Valuing Investment Property under IFRS

Property investments form a major part of the balance sheet of most companies, particularly those operating in the real estate development, leasing, or long term asset investment. These properties are usually held on rent, to appreciate in capital or a combination of both and are regulated by the IAS 40 investment property as per the international financial reporting standards (IFRS) framework.

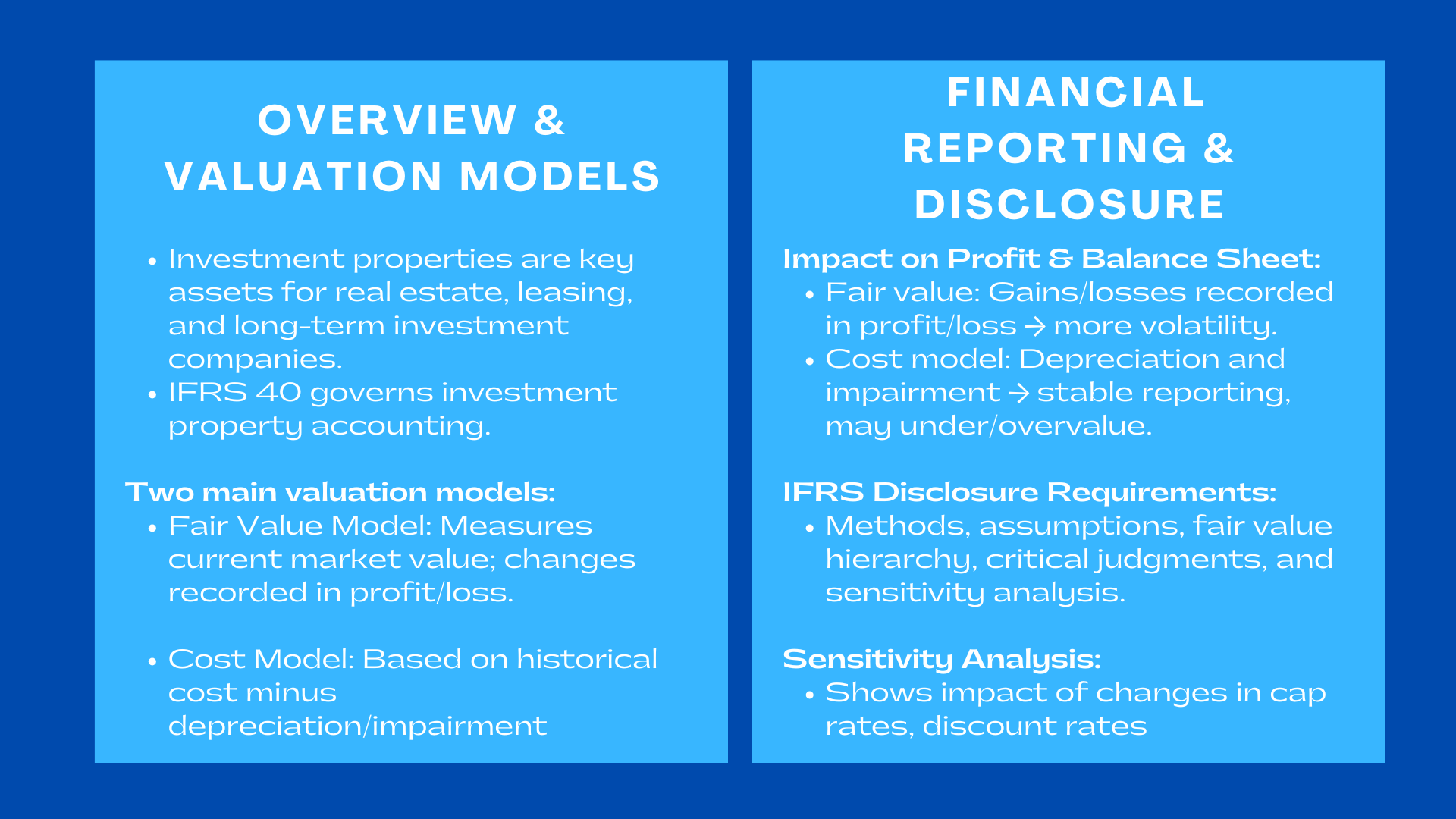

The investment property valuation is also very important in representing the financial position of a company properly. These valuations are used by investors, analysts and regulators in determining the profitability, asset performance and sustainability over a long period of time. Choosing the best valuation method for real estate investment properties is crucial, as the IFRS 40 has two main models of valuing investment property: the fair value model and the cost model. Both approaches have their own set of strengths, weaknesses, and financial reporting implications.

This paper examines the major differences between the two methods, the popular methods of valuation of markets that are applied practically, and the disclosure provisions that make financial reporting transparent.

Investment Property Fair Value vs. Cost Model.

Investment Property Fair Value vs. Cost Model.

Major Differences and Selection Regulations.

Under the IFRS 40, an entity should select either fair value model or the cost model to measure investment property after initial recognition. The model chosen should be used in all investment properties of the same category.

The fair value model is used to measure investment properties on their market value at the reporting date. The fair value changes are recorded in either profit/loss directly, that is, revaluation gains or losses are recorded in the income statement. This method gives an up-to-date and clear data regarding the actual value of assets in the real estate business, which is very close to the market conditions of real estate.

The cost model on the other hand weighs investment property to historical cost minus depreciation and impairment losses. This approach gives greater stability to the reported profits because market fluctuations will not impact the profit and loss account. It might however not always represent the true market value of the asset particularly in fluctuating property markets.

In choosing between the two models, companies have to think of factors like availability of reliable market data, the fluctuation of the real estate industry, and the anticipation of investors or regulators. Companies with busy markets and frequent transactions of their property usually use the fair value model, and companies with less transparent markets use the cost model as it is dependable and easy.

Professional firms offering investment property valuation approaches under IFRS 40 for real estate reporting help organizations select and implement the most appropriate valuation method based on their market context and reporting objectives.

Impact on Profit and Loss and Balance Sheet

The valuation model used has a tremendous impact on the income statement and balance sheet. In the fair value model any increase in the value of property is recorded in the net income as a gain and a decrease indicates a loss that is reported immediately in the profit or loss statements. It may lead to wider volatility of earnings but will give an actual picture of the current asset value.

Conversely, the model of the costs has an influence on the income statement primarily in the form of depreciation and impairment. The carrying amount of the asset in the balance sheet is still pegged on its historical cost, less accumulated depreciation. This model predicts away variations in income but can either underreport or overvalue the property as per the current market terms.

Example Calculations

Take the case of a company which bought an investment property at a cost of 5 million. According to the fair value model, in case the value of the property in the market rises to 5.5 million as of the period at the end of the year, the gain of 500,000 will be realized in the profit or loss account. In contrast, in case the value of the property decreases to 4.8 million, there will be a loss of 200,000.

Under the cost model, the property is reported at a value lower than the original acquisition cost (which is 5 million less depreciation and impairment losses). Unless impairment test reveals a permanent decrease in recoverable amount, changes in market value are not reflected.

This difference shows that the valuation decisions have a direct impact on profitability and financial strength reported.

Techniques of Market-Based Valuation.

Comparable Market Approach

The market comparison method or as it is commonly referred to as the comparable market method is one of the most prevalent methods of determining the fair value of the investment property. It consists in the study of the recent sales of similar property in the same place or in similar conditions. Adaptation is done to reflect the disparities in the character of property, including location, size, condition or lease conditions.

An example will be when similar office buildings are in the area and sold recently and about 2000 dollars per square meter, a similar property of 1000 square meters would be indicated to have a fair value worth 2 million dollars. The adjustments could then be made on special features such as high-quality facilities or long-term leases.

This is applicable in an active property market where there is enough similar data. Other valuation methods however may have to be employed by companies in less liquid or specialized markets.

Income Approach on the basis of capitalization rate.

The other popular method in valuation of investment property is the income capitalization method. According to this approach, the value is determined by the earning capacity of the property in future. The operating income generated by the property less the deducted capital costs is divided by the apposite capitalization rate (cap rate) based on the market standards or expectations of investors.

To use a practical example, when an investment property has an annual NOI of 400, 000 US dollars and the cap rate is 8, then the fair value will be 400, 000/ 0.08 = 5 million.

Income approach gives an impression of the views of investors because they attach value to projected returns. It is especially applicable to income-generating properties including commercial buildings, shopping malls and rental apartments.

Professional valuation specialists providing professional fair value assessment and cost model valuation for investment properties under IFRS utilize these market-based and income-based techniques to ensure accurate, compliant, and defendable fair value estimates for financial reporting.

Example Property Valuation

Suppose a firm has a retail premise, which generates rental revenue of $300,000/year, costs of $50,000, and net operating income of 250,000. At a capitalization rate of 7, the fair value of the property is 3.57 million. In the event that similar market information indicates a premium price of $3.7 million, then the management can align the outcomes of those market results to come up with a final reported fair value.

Such combination of techniques increases objectivity and reliability of property valuations under IFRS.

Disclosure Investment Property Valuation.

Disclosure Requirements under IFRS.

Under IFRS 40, all-inclusive disclosures ought to be done to enable users of financial statements to be aware of the valuation basis, methods, and assumptions that are used. In the case of entities whose fair value model is applied, the disclosures should contain:

- Whether the fair value was made by an independent appraiser.

- The procedures and relevant assumptions that were employed in the calculation of fair value.

- How much the fair value of investment property relies on the observable market prices or other method of valuation.

- The carrying amounts at the start of the period and the end of the period with the additions, disposals, and changes in fair value.

Organisations that use the cost model should reveal the depreciation methods, useful lives, and gross carrying amount of investment properties and also compare for the fair value of the property.

Sensitivity Analysis of Valuation.

Given the nature of the fair value estimation of their assets including the use of assumptions and judgments, IFRS promotes sensitivity analysis by companies. These analyses indicate how the valuation would be impacted by the change in your key inputs, which include discount rates, rental growth rates or capitalization rates.

As an illustration, one percent change in the capitalization rate would decrease the fair value of the property by a significant margin which impacts profit and equity. The presentation of such sensitivity assists investors and analysts to determine the level of estimation risk in the valuation process.

Notes on Financial Statements

The notes to financial statements normally contain the investment property valuations and other disclosures. These notes present transparency in terms of valuation methods, levels of fair value hierarchy (as presented in the IFRS 13) and critical management judgments.

Clearly and elaborated disclosures are not only a guarantee that the IFRS requirements are met but also instill confidence in the investors in the figures that are being reported. They assist the stakeholders to assess the impact that property valuations can have on the future profitability and financial position.

Conclusion to Valuing Investment Property under IFRS

The valuation of investment property in accordance with the IFRS 40 standards implies the need to balance the accuracy, transparency, and practicality. The decision of fair value or cost model has a huge effect on the reported earnings, asset value and financial ratios. Such techniques as market-based and income-based valuation are important in ensuring that the values of property are based on actual market forces and expectations of the investors.

Through compliance with the IFRS disclosure requirements and regular sensitivity analysis, businesses will be in a position to ensure transparency and credibility in their reporting of real estate property. The use of trained valuation professionals also enhances compliance, consistency, and accuracy when applying IFRS standards, and giving investors/regulators a credible opinion of the property portfolio and long term financial viability of an entity.