Professional Business Plan Writing

Introduction to Professional Business Plan Writing

In today’s highly competitive investment environment, organizations cannot depend solely on strong ideas. Investors and lenders demand structured strategies, credible market research, and realistic financial forecasts before allocating capital. This is why hiring a professional business plan writer has become a strategic move for startups, SMEs, and established businesses seeking expansion funding.

A well-developed business plan is not merely a document—it is a strategic tool that communicates direction, reduces uncertainty, and builds investor confidence. Many founders understand their product and vision, but struggle to present it in a format that investors can quickly evaluate. This is where writing professional business plans becomes essential. A strong plan clearly explains how the company operates, how it will scale, and how it will achieve long-term profitability.

Most importantly, an investor-ready business plan is designed to match investor expectations. It demonstrates credibility, competitive advantage, scalability, and financial discipline. This article explains why business plans remain essential, what makes them investor-ready, and how professional planning significantly increases funding potential.

Why Business Plans Still Matter in Modern Finance

Some entrepreneurs assume that pitch decks have replaced business plans. However, pitch decks are mainly designed to generate early interest. Serious investors still require detailed documentation before committing capital. A pitch deck summarizes an opportunity, while a business plan provides a complete strategic and financial justification.

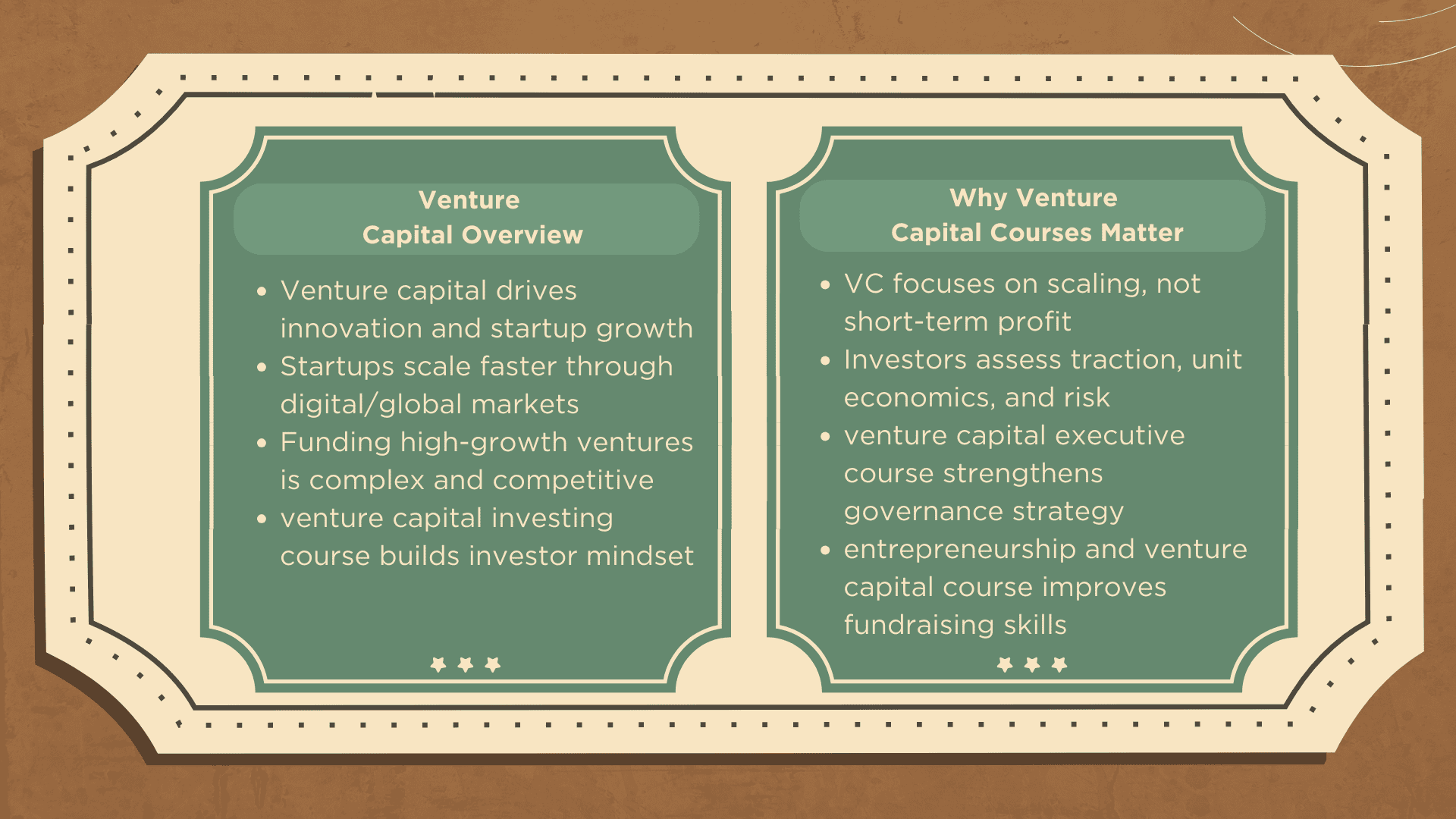

Banks, government grant institutions, and private equity firms almost always request formal plans. Even venture capital firms, while prioritizing growth, still evaluate the same fundamentals: market size, business model clarity, competitive positioning, and financial sustainability. Without a structured plan, founders often appear unprepared, which reduces trust.

This is why businesses that focus on writing professional business plans are typically more successful in building investor confidence. A strong plan also improves internal decision-making by defining measurable milestones and execution priorities. In many cases, an investor-ready business plan becomes a long-term strategy document, not only a fundraising requirement.

The Role of a Professional Business Plan Writer

A professional business plan writer does more than organize content. Their primary responsibility is to convert business potential into a structured investment document that communicates value clearly and persuasively. This includes combining market research, competitive analysis, strategic planning, and financial modeling into one coherent narrative.

Many founders have strong ideas but present them with weak structure or unsupported assumptions. Investors quickly detect unrealistic projections, inconsistent strategies, and incomplete risk planning. A professional writer anticipates these concerns and ensures the plan answers investor questions before they are raised.

A skilled professional business plan writer also understands that different funding audiences require different approaches. Business plans written for banks emphasize stability and repayment ability, while venture capital plans focus on scalability and rapid growth. This alignment ensures the final output becomes an investor-ready business plan, rather than a generic business proposal.

Why Writing Professional Business Plans Requires Expertise

Business planning is often underestimated. Many founders assume they can write a plan quickly, but professional-level planning requires evidence, analytical thinking, and strategic consistency. A strong business plan must align operations, strategy, marketing, and financial forecasts in a logical structure.

One major weakness in self-written plans is inconsistency. For example, a founder may claim aggressive expansion, but the financial plan does not include sufficient marketing or staffing costs. Another common issue is unrealistic market sizing without reliable data sources, which damages investor confidence immediately.

A professional approach ensures the plan is analytical, not only descriptive. This is why writing professional business plans is difficult without strong experience in finance and business strategy. A competent professional business plan writer ensures every section supports the investment logic, resulting in a credible and structured investor-ready business plan.

What Makes an Investor-Ready Business Plan

An investor-ready business plan is not built on optimism. It is built on evidence, clarity, and strong execution logic. Investors want proof that the company understands its market, customer demand, and competitive threats.

A strong plan includes a clear business model, a defined go-to-market strategy, realistic operations planning, and credible financial projections. It also includes risk analysis and mitigation strategies. Investors do not expect a risk-free business, but they expect leadership maturity and preparedness.

A professional business plan writer ensures the plan meets investor expectations using formal, structured, and measurable writing. This is what separates an investor-ready business plan from an ordinary business proposal.

Executive Summary: The First Funding Filter

The executive summary is often the most critical section of the entire plan. Many investors decide whether to continue reading within the first few minutes. If the summary fails to communicate value, the plan is often rejected without further review.

A strong executive summary must clearly explain the business model, market opportunity, competitive advantage, and funding request. It should also highlight key traction points, expected financial outcomes, and the business growth roadmap.

A professional business plan writer prioritizes this section because it acts as both an introduction and an investment pitch. In an investor-ready business plan, the executive summary must communicate confidence while remaining realistic and data-driven.

Market Research and Industry Analysis

Market analysis is a credibility test. Investors need proof that the opportunity is real and that the market is large enough to support long-term growth. This section should explain industry trends, customer needs, market size, and key growth drivers.

Strong plans include clear market segmentation and realistic market share assumptions. Many weak plans exaggerate demand using unrealistic industry figures. In contrast, writing professional business plans requires disciplined market sizing methods such as TAM, SAM, and SOM.

A professional business plan writer also ensures market analysis supports the company’s product positioning. This connection strengthens the investment case and increases the credibility of the investor-ready business plan.

Competitive Analysis and Strategic Differentiation

A business plan must demonstrate competition awareness. Claiming “no competition” is a major warning sign. Even innovative businesses compete with alternative solutions, existing products, or customer behavior patterns.

A strong competitive analysis identifies direct competitors, indirect competitors, and substitute solutions. It compares pricing, market positioning, product features, and distribution channels. Investors want to understand why the business can win and sustain growth.

A professional business plan writer structures this section to highlight competitive advantage with evidence. Differentiation may include proprietary technology, strong partnerships, brand strength, cost efficiency, or scalability. In an investor-ready business plan, differentiation is not a claim—it is supported by logic and proof.

Business Model and Revenue Strategy

The business model explains how the company generates revenue and achieves profitability. Investors expect clarity on pricing strategy, revenue streams, customer acquisition, retention, and long-term scalability.

A strong plan explains how revenue will grow and what key drivers influence performance. It should describe sales channels, conversion strategy, and customer lifetime value. This section is critical because it directly connects to financial projections.

A professional business plan writer ensures the business model is written clearly and professionally. When writing professional business plans, revenue strategy must be realistic and aligned with actual market conditions. A well-structured model increases investor confidence and strengthens the investor-ready business plan.

Operations Plan and Execution Capability

Execution capability is often more important than the idea itself. Investors want assurance that the business can deliver products, manage operations, and scale effectively. This section should include production planning, technology infrastructure, staffing needs, and operational milestones.

The plan should also explain how the business will maintain quality control, customer satisfaction, and operational efficiency as it grows. Investors evaluate whether the company can scale without losing performance.

A professional business plan writer ensures operational planning supports growth projections. In an investor-ready business plan, the execution roadmap must be realistic, measurable, and clearly structured.

Marketing and Sales Strategy

A strong marketing strategy explains how the business will acquire customers and scale demand. Investors rarely trust vague marketing plans that rely only on “social media growth” without clear metrics.

The plan should define customer personas, acquisition channels, sales pipeline structure, and conversion strategy. It should also explain expected marketing costs and customer acquisition assumptions.

This is why writing professional business plans requires alignment between marketing strategy and financial forecasts. A professional business plan writer ensures that projected revenue growth is supported by realistic marketing investment. This alignment strengthens the credibility of the investor-ready business plan.

Financial Forecasts and Funding Requirements

Financial projections are the foundation of investor decision-making. A professional plan includes profit and loss forecasts, cash flow projections, balance sheet assumptions, and break-even analysis. Investors also expect key indicators such as gross margin, operating margin, and projected runway.

One major investor concern is the realism of financial assumptions. Overly optimistic forecasts often result in immediate rejection. Strong plans explain the reasoning behind growth rates, cost structures, and revenue drivers.

A professional business plan writer ensures that projections are evidence-based and aligned with operational planning. A credible investor-ready business plan must clearly state the funding amount required, the use of funds, and expected outcomes. This transparency improves investor trust and supports smoother negotiation.

Risk Analysis and Mitigation Strategy

Risk analysis is essential in professional planning. Investors understand that every business involves uncertainty, but they want evidence of preparedness. This section should identify market risks, competitive risks, operational risks, regulatory barriers, and financial risks.

A strong plan also explains how risks will be mitigated. Mitigation strategies may include diversification, phased expansion, legal compliance planning, or contingency budgeting.

A professional business plan writer structures this section to demonstrate leadership maturity. In an investor-ready business plan, strong risk management reduces investor hesitation and increases overall credibility.

Conclusion

A business plan remains one of the most valuable tools for funding success. In today’s competitive investment market, businesses must communicate strategy with clarity, evidence, and professionalism. This is why hiring a professional business plan writer is often a smart decision for founders and executives who want to raise capital effectively.

By building structured strategy, realistic execution planning, and credible financial forecasts, writing professional business plans becomes a major advantage during investor discussions. A high-quality plan improves credibility, strengthens decision-making, and increases the likelihood of securing capital.

Ultimately, an investor-ready business plan is not only about raising funds. It is a strategic blueprint that supports long-term growth, competitive positioning, and sustainable profitability. For businesses serious about scaling, professional business planning is not optional—it is essential.