Step-by-Step Guide to PPA Valuation in Singapore and Malaysia

Introduction to Step-by-Step Guide to PPA Valuation in Singapore and Malaysia

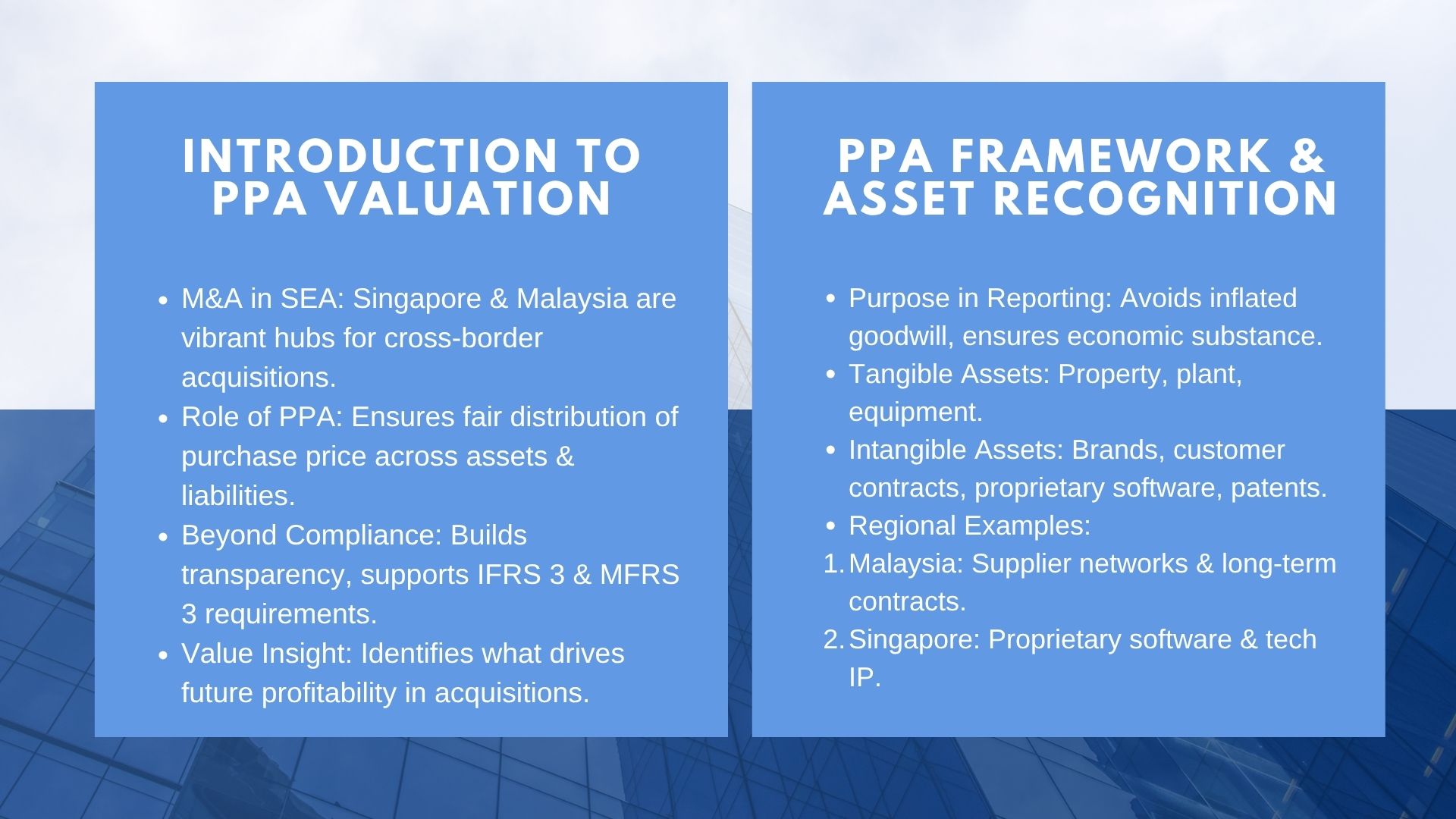

Mergers and acquisitions (M&A) are transforming the business environment in the Southeast Asian region and Singapore and Malaysia are some of the most vibrant markets in the region. To acquire a new market, access some technology, and improve the strategic position, companies seek to make acquisitions. However, the strategic headlines are cloaked by an intriguing financial procedure that defines the method of record keeping, reporting and appraisal of the acquisition by the stakeholders.

Purchase Price Allocation (PPA) is one of the strongest components in this process. Contrary to being a mere accounting exercise, PPA makes sure that the cost in a deal is duly distributed among the tangible and intangible assets and even liabilities. When properly done, it introduces transparency, aids in adherence to the international accounting standards, and gives the management a clue on what contributes to value in the acquired business.

Understanding the PPA Framework

Understanding the PPA Framework

The Purpose of PPA in Financial Reporting

Purchase Price Allocation is not merely the compliance requirement, but the process that helps to conduct the financial statements to give the true image of the acquisition. PPA which is a compulsory requirement imposed on companies by International Financial Reporting Standards (IFRS 3) requires companies to determine the fair value of the acquired assets and liabilities during the date of acquisition. This will help avoid inflated goodwill on the balance sheet and will help ensure the allocation of the purchase price reflects an economic substance of the transaction.

The intention is not limited to local compliance in case of the Singaporean companies. Since most of them have international trade or global investment interest, financial reporting credibility is of utmost importance. PPA is one method of showing investors and analysts that the figures of the company are open and justifiable. PPA is very important in Malaysia, where family-owned businesses and joint venture comprise a large part of the corporate environment, and all stakeholders are highly likely to disagree on the issue of ownership structure, especially when it comes to acquiring companies with complicated ownership arrangements. PPA fosters internal and external trust through imposing transparency.

The Position of Tangible and Intangible Assets.

In contemporary takeover, physical assets such as plants, vehicles and equipments may not constitute the complete value of the deal. Buyers are beginning to pay a premium on intangible assets like brand recognition, customer contracts, proprietary software or patents. These intangibles can be the key drivers of future profitability and are therefore central to the detailed PPA valuation process for businesses in Singapore and Malaysia.

Consider the case of a Malaysian based manufacturing company being purchased because of its good supplier base as well as long term contracts with the international clients. These contracts are not movable properties but they have huge value and are to be recorded separately of machinery and property. Equally, in Singapore, a technological acquisition can entail proprietary software which, although not reported on the balance sheet of the supplier, holds a high potential of revenue in the future. The identification of such assets and its appreciation is important so that the statements of finance actually show sources of business value and not just the physical holdings.

Navigating the PPA Process

Practitioner Methodologies of valuation.

A PPA is executed by using the appropriate techniques of valuations to the various assets. Valuation of tangible assets can either be a cost or a market approach but intangibles usually involve more complex models. An example of this is that customer relationships may be appraised by applying the multi-period excess earnings method which estimates the future revenues that the relationship allows and discounts them to the present value. There is a possibility that intellectual property can be estimated using the relief-from-royalty approach, which tries to estimate the saving that a business can get by owning the asset as opposed to licensing it.

These methods are not easily applicable. Both of them need thorough financial modeling, comparison with data in the industry, and the application of relevant discount rates. Businesses that engage professional step-by-step PPA valuation services in Singapore and Malaysia benefit from advisors with the technical expertise to apply these methodologies consistently. This ensures valuations are defensible, auditor-ready, and aligned with both local practices and international reporting standards.

Resolving Compliance and Audit Complications.

The compliance with the auditors and regulators is one of the most challenging parts of PPA. The auditors would require not only proper documentation of value assumptions but also show that methods have been used accordingly. This is especially critical to goodwill which is not to be amortized but to undergo impairment testing on a yearly basis. When goodwill is overstated during PPA, any future write-downs may have a wide spread effect on profitability and investor confidence.

In Singapore, the international investors scrutinize the companies, and this increases the audit preparedness. In Malaysia, firms tend to deal with the further complication of cross-border acquisitions of the neighboring markets. Both contexts require PPA reports that withstand regulatory and audit review. By working with experts who understand the professional step-by-step PPA valuation services in Singapore and Malaysia, companies can avoid restatements, audit delays, and potential penalties while building investor trust.

Conclusion

Purchase Price Allocation is far more than a compliance requirement to the companies in Singapore and Malaysia: it represents a foundation of quality financial reporting and operational clarity. The company can be able to have the acquisitions reflected in the financial statements of the company by having the right framework, valuing both tangible and non-tangible assets in a rigorous way, and using strong valuation methodologies. Not only does strong PPA ensure auditors and regulators satisfaction but also gives the investors confidence that they have taken a true value of a deal. In the current environment of intense mergers and acquisitions, PPA is a necessary tool to transform ambitious deals into the success.