Startup Exit Strategies: Maximising Valuation During Acquisition

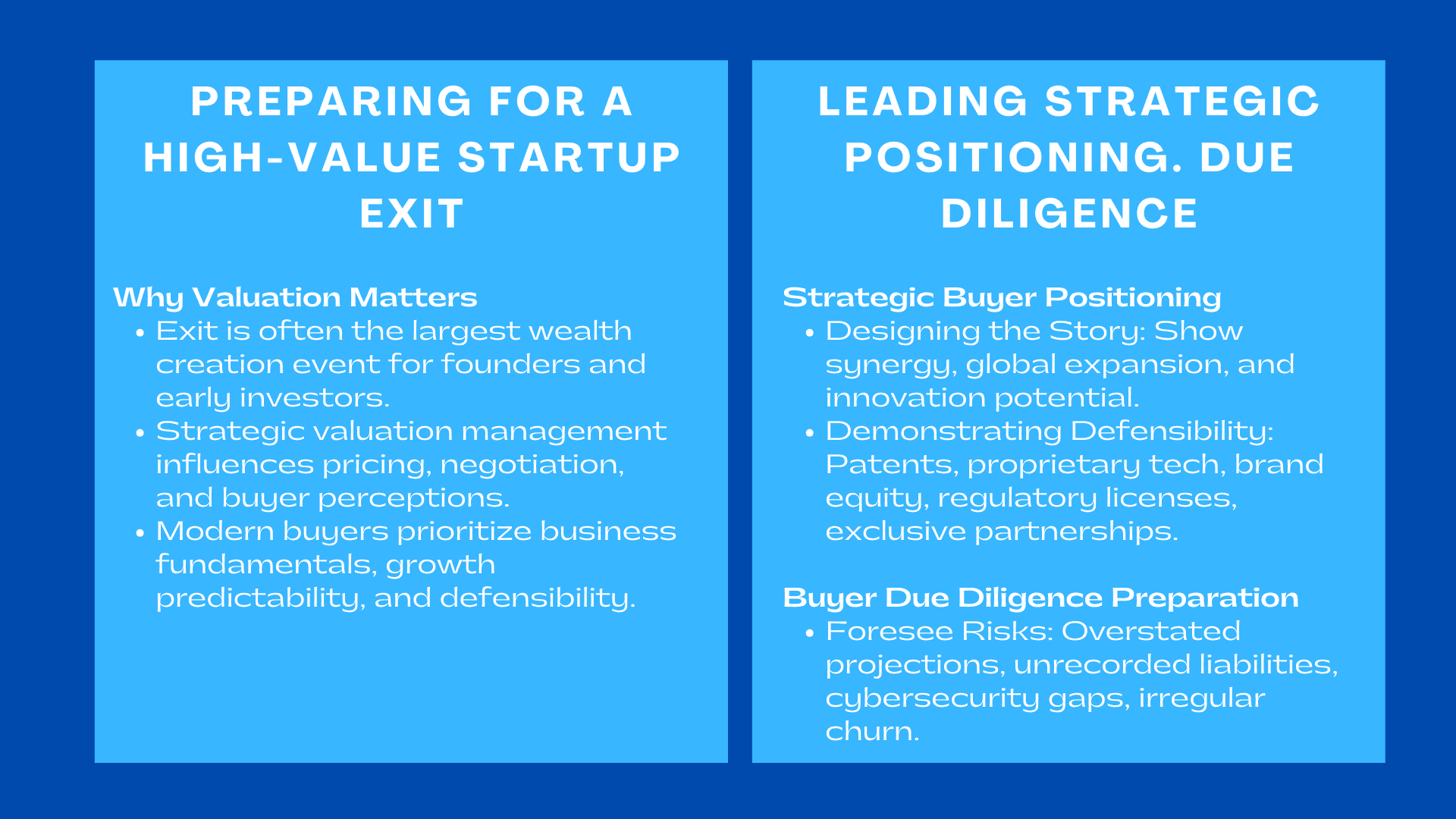

An exit is usually the biggest wealth-creation event of founders and early investors of a startup. However, most exits are not what they can be–not due to lack of business potential, but due to the fact that the process of valuation was not forcefully managed, positioned and defensed prior to the acquisition. With modern buyers becoming more cautious, funding markets increasingly volatile, and a growing focus on the strategic importance of business fundamental, attitude in influencing and streamlining valuation has assumed strategic importance. Rather than perceiving valuation as a passive figure that is set upon the negotiation table, founders are beginning to think about it as an active and long-term science, which they can use to prepare an exit, present their metrics, and manage buyer perceptions. Many founders in Singapore enhance their preparedness by attending a Mergers acquisition strategy course in Singapore, learning how to strategically position and defend their startup valuation.

1. The Research Question: How Buyers Value Startups.

1. The Research Question: How Buyers Value Startups.

1.1 Fundamentals of commercial and positioning in the market.

Strategic acquirers consider startups on a standalone basis as well as synergies. These are the quality of revenue, concentration, margins, addressable market, and product defensibility. A company with a slower growth but a high customer retention is also more valuable than one with shallow growth but poor unit economics. Founders that know these drivers are better placed to drive internal decisions in the months or years before exit.

Indicatively, a SaaS vendor based in Singapore getting ready to sell found out that a quarter of its contracts were short-lived and of high turnover. This strategy to move clients into longer contracts and target higher-value segments at an early stage led to a significant improvement in valuation by the time the buyers come.

1.2 Signals of Forecast Visibility and Scalability.

Predictability is bought at the cost of the acquirer. Evidence of revenue visibility: through subscriptions, multiple-year contracts, or pipeline conversion information can have a material positive impact on valuation multiples. This is particularly true in constructing a strategy of exiting a startup in the form of a valuation where enhancing the reliability of the forecast in many instances can heavily affect the willingness of the buyer to pay a premium.

Scalability is also an important one. Buyers seek to find that the margins grow with the size of the business and that operations can grow without capital increase that is disproportional.

2. Enhancing Financial and Operational Preparedness Pre-Sale.

2.1 Audit Ready Financials.

Audit ready financial statements are one of the quickest methods of earning buy trust and increasing offers. Startups do not take this step seriously enough since they believe that acquirers will sort it out in due diligence. As a matter of fact, ambiguous revenue recognition, founder-related, and unrecorded liabilities can decrease valuation or cause buyers to insist on aggressive price guarantees.

Prior to the entry into the market, startups ought to:

- Normalise EBITDA to sustainable earning.

- Harmonize customer and revenue data cohort.

- Make sure that all major contracts are well documented.

Singapore-based founders often seek sell side valuation tips Singapore to ensure their financials meet global acquirer expectations, especially when approaching multinational buyers.

2.2 Documenting Growth Drivers and Unit Economics

There are clear and data-driven explanations of growth mechanisms that assist in anchoring the narrative of the valuation. Buyers look at customer acquisition cost (CAC), lifetime value (LTV), churn, payback period and gross margin trends. Once these metrics are regularly monitored and compared to industry averages, startups will be able to base their valuation on plausible evidence as opposed to speculative forecasts.

Suppose a fintech corporation is about to be acquired. The founders were able to neutralize the actions of the buyer to use lower multiples because he believed it to be volatility by generating more detailed cohorts that indicated improving payback periods and increasing LTV in several quarters.

3. Strategic Buyer Positioning of the Startup.

3.1 Designing the Strategic Story.

In addition to financial performance, valuation depends on narrative, or how the startup fits into the strategic plan of the acquirer. A narrative is well-developed and it shows:

- The complement of the product to the portfolio of the acquirer.

- The way the startup goes global or gains more innovation.

- Value-creating synergies.

When a clear articulation of this story is implemented, startups tend to do better in negotiation than their counterparts.

3.2 Showing Competitive Advantage and Demonstrating Defensibility.

Defensible moats are sold at a high price. This might be in the form of proprietary technology, brand equity, regulatory licences, exclusive partnerships or high switching cost. Evidencing these benefits, e.g. through patents, technical roadmaps and customer testimonials, helps serve to strengthen valuation as well as reduce buyer anxieties over competition.

A local logistics-technology start-up that made acquisition talks noted that it has programmed routing algorithms as well as that it had powerful government licences. The above components of defensibility allowed the founders to negotiate high valuation than the normal market multiples.

4. Making Buyer Due Diligence Preparations.

4.1 Foreseeing Valuation Risk.

Buyer due diligence usually reveals problems that may jeopardize valuation overstated projections, unrecorded liabilities, ineffective cybersecurity systems, or irregular churn data. When founders are able to foresee these problems, they will be able to handle the objections in an understanding manner and avoid valuation erosion.

An effective data room should be present, which should include:

- Financial statements

- Customer contracts

- IP documentation and product architecture.

- HR, compliance and risk management records.

In the absence of such preparation, buyers can bring risk discounts or demand extended earn-outs.

4.2 Communication and Momentum Management.

Deal-making psychology is very important in valuation. Active and open communication builds buyer trust. On the other hand, sluggish replies, vague clarifications or inconsistency in information may raise a doubt, leading to reduced bids or supplementary price guard.

Sustaining momentum-to supply requested documents in good time, clear assumptions and expectations management are helpful in ensuring valuation integrity is maintained in the diligence process.

5. The use of Advisory Support to Maximise Exit Valuation.

5.1 The sell-side valuation advisory includes sell-side valuation of companies and other entities involved in securities, particularly in the stock markets of London and New York.

Independent valuation assessments by specialist advisors anchors the expectations of the startup in valuation and enhances the bargaining value of the startup. They put the startup into a benchmark against similar transactions, market multiples and industry measures. Founders in Singapore are turning more and more to advisers who understand the cross-border deals to create acceptable valuation storytelling to attract international strategic buyers.

This is where sell side valuation tips Singapore become valuable—local market knowledge, regional transaction benchmarks, and familiarity with acquirer expectations can materially influence outcomes.

5.2 Negotiation and Deal Structuring Support

In addition to valuation, advisors can help to structure a deal to preserve or augment founder proceeds including:

- Earn-outs based on achievable performance objectives.

- Retention packages – founder goals.

- Equity rollover mechanisms

- Limiting exposure working capital adjustments.

A combination of the right structure can add millions of effective value, even in scenarios where headline valuation has not changed.

Conclusion to Startup Exit Strategies Maximising Valuation During Acquisition

The process of maximising valuation when a startup is exiting is not a coincidence or end-of-the-night bargain. It involves conscious planning, strict financial discipline, a powerful strategy story and the capacity to influence perceptions of buyers using data and positioning. With increasing pickiness of acquisition markets and tightening of buyer standards, founders that think of valuation as a long-term strategic concern, and not a closing market exercise, are likely to have much more favorable results. Through effective combination of planned organization, evidence-based valuation, and strategic storytelling, startups can gain significant value and have successful exits even in an extremely competitive world.