Applying Discounted Cash Flow (DCF) Valuation under IFRS Guidelines

Guide on Professional DCF Valuation Courses IFRS Guidelines

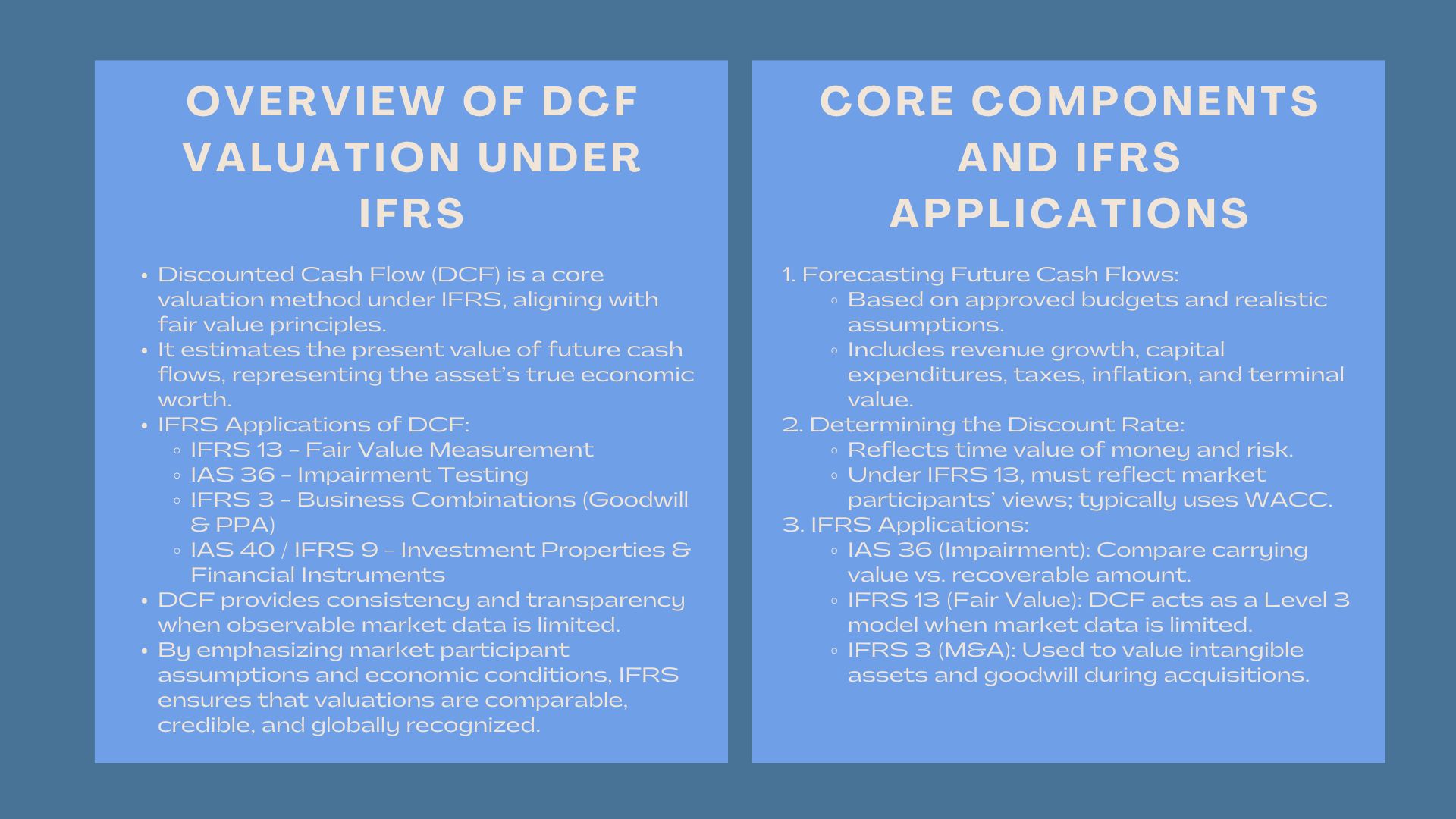

Discounted cash flow (DCF) model is considered to be among the most effective and common tools of valuing assets and businesses. According to the International Financial Reporting Standards (IFRS), the use of DCF approach is core in fair value measurement, impairment testing and analysis of investment. Its concept, of valuing an asset using the current amount of the expected future cash flows is consistent with the emphasis of IFRS on fair value and disclosure of financial reporting.

The paper discusses the application of DCF method by IFRS, its main elements, assumptions and implications on valuation professionals and financial analysts.

The Role of DCF in IFRS Valuation

The Role of DCF in IFRS Valuation

The DCF valuation model application in IFRS financial reporting provides a consistent framework for estimating fair value, especially when observable market data is limited. According to IFRS, valuations have to indicate the assumptions of market participants and prevailing economic trends. As cash flows in the future tend to be the most direct connection to the earning capacity of an asset, the DCF model comes in extremely useful to reflect its real economic value.

Under the IFRS, DCF is usually applied to:

- Measurement of fair value (IFRS 13): It is an estimation of the price at which an asset would be retailed or liability transferred in a normal transaction.

- Impairment testing (IAS 36): Estimating recoverable amounts of the tangible and intangible assets.

- Business combinations (IFRS 3): Purchase price allocation and measuring of goodwill.

Investment property and financial instruments (IAS 40, IFRS 9): The determination of changes in value and their future returns.

With the standardization of the valuation of future economic benefits, IFRS facilitates higher comparability and credibility of international financial statements.

Basic elements of valuation of DCF IFRS.

Projecting the Future Cash Flows.

Every DCF valuation is built on the basis of the future cash flow predictions. Under IFRS, these projections should be founded on the reasonable and supportable assumptions related to the last budgets or financial projections that have been approved by the management.

In making the DCF projections, companies ought to take into account:

- Projected increase of revenues and expenditures.

- Fixing and operating capital expenditures.

- Assumptions of taxes and inflation.

Estimation of cash flows outside of the forecast period is normally done with a terminal value, which is an indication of the perpetual growth or exit multiple strategy in line with market expectations

Determining the Discount Rate

The discounted cash flow analysis for fair value measurement under IFRS depends heavily on the discount rate selected. This rate is the time value of money or risks of cash flow in the future.

Under the IFRS 13, the discount rate should represent the assumptions that market participants would apply to price the asset. In case of corporate values, weighted average cost of capital (WACC) is usually employed that involves the cost of debt and equity in terms of market inputs.

Increasing the discount rate lowers the present value of the cash flows which is an indication of increased perceived risk whereas decreasing the rate indicates increased confidence in future performance.

DCF Practice: IFRS Applications.

Impairment Testing IAS 36.

DCF method is inherent in the process of determining whether an asset is impaired or not. An impairment loss has to be realized when the fair value of an asset less the cost to dispose of the assets or its value in use is less than the carrying amount of the asset.

DFM calculates value in use by calculating discounted future cash inflows and outflows of continuity use of the asset. The assumptions made by the entities should be aligned with the views of the market participants e.g. the growth rates and the discount rates. This approach is ideal for professionals seeking IAS 36 Impairment of Assets Certification Singapore to strengthen their expertise in asset valuation and impairment testing.

Under the IFRS 13 system Fair Value Measurement.

In those assets that are measured at fair value, IFRS 13 advocates that the methodology of valuation exploit the most observable inputs. Since market prices (Level 1) or data that can be easily observed are unavailable (Level 2), DCF is a Level 3 input model.

The model measures the future economic benefits that are likely to be experienced in the future into a single fair value estimate that is a clear and theoretically valid valuation basis particularly in intangible or illiquid assets.

Business Combinations in the IFRS 3.

During mergers and acquisitions, DCF is very important in fair valuing assets and liabilities that are purchased. Thank God, attitude towards goodwill, customer relationships, trademarks, and other intangible assets are determined with the help of the future cash flow projections. The valuations under IFRS 3 are to take into account the conditions on the date of acquisition but not the future performance.

Assumptions and Important Sensitivities.

The DCF valuations can only be as good as the assumptions made. IFRS points out the importance of the sensitivity analysis to determine the impact of the changes in key inputs on the valuation outcome.

Common variables which are discussed are:

- Discount rate variations (+-1-2%).

- Adjustments of terminal growth rates.

- Changes in revenues or margins.

Firms are able to enhance transparency by reporting these sensitivities in the notes to financial statements, which in turn informs the stakeholders about the valuation uncertainty.

Benefits of DCF Usage under the IFRS.

- Broad economic outlook: DCF is all-encompassing in terms of present and prospective earnings.

- Flexibility in asset classes: Flexible in tangible assets, intangible assets and financial assets.

- Conformity to IFRS fair value standards: Reveals assumptions of the market and the time value of money.

- Improved decision-making: It is useful in terms of investment analysis, impairment assessment and capital budgeting.

Limitations and Challenges

Though DCF is mighty, it is not free of difficulties. Minor changes in assumptions, e.g. growth rates or discount rates, can dramatically change the results of a valuation. Besides, long term cash flows are subjective and highly uncertain especially in a volatile market.

These challenges are reduced by IFRS, which forces entities to give disclosure of the valuation methodology, key assumptions, sensitivity and sensitivity to change.

Combining DCF and Other Valuation Models.

In IFRS, other techniques- market approach or cost approach are used more likely to triangulate fair value complementing DCF. As an illustration, DCF gives an inward look at the value whereas market multiples (e.g., EV/EBITDA) give a outward look at the value depending on similar transactions.

The mix of the two methods enhances the valuation in respect to credibility, particularly during audits or regulation scrutinies.

Conclusion

The IFRS fair value measurement continues to be pegged on the DCF valuation approach. Its proactive character is consistent with the current focus of financial reporting on transparency, steadiness and market applicability. Through the strict enforcement of DCF methods-based on sound forecasts, and rationalized discount rates and clear disclosures, entities can put forward valuations that actually reflect the economic reality and will give confidence to the investors, auditors, as well as regulators.

Essentially, learning DCF valuation according to IFRS does not only have a technical correctness, but rather, it has to do with integrity and transparency of financial reporting in a globally interconnected economy.