How to Conduct a Purchase Price Allocation (PPA) Valuation

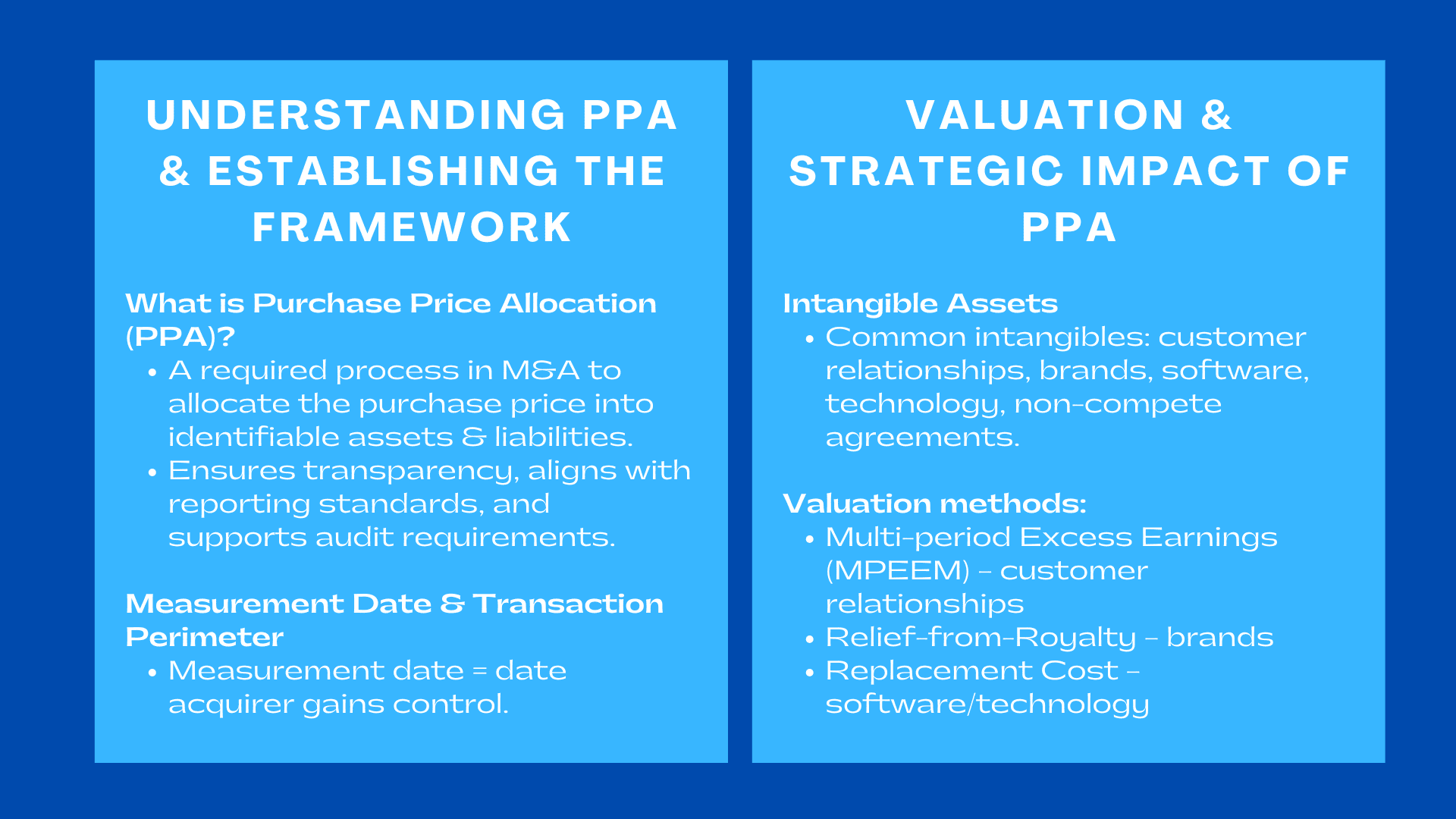

Purchase Price Allocation (PPA) is a characteristic feature of contemporary mergers and acquisitions, which is the way in which companies reflect the assets and liabilities gained in a deal. Due to the growth in the number of deals across Southeast Asia, as well as the tightening of financial reporting standards, organisations have been under growing pressure to explain the prices of acquisitions, determine intangible assets with certainty, and record valuation methods that can endure the audit team. As more professionals enhance their skills through programmes such as a corporate valuation training course Singapore companies increasingly seek, an appropriately carried out PPA establishes confidence amongst regulators, investors, lenders, and auditors and also gives assurance that financial statements prepared by the company after the deal reflect economic reality.

Knowledge of how to do a PPA valuation is critical to finance heads, corporate development staff, and company proprietors of an M&A deal. It is not only a technical valuation process but also a process that requires knowledge of financial reporting standards and the business rationale of the transaction. The exercise increases transparency and gives a good base to continued financial performance evaluations when the exercise is done well.

1. Determining the Framework on a PPA Valuation.

1. Determining the Framework on a PPA Valuation.

1.1 Determining the Measurement Date and the Perimeter of the Transactions.

Any PPA valuation starts at the date of measurement wherein the measurement date is the date the acquirer gains control of the target. This date controls all fair value evaluations and influences every aspect of market participant assumptions to the choice of discount rates. This is one of the most typical issues when the acquisition deal is signed months prior to the closing date, and valuers have to revise the assumptions to address the changes in the market.

It is also important to establish the perimeter of the transaction. This and includes the identification of the assets and liabilities involved in the deal such as items of working capital, contingent liabilities and off-balance sheet risks and obligations. In cases of acquisitions which involve many subsidiaries or other assets in other jurisdiction, great care must be taken to ensure that valuation is made correctly and in compliance.

1.2 Procuring and evaluating Management Information.

A sound PPA is based on quality financial and operation data. The valuation is based on the management forecasts, past performance, data on the concentration of customers and data on the contracts. At this level, the specialists can also examine due diligence outcomes to determine the risks or concealed value drivers. Where there are irregularities in the historical financials, normalisation adjustments can be made so as to have a forecast that is a market-participant perception and not management expectations.

During this phase, many organisations also seek guidance on purchase price allocation Singapore requirements to ensure alignment with local regulatory and audit practices. When Companies involve valuation professionals in the early stages, there is minimization of the risk of late-stage adjustments that may make reporting schedules to be complex.

2. Recognition and Measuring Intangible Assets.

2.1 Recognisable Intangibles that are common in PPA.

Intangible assets unlike the tangible ones may need to be analyzed in detail to identify whether they qualify to be recognized or not. The relationships with the customers, brands, technology, proprietary software, as well as non-compete deals are often appreciated in PPA engagements. As an illustration, an acquisition of a technology can disclose various recognizable intangibles despite the fact that the acquiring company has not recognized any intangibles in its balance sheet before.

The intangible assets should possess a quantifiable economic advantage and need to be discernible to goodwill. Contracts which are automatically renewed, long-term licensing deals, and patents normally pass this test because of the obvious contribution of cash flow.

2.2 Intangible Asset valuation methods.

The valuation method will rely on the character of the asset. The multi-period excess earnings method is a more common method of valuing customer relationships by isolating future cash flows which can be attributed to customer retention. Valuations of the brands can be based on the relief-from-royalty approach founded on hypothetical licensing agreements. A replacement cost approach is generally used to value software and technology in cases where it is challenging to determine effective cash flow attribution.

Practically, organisations often hire experts to implement these methodologies in a uniform way particularly in preparing reporting packages to the external auditors. This is where post acquisition valuation process guidance becomes vital, as it helps management understand audit expectations, model assumptions, and documentation standards.

3. Measuring Tangible Assets and Liabilities at Fair Value

3.1 Property, Plant, and Equipment

Physical assets like machinery, land and buildings must be measured based on fair value that is based on market transactions, replacement costs or income methods. Industrial equipment can be priced under a depreciated replacement cost model since secondary market is low and commercial real estate is usually based on similar market deals or income capitalisation.

Functional and economic obsolescence are also taken into account under fair value measurement. As an example, the manufacturing facilities in industries being digitalized might face the risk of value erosion because of the automation trends or changes in the production system.

3.2 Items and Financial Liabilities of working capital.

The component of working capital such as trade receivables, inventories and payables also need to be re-valued as part of the PPA. It is possible that inventories need step-ups to indicate selling prices less completion and disposal costs. The credit risk is adjusted on receivables, and the payables are usually carried at the carrying value unless otherwise as required by the contractual requirements in comparison with the market practice.

Long-term borrowings or lease obligations are also done at fair value based on the current interest rates in the market. Fluctuations between the transaction date and the closing date usually cause effects that bear implications particularly in an upward-rate environment.

4. Computation of Goodwill and Preparation of Audit Ready Documentation.

4.1 Determining Goodwill

Goodwill is the super- consideration that is paid on the fair value of identifiable net assets. It replicates synergies, value of workforce assembled and prospective growth opportunities that cannot be recognised individually. Goodwill is easy to compute but the justification is only possible by trying to get valuation outcomes to conform to the commercial approach to acquisition.

In case of an example, the purchase of a local courier company by a logistics company to increase the ability to operate last-mile, goodwill may capture strategic benefits, including the expansion of networks, route optimisation, and savings on customer acquisition costs.

4.2. Standards of documentation and audit review

Once the valuation process is done, an elaborate PPA report should be prepared. This comprises of elaborate methodologies, assumptions, market data, risk factors and reconciliation schedules. Auditors test the fair views on the perspectives of the market participants, and assumptions of discount rates, attrition rates or royalty rates made.

Organisational planning is usually done early to avoid delays in the issuance of financial statements through the preparation of audit-ready documentation. Uniformity of financial due diligence findings, management forecast and valuation assumptions are critical in ensuring credibility in the audit review.

5. Strategic Implication of an effective PPA.

5.1 Effect on Future Earnings and Financial Statements.

PPA exercise affects the depreciation, amortisation, and impairment risk, as well as future earnings trends. The intangible assets like technology or customer relationships can greatly add yearly amortisation charges and this will impact on the forecasts of profits. Businesses should also undertake the impairment testing of goodwill once in a year and in doing so, it is necessary to monitor cash-generating units.

This information of implications helps the management to prepare the stakeholders on after-acquisitions financial performance. Effective communication minimizes the elements of surprise in the quarterly reporting periods.

5.2. Improving Stakeholder Confidence.

Investors and lenders are growing more demandant of defensible valuation practices that they can see. Through a strong PPA, compliance is achieved, and the stakeholders place their trust in the company since it is proven that the purchase value is based on objective economic value. Those companies that have well-managed valuation have a streamlined capital-raising and a better reputation among regulators.

Conclusion to How to Conduct a Purchase Price Allocation PPA Valuation

PPA valuation has to be performed under a keen coordination, technical skills, and profound knowledge of the commercial as well as reporting aspects. When properly presented, it promotes transparency, audit requirements, and the financial statements should be accurate, reflecting the economics of a transaction. As the pace of M&A increases, organisations that develop robust valuation processes now will be in a better position tomorrow to acquire in the future, merge new business, and ensure the trust of stakeholders.