to be recorded under equity in case of any increase in the value of the assets. This boosts the net asset base of the company and gives it strength in the financial position before lenders and investors.

For Singapore entities applying the revaluation model, the process must follow the principles described in asset revaluation accounting Singapore, ensuring consistency and reliability in the valuation methodology used.

Revaluation gains, however, do not traverse profit or loss, with the exception that they undo prior negative revaluations. This will not affect the income statement in any way and will retain the integrity of reporting operations performance.

2.2 Revaluation Depreciation Adjustments.

After an asset is revalued, the amount of depreciation is varied. This has an impact on future depreciation costs, which further impact profit margin, EBITDA and cash flow projections. Large upward revaluation will boost depreciation and this may decrease accounting profits even where operational performance is constant.

As an illustration, when a hospitality company reappraises its hotel building of between $12 million and $16 million, there would be a rise in its yearly depreciation expenses, which will change further financial estimates. Finance teams are thus required to consider changes in depreciation when making budgets or investors reports.

2.3 The frequency of revaluation to determine the proper amount of accrual and comply with the standards

Although standards do not specify the frequency of revaluation, the regularity should be such that the carrying amount will not materially deviate out of the fair value. Asset valuations of businesses with unstable asset values (e.g., property development, energy infrastructure or logistics) tend to be required more frequently.

This is more critical when using a business revaluation frequency guide to specify the intervals that should be used by the companies depending on their market volatility, regulatory expectations and internal risk assessment.

3. Tax Consequences to Revaluation of Assets.

3.1 Revaluation and Deferred Tax Liabilities.

As the value of an asset increases so is the gap between its carrying amount and its tax base. This normally leads to a deferred tax liability. This in itself does not translate into cash outflows but it needs to be recognised to capture future tax liabilities.

As a case in point, when a building has been revalued to a higher amount in the financial reporting but the value is still kept at the historic cost when calculating taxes, the company has to record deferred taxes in the difference. This helps in avoiding the overstatement of equity and also makes it in line with international accounting standards.

3.2 Effects of Capital allowances and Revaluation.

Capital allowances in Singapore are usually done based on the original cost of the asset and not the revalued cost of the asset. This implies that revaluation will not raise deductions in the form of taxes unless the tax rule permits the adjustment of certain classes of assets. Companies have to know this difference to prevent exaggerating tax accounting gains of revaluation.

Further, although the value of an asset is impaired and the impairment is recognised to be tax deductible under accounting rule, it does not necessarily follow that such an asset will be deductible under tax rules. The firms should evaluate whether the impairment satisfies the requirements of the tax authorities before anticipating any tax savings.

3.3 The re-evaluation and gains upon disposition.

The revalued assets with a profit can be taxed referring to a nature of the gain as either revenue or capital. The re-evaluation in itself is not a tax event but the eventual disposal may be a tax event. Thus, strategic planning becomes essential when companies are planning to sell significant assets or reorganize the business processes.

An example is where a corporation intends to spin off property, the time of revaluation may be pre-restructuring or post-restructuring, which may affect taxable gains and tax compliance requirements. The right time of revaluation strategy guarantees the transparency, as well as optimal tax results.

Conclusion

The ability to know when to revalue assets is a very important aspect of good financial administration particularly where prices in the market vary considerably or where there could be a significant change in how the business is carried out. Not only the financial reporting is involved in the revaluation but also in the depreciation, equity strength, taxes and long-term strategic planning. With the stricter audit requirements and regulatory demands, as well as economic unpredictability, asset revaluation is not merely a compliance requirement but an instrument of clear communication and financial strength.

In the future, the businesses that will be able to build proactive valuation policies, incorporate data-driven models, and ensure excellent governance of their asset registers will be in a stronger position to produce believable financial reporting. The strategic revaluation will be imperative to the pursuit of clarity, investor confidence and the financial base to be used in future developments.