IFRS 5: Fair Value Valuation for Non-Current Assets Held for Sale

Introduction to IFRS 5 Fair Value for Assets Held for Sale

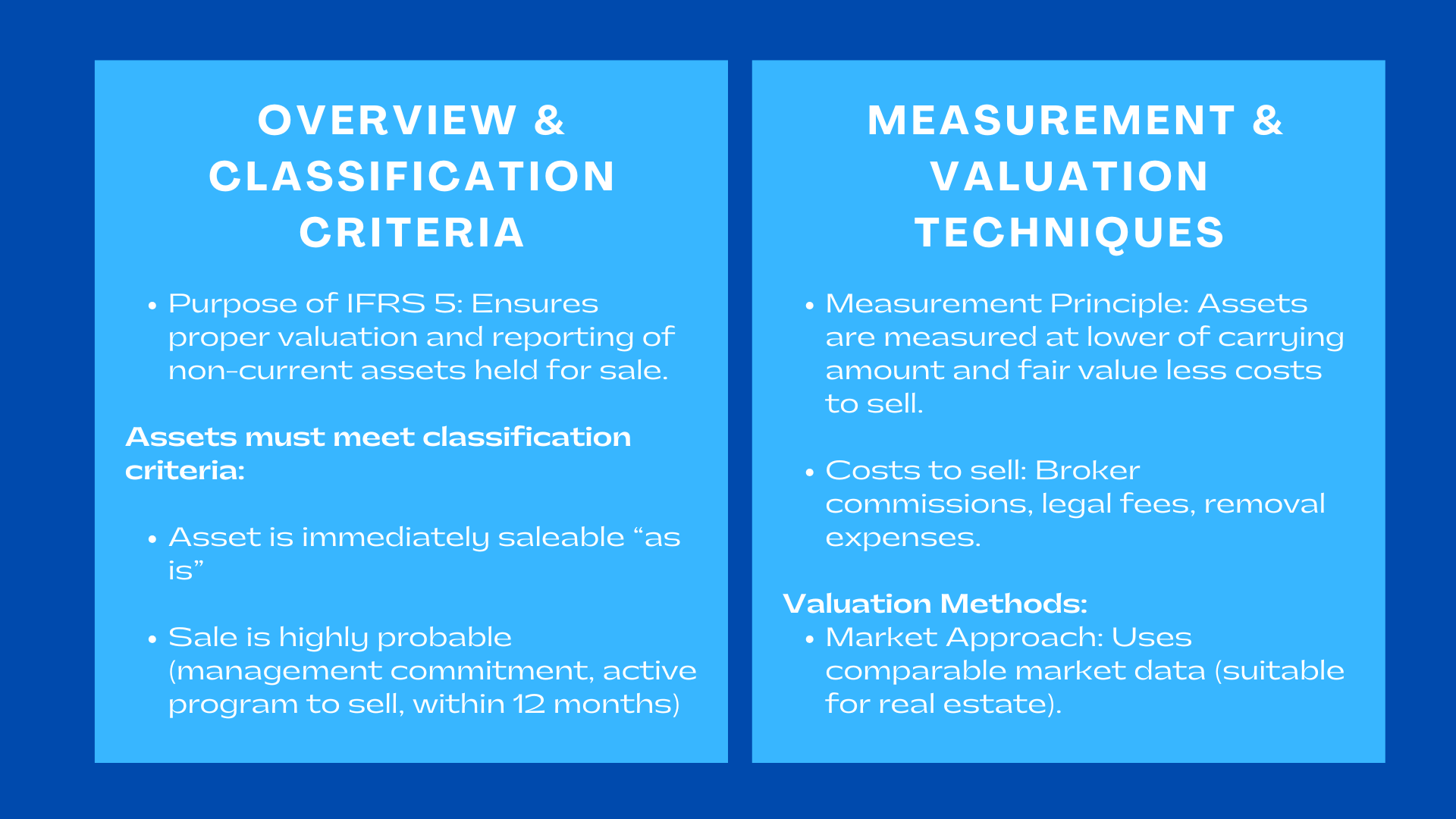

Proper valuation and reporting is important when a company decides to dispose of an asset or a collection of assets. In this respect, IFRS 5 Non-Current Assets Held for Sale and Discontinued Operations comes in. The standard gives extensive information on the sorting, the quantification, and the reporting of the non-current assets that are to be sold and not to be utilized in the business.

The IFRS 5 also has guaranteed that the assets held in sale should be measured accordingly and that the value of the financial statements should be the current value the assets can fetch. Companies should remeasure such assets using fair value as opposed to further depreciation of such assets, which provides stakeholders with a fair measure of their recoverable value. Knowledge about the union requirements of the IFRS 5 is vital to finance professionals, auditors, and valuation experts in matters of assets disposal, corporate restructuring, and in understanding Employee Stock Option Plan regulations Singapore for proper reporting and compliance.

Criteria of Classifying Non-Current Assets Held for Sale.

Criteria of Classifying Non-Current Assets Held for Sale.

According to IFRS 5, the specific conditions are to be satisfied before an asset is classified as being held to sale. The asset has to be immediately saleable as it is and the sale should be very likely to take place. Highly probable means that management has made a commitment of a plan to sell the asset, there exists an active program that is being initiated to find a buyer and the sale should be made in the next 12 months.

As an example, when a manufacturing firm in Kuala Lumpur decides to sell one of its production plants, the reclassification to a held for sale asset can only be performed under such conditions. The assets that do not fit into the requirements will be continued to follow their respective accounting standards, which are IAS 16 on property plant and equipment or IAS 38 on intangible assets.

Under the IFRS 5, Measurement Principles.

After the classification as held for sale, the group of assets or disposal should be determined at the lesser of its carrying amount and fair value less sell-out expenses. Such a change in the measure is relevant to make sure that financial statements show the most realistic amount that company is likely to recover after the sale.

Depreciation ceases at this stage. As the value of the asset will now be recovered by selling it instead of using it, it would no longer be relevant to depreciate that asset. Any write-down caused by the remeasurement is an impairment loss that is identified in the income statement.

The methodology is a reconciliation of accounting and valuation since fair value adjustments provide the relevant stakeholders with a reliable measure of how the asset would sell. Companies typically engage valuation specialists to ensure compliance with IFRS 5 fair value measurement of non-current assets held for sale, ensuring accuracy and regulatory adherence.

Learning about Fair Value and Cost to Sell.

The fair value is the price, which would be obtained in an orderly transaction of selling an asset on the date of measurement among the members of the market. Incremental cost that can directly be attributed to the disposal and are considered costs to sell are commissions to brokers, legal expenses, and removal expenses.

Under the IFRS principles, the fair value is usually calculated with the help of one of the three valuation techniques:

- Market Approach: Likewise market data used in other similar assets.

- Income Approach: The approach discounts future cash flows on the asset.

- Cost Approach: The current replacement cost of the asset has been estimated taking into account depreciation and obsolescence.

Market approach can be most relevant with some type of assets like real estate and the cost approach can be more appropriate in estimating the recoverable value of some specialized machinery or equipment.

Presentation and Treatment of Accounting.

In the instance where an asset satisfies the requirements of being held or sold, it is recorded as current assets in the balance sheet and is reclassified as non-current assets. Liabilities that may be related to the same are also reclassified under a different line as liabilities directly related to assets held to sale.

Income statement The income obtained in discontinued operations where necessary are shown separately to improve clarity. These are the pre-tax profit or loss on the discontinued operation, and the realized gain or loss on either disposal or remeasurement to fair value.

This kind of presentation would make the investors and analysts able to clearly distinguish between the current operations and those which are being divested thus enhancing comparability of the financial statements.

Practical Case: Asset reclassification under the IFRS 5.

Take the example of a company having an office building that is being carried at a book value of 12 million dollars. The company resorts to the sale of the property and categories the property as held to sale when the board approves the selling plan and appoints a broker. It has a fair value less costs to sell of an estimated amount of 11 million dollars.

Under the IFRS 5, the company will have to remeasure the asset and record a 1 million impairment loss in the profit or loss and a 11 million asset. There is no subsequent depreciation taken on the building henceforth. A gain or loss on disposal is recognized on the sale of the property when the property is finally sold at a price that is different than the carrying amount of the property.

It is done to make the book value of the asset reflect the recoverable amount and financial results reflect the actual impact of the sale.

Issues of Valuation and Problems.

Despite the illustrative nature of the IFRS 5 frame, difficulties in application are always encountered in practice. It is one of the primary challenges to select the right fair value less costs to sell. The final figure is affected by market conditions, liquidity, as well as asset specificity.

An example is special machinery employed in the manufacturing industry or the energy industry and there might be very few similar market transactions and therefore valuation is very subjective. This is where professional valuers play a vital role in providing accounting treatment and valuation of assets classified as held for sale under IFRS 5. Their technical competence makes the fair value estimates to be reliable as far as the market evidence is concerned and that the estimates are in line with reporting standards.

The other most common problem is the classification timing. Firms have to make sure that the high probability-standard is actually fulfilled because early classification may result into inaccurate financial reporting. They also need to perform regular re-evaluation, in case the criteria are not met anymore, the asset should be reclassified to its initial category, with its value being determined based on the assumption that it was never kept on sale.

Financial Statements Disclosures.

IFRS 5 compliance is based on transparency. Organizations should provide information on their financial statements as outlined in details, which includes:

- A description of the non current assets or the disposals groups to be sold.

- The significant classes of assets and liabilities classified as held-in-sale.

- Impairment losses or reversal disclosed.

- The anticipated way and time of disposal.

In case sale is included in an operation that has been discontinued, more disclosures concerning the segments revenue, expenditure, and cash flow are needed. Such disclosures give investors and regulators information on the strategic choices of the management and how such planned disposals will affect the bottom line.

The Strategic IFRS 5 in Company Decision-Making.

IFRS 5 is not merely a compliance measure, but a financial strategic instrument. It also assists the management to evaluate resources allocation and capital efficiency by obtaining a clear differentiation between assets to be sold and the resources to be used in operations.

As an illustration, reclassifying impaired assets to held to sale can simplify the balance sheet of a firm and emphasise on its core operations. Meanwhile, the remeasurement based on fair values guarantees that there will be transparency in the information provided to the stakeholders about the true value of such assets.

Appropriate use of IFRS 5 offers a credible basis of negotiation and due diligence in cases of mergers and acquisitions (M&A), and restructuring. The buyers will be assured of fair value assessments in accordance with the international standards and presented reported asset values.

Conclusion

IFRS 5 is used as a linkage between financial reporting and valuation whereby assets that are intended to be sold should be reported at the most feasible recoverable value. It encourages transparency and investor confidence as it requires reclassification, fair value adjustments and disclosures.

In the case of companies intending to make disposal or restructuring, the effective application of IFRS 5 would protect the financial integrity and credibility of decision-making, that is, ensuring all assets on sales are not only valued on accounting bases, but also on its market potential.