Case Study: Business Plan Development Supporting Strategic Growth and Investment Readiness

Background on Business Plan Case Study

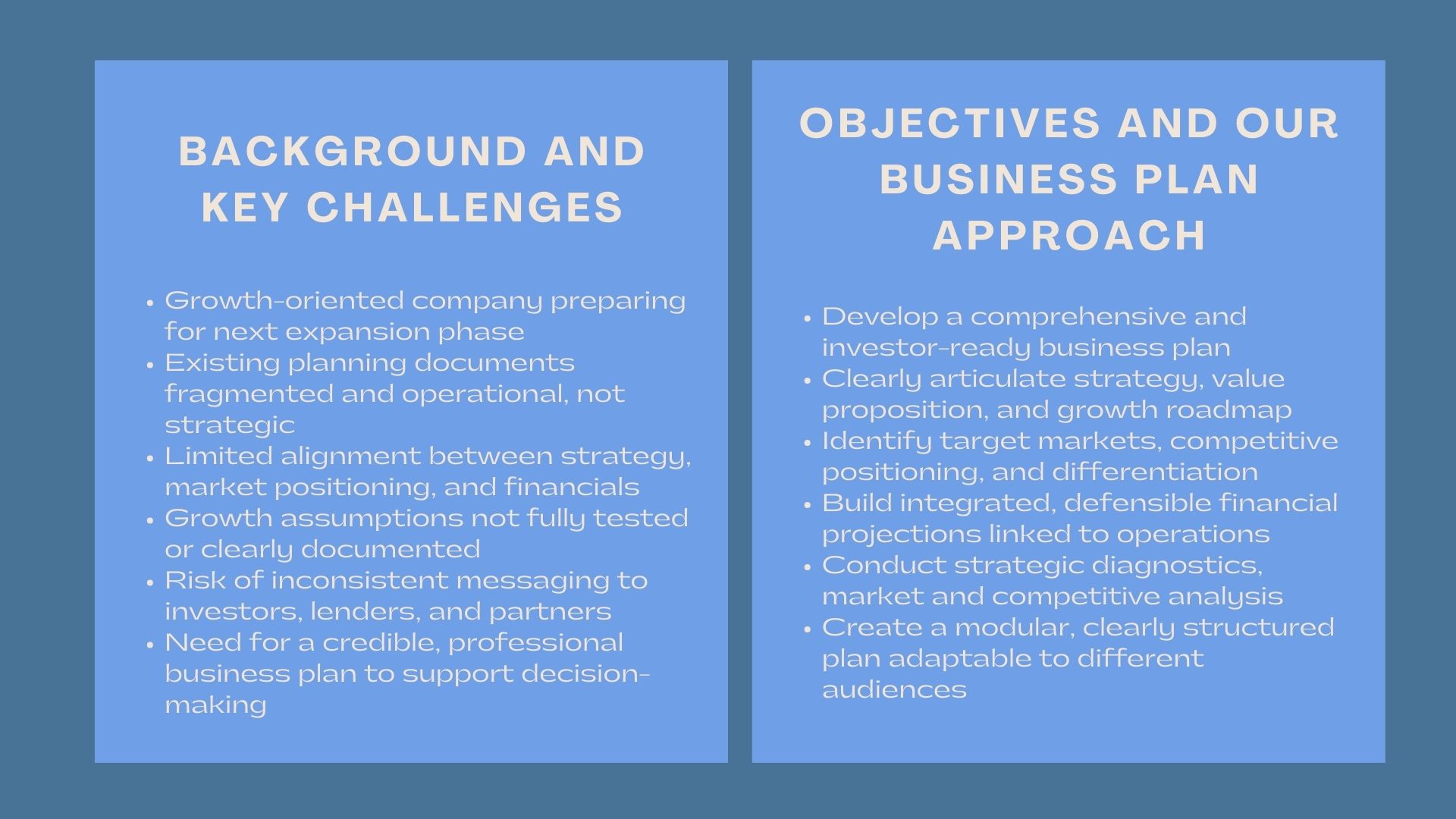

The company under consideration was a growth-oriented one that was getting ready to pass to the next stage of its expansion after a certain time of the stable development of the organization. Although the business had already shown some initial commercial moves, the current planning documents were disjointed and more operational than a strategy. The management felt that its business plan should be comprehensive and professionally organized, to help it explain its strategy, to get internal stakeholders aligned, and to facilitate negotiations with external entities like investors, lenders and strategic partners.

By using our advisory team, the company was able to create a sound business plan, which would help the company to transform its vision, market opportunity, and financial potential into a viable, credible, and decision-making document. The engagement was not only placed as a documentation exercise, but a strategic process to create clarity about priorities, assumptions testing and higher preparedness in execution.

Issues and Challenges

The client experienced some of the challenges that are associated with expanding companies. The management had a good knowledge of its product offering and the market; however, most of this information was largely in the heads of the management rather than being documented. Their strategic goals were negotiated internally and not done in a format that connected the market opportunity with competitive positioning and financial performance.

There was high financial projection but this was not completely combined with operation plans. Income growth, pricing, customer acquisition, and cost structures had not been put to stress and it was not easy to determine how the projected performance is sustainable. This raised the issues of credibility when dealing with external stakeholders.

Moreover, the business was run in a dynamic and competitive space, and it needed a clear definition of differentiation and long-term strategy. The lack of a logical business plan meant that the management would have ran the risk of not being on constant page with the various teams, having inconsistent messages to their stakeholders and not having confidence of potential investors or financiers.

Objectives

The main goal of the engagement was to create a business plan that gives a clear picture of the plan of the company, the growth plan, and the financial prospects. The client wanted a report that could be used in various ways such as the internal planning process, investment discussions as well as the process of making strategic decisions, while also aligning with insights and skills from Master Finance and Investment Courses to ensure professional, data-driven financial analysis and actionable recommendations.

Particularly, the client wanted to:

- Communicate strong business strategy.

- Identify target markets, value proposition and competitive positioning.

- In advance premeditated consolidated and justifiable financial forecasts.

- Earmark major risks and assumptions that the business model is based on.

- Make the business presentable to investors.

The business plan had to be strategic and realistic at the same time.

How We Helped

We have followed a systematic and partnership methodology in business plan development and have worked in partnership with the management all through the engagement. We have started with a strategic diagnostic, which involves conversation with the key stakeholders to get an idea of the vision, objectives, and realities of operations of the company.

We have been able to carry out a market and competitive analysis to put the offering of the company on a broader industry context. This analysis was used to develop the value proposition, target customer segments and differentiation strategy. We were also able to assist the management in perfecting its go-to-market strategies and expansion plans.

We have built an integrated financial model which is consistent with the strategic story on the financial side. It involved revenue drivers, cost assumptions, capital expenditure, and cash flow projections. The assumptions were well written and then verified to be consistent and reasonable so that the financial perspective was both ambitious and plausible.

In the process, we were concerned with simplification of complex ideas into clear and structured content. The business plan was to be modular and the management could construct it to suit various audiences with one strategic message to pass.

Value Delivered

This exercise showed how a well-established business plan may act as a strategic base and not a fixed document. Our Business Plan Development services took the client to the next step by leaning on strategic analysis, financial rigor, and clarity of communication, and making the client look better.

The outcome was the business plan that facilitated informed decision making, boosted the confidence of the stakeholders, and put the business in a position to succeed long term.