IAS 36 Goodwill Impairment: Why Annual Testing Protects Balance Sheets

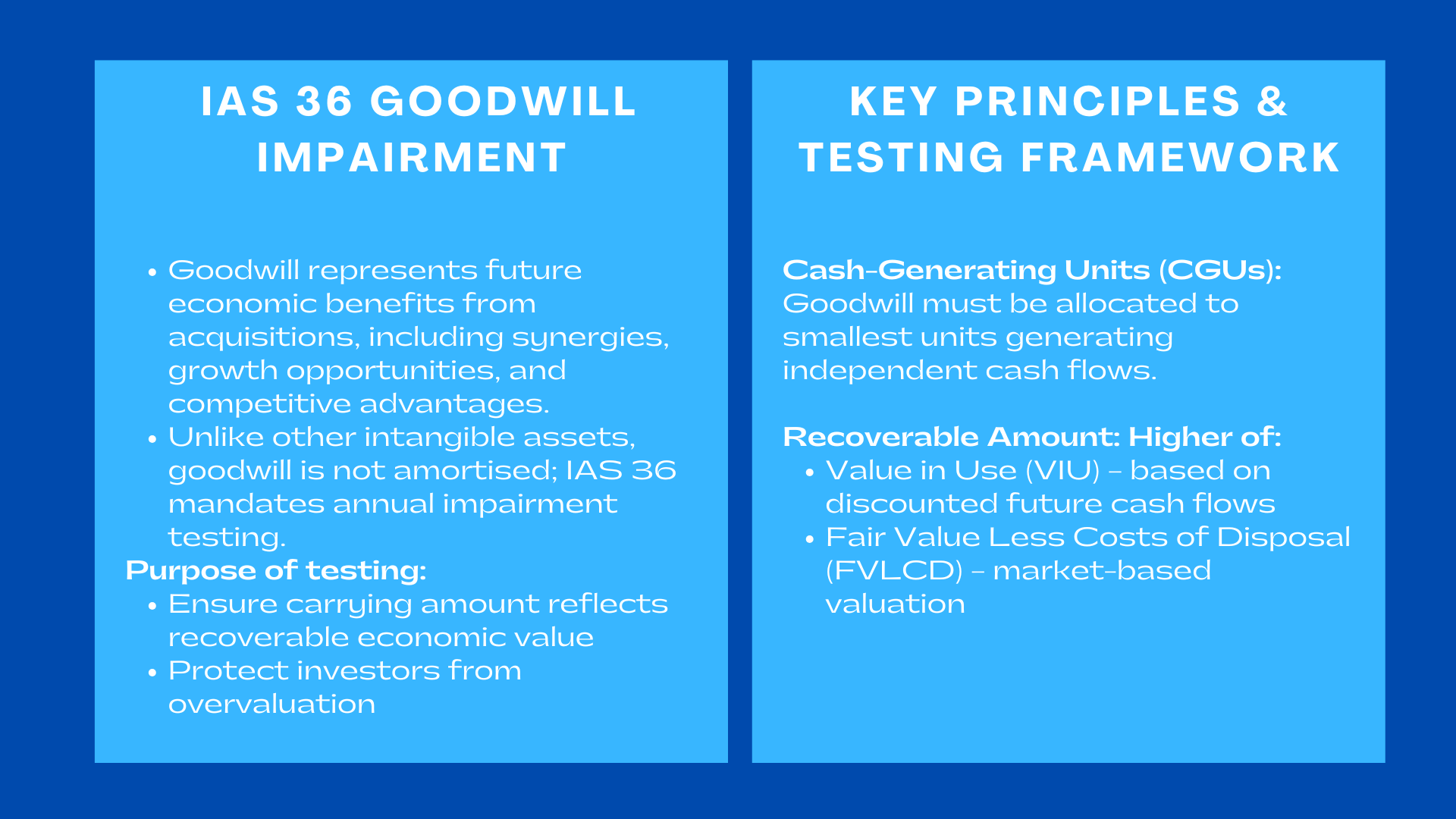

Goodwill is one of the most influential and most intensely scrutinised entries in the balance sheet of a company. It captures the economic benefits of future deals from an acquisition which cannot individually be identified and separately recognised, including synergies, anticipated growth opportunities, unique capabilities and competitive advantages embedded in acquired business. Unlike other intangible assets, goodwill is not amortised over time under IFRS, the IAS 36 instead takes an annual impairment test to ensure that the carrying amount of goodwill continues to show a recoverable economic value. This requirement is not simply an accounting convention but is useful as a protection mechanism to maintain the credibility of financial statements, to protect investors from the risk of overvaluation, and to ensure that there is discipline in the strategic assumptions of management.

The reason for annual testing is because of the very nature of goodwill. Goodwill is the representation of expectation regarding the future, rather than some past work. These expectations can change rapidly on the back of competitive pressures, technological disruption, economic downturn, shifts in regulation, or shifts in consumer behaviour. If the process of testing goodwill is not followed, companies will be at risk of carrying assets at values that reflect their economic realities. IAS 36 goodwill impairment testing requirements for multinational companies attempts to avoid this distortion by requiring entities to determine whether the recoverable amount of goodwill continues to be higher than the goodwill’s carrying amount to ensure that the balance sheet is accurate and reliable.

The impairment test is particularly meaningful if there are times of volatility. When markets are down, interest rates are higher or declining profitability becomes evident, goodwill may be one of the first impaired assets. Annual testing is a periodic check point which forces the management to review their assumptions and to re-assess if acquired business is performing the same benefits as it was originally assumed. It instills an element of accountability into the acquisition process, and reminds stakeholders that goodwill has to be backed with an element of real, sustainable performance, rather than temporary optimism.

Cash-Generating Units as the Foundation of Goodwill Testing

Cash-Generating Units as the Foundation of Goodwill Testing

One of the extremely important principles of IAS 36 is that you cannot test goodwill in isolation. As goodwill does not give rise to independent cash inflows, it must be allocated for the cash generating units, or CGUs. A CGU is defined as the smallest recognizable grouping of assets which produces cash inflows which are substantially independent of the cash inflows of other assets or groups of assets. The goodwill allocation to CGUs is therefore essential and how impairment testing is performed has a particularly large influence on whether an impairment takes place. Professionals participating in international financial reporting training for companies will learn how proper CGU allocation is critical for accurate goodwill impairment testing and reliable financial reporting.

CGU determination entails a deep understanding of the operational organization, revenue generation processes and internal management reporting practices of an entity. Companies have to analyse how synergies come into materialisation, customer interaction with the purchased business, whether products are interdependent, and whether common resources affect performance. CGUs cannot be simply a matter of organisational convenience, but need to reflect economic substance. If this is allocated too broadly, potential impairments will be masked in the stronger-performing areas. If designed too narrowly, the allocation of a CGU is likely to be unfairly penalised by the burden of goodwill which is borne by the wider portfolio of operations.

Once the goodwill has been assigned to CGUs, according to IAS 36, impairment testing needs to take place at this CGU or group of CGUs level on an annual basis. The performance of the CGU (as regards its revenue trajectory, cost dynamics, competitive landscape, strategic positioning, etc.) determines the amount that can be recovered directly. This way, goodwill is based on factual economic activity as opposed to hypothetical group-wide assumptions. It provides a mechanism through which investors and analysts have a better understanding of how the acquisitions perform in the scheme of the business.

VIU vs FVLCD: Understanding the Recoverable Amount

IAS 36 mandates that the recoverable amount of CGU have to be determined as superior of the following two valuation perspectives: Value in Use (VIU) and Fair Value Less Costs of Disposal (FVLCD). This dual approach ensures that the recoverable amount is not underestimated or overestimated and both internal expectations and external market indicators are appropriately taken into consideration.

Value in Use is the discounted value of future cash streams scenarios that are expected to come from the continued use of the CGU. It takes management’s assumptions about future revenue growth, operating margins, cost structures, capital expenditure requirements, working capital changes and long-term strategic development. VIU is an internal derived measurement, based on a company’s strategic projections, internal budgets and industry outlook. Because it is based to a large extent on forward-looking estimates, VIU calls for disciplined modelling, objective evidence and consistency between internal planning processes and impairment assumptions.

Fair Value Less Costs of Disposal, on the other hand, shows the amount that might be received for the sale of the CGU in an arm’s length transaction between the knowledgeable market players, less costs of disposal. FVLCD is based on external evidence in the form of transaction multiples, market based value, quoted price indicators or asset-specific market benchmarks. It reflects what the market would reasonably pay for the group of businesses or assets in given circumstances covering actual economic sentiment as opposed to merely projections internal to the operator.

The Comparison of VIU and FVLCD helps develop a balanced picture on the recoverable amounts. VIU is valued from a strategic management point of view, whereas FVLCD is valued from a market-oriented viewpoint. Using the higher of the two helps to guard against the CGU being undervalued but at the same time ensures that it is recognised that impairment has been recognised where market forces or operational realities justify it.

Discount Rates and Growth Rates: Critical Assumptions for Impairment Models

One of the greatest sensitivities in and judgment component of the impairment process is the choice of discount rates and growth rates. A discount rate represents the time value for money and the risks that exist in the cash flows of the CGU. IAS 36 mandates a pre-tax discount rate that is based on market assessments of the risks within the CGU that is being tested, as assessed at that moment. This requirement means that the VIU model does not assume arbitrary or overly optimistic market expectations, but rules in actual, risk-adjusted market expectations.

Estimating a proper discount rate requires the analysis of the data in capital markets, industry risk premiums, country-specific risks, inflation expectations and the CGU’s operational risk profile. A discount rate that is too low will artificially inflate the VIU such that an impairment may be avoided that would be a realistic requirement in economic conditions. On the other hand, an overly high discount rate can skew the risks too high and suppress recoverable amounts and evoke an impairment prematurely.

Growth rates and especially terminal growth rates also need to be carefully chosen. IAS 36 caps terminal growth at rates no higher than the long-term growth prospects of the market or economy in which the CGU is in business. Growth rates should be consistent with historical past performance, industry projections, market maturity and strategic initiatives without exaggerating future potential. A credible growth rate is consistent with internal budgets and still has its foot in the door in terms of what is reasonable from a market business perspective.

When discount rates and growth rates are judiciously and candidly set, it is the backbone of a sound impairment analysis. Such assumptions determine the course of long-term valuation of the CGU and have a direct effect of whether or not goodwill is recoverable or impaired.

Impairment Indicators and the Need for Continuous Monitoring

Despite the fact that IAS 36 requires that the impairment of goodwill should be tested annually, the company should also do interim testing of impairment indicators when occurrences take place. This is due to factors captured by these indicators that depict events or trends which lead to the possibility of a reduction in the recoverable amount of a CGU. Among the external indicators, one can mention economic downturns, considerable market segment loss, heightened industry competition, unfavorable regulatory trends, or worsening industry conditions. Internal signals can include loss of revenues and decreased profitability, shortages of budget, operational sweats or sudden rise in costs.

There is a need to be vigilant with monitoring impairment indicators. A company cannot count on end of year financial review alone, the company should always evaluate whether the risks or the structure changes are pointing to the fact that the goodwill can be impaired. Reporting Indicators of impairment at an early stage would help companies to respond to valuation risk in advance, refine their assumptions, revise strategic reactions, and maintain the integrity of financial reporting.

The inability to identify indicators of impairment early can lead to impairment recognition being delayed, regulation, or the two can be seen to be unclear regarding worsening business conditions when the management does not act openly. Monitoring of the impairment indicators continuously gives more strength to the governance and credibility to the impairment process.

Sensitivity Testing: Revealing the Fragility of Assumptions

Considering that determining long-term cash flows is a challenge that is not easy to predict, IAS 36 mandates businesses to undertake sensitivity tests. Sensitivity analysis illustrates the effect of changes in the assumption of importance into the recoverable amount, i.e. changing time value of money or growth rate and operating margin. Such transparency contributes to the fact that the stakeholders can know that the CGU is resilient to different economic situations.

Sensitivity analysis is very pertinent to CGUs when recoverable value is financially almost equal to carrying value. When this is the case, minor changes in the assumptions can result in high impairment risks. Sensitivity testing indicates the tipping points, which indicates the assumptions that might or may not support recoverability. This knowledge will allow the management to determine the risks their projections have and will give the auditors an idea of the responsiveness of internal assumptions to normal fluctuations.

Sensitivity testing can also be helpful in communicating to the investor to show how valuation is dependent on certain economic variables. It helps in sound risk management and helps the companies to come up with contingency strategies to face part of adverse scenarios. Made publically, sensitivity results will give a better story on future uncertainty and will help the shareholders retain faith during economic pressures.

The Impairment Process: From Allocation to Disclosure

The impairment of the goodwill process is done in a number of strict steps which are all aimed at enhancing the maintainability and authenticity of the end result. It starts with the goodwill being allocated to the concerned CGUs who appear to be beneficiaries of business combination. This is the first step to guarantee that goodwill is subject to test at the stage of realisation of economic benefits. After assigning it, the management develops elaborate cash flow projections that consider realistic projections of forecasts given the realities of budgets, past accomplishments, and strategies and the market conditions.

The second step will be the calculation of the recoverable amount based on Value in Use and Fair Value Less Costs of Disposal. Both of the approaches have different methodologies and assumptions that should be talking about a similar understanding of the economic environment of the CGU. A comparison between the carrying amount of the CGU with goodwill and its recoverable amount is done after both the valuations are done. In case carrying amount is greater than recoverable amount, an impairment loss shall be recognised at one go. The impairment is then distributed to first reduce the goodwill and then distribute another asset within the CGU as needed.

Having identified the impairment (assuming there is any), IAS 36 requires numerous disclosures to elaborate on the assumptions and models, sensitivity analysis, CGU nature, and the conditions that resulted in the impairment. Such disclosures provide a high level of transparency and allow one using financial statements to grasp the valuation reasoning used in the impairment decision.

Conclusion to IAS 36 Goodwill Impairment Why Annual Testing Protects Balance Sheets

The IAS 36 offers a stringent and fundamental guideline to safeguard the goodwill integrity on the balance sheet. The goodwill contained in yearly impairment tests make sure that goodwill does not continue to exist in a diminished form of over-charged legacy of preceding purchases. The IAS 36 assists companies to have financial clarity and investor confidence through proper distribution of goodwill to the CGUs, restrained generation of the cash flow forecasts, sound valuation methods, sensible choice of discount and growth rates, and clear sensitivity tests.

Goodwill impairment testing is a safeguard in a business location whereby economic circumstances change at a high rate and where competition increases and focuses on price, profit and loss statements are not influenced by old expectations. It strengthens accountability and all acquisitions will be still justifying the recorded worth. In the end, How to determine CGU recoverable amount under IAS 36 using VIU and FVLCD increases the credibility, transparency and reliability of the financial reporting providing the stakeholders with a clear and consistent idea whether goodwill on the balance sheet reflects the actual economic value of the company or not.