Business Valuation for Mergers & Acquisitions under IFRS Standards

Introduction to Business Valuation for Mergers Acquisitions IFRS

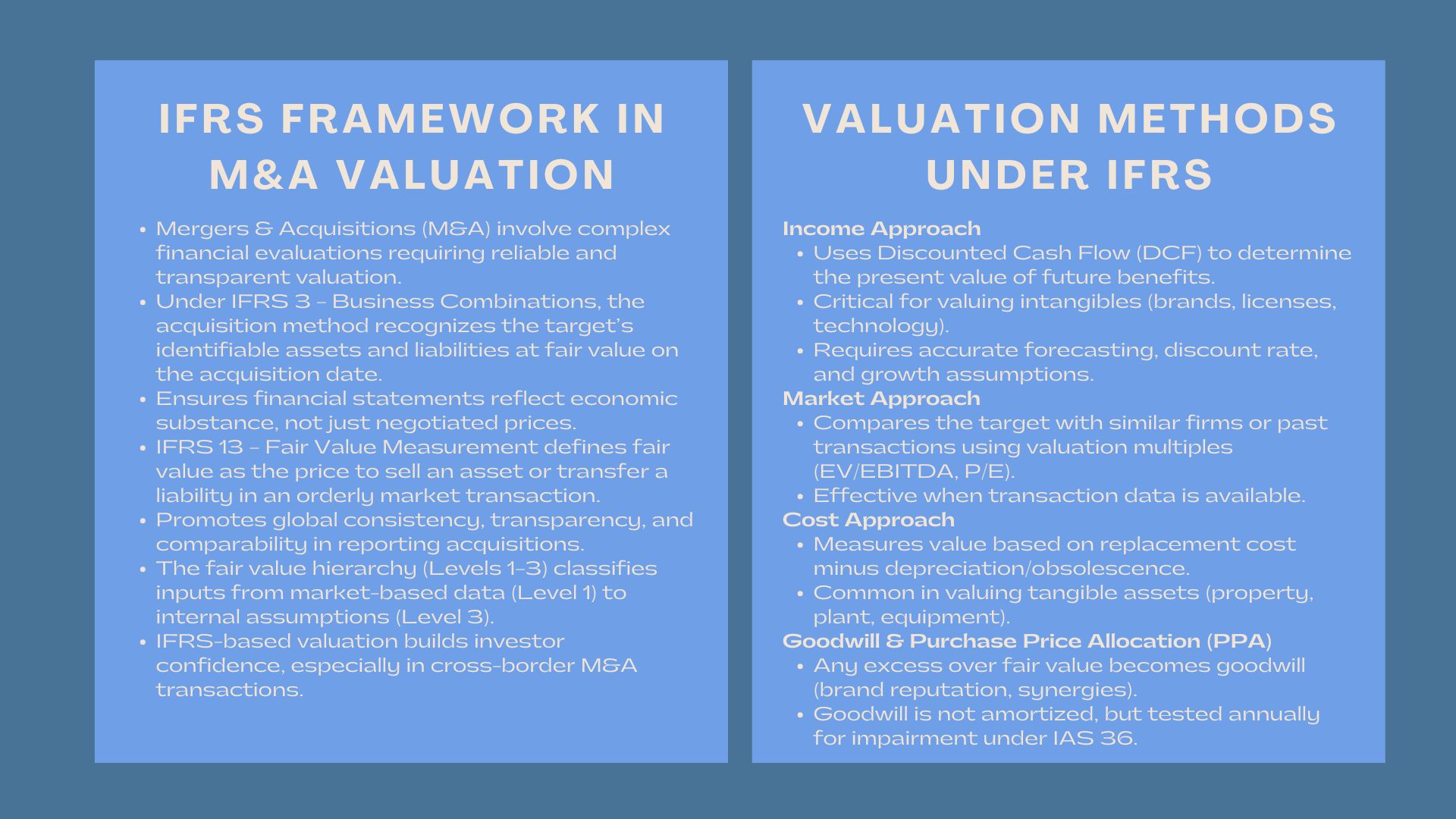

Mergers and acquisitions (M&A) are the most complicated and risky financial deal in corporate strategy. They need to be evaluated strictly to ensure that a deal does create economic value. Under the International Financial Reporting Standards (IFRS), business valuation is important in ensuring that all the acquirers as well as investors know the fair value of assets, liabilities and goodwill. IFRS is used to identify, measure and report the financial effect of acquisitions globally which means that there is transparency and comparability in the markets.

The guide presented below discusses the effects of the IFRS standards on M&A valuation, including fair value measurement and purchase price allocation, as well as the treatment of the goodwill or disclosure requirements. It also emphasizes professional approaches that are employed to make sure that valuations give an accurate value of the acquired business. This guide is ideal for those seeking Business Valuation Exam Preparation Singapore to strengthen their practical knowledge and skills in corporate valuation.

Valuation using the IFRS Framework in M&A.

Valuation using the IFRS Framework in M&A.

The IFRS and the role of IFRS in Business Combinations.

In the acquisition method, IFRS 3 Business Combinations requires the adoption of the method of acquisition. In this method, the acquirer acknowledges the identifiable assets and liabilities of the target company to the fair value of the acquisition date. It makes sure that the financial statements reflect the actual economic substance of the transaction as opposed to the past cost or negotiated price

The IFRS-compliant business valuation methods for mergers and acquisitions focus on consistency, reliability, and market-based evidence. This principle-based approach enhances investor confidence, particularly in cross-border deals where multiple accounting standards previously created inconsistencies.

Measurement of Fair Value under the IFRS 13.

In the IFRS reporting, fair value is at the centre stage. According to the definition of IFRS 13 Fair Value Measurement, it is the price at which an asset would be sold, and a liability would be transferred in an orderly transaction. Fair value has an impact on first time accounting and future financial reporting in M&A transactions.

There is also the Fair Value Hierarchy Levels1, 2, and 3 offered by IFRS 13 that categorize inputs according to their observability. Whereas Level 1 inputs are based on quoted market prices, Level 3 is based on numerous internal assumptions and models, which are typically utilized in company-specific valuations and intangible asset valuations.

Basic Valuation Methods in M&A UPS IFRS.

Income Approach

The income method determines the current value of economic benefits in the future of an asset or business. Discounted Cash Flow (DCF) model, a model in this method forecasts cash flows and discounts them at the present value based on a rate of risk and cost of capital. The method is particularly applicable in assessing intangible resources such as customer database, technology and licenses where the cash flow generation is of central importance in the computation of value.

It is important to have accurate forecasting, growth assumptions, and determination of the discount rate. These inputs are susceptible to misjudgment and cause significant misstatements of goodwill and asset values that future impairment losses will take place.

Market and Cost Approaches

The market approach compares the target company with the similar firms or transactions. Using valuation multiples like EV / EBITDA or P/E ratios, the analysts make inferences as to what the market will pay to acquire another company of the same nature. The approach is especially successful in the field where there is enough transaction data, such as manufacturing or consumer goods.

The cost approach on the other hand evaluates the value of an asset in the form of replacement cost less depreciation and obsolescence. Although it is not as widely used when valuing total businesses, it is critical in valuing tangible assets- property, plant and equipment particularly in acquisitions that have a lot of assets.

Goodwill Recognition and Purchase Price Allocation.

Purchase Price Allocation (PPA) is a procedure that takes place when an acquisition takes place under IFRS 3. This entails allocation of the entire purchase consideration of identifiable assets and liabilities in fair value. After such allocations are made, any excess that is left is recorded as goodwill.

Goodwill is future benefits that cannot be singly identified, as the brand reputation, synergies, and qualified workforce. It represents the premium that a purchaser will pay over and above the fair value of identifiable assets.

The fair value measurement of acquired businesses under IFRS ensures that goodwill is recognized transparently, preventing inflated valuations and ensuring post-acquisition reporting accuracy. Goodwill should be tested on an annual basis under IAS 36 as opposed to amortization. In the event that the recoverable amount of a cash-generating unit (CGU) is less than its carrying amount, an impairment loss is recorded.

Use of the Fair Value Hierarchy to M&A Valuation.

Level 1 Entries: Measurable Prices in the market.

They are based on active markets on the same liabilities or assets. Market quotes can be used to directly value those securities that are publicly traded or are liquid.

Level 2 Intrusions: Reality but Secondary Data.

This contains data like the yield curves, interest rates or market-based pricing of similar instruments. These inputs are then varied to make them pertinent to the features of the particular asset under valuation.

Level 3 Inputs: Internal Unobservable Estimates.

Level 3 inputs are based on management assumptions, projections or valuation models. They are most prevalent in M&A valuations, especially of intangibles or privates where no market data are available. Methodologies and sensitivity analyses have to be detailed disclosure.

Difficulties in M&A Valuations by IFRS.

Valuing using the IFRS may be a difficult task because it requires professional judgment and sound information. The volatility of the market, the inability to find comparables, and the fast variability of economic conditions may also influence the accuracy of valuation.

The other significant issue is to harmonize between the internal management projections and the external audit inspection. Valuation assumptions, such as discount rates, terminal growth projections, and risk premiums, need to be in many cases supported in detail by auditors. Insufficient documentation may result in compliance problems or problems in valuation.

Moreover, there are chances that post-acquisition integration can affect the performance of assets and cash flows and this necessitates the precautions or impairment tests which revalue past reported figures.

Increasing Transparency by using the IFRS Disclosures.

The IFRS focuses on transparency by thoroughly reporting on valuation procedures, inputs and assumptions. Firms should state what techniques they applied, the reason why a particular technique was chosen, and what the implications of a shift in assumptions are.

Such disclosures will create a sense of trust in the investor because the stakeholders are able to know the rationale behind the fair values reported. They also minimize the chances of being misconstrued or partaken of earnings manipulation. The transparent valuation reporting does not only meet the compliance but also improves credibility to the investors, the regulators and lenders.

The Strategic Value of M&A Valuation on the basis of IFRS.

Besides compliance, the IFRS-based valuation is strategic in making decisions on acquisitions. A properly designed valuation offers understanding of critical value drivers, synergies and post merger opportunities. It also assists the acquirers to negotiate more favorable terms and strategize the integration plans that are consistent with the financial reality of the deal.

In the case of multinationals, IFRS will provide international consistency, which will promote easier international transactions. This international uniformity facilitates the investor confidence and the corporate reputation in the capital markets.

Conclusion

IFRS business valuation makes M&A a transparent and data-driven process rather than a financial negotiation process. With their reliance in standardized fair value principles and full disclosure practices, the companies make sure that their transactions are reflected in actual economic value. With the ever-changing nature of global markets, compliance with the IFRS requirements of valuing assets is not only the guarantee of compliance, but also an enhancement of strategic decision-making and investor confidence.