Top PPA Experts in Malaysia – Compliance & Financial Reporting Insights

Mercers and acquisitions (M&A) is one of the most active strategies of growth, diversification, and expansion into international markets in Malaysia with the fast-changing environment of businesses. Making the deal is not the end. The actual difficulty is to leave the transaction appropriate in the books, auditing it and making it in compliance with the financial reporting standards. And this is where Purchase Price Allocation (PPA) comes in- a process that is important and needs expert knowledge.

In companies emerging in the post-M&A integration phase, dealing with the most competent PPA valuation consultants to comply with Malaysia would not only provide proper reporting but also the long-term financial perspective.

Knowing the of Top PPA Experts in Malaysia

Knowing the of Top PPA Experts in Malaysia

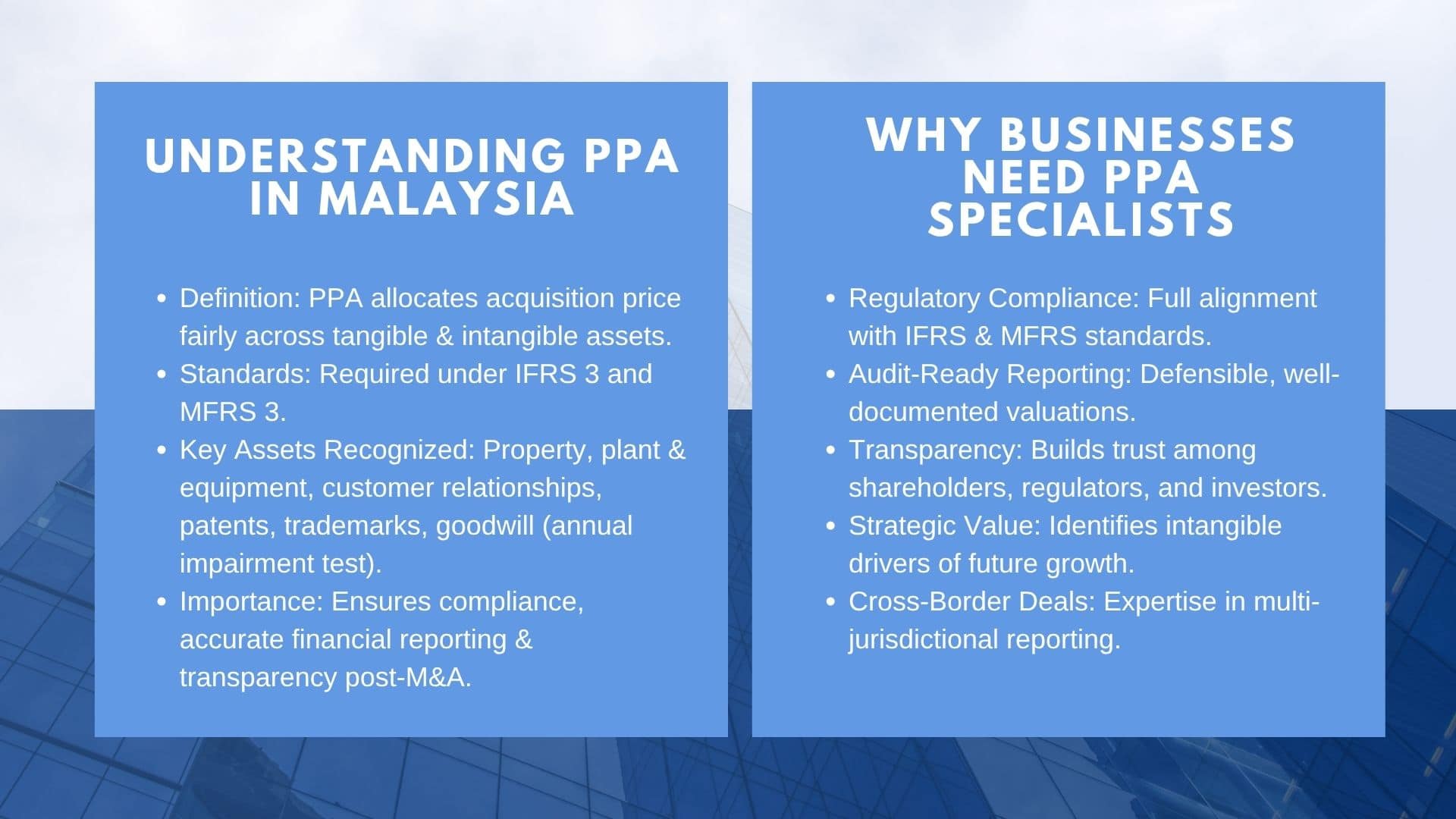

Purchase Price Allocation This process involves apportionment of the purchase price paid in an acquisition over the assets and liabilities of the acquired company, in fair value. The PPA is a required post-acquisition step under International Financial Reporting Standards (IFRS 3) of PPA as well as in Malaysia under Financial Reporting Standards (MFRS 3). Companies often engage the best PPA valuation services Singapore for post-M&A integration to ensure compliance and accurate reporting.

In case of acquisition of a business by a Malaysian company, it is obliged to recognize both of tangible and intangible assets including property, plant and equipment, customer relationships, patents and trademarks. Any overvaluation of purchase price in relation to the fair value of net assets will be goodwill, which is to undergo testing on an annual basis, on impairment.

Professional skills are a requirement without proper PPA as companies would be prone to audit problems, compliance risks, or falsified financial statements.

Why Businesses Need PPA Specialists

Although most accounting and advisory firms would help in financial reporting, PPA needs a high level of technical expertise on the principles of valuation and industry-related dynamics. Utilization of external advisors or generic team alone may cause misallocation, regulatory opposition, or auditor conflict.

Engaging professional purchase price allocation experts in Malaysia provides several advantages:

- Regulatory Guarantee: Professionals make certain that they are fully compliant with MFRS and IFRS.

- Transparency: Independent valuations instill confidence between the shareholders, regulators and investors.

- Audit-Ready: Reports are prepared in a way that they can survive audit.

- Strategic Insight: PPA provides insight on intangible assets beyond compliance that lead to growth in future.

Compliance and Financial Reporting Problems.

The PPA conducted in Malaysia is associated with a number of considerations that are unique:

- Complexity in Regulations: Companies need to be in compliance with the international and Malaysian standards of reporting financial matters.

- Cross-Border Transactions: Acquisition or merger of businesses in the region is a common practice among Malaysian firms and this necessitates the support of a consultant who is conversant with multi jurisdictional reporting.

- Intangible Asset Valuation: It is very subjective to simply assign fair value to brands, technology or customer contracts without professional consultants.

- Audit Expectations: The local and the international auditors provide defensible well documented valuations.

These challenges highlight why partnering with the best PPA valuation consultants for compliance in Malaysia is critical.

Key Stages of a PPA Engagement

To find out how experienced one should be, one can refer to the key steps of a PPA process:

- Deal Review: Consultants also examine deals and deal structure.

- Asset Identification: both tangible and intangible assets are identified and classified.

- Valuation Methodologies: Each type of asset is subjected to proper methods (income, cost, or market).

- Allocation and Goodwill Calculation: Purchase price is also allocated among the assets and liabilities with the remaining part going to goodwill.

- Reporting: An expansive report is prepared to the management and auditors, making it compliant.

How PPA Strengthens Corporate Governance

In addition to the compliance with the accounting standards, PPA is relevant to enhancing the governance and investor trust. The management is transparent to the interested parties by demonstrating how the purchase price will be disseminated. This amount of disclosure assists investors to consider the possibility of the acquisition to generate long term value.

In the case of listed companies in Malaysia, transparent reporting can also decrease speculation in the market as well as increasing credibility in quarterly and annual reporting. In the case of SMEs, it assures of banks, private capital investors and other financing partners.

Trends in the financial reporting in Malaysia.

Over the past couple of years, there has been an influx of cross-border purchases in Malaysia especially in technology, manufacturing and consumer goods. The current regulators and auditors require companies to be more detailed in reports regarding their PPAs.

The trend represents a wider trend in the world: intangible assets are now a large portion of enterprise value. Intangible assets are in most cases the source of deal premiums in a fintech start to proprietary software and a well-regarded brand in consumer products. Professional consultants are very crucial in measuring these intangibles in order to make them part of the financial statements.

Real-life situations involving the use of PPA.

- Private Equity Acquisitions: Exit planning will be made difficult by PPA because subsequent buyers and investors will examine the way purchase price was distributed.

- Cross-border transactions: When Malaysian firms are acquiring regional stakeholders, their valuation must be based on the local and international reporting standards.

- Family-Owned Business Transactions: A transparency and tax allocation needs to be properly done even in small scale acquisitions or mergers.

- Public Company Deals: Public company deals are under more scrutiny than ever, and independent, defensible reports are necessary.

How to Expect When collaborating with PPA Experts.

Company hiring professional consultants should anticipate:

- Customized Solutions: Not every acquisition is similar, approaches are customized to suit industry and acquired assets.

- Clear Documentation: It should have reports of assumptions, methodologies, and calculations.

- Cooperation with Auditors: Top consultants work directly with auditors and clarify issues and simplify audits.

- Practical Advice: Other than valuation, professionals tend to offer information on integration and asset optimization.

Cost and Time Contemplations.

The price of the PPA services in Malaysia is diverse depending on the size and complexity of the deal. Small acquisitions can take a few weeks of work whereas large and multi-entity deals can take several months. Fees are an indication of the level of analysis required and this is particularly so in situations where the transaction is mainly made up of intangible assets.

Companies should also ensure that they have ready documentation including acquisitions agreements, financial statements, intellectual property and projections of revenues. Cost reduction and accelerated completion are sometimes achieved through the proactive preparation.

Choosing the Right PPA Consultant in Malaysia

In choosing a consultant, businesses are to consider:

- History of dealing with such deals and industries.

- Image within auditors and regulators.

- Capability of being both technical and business savvy.

- Autonomy with other advisory services to prevent conflict of interest.

- International coverage and international experience, where necessary.

When companies properly vet their advisors, it can improve their strategic integration as well as ensure that their PPA process is a assistive factor to adherence to.

Frequently Asked Questions About PPA in Malaysia

- Should PPA always follow an acquisition?

Yes. According to IFRS and MFRS standards, material acquisitions have to go through PPA.

- Is PPA valuation an advantage to SMEs?

Absolutely. Transparency of even minor deals, improves investor relationship and eases audit.

- What are the impacts of PPA in the balance sheet on goodwill?

The value of goodwill is not the value of assets and liabilities that have been allocated. It should be impaired tested on a yearly basis.

- Are all PPA reports acceptable to auditors?

Not necessarily. Reports that are well done and defensible by the credible consultants are accepted wholesomely.

- Is PPA applicable in tax planning?

Yes. The results of PPA may have consequences on the computation of the deferral tax as well as the general tax planning methods.

Conclusion

PPA is not simply a compliance measure that is beneficial to businesses in Malaysia, but rather, it is a transparency, governance, and strategic integration tool. Through the recruitment of the most appropriate PPA valuation consultants to ensure compliance in Malaysia, a company will have confidence that its acquisitions are reflected in the financial reports correctly.

What is also crucial, Malaysian professional purchase price allocation specialists assist business in finding out the true drivers of value, and the insights they provide go far beyond the mandatory regulatory requirements. In the business environment where competitive advantage is more frequently characterised by intangible assets, collaborating with the PPA professionals one can trust is the guarantee that every purchase will have a long-term effect.