Valuation on REITs refers to Real Estate Investment Trusts, and it offers ways to invest in real estate, and you don’t have to buy the real estate directly. The popularity of REITs is increasing with time since they have high liquidity, affordability, stable income, and professional management. However, regardless of how well this sector is doing, it is no secret that some firms surpass others. How do you determine the value of REIT businesses? This article will explain the factors you must consider and the valuation process.

Quick Contact

Need Help?

Please Feel Free To Contact Us. We Will Get Back To You With 1-2 Business Days.

info@valueteam.com.sg

+65 9730 4250

How to do Valuation on REITs?

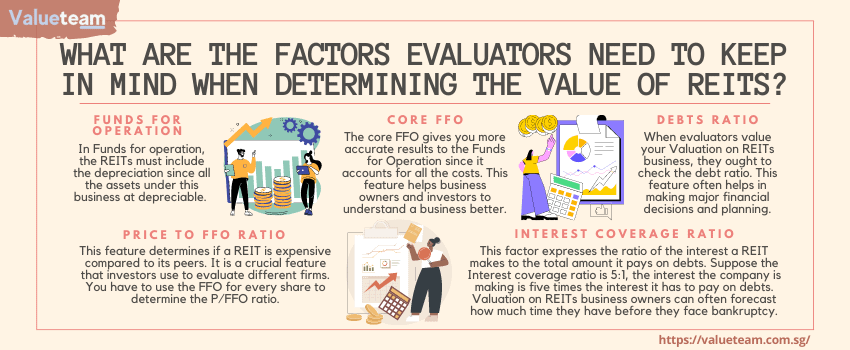

What Are the Factors Evaluators Need to Keep in Mind when Determining the Value Of Reits?

Here are some of the significant factors to use to determine the value of these companies:

-

Funds for Operation:

This factor is almost similar to the net income for each share. It is the primary determiner of the total amount of money the business is making. In Funds for operation, the REITs must include the depreciation since all the assets under this business at depreciable. Before investing in a REIT company, it is vital to understand the FFO metric.

-

Price to FFO Ratio:

This feature determines if a REIT is expensive compared to its peers. It is a crucial feature that investors use to evaluate different firms. You have to use the FFO for every share to determine the P/FFO ratio.

-

Core FFO:

When running any business, it is no secret that you require maintenance expenses, and the same case applies to Valuation on REITs. The core FFO gives you more accurate results to the Funds for Operation since it accounts for all the costs. This feature helps business owners and investors to understand a business better.

-

Debts ratio:

Every business working under too many debts has too many risks, including the REITs. As much as debts assist in developing major projects, too much of it may lead to bankruptcy. Therefore, when evaluators value your Valuation on REITs business, they ought to check the debt ratio. This feature often helps in making major financial decisions and planning.

-

Interest Coverage ratio:

This factor expresses the ratio of the interest a REIT makes to the total amount it pays on debts. Suppose the Interest coverage ratio is 5:1, the interest the company is making is five times the interest it has to pay on debts. Valuation on REITs business owners can often forecast how much time they have before they face bankruptcy.

Valuation of REITs

REITs offer you a chance to invest in commercial real estate without directly acquiring the property. And business owners often use valuation to determine the value of their business and make major financial decisions. This process involves Valuation on REITs the drivers above and estimating the company’s value according to the market trends. Additionally, other than planning, the valuation process will assist you in attracting more investors.

Conclusion

The real estate business is doing great, including the Valuation of the REITs sector, explaining why its popularity is high. Why? It is the safest method to invest in real estate. This article gives you an insight into ways of valuing a REIT business and the basic information about the valuation process.