IFRS 9 Financial Instruments Valuation

Introduction to IFRS 9 Financial Instruments Valuation Training Guide

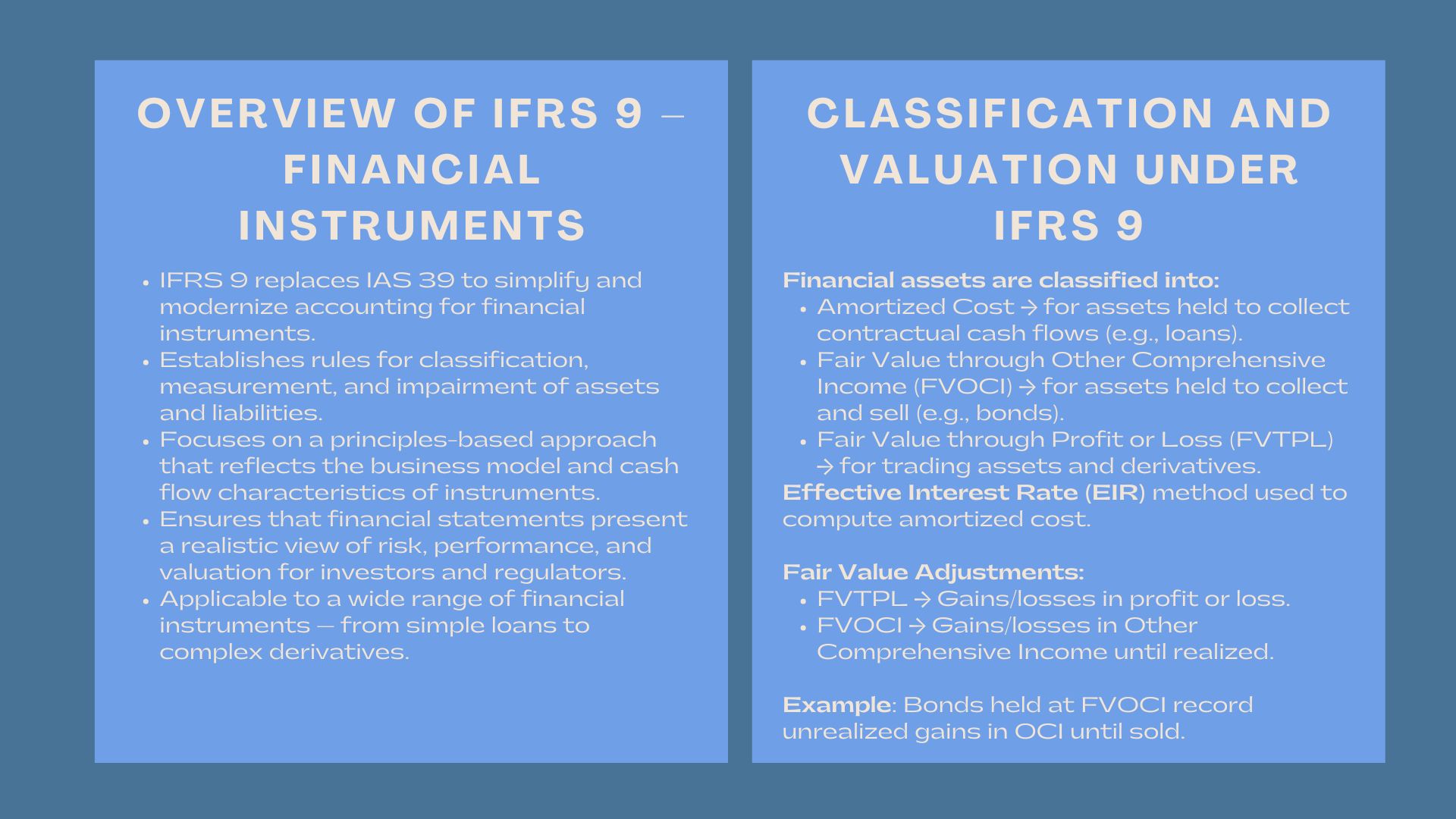

Financial instruments constitute a part of business affairs in the contemporary world as they can be simple loans and trade receivables, or sophisticated derivatives and structured products. To maintain consistency and transparency of financial reporting, the International Financial Reporting Standard (IFRS) 9 – Financial Instruments, establishes principles which are to be used in classifying, measuring and impairing these financial instruments.

The IRS 9 is a replacement of the previous IAS 39 framework, which was rather complex and did not reflect the economic reality in accounting practices. It focuses on principles based approach that indicates the nature of contractual cash flows as well as the business model. This provides a more precise picture to the investors and any other regulatory authority about how a company would be affected by any financial risk and its performance in the long run.

Classification and Fair value of financial instruments.

Classification and Fair value of financial instruments.

Types: Amortized Cost, Fair Value through Profit or Loss and Fair Value through other comprehensive income.

Under IFRS 9, financial assets are placed in either of three categories depending on two major factors which includes the business model of the entity to manage the financial assets and the contractual nature of the cash flow of the asset.

- Amortized Cost – Financial assets are those assets retained by a business model that have the goal of gathering contractual cash flows, with the cash flows being the payment of only principal and interest (SPPI). Examples are typical in the form of loans and receivables, which are closely related to amortization expense in financial reporting for accurate recognition of income and asset value over time.

- Fair Value through Other Comprehensive Income (FVOCI) – This is applied to assets that are being held to receive cash flows as well as those that are to be sold. Debt instruments such as government bonds and corporate bonds can be of this nature.

- Fair Value Through Profit or Loss (FVTPL)- Financial assets that do not satisfy the above two categories. These are derivatives, trading securities, and structured notes.

The different classifications would decide how the further measurement and profit recognition would be done in the financial statements. As an illustration, income or expenses in FVTPL assets are either recorded immediately in the income statement and FVOCI in other comprehensive income until they are realized.

These rules form the foundation of fair value measurement of financial instruments under IFRS 9 standards, ensuring a consistent and market-based valuation framework across industries.

Classification Criteria.

The classification is not random- it is based on the management of the financial assets as well as their cash flow nature. Under the new IFRS 9 models, a business model assessment and SPPI test is included:

- Business model test is used to analyze whether an entity has an intention of holding financial assets to generate cash flows, to sell or both.

- The SPPI test provides that the contractual provisions of a financial asset generate only cash flows which are payments of principal and interest.

An example is a corporate loan that is held to maturity and satisfies both requirements and is measured at a cost that is amortized whereas an investment that is not traded would be under FVTPL.

Bonds, Loans and Derivatives.

A couple of real-world examples can be used to explain how classification can be done:

- Corporate Bonds: They are categorized at FVOCI in case they are held to collect income and to be sold occasionally.

- Bank Loans: They are generally of amortized cost as they are held in the form of cash collection.

- Derivatives: They are always valued at fair value with the help of gains or losses because of their market based value and absence of stipulated contractual cash flows.

This classification methodology has been used to guarantee a fair value reporting that is consistent with the economic reason of owning every instrument.

Amortized Cost vs Fair Value Valuation

The Effective Interest Method of Calculating Amortized Cost.

The method used in computing amortized cost is the effective interest rate (EIR). EIR is the rate that discounts with preciseness the estimated cash receipts or payments in the future by the projected life of the instrument up to its gross carrying amount.

To take an illustration, assume a firm lends out a loan in cash in the amount of 1,000,000 at the unitary interest rate of 8 percent, only to find out that the actual interest rate taking into consideration transactions costs and other expenses is 7.5. This interest rate that has been adjusted will be reflected in the amortized cost and the interest income or expense will be gradually recognized as the cost is amortized.

This methodology will make sure that financial income or expense is registered in the manner that will give the actual cost or yield of the instrument.

Fair Value Adjustments and Gains/Losses Recognition.

Changes in fair value, where the financial assets are at fair value, are as follows by the classification category:

- Under FVTPL, all the changes are recorded to either profit or loss.

- There is recognition of unrealized gains or losses in other comprehensive income until they are disposed of as per FVOCI.

These changes make sure that the financial statements record the movements in the market and reflect the current values and not the old book values. To illustrate a case, a company that has the government bonds which have been marked to market will record the increment in the value of the bond as a gain to bring in more transparency in the financial performance of this company.

Examples of Calculations Practically.

Let’s take an example:

A financial institution buys a bond of five years with a coupon rate of 6 per cent and a value of 1,000,000 and categorises it under FVOCI. One year later, the bond fair value grows to 1,050,000 with a reduction in the interest rates in the market.

- The gain of 50,000 will be unrecognised gain in other comprehensive income (OCI).

- In case the institution sells the bond next year at a price of $1,070,000, the OCI gain of cumulative profit of $70,000 becomes reclassified into profit or loss.

This example demonstrates how the fair value adjustments are to be classified differently and the impact that they have on the balance sheet and the income statement.

Practical Valuation Examples of Financial Instruments

Valuing the Derivative Contracts at Fair Value.

Under IFRS 9, derivatives (options, forwards, and swaps) are always quantified at fair value. Their valuation is often based on market observable data and valuation models, such as the black-scholes model of options or the discounted cash flow model of swaps.

The inputs such as the interest rate curves, volatility assumptions, and credit spreads should be revised frequently in order to make sure that fair value is interpreted in accordance to the prevailing market conditions. Preferred is level 1 inputs (quoted market prices) though in absence the Level 2 or Level 3 methods of valuation is utilized based on availability of data and complexity.

Sound fair value measurement of derivatives offers the investors with an insight into the exposure the firm has to the market, credit and liquidity risks, which are vital aspects in the determination of financial stability.

Impairment on the Expected Credit Loss Model.

The IFRS 9 made it mandatory to use the Expected Credit Loss (ECL) model to substitute the incurred loss model used in IAS 39. This model also stipulates that entities should identify credit losses at an earlier point by estimating future credit risk as opposed to default occurrences.

The ECL model is developed around three steps:

- Stage 1: Assets that do not have a considerable credit deterioration- 12 months expected credit losses are recorded.

- Stage 2: Assets that have higher risk of credit losses- lifetime expected losses are seen.

- Stage 3: Credit-impaired assets-interest revenue will be calculated on the net carrying amount (net of loss allowance).

To illustrate, a bank can give an approximation of probability of default on a portfolio of loans amounting to $10 million as 2%. It would then be an expense of 200,000 being 12-month expected credit loss.

This progressive model increases the level of transparency and brings accounting to the contemporary method of risk management.

Financial Statement Reporting.

Every financial asset and liability determined by the IFRS 9 should be transparently presented in financial statements. Entities should include:

- The classification and the basis of measurement of every financial asset and liability.

- Level of hierarchy of fair value hierarchy used (Level 1, 2, or 3 inputs)

- Opening carrying amounts and closing carrying amounts Reconciliation.

- Credit risk exposure and impairment losses information.

Such disclosures enable users to know the nature and level of financial risks, and the method of fair value determination.

Professional analysts and auditors often rely on professional valuation methods for IFRS 9 financial assets and liabilities to ensure consistent application of models and assumptions across portfolios, particularly when valuing complex instruments.

Conclusion

The accounting environment of financial instruments by IFRS 9 transforms evaluating measurements and classification, in addition to impairment of financial instruments by aligning the accounting principles with risk management practices in use by an entity. It increases transparency through highlighting fair value reporting and future credit loss estimation.

The strict adoption of IFRS 9 helps companies to have a realistic picture of their financial position and performance in their financial statements. Derivative valuations to a bond portfolio, fair value principles under IFRS 9 introduce consistency, comparability, and reliability of global financial reporting – a fundament to the trust of investors and regulatory assurance.