Contingent Consideration Valuation in IFRS 3 Business Combinations

Learn Advanced IFRS 3 Valuation and Accounting Course

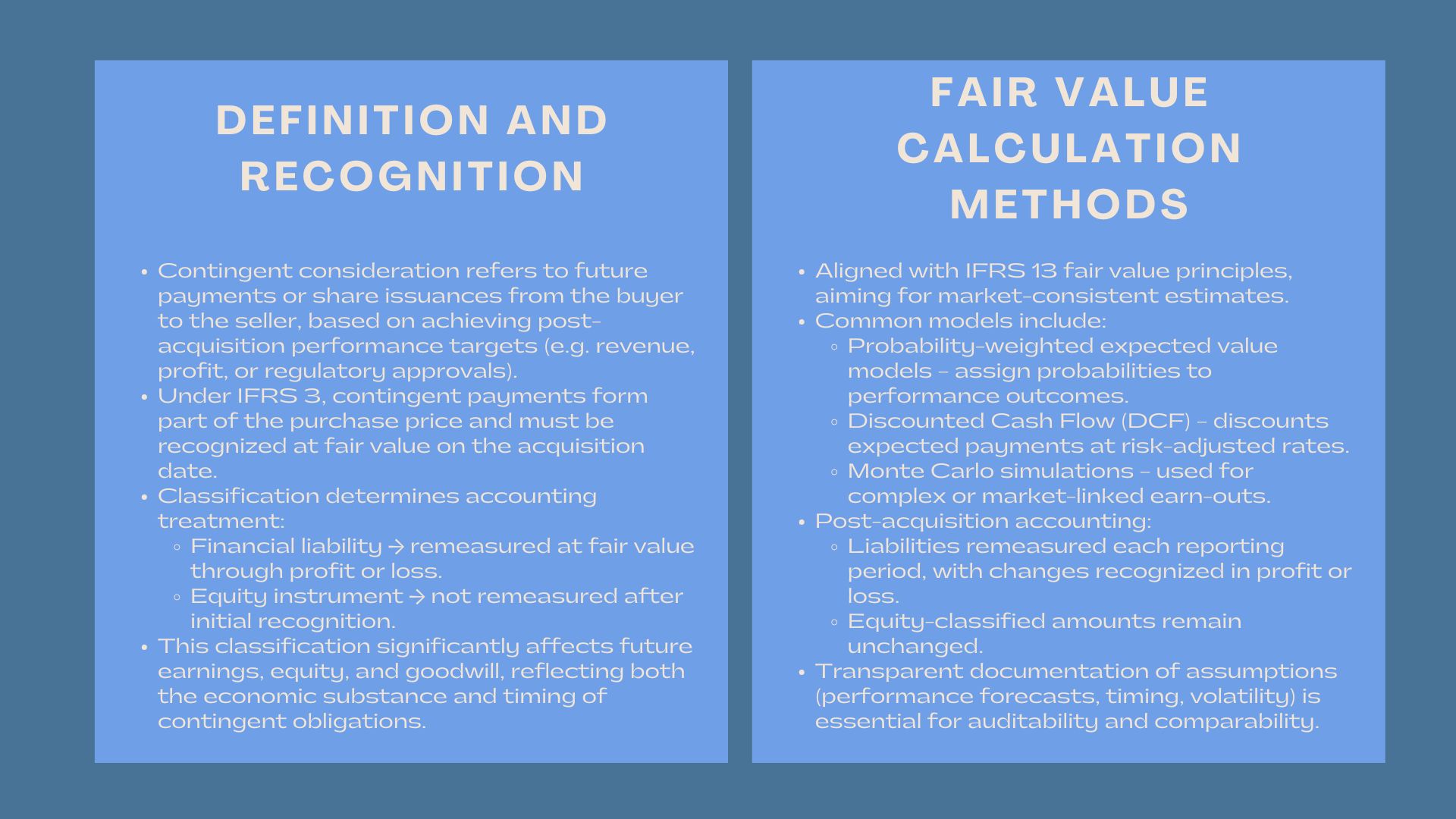

Buyers and sellers in a merger and acquisition (M&A) are usually in agreement not only on the price of the acquiring but also future payments tied to future performance. These are the future commitments, referred to as contingent consideration, which make a major feature of most of the contemporary business combinations. According to IFRS 3 Business Combinations, such arrangements must be recognized and measured at fair value taking into consideration the future payment that is to be received by the entity in case some financial or operational benchmarks are met.

The method balances the accounting treatment and economic substance of the transaction, but it is also complex. To determine the fair value of contingent consideration, there is a need to estimate the future outcomes whose uncertainty is not known and employed sound financial modelling approaches.

Nature and Recognition of Contingent Consideration.

Nature and Recognition of Contingent Consideration.

Contingent consideration is a binding consideration on the part of the buyer that they will pay extra sums or issue shares to the seller in the event of happening of certain events in the future. These may be realisation of revenue targets, profit targets or effective regulatory approvals

According to the IFRS 3 contingent consideration valuation and accounting treatment, contingent payments are part of the overall purchase price and must be recognized on the acquisition date. The acquirer records the fair value of such payments in either goodwill or purchase gain of a bargain.

In case contingent consideration is considered to be:

- It is a financial liability, which it should be remeasured in fair value by profit or loss at every reporting period.

- It is an equity instrument which is not remeasured on initial recognition.

There are significant implications of this classification on the way the transaction impacts on earnings and equity with time.

Calculation of Fair Value at Acquisition.

The measurement of contingent consideration at fair value as required by IFRS 3 is in line with that of IFRS 13. The major aim is to come up with the estimation of the price which would be paid in a current transaction between the market participants under normal conditions.

Valuation techniques used often are:

- Models of probability-weighted expected value, where different performance scenarios are given probabilities.

- Discounted cash flow (DCF) techniques, in which the anticipated contingent payments have been discounted using the risk-adjusted rates.

- Monte Carlo, particularly when in complex earn-outs that are linked to stock prices or many performance variables.

All the methods are based on a set of informed assumptions regarding future performance and volatility and timing of payment. These assumptions have to be documented in order to be auditable and transparent.

Post-Acquisition Change Accounting.

Contingent consideration that is to be included as financial liability in a post-acquisition date should be remeasured to fair value at every reporting date. Any modification that comes with revised expectations on future performance is captured in the income statement.

This implies that when forecasts are better, the liability is likely to increase and an expense is likely to increase, and vice versa. Conversely, equity-classified contingent consideration does not change upon subsequent recognition and hence is easier to account for, but could create a false impression of comparability in the future.

Valuing Earn-Out Arrangements

The fair value measurement of earn-out arrangements under IFRS 3 is one of the most challenging aspects of M&A valuation. Earn-outs are conditional payments, which are made depending on after-acquisition performance and is usually pegged on such variables as EBITDA, net profit after a given period.

Key challenges include:

- Budgeting financial performance: Predictions should be based on feasible assumptions on synergies, cost of integration, and the market dynamics.

- Selection of discount rates: They must be based on the time value and the risk in the process of attaining milestones in the future.

- Simulating complex payment structures: Most earn-outs have non-linear form structures, e.g. step payments, capped payments, that must be simulated in detail.

The rightful valuation of earn-outs would mean that the financial statements would reflect the projected economic results of the transaction.

The Disclosure and Transparency Requirements.

Under IFRS 3, in the disclosures of contingent consideration, they are required to be disclosed in detail as follows:

- The character, conditions, and the main peculiarities of the arrangements.

- The methods and assumptions of obtaining fair value by way of valuation.

- Alterations on fair value identified in profits or losses.

- The possible future payments which are undiscounted.

The disclosures enable the investors to appreciate the fact that future obligations may impact on the financial position and performance of the acquirer.

Real-life Valuation Issues.

Contingent consideration valuations are in practice subject to a number of repeatable challenges:

- Market uncomparables: There are not many transactions that can be used as direct comparables.

- Subjectivity of assumptions: The forecasts made by the management may be optimistic thus creating bias.

- A complex modeling: Non-linear and performance-based structures are hard to analyze.

- Conflicts among parties: The difference in the interpretation of the terms of the contract can result in the litigation or changes.

To overcome such difficulties, it is essential that companies have valuation models that are reviewed independently, well-documented assumptions, and a process that is consistent with the IFRS and market best practice.

Increasing the Reliability of Valuation.

In order to enhance the measurement of contingent consideration, companies ought to:

- Bring on board multi disciplinary skills: Incorporate legal knowledge, finance and accounting when doing the valuation.

- Use sensitivity analyses: Test the responses of the essential assumptions.

- Check consistency of the audit trail: Have records on the inputs, model parameters and professional judgments.

- Frequently change valuation: Reflect on the latest trends in the development of the performance and the macroeconomic situation.

The practices enhance the consistency of financial reporting and reduce the probability of restatements.

Conclusion

Under the IFRS 3, contingent consideration valuation is important to have business combinations reflected faithfully on financial statements. It requires a combination of technical accuracy, judgment and truthfulness to reveal the actual fair value of the uncertain future payments.

With an effective implementation, such valuations do not only adhere to IFRS requirements but they also give the stakeholders more insight into the risks and rewards that are associated with M&A transactions.