IFRS 2 Share-Based Payments: Why Companies Need Independent Valuation Support

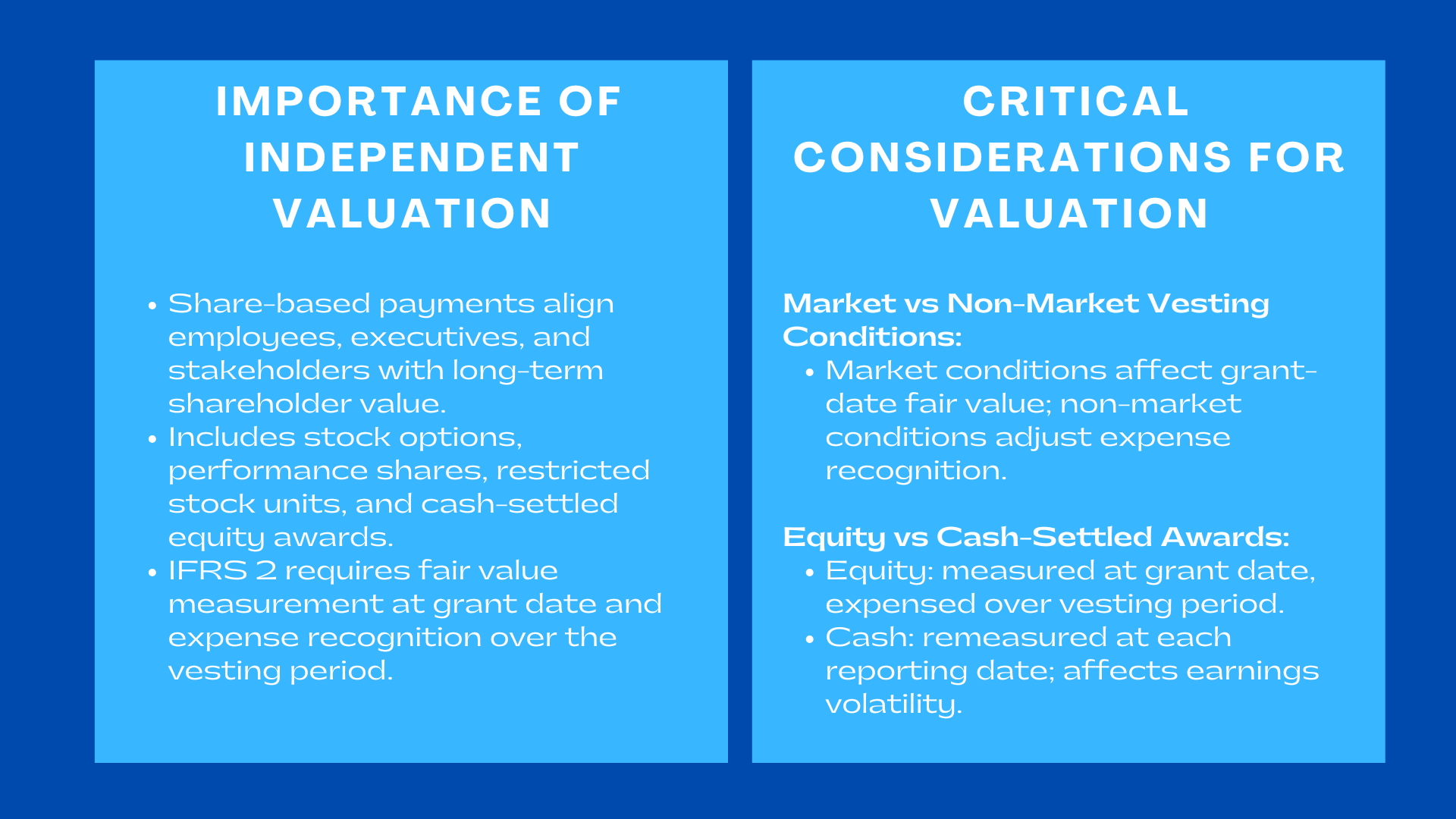

Share based payments have now become a critical success factor in aligning the employees, executives and the key stakeholders with long term shareholder value. These compensation structures are a great incentive to organisational strategy whether it is in the form of stock options, performance shares, restricted stock units, or cash-settled equity-linked awards. The IFRS 2 accounting treatment however presents a lot of complications due to the fact that to grant the share-based payment the fair value is to be measured at the date of granting and this should be expensed over the vesting period. Consequently, the correct validity of the valuation becomes of utmost importance both in making financial reporting Compliant, and in maintaining the transparency, comparability and credibility of the corporation.

According to IFRS 2 share-based payment valuation methodology using Monte Carlo and binomial models , companies are expected to find the fair value of share-based payment plans through sound valuation methods that are related to the economic substance of the awards. This is much, much more than just price inputs are required; it requires complex financial modelling, analysis of the conditions of vesting, estimated volatility to expect, risk-free rate calibration and scenario analysis. Valuation mistakes can bind material distortion of financial statements, spout compensation expenses and confuse stakeholders. They are thus putting more and more trust in independent valuation professionals to help guide them through the complexities of the standard through the application of the necessary technical expertise, objectivity, and methodological consistency.

The Importance of Robust Valuation Models Under IFRS 2

The Importance of Robust Valuation Models Under IFRS 2

Appraisal of IFRS 2 can consist of more complex financial models especially where awards are non-standard or contain performance-based aspects. There are two of the most commonly used valuation models binomial models and Monte Carlo simulation, which are important in the determination of fair value.

The binomial model, which is commonly described by a lattice model, gives companies an opportunity to price share options by the model of possible paths a share price can follow through time. In contrast to a noncomplicated Black Scholes model, the binomial model includes the behavior of early exercisings, the vesting, the forfeiture expectations and the exercise strategies. It is customizable to indicate the elaborate award design characteristics which frequently occur within an executive compensation package. The binomial model can be flexible in understanding the real-world decision-making process of the option holders by assuming that the option prices fluctuate in discrete time with the probability of changing in a particular direction. Such advanced valuation techniques are often covered in a global IFRS financial reporting training program to equip accountants and finance professionals with practical skills in complex share-based payment accounting.

The Monte Carlo simulation on the other hand is highly applicable in awards that have vesting schemes based on the market such as in case of total shareholder return (TSR) performance shares. Monte Carlo models run physical simulations of the possible future price trajectories in the event of thousands or millions of possible future volatilities, correlation, and distributional parameters. He or she would estimate the frequency of meeting the criteria of vesting requirements in the simulated scenarios and, based on that, fair value would be computed. Since the aspect of fair value is directly influenced by the market conditions, the IFRS 2 states that the aspects should be included in the model, as opposed to being revaluated in the post-grant adjustments. Monte Carlo simulation gives the advanced stochastic model required to fulfill this.

Collectively, these valuation models would place into consideration the share-based payments to be valued through methods that would indicate the true economic risk and likely results. Their effective application, though, requires a lot of financial modelling skills and it is quite natural that independent valuation support is obligatory in many organisations.

Market vs Non-Market Vesting Conditions and Their Accounting Impact

One of the most important requirements of the IFRS 2 is the ability to differentiate between the market and non-market vesting conditions because this is one of the primary killers of the valuation and expenses recognition. Such measures are the performance of share prices, relative TSR, or stock index thresholds, which are represented by the market conditions. Service conditions and non-market targets are service requirements and performance objectives, which are not related to market prices, i.e. revenue growth, EBITDA, project milestones or operational KPIs.

The market conditions affect the award grant-date fair-value, and should be directly factored into the models of valuation like Monte Carlo simulation. After establishing the grant-date fair value, the market conditions do not have anything to say on making the adjustments on expense recognition; though not necessarily the conditions may always be met. The cost is identified as far as service conditions are being made good.

However, non-market conditions instead of the grant-date fair value are the ones that influence the number of awards to be vested. The companies need to reevaluate the recognised expense in accordance with the best forecast of the amount of awards to be vested, and revamp their forecast on a period to period basis up until the time of vesting. This difference brings about tremendous estimation work, judgement and internal controls and justifies the necessity of a powerful independent valuation backed with excellent financial governance.

The interaction between these types of conditions is critical towards the provision of the recognition of the compensation expense that is to be recognised with the requirements of the IFRS 2.

Equity-Settled vs Cash-Settled Awards

IFRS 2 makes a key distinction between a cash-settlement and equity-settlement of a share based payment. Settlements based on the equity are valued at the fair value at the date of grant and are charged out through the time of vesting without any further remeasurement. This treatment will stabilise reported costs of compensation and will fit well with long-term incentive structures.

Cash settled awards though, must be measured at fair value at each reporting date until settled. Under this method the award is considered a liability to be taken into account by the earnings of a firm but the award is not a fixed sum as it is subject to market changes generating variable costs that can largely impact the earnings volatility. Those companies which make performance shares or phantom share plans cash settled should thus invest in sound methods of valuation that can support frequency and proper remeasurement.

The award classification is not simply the technical choice as it has large implications on the outcomes of accounting, predictability of earnings, risk management, and the design of compensation programs in general. An independent valuation support will enable the companies to navigate this complexity with ease because the classification and measurement will be kept in conformity with the economic content of the award and IFRS 2.

Estimating Volatility, Risk-Free Rates, and Other Critical Inputs

The valuation model based on the IFRS 2 depends on a collection of financial inputs which should be estimated with care to avoid the wrong fair value. Volatility is among other forces that are most influential in the sense that the higher the volatility, the higher are the chances of reaching the conditions of performance or using the options and thus greater the value of fair value. The volatility can only be estimated after analysing historical share price data, implied volatility on instruments traded, similar company volatility and structural changes adjusted. The non-long trading companies might need proxy volatilities on the basis of peer data to enhance the modelling complexity even more.

Discounting the future payoff of future prospects is also greatly influenced by the risk-free rate, which is usually calculated as the yield of government bonds of similar maturity. Other inputs could be projecting dividend rates, correlation variables to multi-entity TSR frameworks, assumptions of employee exercise behaviour, as well as anticipation of early exercise or forfeiture. Such misjudgments may hugely taint fair value measurements causing wrongful expenses to be taken. The required access to market data, modelling skills as well as professional judgement that would reliably determine these inputs can be achieved by independent valuation professionals.

Scenario Valuation, Expense Recognition, and the Grant-Date Principle

The basic principle defined by the IFRS 2 is that when the awards are settled through equity but not re-priced in-between periods, the fair value of the awards should be calculated by the date of granting the award and no more. This principle bases compensation costs on the economic environment where the grant is granted so that in case future markets are volatile financial reporting becomes unaffected by this. In an effort to satisfy this condition, valuation models should include all the appropriate inputs and conditions at the grant date, where the running scenario-based valuation should reflect all the distribution of potential outcomes.

Upon deciding on the fair value, companies are expected to prepare an amortisation schedule which is likely to recognise the cost during the period of vesting. The plan shall show the amount of awards that are supposed to be in place in the form of vesting and the estimates shall be updated based on the non-market condition. Recognition of expenses under the IFRS 2 therefore needs a combination of valuation outcomes and periodic evaluation of the service or performance status. Such a dynamic relationship between valuation modelling and financial reporting assists in supporting the independent expertise and lent control processes.

The IFRS 2 Valuation and Reporting Process

Starting with the determination of the characteristics of their award be it option, shares, performance, market, service duration or cash-settlement obligation, the accounting of the payment of the share-based payment is initiated. This is because it is necessary to understand the economic design of the award to know what type of valuation to use and what should be classified in the IFRS 2.

After identifying the characteristics of awards, companies have to select the proper model of financial analysis, which could be a binomial model or a Monte Carlo analysis. Once the model has been established, there are critical assumptions that will have to be estimated such as volatility, risk free rates, expected dividends and pattern of employee exercises. The premises result in valuation scenarios that create fair value per unit award.

The second step will be to develop an expense amortisation schedule in which the compensation expense would be recognised within the vesting period based on the grant-date fair value principle of IFRS 2. In the cases of cash-settled awards, remeasurement has to be carried out at the reporting date, which incorporates updated fair values in the balances of liabilities and recognition of expenses. Lastly, businesses have to prepare reports, which clarify valuation assumptions, modelling, vesting, classification choices, as well as financial implications of share-based payment programs.

It is a broad undertaking that underscores the hefty technical requirements of IFRS 2 and why the use of independent valuation support now is seen as a best practice of both publicly and privately-traded companies.

Conclusion to IFRS 2 Share-Based Payments Why Companies Need Independent Valuation Support

The IFRS 2 has obligated firms to exercise strictness in their methods of financial modelling and reporting in order to ensure that the share-based remunerations are identified and recorded appropriately. The standard facilitates accountability and comparability in the organisations that use it because of the following reasons; 1.) the requirement to measure at fair value; 2.) the differentiation between market and non-market conditions; 3.), the careful classification of both equity and cash-settled awards; and 4.) the execution of disciplined amortisation and disclosure requirements.

Since the accuracy of the valuation is determined by the proper use of binomial models, Monte Carlo simulation and complicated financial data including volatility and risk free rates, independent valuation support is vital in offering the necessary expertise and objectivity. With the increased use of equity-based compensation in attracting and retaining talent in the business community, the value of good, defensible under the How to determine fair value of equity awards under IFRS 2 for accurate expense recognition remains to be of even greater significance. An independent analysis further leads to strengthening of the integrity of the financial reporting, improvement in investor confidence and the compensation structures in the true economic cost and strategic purpose.