Why Accurate PPA Valuation is Critical in Mergers and Acquisitions Deals

Introduction to Why Accurate PPA Valuation is Critical in Mergers and Acquisitions Deals

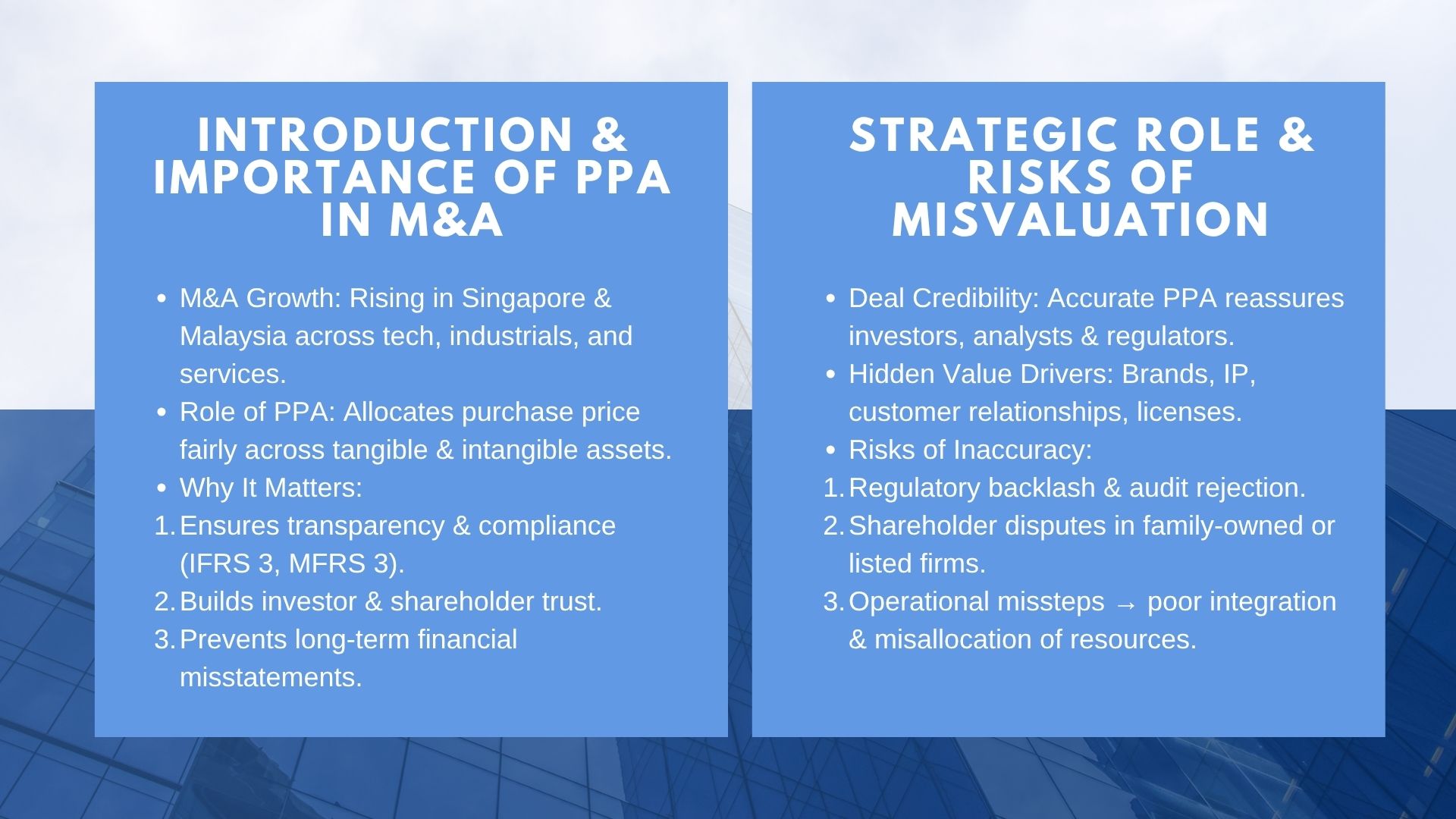

Mergers and acquisitions (M&A) are effective tools of corporate development that allow organizations to diversify, expand to new geographical locations, and increase their competitive advantages. The M&A activity has been on the rise in the region in the last ten years, particularly in Southeast Asia and specifically in Singapore and Malaysia. Singapore is a financial and global hub, which means that it is a point of entry of multinational companies in the country, and Malaysia has a diversified economy with local consolidations and international buy-outs. Technology start-ups, industrial powerhouses, and firms in all industries are turning to M&A to attain growth that can hardly be achieved through organic expansion.

The successful transaction, however, has a shadowy side of a complex process of financial accounting that determines the perception of the deal by the stakeholders. The center of this process is Purchase Price Allocation (PPA). It directs that companies spread the cost of purchase over acquired assets and liabilities in a manner that indicates its fair market values. Although this might seem as a technical exercise, proper PPA valuation is essential: it creates transparency, compliance with regulation, and allows companies to achieve all the strategic potential of their acquisitions. Actually, incorrect or unfinished PPA may cause financial imbalances, regulatory backlash, and shareholder trust loss in the long-term.

The Strategic Role of PPA in M&A

The Strategic Role of PPA in M&A

Increasing Deal Credibility through Accurate Valuation.

Whenever there is an announcement of an acquisition, one of the questions that the investors will tend to ask is whether the price paid is reasonable. PPA gives a clear division of the amount of value being represented by the tangible assets including property and machinery and the amount of value being represented by the intangibles including intellectual property or customer relationships. This transparency shows that the management is disciplined when deciding on acquisitions.

The credibility of deals is essential in Singapore where enterprises are fighting over international capital. The investors and analysts analyze the minutest details and correct PPA is an indication of professionalism and responsibility. It is also applicable in Malaysia where it has a significant share in family-owned businesses and conglomerates, and which involves transparent allocation, which minimizes the chances of shareholder conflicts. By working with trusted PPA valuation advisors for M&A transactions in Singapore and Malaysia, companies protect themselves from skepticism and ensure the deal is viewed as financially sound.

Discovering Business Value Hidden Drivers.

Intangible property is common in the majority of the most valuable purchases of the modern world. These are software, patents, trademarks, brand equity and licenses as well as customer contracts. PPA identifies and measures these drivers so that profitability in future is associated with certain assets instead of being combined into generic goodwill.

Consider the case of a fintech start-up in Singapore which was taken over by a regional bank. Its physical resources can be small; it can only consist of laptops and leased offices, but its own payment technology and recurrent customer base constitute enormous value. An acquisition in the agribusiness in Malaysia may depend on the intangible assets like export permits or unique distribution channels. A properly prepared PPA throws light on these unseen drivers so that the management and investors can have a clearer picture to where they are going to get cash flows in the future.

Traps of Failing to Do Accurate PPA.

The Compliance Risks That Will Sink a deal.

When proper PPA is not undertaken, it may cause some severe violations. International Financial Reporting Standards (IFRS 3) involve full-scale allocations and both Singapore and Malaysian auditors are strict on verification of such reports. The valuation can be rejected by the auditors in the event that assumptions are not supported and that the assets are misclassified and do not meet the deadlines of reporting and may even require the public restatements.

Consider a Malaysian logistics company that is acquired because of the contracts with its established customers. When the acquirer mischaracterizes such contracts as goodwill and not as intangible asset, then the auditors can question the financial statements which have to be corrected. This does not only damage reputation, but it can also result in fines or lawsuits by shareholders. Such errors can seriously affect the share prices in Singapore where the market is highly sensitive to governance lapses.

Operational and Strategic Fallout from Misvaluation

False PPA has non-compliance long-term effects. Goodwill can be greatly overstated, which in turn results in impairment write-downs in the future which hurt profitability and market perception. Underpricing the intangible resources may create an internal decision-making problem that makes the management hard to mobilize the resources adequately in the integration process.

Take the case of a Singaporean based telecommunications company which has taken over a smaller player in the region. When the PPA does not give sufficient emphasis on brand recognition and customer loyalty of the target, strategies after the merger could be over-emphasized on physical structures instead of retaining customers. This oversight can reduce the deal’s long-term success. By contrast, organizations that engage professional PPA valuation services for post-merger integration in Southeast Asia ensure that both tangible and intangible assets are measured accurately, guiding smarter operational choices.

Building Stronger M&A Outcomes with Effective PPA

The use of Methodologies that Stand the Test of Time.

Valuation methodology of different asset classes are different. Physical assets are commonly either market based or cost based valued atop whereas intangible assets necessitate income based models. Relief-from-royalty is usually applied to intellectual property with multi-period excess earnings methodology being used to reflect the customer relationship value.

Not only are technical know-how and skills needed in these methodologies but also trustworthy market information and business-related understanding. In other words, to use valuation of a software license in the tech sector of Singapore as a benchmark is very different than using a valuation of export rights in the commodities sector of Malaysia. The way through these complexities is done through experienced advisors who make sure that valuations are rigorous, transparent and defensible. This will avoid problems of auditors and instill confidence among investors.

Making PPA a Strategic Competitor.

PPA too often becomes a box-ticking exercise by the companies. As a matter of fact, it may be used as a strategic instrument of integrating after merging. PPA enables the management to focus on the integration initiatives by disclosing the assets that add the most to the long-term value and devote resources to areas where they are most needed.

As an example, a healthcare organization in Singapore buying a local chain of clinics can find out using PPA that patient relationships and brand reputation contribute to most of the acquisition value. With this information, the management would be in a position to concentrate on maintaining the service quality and customer loyalty in the integration process. This outlook also leaves PPA as a compliance requirement as a roadmap to deal value unlocking.

Future Trends in PPA Valuation

Rising Importance of Intangibles in a Digital Economy

The share of deal value related to intangible assets will also increase with the expansion of the digital economy of Southeast Asia. When it comes to fintech platforms in Singapore, e-commerce ventures in Malaysia, among others, the acquisition of assets turns to be not included in the balance sheet of the seller. This trend complicates the concept of precise PPA while also making it more essential. Firms that cannot harness the value of software, algorithms, or customer data face a risk of underestimating the forces of future growth.

Complexity across Borders and Regionalization.

The second trend that is influencing PPA is the emergence of cross border transactions in Southeast Asia. With companies reaching out to other markets besides local markets, PPA needs to consider the various regulatory environments, cultural environment, and industry practices. The local wisdom and regional view is needed to value assets in different jurisdictions. As an example, a Singaporean company buying a Malaysian manufacturer might have to address the discrepancy in the area of tax treatment, licensing, and the provision of market information. Regional knowledgeable trusted advisors are increasingly being vital in making sure that PPA valuations are not only compliant but also strategically helpful.

Conclusion

Proper PPA valuation is more than a technical phase in the M&A process it is the basis of financial transparency, compliance and strategy. It also makes sure that deal value is correctly apportioned between tangible and intangible assets to avoid audit issues and write-down of impairments. More to the point, it offers insights that would enable smarter post-merger integration so that the companies can enjoy the full fruits of their acquisitions.

Precise PPA has ceased to be a choice and is now a necessity to businesses in Singapore and Malaysia and the rest of the Southeast Asia region. Through collaborations with advisors that know both international standards and local dynamics, businesses are able to make sure that their M&A transactions do not only satisfy the compliance requirements, but also provide them with long-lasting value.