IFRS Valuation of Property, Plant & Equipment

Introduction to IFRS PPE Asset Valuation

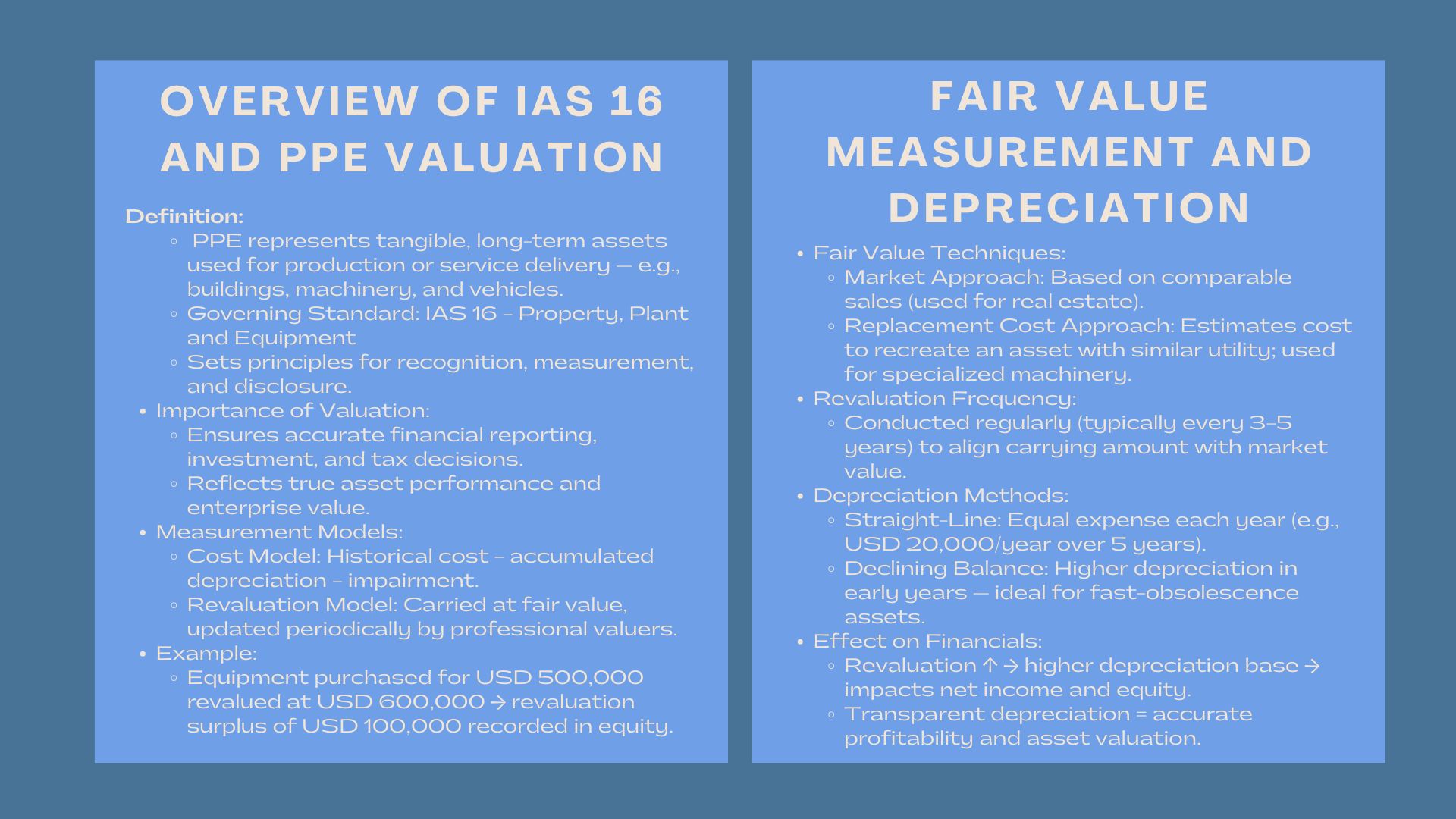

Property, Plant, and Equipment (PPE), are the foundation of the balance sheets of the majority of companies, showing the physical assets that are utilized to create goods and services. These assets, whether factories and office structures, machinery and vehicles, are very important in the performance of the business and in many cases, are substantial part of the overall enterprise value. PPE is recognized and recorded under the IFRS, which follows the requirements of IAS 16, which provides recognition, measurement, and disclosure of tangible fixed assets. The proper valuation of PPE is not only important in the financial reporting but also in making important decisions associated with investment, financing and taxation.

This article is an effective and practical summary of the PPE valuation under the IFRS, including the cost and revaluation models, measurement of fair values techniques, and the effects of depreciation to the valuation of the assets.

Valuation Cost Model Revaluation Model.

Valuation Cost Model Revaluation Model.

There are two major subsequent measurement of PPE models (cost model and revaluation model) in IAS 16. Both methods give a varied understanding of the way assets are reported in the financial statements and have varying implications to both reporting and compliance.

IAS 16 Model of Cost vs Revaluation Explained.

In the cost model, the carrying amount of assets is based on their cost less accumulated depreciation and impairment losses. This model is very simple and offers uniformity across time thus is widely used amongst companies that are keen on simplicity and comparability. It however fails to take into consideration any changes in market value hence there is a risk that book values and fair value can be very different after a period of time.

Conversely, revaluation model permits carrying of assets at fair value, which is done by professional valuers on a periodic basis. In case of an increase in fair value of an asset, the increase is reflected in a revaluation surplus in equity (except in the event of reversal of other revaluation decreases). In case of a downward fair value, the decrease is recorded in profit or loss with the exception of counterbalancing an established excess.

As an example, one can buy equipment costing USD 500,000. Three years later when the fair value of the machinery increases to USD 600,000, a revaluation surplus of USD 100,000 is recognized under revaluation model. Conversely, the cost model would keep the machinery recorded at the historical cost less depreciation without the upsurge in market value.

Advantages and Limitations

Cost Model Advantages:

- Visa simpleness and convenience.

- Causing less dependence on external valuations.

- Stable reported earnings

Limitations:

- May overstated asset value in the past.

- Not responsive to the prevailing market conditions.

The benefits of Revaluation Model are:

- Reports present fair value in current form, making it more transparent.

- Increases the potential asset-based lending.

- More investor and stakeholder friendly.

Limitations:

- Should be valued by the professionals on a regular basis.

- Have the ability to inject volatility in reported results.

- Increased cost of administration.

When companies engage external experts for fair value assessments, they often rely on property, plant, and equipment valuation techniques under IFRS for fair value reporting to ensure accuracy and compliance with IAS 16. These professional evaluations are essential to maintain credibility and consistency in financial disclosures.

Example Journal Entries

Individually, the journal entry made when there is an upward revaluation is as follows:

- Dr. PPE (Asset)

- Cr. Revaluation Surplus (Equity)

In case of a reduction of revaluation:

- Dr. Revaluation Surplus (Equity)

- Dr. Profit or Loss (where no excess is available)

- Cr. PPE (Asset)

Such entries will make sure that the balance sheet and income statement correctly show the change in the value of assets with time.

PPE Measurement of Fair Values.

The revaluation model is based on fair value measurement. It obliges companies to establish the market value of their PPE assets through relevant valuation techniques. IAS 16 promotes entities to impair their assets on a regular basis with reasonable regularity in order to present the carrying amount that is not materially different than fair value.

The Market and Replacement Cost Approaches.

Market approach values fair value on the basis of past transactions of similar assets in functioning markets. It is usually applied to properties, including office premises or warehouses, where the market information is easily accessible.

In replacement cost approach, value is calculated based on the estimation of the cost of acquiring or building a similar asset with the same utility, but depreciated and the obsolescence. This is commonly applied to specialized assets or industrial equipment that may not have lively markets.

As an illustration of this example, the machinery in an oil refinery can be priced by the replacement cost method because such equipment has special specifications and none can be found in the market.

Professional valuers and include engineering and financial tests to an estimate of fair value, which is reliable. Companies often engage specialists who provide professional PPE revaluation and impairment testing services under IFRS standards, ensuring compliance with both technical and accounting requirements.

Revaluation Bianuality and reports.

IAS 16 does not stipulate how frequently the revaluation should take place, but it should be done regularly to ensure that the carrying amount is close to fair value. Practically, businesses are revaluing their assets after every three to five years or even within unstable markets.

The disclosure requirements are:

- The effective date of revaluation

- The presence of an independent valuer or not.

- Carrying amount of both models (cost and revaluation

- The period movements in the revaluation surplus.

Clear disclosures enables the stakeholders to know how valuation process is done and what its impacts are on the financial statements to achieve investor confidence and comparability across reporting periods.

Practical Examples

Singapore’s property developer may reprice its commercial buildings to mirror the increasing prices. The growth in value would be realized in equity, and this would boost the asset base of the company and could also lead to an increase in its borrowing capacity. On the other hand, the manufacturing company in Malaysia can have the value of machines declining because of obsolescence, lowering asset value and future depreciation cost.

Effect of depreciation on the value of the assets.

Depreciation refers to the methodical way of establishing the cost of the asset to be used at the useful life. It provides that the cost of using the asset is incurred over a period to match cost with revenue generation. The method of depreciation adopted has a huge role to play in the carrying amount of the asset as well as the financial statements reported.

Plug vs Sloping Methods.

In the straight-line approach, the depreciation expense is charged to the useful life of the asset. Using a good example of a car that has a useful life of five years and the cost of the car is USD 100,000, then the depreciation of the car would be USD 20,000 per year.

Declining balance method on the other hand has a faster rate of depreciation in which high expenses are realized in the earlier years where the asset is more efficient and productive. This is more economically realistic when the assets are expected to depreciate rapidly like technology equipment.

Impairment on both the carrying value and fair value.

Depreciation of the carrying amount of PPE is a direct loss to the carrying amount. Under the revaluation model, depreciation is charged on the revalued amount and therefore depreciation costs are higher compared to those in the cost model. In the long run, this will impact on net book value and equity.

As an example, the fair value of an asset could grow on the post of revaluation, as USD 800,000 to USD 1,000,000. The new fair value would be USD 1,000,000 and the depreciation charge would be calculated based on the new fair value rather than the old one. This is to make sure that the income statement reflects the actual cost of using these assets according to the prevailing market conditions.

Implications of Financial Reporting.

Proper depreciation will make financial statements reflect a real image of value and profitability of assets. Reported earnings may be biased by misestimating useful lives or the residual values and may deceive investors. That is why, the companies have to periodically reconsider the depreciation policies and modify them when it is needed to reflect the shift in assets conditions or schemes of use. This process is essential in achieving steps to success in advanced financial management.

Moreover, IAS 16 also demands that a given entity report the depreciation procedures, useful lives, and gross carrying amounts per asset category. This transparency is what increases the comparability and adherence to international standards.

Conclusion

What is the PPE valuation based on the IFRS is crucial to the proper financial reporting and effective decision-making. The two cost and revaluation models under IAS 16 offer flexibility to an entity to enable companies to choose a model that reflects its operational and market realities.

Periodic fair value appraisals with the aid of professionally trained valuation experts will make sure that the value of the assets is kept up to date and sound. In the meantime, depreciation and disclosure practices should be stable to increase the clarity of financial statements, which increases the trust levels of investors, auditors, and regulators.

In the end of the day, the correct use of PPE valuation principles does not only enhance compliance, but gives the actual picture of economic value of long-term value of a company which presents an honest and transparent picture of the financial status of a firm.