IFRS 16 Right-of-Use Asset Accounting

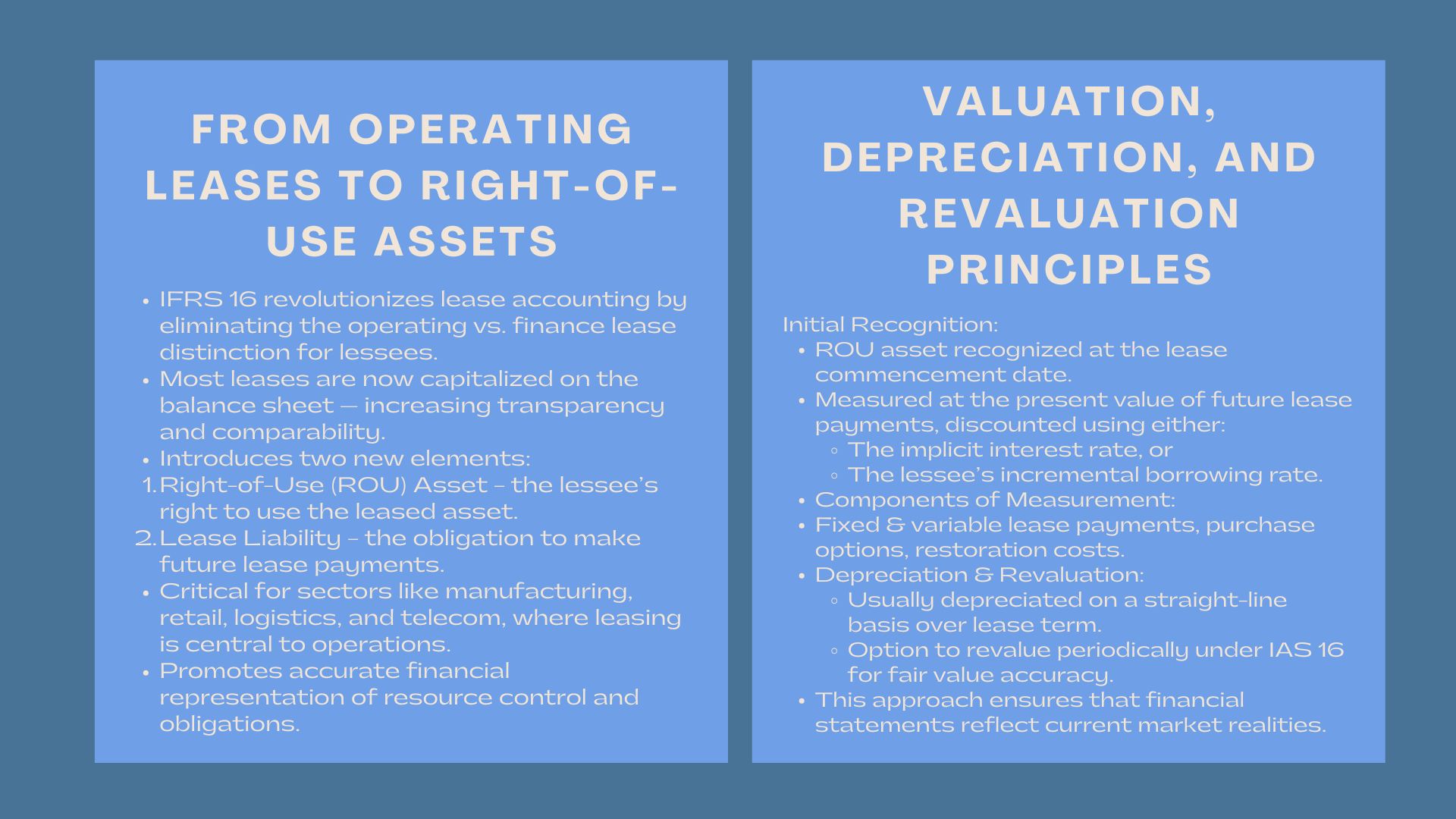

The new accounting practice of leases has also been revolutionized by the IFRS 16 in the current dynamic financial reporting environment. Highlighting the fact that the previous model identified the differentiation between operating and finance leases of the operating leases, IFRS 16 demands most of the leases to be capitalized in the balance sheet. This significant change in accounting would achieve higher transparency and comparability among businesses and industries.

The IFRS 16 introduces the notion of the right-of-use (ROU) asset and the lease liability, which makes the financial obligations and the use of the assets of an entity more complete. In industries (such as manufacturing, logistics, retail, and telecommunications) where leasing is one of the core elements, it is now necessary to understand how to correctly measure, and report lease-related balances to comply, ensure investor trust and make decisions.

Right-of-Use Asset Valuation IFRS 16.

Right-of-Use Asset Valuation IFRS 16.

In accordance with the IFRS 16, the key stone of the lease accounting is the recognition of a right-of-use asset which is an asset of representing the right of the lessee using an asset which is leased in accordance with the lease period. The recognition is done at the date when the lease begins, i.e. when the lessor has the underlying asset in place to be used.

Right-of-Use Assets Recognition.

Upon lessee inception, right-of-use asset and a lease liability should be identified. The ROU asset is basically a reflection of the lease obligation value with or without initial direct costs or lease incentives that have been obtained or the obligation to restore. This form of treatment provides a consistent start of the asset and the liability by giving an establishment of uniform future measurement.

Take the case of a company leasing a piece of equipment over a five-year period the ROU asset is the legal right of the equipment to be used over the time period of lease. Such a recognition will give the stakeholders a better understanding of how the company is in control of its resources and what future economic implications can be gained off the leased property.

Primary Measurement at Present Value of the lease payments.

The original value of the right-of-use asset is based on the value of lease payments that will be made in the future, which are discounted at a suitable rate. This is a core aspect of the fair value measurement of right-of-use assets under IFRS 16 for financial reporting. The lease payments also usually contain the fixed payments, variable payments to an index or rate, and the exercise price of purchase options in case the lessee is reasonably sure to exercise his options.

These discounting of future cash flows will make sure that ROU asset shows its current economic value as opposed to a mere summation of nominal lease payments. Interest rate implicit in the lease is the discount rate normally used; however, in case the former is not easily available, the incremental borrowing rate of the lessee is used.

Depreciation and Revaluation Revisions.

Rights-of-use assets upon being identified, are normally depreciated straight-line over the lease period or the useful life of the asset, whichever is lesser. Nonetheless, IFRS 16 permits organizations to exercise the revaluation model in IAS 16 in the backdrop of other similar assets adopting the same model.

Practically, this includes that companies that have large property leases can periodically revalue their ROU assets to their current market conditions, and this is particularly set to be the case whereby there is a significant difference between the fair value and carrying value. Frequent appraisal is an element that keeps the financial statements up to date and relevant in that they give a better picture of the asset base of a company.

Measurement of Lease Liability Fair Value.

In line with the identification of the right-of-use asset, a lessee should also have a lease liability. This liability is a statement of the present value of lease payments which are due to be made by the lessee during the lease period.

Lease Liabilities Calculation.

The lease liability is firstly measured at the present value of future lease payment that comprises of all fixed payments (without any lease incentives) and variable payments determined by an index and amounts to be paid which is anticipated to be paid under residual value guarantee.

An example of this is where a business enters into a 10-year warehouse lease with an annual escalating lease payment, the business has to project all the lease payment, discount back to the present value and then record the liability. Close estimation and documentation of the process is necessary to guarantee compliance to audit and transparency.

The next measure is to add the liability to the interest costs and subtract the measure to the payments made. This is similar to amortization of a loan whereby regular payments made during the lease have a principal and interest portion.

Selection of Discount rate and its effect on Valuation.

The discount rate used contributes a lot to the value of lease liabilities. An increased rate will shrink the present value of the obligation whereas the lesser the rate, the larger the reduced value of the liability. Under IFRS 16, the rate used in respect of the lease is the implicit interest rate. In case that rate is not available, companies are to rely on their incremental borrowing rate, which is basically the rate they would have to pay to borrow a similar term and with similar security.

This is an area where many organizations seek professional lease liability and right-of-use asset valuation under IFRS 16, as the rate selection requires professional judgment, consideration of market conditions, and an understanding of the entity’s financing structure. A wrong discount rate may result in the misstatement of both ROU and asset of the liability which will have a bearing on the profitability and solvency ratios.

The practical example of Liability Measurement.

Take the example of a company that is leasing a piece of office space over a period of five years where it is paying RM100,000 every year and the incremental rate of borrowing is 5%. These payments less discounted at 5 percent make up the initial lease liability. With time, the company will realize the payment of money and the liability will be reduced, but the interest will be reflected in profit or loss.

This case demonstrates the nature of the goal of IFRS 16, which is to harmonize the accounting of leases with their economic realities. Both asset and liability change with time, indicating the variation of the financial liability and control of the resources in the company.

Effects of Lease Valuation to Financial Statements.

The application of the IFRS 16 has impacted not just the balance sheet but also has claimed the income statement and significant financial ratios. Firms should be aware of such implications in order to report true financial performance to stakeholders.

Balance Sheet and Profit or Loss Effects.

The leasing capitalization of the balance sheet adds to both the total assets and total liabilities, which may decrease the equity ratio. Under the income statement, IFRS 16 will also depreciate the ROU asset and interest expense on lease liability instead of the rent or lease expense. This leads to increased EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) and can have a positive effect on the performance indicators but can also cause greater volatility in the profit numbers.

This accounting shift is especially relevant for the asset-intensive sectors such as airlines, logistics, and retail where leasing is one of the primary sources of finance. Sound lease valuation makes these companies reflect a sound financial image to the lenders and investors.

The ratios that were influenced by the lease valuation include:

Under the IFRS 16, several financial ratios are influenced. As an example, the debt-to-equity ratio would increase because of an increase in the reported liabilities. On the same note, the return on assets (ROA) might decrease due to the growth in the total assets due to capitalized leases. On the other hand, the EBITDA margins are enhanced with lease expenses being substituted by non operating items.

In order to make sure that these ratios are benchmarked correctly, analysts and investors will need to change their interpretation of these ratios after the adoption of IFRS 16. The implications of redesigning to IFRS 16 on these key metrics should also be reported by the management in order to be transparent to the stakeholders.

Disclosure Requirements

The IFRS 16 requires extensive disclosures to the financial statement notes. The companies have to present qualitative and quantitative news in relation to their leasing operations, such as the nature of lease, assumptions made in calculating discount rates and analysis on maturity of lease liabilities.

These revelations enable the financial statement users in evaluating the effects of leasing on the financial position and performance of the company. They also strengthen accountability, where the entities are obliged to justify the judgment and estimates made to recognize and measure leases.

Conclusion: IFRS 16 Right-of-Use Asset Accounting

Adoption of IFRS 16 is a major development in the field of financial reporting one that brings greater transparency to the lease agreement and the use of assets by companies. Organizations are able to capitalize leases to provide investors and regulators with a better picture of the financial commitments.

Being aware of the requirement in the recognition, measurement, and reporting of both the right-of-use assets and lease liabilities will also make sure that the reports are compliant and accurate in financial reporting. Regardless of the complexity of lease arrangements or the revaluation principle, the company that understands the concepts of fair value as applied in IFRS 16 would be in a better position to develop clear and plausible financial statements in a globalized business set-up.