When Should You Seek a Valuation Update?

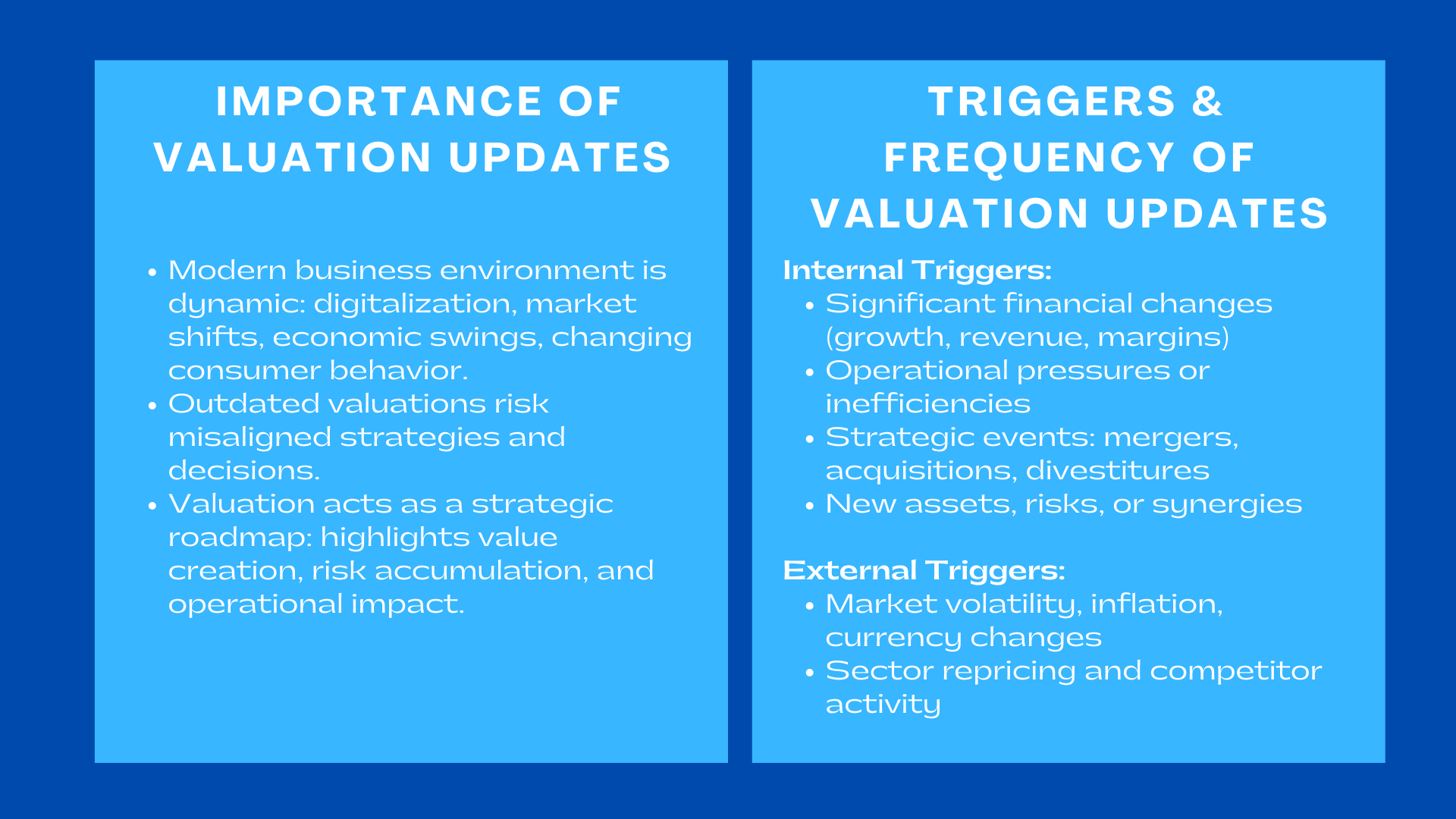

Re-pricing operations are now becoming critical in a globalised economy of endless budgetary alteration and uncertainty. Business organizations are no longer competing on conventional lines. As an alternative, they are confronted with the changing competitive forces, novel business models with the assistance of digitalization, unpredictable economic swings, and swiftly compartmentalized consumer patterns. These circumstances imply financial variables, which may redefine the risk profile of a company and the cash that the company will have in the future within a few months, even weeks. Due to such a dynamic environment, basing the company on a valuation that has been introduced several months ago might not be the reality of the company. The valuation, which was previously used to reflect the worth of the company, may not incorporate new assumptions regarding the market competitions, model of cost, market conditions in the capital markets, technology changes, and behavior. This inconsistency may make the companies seek strategies that are not properly aligned with the actual value of a company.

Valuation in the modern day setting goes beyond establishing how a sale is priced or investment valued. It acts as some road map or strategic guide which directs the leadership decisions and organizational direction. A valuation also indicates that the valuation is creating a value, or that the volume of risks is accumulating, and that operational improvement actions are creating a significant impact. Such an understanding enables the companies to make changes in their plans before minor issues start to face them as a significant challenge. Recalculated values also ensure that it can be determined whether some lines of products or areas of business are adding any value to enterprise value or whether they have to be restructured or sold. Companies that do not update their valuations on a timely basis face the risk of making their decision based on previously outdated expectations that no longer reflect the market conditions.

There is increased reliance on the boards, management teams, investors, regulators, auditors and the employees on the accuracy and updated valuation information. Boards use the updates on valuation to assess the performance of the management team, and also maintain the company on track to meet the long-term goals. Investors need new valuations so as to determine whether growth expectations are attainable. Valuations are relied on by regulators and business valuation update frequency auditors in order to be in accordance with the IFRS. When employees are under the stock based compensation programs, they desire to know that their equity is a true reflection of their current performance of the company. When valuation is obsolete, the credibility of financial reporting, corporate governance and internal decision-making is undermined.

Understanding Valuation as a Dynamic Financial Instrument

Understanding Valuation as a Dynamic Financial Instrument

The Evolution of Modern Business Models

In contemporary businesses the whole focus is no longer on accumulation of physical resources such as machinery or buildings as means of growth. Rather, they develop, to a great extent, intangible resources, including technology platforms, intellectual property, data ecosystems, creative brand resources, and customer loyalty. The intangible assets are more susceptible to changes and can grow or go down within a short span depending on the market conditions, customer feeling, adoption of product or a change in policy. Consequently, the process of valuation develops as a dynamic financial tool that needs to be updated with the changes.

The Dominance of Intangible Value Drivers

Intangible assets are the motivation for a big part of the corporate valuation. They do not wear out in predictable manners as it is in the case of physical assets. An excellent brand can easily be dropped by the people. New privacy laws can impose some limits on the data assets. The intellectual property can be ruined in the event that other competitors come up with alternative technologies. The retention strategies can cause customer relationships to decrease in case of failure. The intangible value changes too fast hence companies can not afford to assume that valuation is stable. Rather, the valuation models should be revaluation timing for companies rebalanced regularly to be consistent with the intangible driver performances.

Why Intangible Assets Cause Faster Valuation Fluctuations

The intangible assets increase the growth and risk. As an example, a startup that has already won big enterprise customers can experience a soaring valuation, whereas a company can lose a lot of value when another firm issues a better technology. These changes are much more unstable than ones in the traditional brick-and-mortar business. Since valuation is a prospective consideration, assumptions regarding growth rates, efficiency of operations, adoption of technology and customer loyalty should be changed frequently. Even the slightest changes will change the valuation. As an example, customer acquisition cost or churn rate can change and thus influence lifetime value or assumptions which is then directly related to discounted cash flow projections.

The Impact of Global Market Forces

Valuation is not done in isolation. Valuations are directly affected by global economic forces, including interest rates, inflation, change of regulatory policies, valuation downstream failures caused by disruptions in supply chains and geopolitical developments. An increase in interest rates raises the discount rate on the future cash flows resulting in decrease in valuation. Inflation influences cost set ups. Technology has a tendency of reducing the product life. Slumps in the market alter the investor sentiment and similar company multiples. All these external factors are important to valuation and as a result there is a need to update it frequently to keep the results in touch with the economic reality.

Internal Triggers for Valuation Updates

Significant Changes in Financial Trajectory

Ample changes to financial performance are one of the best causes to request valuation updates. The rate of growth in revenue, significant growth in recurring revenue and the company acquiring large clients could add substantial value to the company. Equally, poor financial performance indicators, i.e. reduced revenues, deteriorating profit margins, high operating expenses or low cash flows, are indicative of valuation review. Valuation models are very reliant on the projections of future financial performance; as such, a change in performance trend, however minuscule, can contribute to the enterprise value in a big manner.

Operational Pressure and Financial Decline

Value can be influenced by operational inefficiencies, cost escalation, decreased capacity of production or internal restructuring. An organization with a day to day cash-flow crunch or urgent cost can require a new valuation in order to justify refinancing or negotiation with creditors. The perception of risk tends to change in a company that is going through challenging operational phases and it will have to be reflected by the valuation models instantly.

How Performance Trends Influence Investor Expectations

Revision of the performance indicators leads to alterations in the assumptions of investors. Good quarters can enhance investor confidence and bad performance can portray an increase in risk. Analysts change their values multiples and the market re-evaluates the competitiveness of the firm. The estimation of the company value under old performance patterns will give a wrong image about the company and will deceive the stakeholders.

Transformational Strategic Events

Significant strategic events that include mergers, acquisitions, divestitures, to restructure, recapitalization or major financing activities have a great impact on the size, structure and risk exposure of a company. Such occurrences bring new resources, debts, synergies, and business requirements. Lack of an updated valuation means that companies will overprice or underprice transactions or will exaggerate their financial status to investors.

New Assets, Risks, and Synergies

Acquisition is associated with new sources of revenue, intellectual property and talent. Divestitures transform the focus of operations at the company. Alliances that are strategic frequency of revaluation needs involve new opportunities and threats. Each of them demands updating models of valuation to take to consideration the changed company profile.

External Triggers for Valuation Updates

Market Volatility and Economic Shifts

Economic volatility affects the valuation using discount rates, cost of capital as well as market demand. An international recession could dampen the enthusiasm of investors, decrease similar multiple attunements, and augment anticipated industry threats. Elements Inflation impacts on purchasing power and operation costs. Currency fluctuations affect those companies that are involved in international business.

Sector Repricing and Risk Perception

Certain events that are industry-specific might necessitate a valuation change in the event of stagnant internal performance. Expectations of companies working within the same sector can be changed due to new regulatory policies, the innovations of competitors, and the disruption within the sector. Firms will have to make adjustments so that they do not blacken their competitive stance.

Regulatory and IFRS Requirements

Under some circumstances of updating valuation, which include impairment testing, fair value adjustment, and reporting of business contributions, IFRS compels valuation updating. When the signs of impairment appear in the form of impaired sales or market share, the companies should reevaluate the assets in the current period. Sound valuation will bring about compliance and finances misstatements will be avoided.

Equity Compensation and Fair Market Value Compliance

The stock compensation plans must be valued regularly so that it can be priced fairly. With dynamic ESOP plans that are implemented by fast-growth companies, updates on a quarterly or semi-annual basis might be required to ensure compliance and equity. The valuations determine correct compensation and motivation of employees.

Recommended Frequency of Valuation Updates

High-Growth and Venture-Backed Firms

High-growth companies also do not have steady performance and risk profile. They can change their valuation drastically with every fundraising round, new product introduced or expansion into a new market. Consequently, they need valuation updates in a number of months.

Scaling Mid-Market Companies

Intermediate valuations are typically done on a yearly basis in mid-market firms with interim reports being done on significant occasions like expansions, restructurings or regulatory changes. They are noticed to be valued based on the stability of their performance and the market.

Mature and Stable Enterprises

Established businesses characterized by large cash flows and predictable customers usually drive the business. They make an annual valuation of their financial reporting and governance. Nevertheless, drastic changes in the market or operational issues require interim updates to be done.

The Universal Rule

Valuations should be revised when a company fundamentally changes its prospects of its revenue, the risk profile or market conditions whether due to internal or external events regardless of its size, industry, or level of maturity. The principle guarantees accuracy, sexuality, and tactical conformity.

Strategic Advantages of Maintaining Updated Valuations

Elevated Decision-Making Quality

Renewed valuations will give executives a true understanding of the financial performance, business risk and strategic potential. This knowledge helps to plan better, allocate the available resources, and control the priorities in a corporation.

Stronger Governance and Shareholder Transparency

It increases the corporate governance to ensure that boards have timely information to analyze the performance and manage strategic decisions through regular updates in the valuation. Shareholders like transparent companies because they consider them to be disciplined and reliable with regard to valuation practices.

Improved Financial Planning and Capital Allocation

New valuation would underpin the budgetary process, projections and investment strategies. They assist the companies in identifying the initiatives that create value and those that demand structural reorganizations. Such transparency enhances long-term planning.

Enhanced Negotiation Position in Deals

Firms that negotiate with investors, partners, acquirers or lenders have more recent valuations giving them credibility and bargaining power. Valuations that are obsolete deter the position of a company and can lead to worse terms of the deal.

Fair and Motivating Employee Equity

Stock based compensation plans require employees to be assumed by fair and current values. Periodical appraisal reviews are known to build trust and improve retention among employees and align their effort with the organizational objectives.

Conclusion to When Should You Seek a Valuation Update

Valuation updates are critical strategic measures that make sure that the companies act in line with the current markets and not the assumptions that existed in the past. They facilitate rapid decision-making, increase investor confidence, meet regulatory harmonization as well as improve long term value generation. In a world where technological change is occurring rapidly, the economic uncertainty is present, and the competitive relations are shifting, the companies with updated four-year-old valuation receive a strong strategic benefit. Valuation frequency may change based on the internal performance, the volatility of the industry, regulatory provisions, and strategic events- however the point is that the valuation should be updated each time there is significant change that has taken place.