IFRS 16 ROU Asset Valuation: Why Discount Rates Drive Accuracy

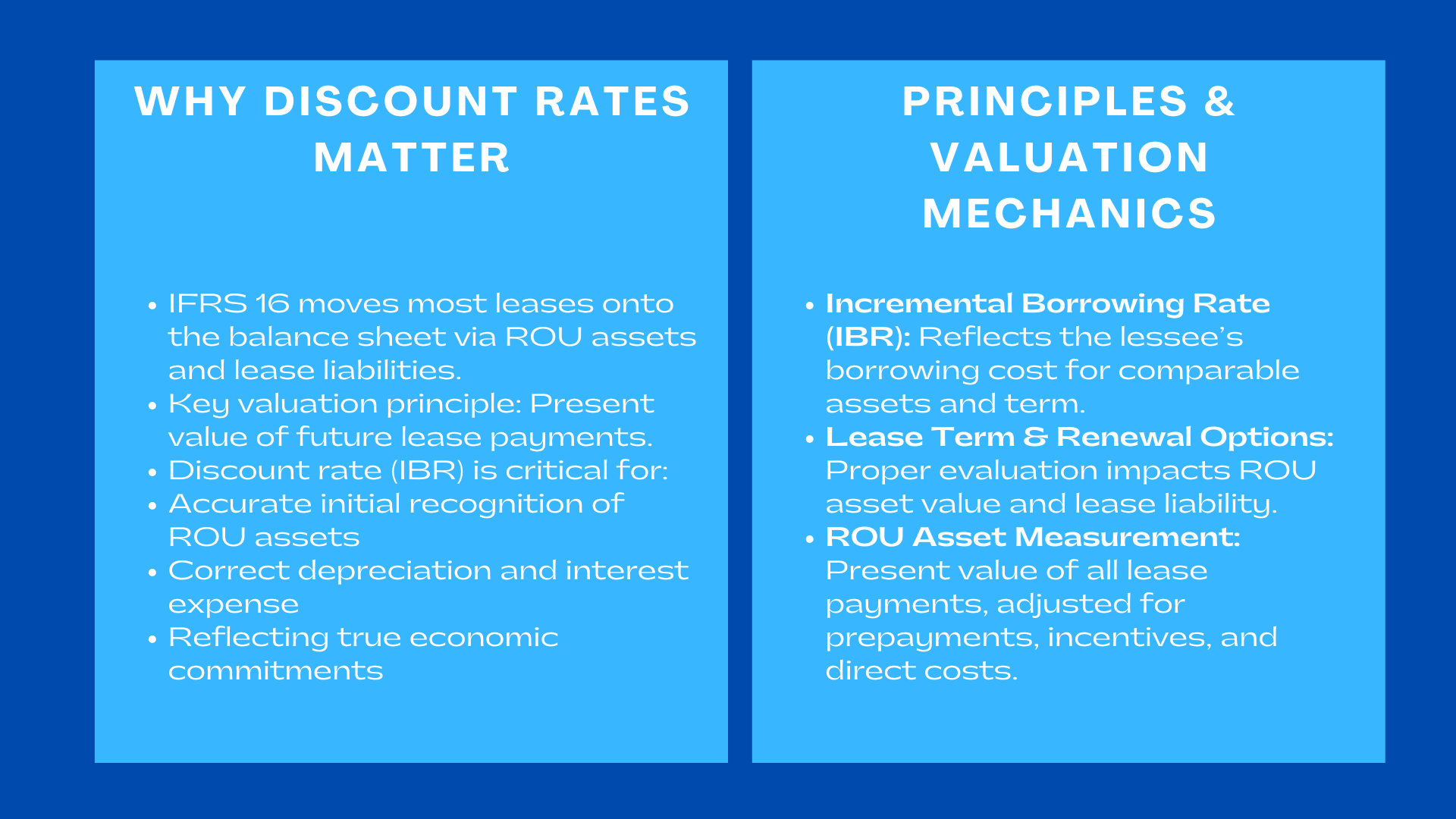

Introduction of the IFRS 16 had fundamentally altered the recognition and measurement of leases where the majority of leasing arrangements were moved to the balance sheet by recognition of the Right-of-Use (ROU) assets and lease liabilities. This amendment removed operating and finance lease removables of lease under a more transparent and comparable way of lease reporting across all industries. The most important principle of valuation in this standard is the present value of the future lease payments. Since the determination of both the ROU asset and the lease liability is based on the process of discounting the contractual payments, one of the most important judgments made under the IFRS 16 is the discount rate, especially the incremental borrowing rate (IBR). The validity and sanity of valuation of ROU assets depends on this rate and is considered imperative in terms of giving financial statements that capture the true economic commitments and not arbitrary or overestimated charges.

IFRS 16 has requested that companies should identify an ROU asset indicating entitlement of a lessee to use some underlying asset throughout a fixed time, and a lease liability indicating liability to settle lease payments in future. In contrast to the simple rental accounting under the IAS 17, How to determine the incremental borrowing rate under IFRS 16 for accurate ROU asset valuation will impose the same lease accounting that is guided by the financing principle, where the lease payment is treated as a series of liabilities, which are related in nature to interest-bearing debt. Consequently, the choice of discount rate affects, not only, the initial recognition of ROU assets, but also expenses charged on depreciation, interest, balance sheet structure, as well as essential financial ratios in the end. Any incorrect discounting rate will significantly disclose financial reporting, excessive discounting produces inflated ROU assets and liabilities, whereas a high discounting would undervalue it. As such, the determination of the discount rates should be based on good methodology, information which is based in the market and the application which is consistent.

Understanding the Incremental Borrowing Rate and Its Impact

Understanding the Incremental Borrowing Rate and Its Impact

The first one is the concept of incremental borrowing rate which is central to IFRS 16. The IBR is the rate on which a lessee would be required to borrow, on a comparable term and with comparable security, the amount of money he would require to borrow, which would put him in a comparable economic position, in terms of acquiring a similar kind of asset. Since an interest rate is not clearly stated in the majority of lease agreements, the IBR is the main discounting rate applied to gauge the lease obligations and through it, ROU assets as well. When establishing an IBR, prudent decision-making is needed because it should put into consideration the credit worthiness of the lessee, the type of leased property, and the term of the lease among other factors as well as the market interest rates. Professionals attending a corporate IFRS reporting course for accountants will learn how to determine and apply the incremental borrowing rate effectively for accurate ROU asset valuation.

A properly established IBR indicates the economic power of the financing element of lease. It takes into account the conditions, in which a corporation would practically borrow funds to gain control over the underlying asset. The curves that are normally used in computation of the IBR refer to yield curves, observable rates of securitization of lending, credit spreads and economic conditions. In other instances, entity specific adjustment might need to be done so as to alleviate the rate to the risk profile peculiar to the lessee. The IBR thus is not just a mere accounting estimate but a strategic financial judgement which influences the reported values of assets, the interest costs and the trend of recognition of the income during the lease period.

Lease Terms, Renewal Options, and the Importance of Evaluating Economic Incentives

The valuation of ROU assets commences by establishing the lease term that would comprise of the non-cancellable period of the lease and any extension or rope out opportunities that the lessee possesses that are well known to exercise the opportunity. The IFRS 16 results in the companies evaluating various economic incentives, strategic considerations, the need of the business, and renewing or ending the contract before developing a reasonable certainty. Such an evaluation directly affects ROU asset valuation with the result that the future lease payments will be considered in the present value calculation.

The longer the period of lease the higher is the lease liability and the ROU asset whereas the shorter my period of lease the less. The business should consider a variety of options, such as the value of the underlying asset in business, relocation expenses, existence of alternative options and contract provisions that may include having below-market renewal rates or inclusive termination offers. The leasing of certain property, production plant and equipment of strategic importance are areas that the judgement of the renewal option should be involved especially in issues related to renewing lease. The failure to estimate the financial soundness of the rationale of renewal decisions may lead to errors in the value of ROU assets and unequal financial reporting over time periods.

ROU Asset Measurement and the Mechanics of Present Value

The ROU asset is the right of the lessee to make use of the underlying asset throughout the lease period at an economic level. Its initial measurement is directly related with the present value of whether the lease payments in the future. The lease payments occasion fixed payments, in-substance fixed payments, variable payments made based on an index or rate, and something to do with optional purchasing deals, residual value assurances, or even penalties in case of premature discontinuement. Once these payments are determined they have to be discounted at the relevant discount rate which is usually the IBR.

The importance of utilizing the mechanics of the present value is that it would place the long-term payment amounts of payment obligations into a single value in the present value, which would resemble the valuation of a loan or financing transaction. The present value analysis takes into consideration that money possesses time value and that present future payment should be discounted depending on how much such payment is expected to be discounted in future. Under IFRS 16, the companies are compelled to apply standard formulas of present values, whereby the discount rate is included in each payment stream based on the timing. The lease liability that results is the basis on which the ROU asset is measured, and answered with such adjustments as prepaid lease payments, lease incentives generated, initial direct costs and not responding to the obligation to restore the property.

The ROU assets are then depreciated on a regular basis during lease term, on a straight-line basis. Consequently, the values of the ROU asset at inception have a direct impact on the patterns of depreciation expenses, interest rate on lease obligations, and operation performance indices. The use of present value mechanics and ROU in context of synergy indicates why correct discounting is the core of the credibility of the financial statements as presented according to the IFRS 16.

The Role of Discount Rates in Long-Term Lease Valuation

The impact that the discount rates have is not limited to acquisition of the lease obligations; they determine the entire financial articulation of a lease operation. Since the ROU assets influence depreciation and the liabilities influence the interest accretion, the discount rate influences the way the expenses are recognised with passage of time. A discount rate that is less is the one that gives high present values as well as large assets and liabilities. This will have an increase in depreciation but a reduction in interest expense. On the other hand, an increased discount rate will create lower present values, which leads to lower ROU assets and liabilities with less depreciation that have higher interests at the start of the lease period.

This dynamic produces a significant effect on such financial ratios as EBITDA, leverage indicators, the turnover of assets, and the invested capital. There is a growing fascination of investors, lenders, as well as analysts in the lease-related disclosures as to how a company depends on the discount rate assumptions to determine the percentage of financial position of a company. To this effect, numerous firms come up with advanced discount pricing models that involve treasury base rates, country risk mark ups, industry adjustments, and credit spread evaluations. There should be consistency in the use of discount rates in different portfolios of leases so as to prevent distortions and other common comparative differences between one reporting period to the other.

Lease Modifications and Adjustments to ROU Asset Values

The lease arrangements often change with the restructuring of the business, the renegotiation, issuing a new premise or changes in the operation requirements. Under IFRS 16, the companies are mandated to revert to the reassessment of lease liabilities and Rock understand assets in case of change in terms of lease, renegotiation of lease payments, or even reassessment of renewal options. The changes could be the expansion or reduction of the lease, altering the areas of the lease, or modification of payment schemes.

In the case where the modification lacks accounting of the modification as a distinct lease, the companies are required to revise the lease obligation with a new discount rate applied based on the modification date. This recalculation is used to adjust the ROU asset by raising or lowering it according to its economic impact of the change. Adjustments thus add some dynamic aspect to ROU asset valuation, which currently demands a continuous management judgement and sound internal procedures, so that a re-assessment is not deferred.

Since discount rates need to be re-evaluated whenever there is a change in the lease, business organizations need to have uniform procedures for arriving at new IBRs. The inability to properly reshape the effects of modifications can result in the material misstatements, including depreciation, as well as interests, and the presentation of the balance sheet in general.

The ROU Valuation Process From Contract Identification to Final Reporting

Making valuation decisions concerning the assets of ROU by another method, IFRS 16, will be done in a systematic manner that commences the process of locating lease contracts. A lease is there when a customer acquires the authority to manage the utilization of a recognized property in return with consideration. Once a lease contract has been found, the second process is to decide on the lease tenure which may be extended or ceased in case the lessee is reasonable in taking them.

When the term of the lease is determined, the entity should estimate incremental interest rate or apply the interest rate implicit in the lease where the same can be easily known. The use of discount rate on payments of contractual leases converts future payments into their present value, which results in the first lease obligation. The ROU asset is determined by; the lease obligation, reduced by the prepayments, incentives, direct costs or any destruction obligations. The ROU asset should be revised to reflect changes that take place over the period of lease, and this is in accordance with the economic changes, which comes with the new contract terms.

All this will make sure that ROU assets and lease liabilities capture the nature of financing of the lease as well as an economic value of the underlying asset. It represents rights and obligations of the leases clearly that reflects the financial statements with the reality in the economy.

Conclusion to IFRS 16 ROU Asset Valuation Why Discount Rates Drive Accuracy

The valuation of lease in IFRS 16 puts the discount rate in the sovereign position as it is acknowledged that the discount rate of lease value dictates the valuation of the ROU asset as well as afforded lease liability. Companies guarantee that the financial statements of lease arrangements reflect the economic substance of lease arrangements through the prudent approach of determining the incremental rate of borrowing, judicious evaluation of lease terms and renewal option, and the application of the resulting use of present value mechanisms.

The standard increases transparency, raises comparability between industries, and eliminates the tendency of leases to be understated and distorted. The greater the strategic flexibility, capital efficiency and scale of operations offered through leasing structures continue to be important to the companies, the greater the accuracy of the determination of the discount rate and ROU valuation. The final product of IFRS 16 discount rate methodology for long-term lease measurement and financial reporting accuracy is that the value of the right-to-use of an asset will not be over- or understated to ensure the integrity of balance sheets and provide them with a credible perspective on the long-term commitments and economic rights of a company.