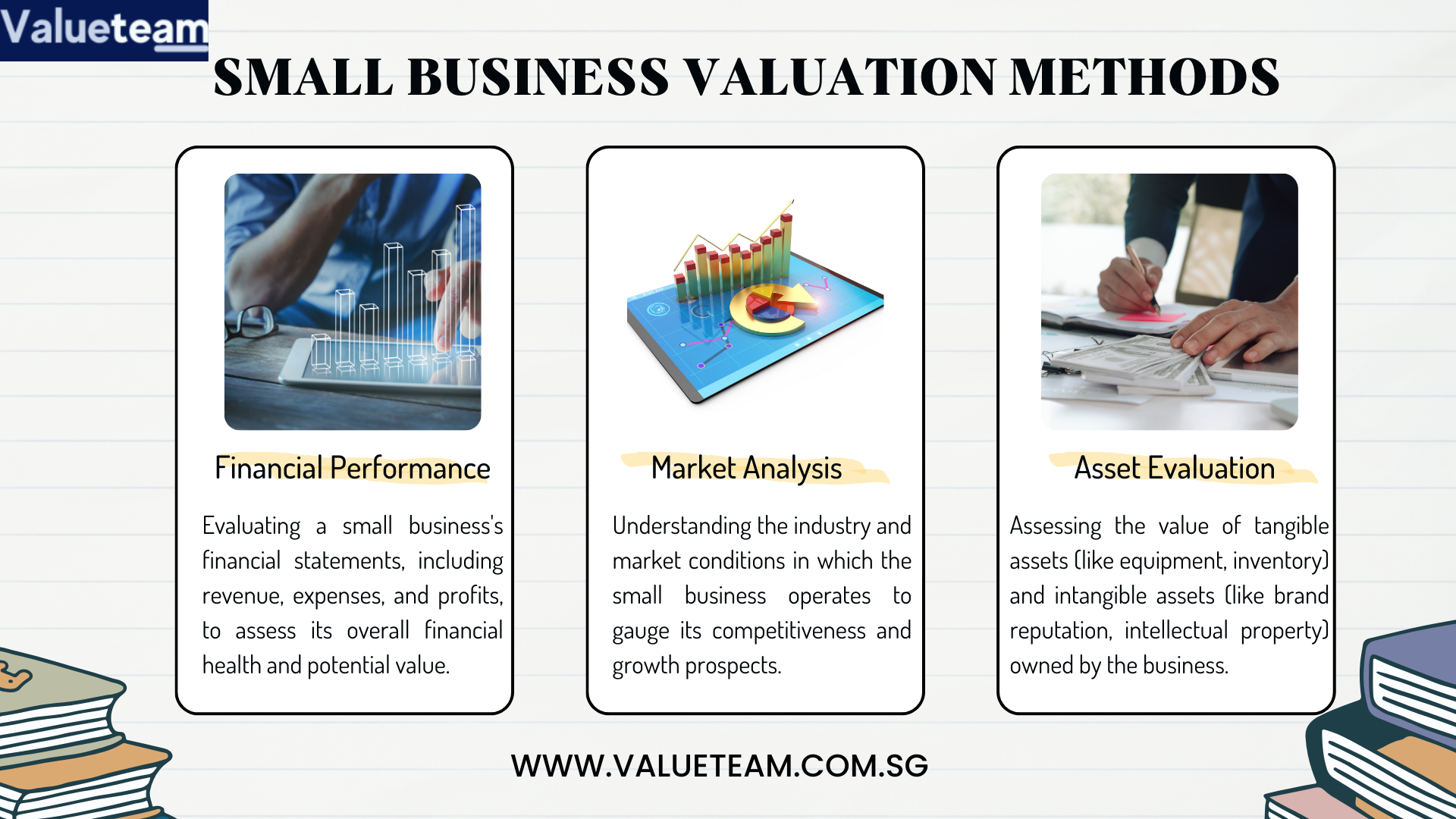

Financial whizzes and theory-loving academics both like the income strategy. Most small company owners find it challenging to comprehend, much alone quantify small business valuation. To sum it up, you need to calculate the company’s future economic advantage (forecasting financials), consider growth rates, cost structures, taxes, and other factors, and then discount that future financial benefit to its current worth. Discount rates, discounted cash flow calculations, or capitalization of profits are all part of the process. The very act of attempting to describe how it works has left me exhausted and bewildered.

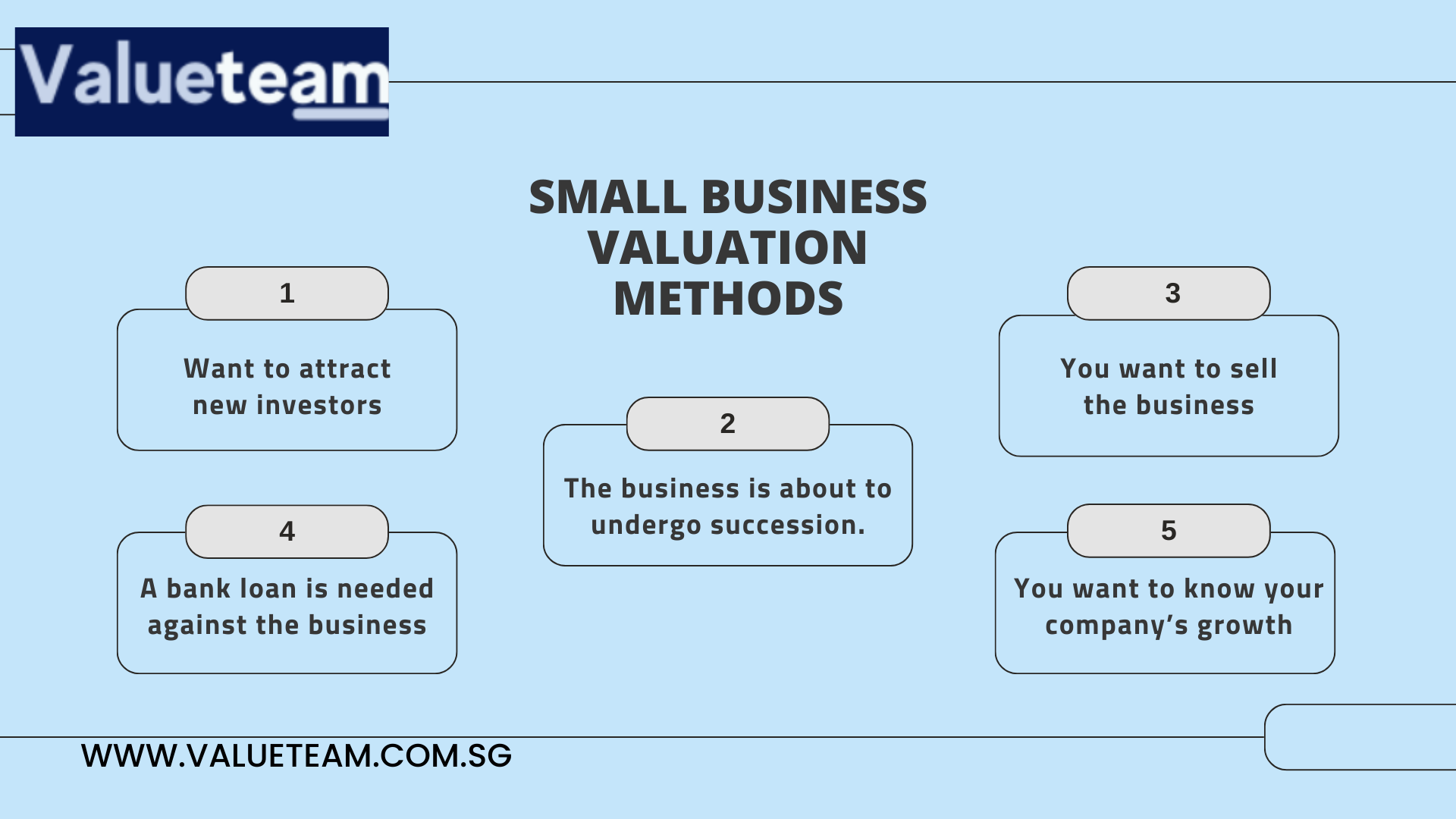

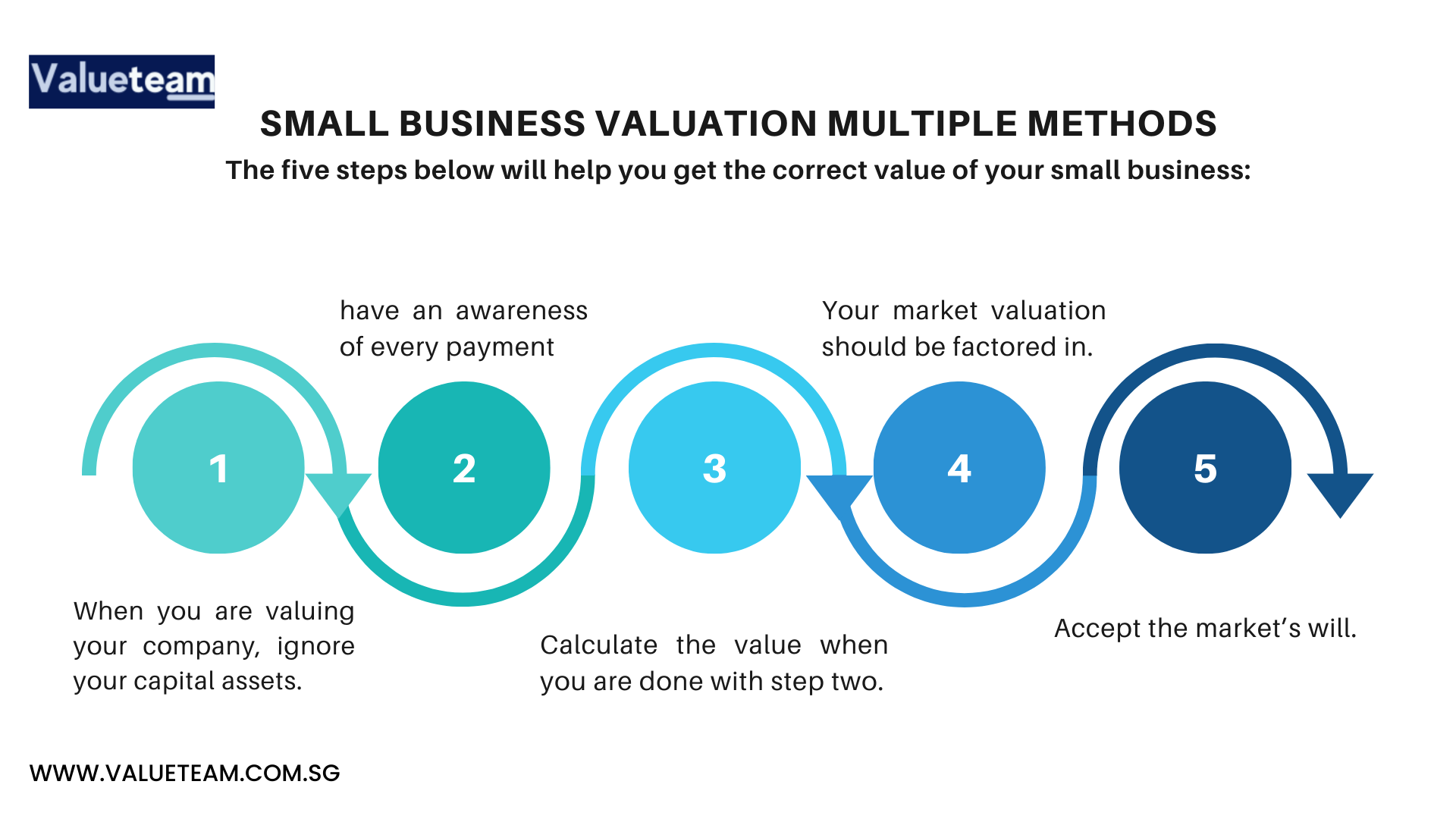

Take this strategy as our primary emphasis for the time being. How much is your company worth? You can find out in five minutes with our straightforward tool (or at least a broad range). Comparing a company’s size, sales, and other characteristics to competitors in the same field might help you decide on a reasonable asking price when selling a small business valuation. Your company’s worth is directly linked to its monetary value.

A simple example to help you understand. It’s a simple business valuation method for small businesses you can use for your company after mastering it. Cash-flowing firms sold multiple of the seller’s discretionary profits for an average industry. It is necessary to “add back” a few things from your profit and loss account if it displays a $100,000 net profit. Personal, discretionary, and one-time costs are also included, as is the pay of one owner.

For the argument, let’s say your annual pay is $50,000, and you utilize the company to pay for your family’s health insurance, petrol, and vehicle insurance to minimize your taxable income. Depreciation, interest, and retirement contributions are all factors to consider. For this example, let’s say that all those costs are $50,000.

This is how the math works out:

$100,000 – Net profit

An owner makes $50,000 each year.

Expensive add-backs include: (these must be documented and justified)

$200,000 (100,000 + $50,000 + $50,000) for the SDE.

Now, let’s get to the numbers:

$200,000 is the sustainable income

It would be best to multiply profit with multiple to get the company valuation. The real world’s value is ($200,000 x the Industry Multiple).

So there you have it. Your company’s market business valuation, if it’s a small business worth, may be rapidly determined by multiplying the sustainable income by the typical market multiple in your Industry.

Identifying your market multiple using the small business valuation formula multiples is critical, and access to completed transactions is essential for this investigation. An M&A expert like Valueteam will likely be your best bet in these situations. Using the typical market multiple or small business valuation methods for your Industry, these experts may change it up or down depending on the unique qualities of your firm and the current market situation.

Small business valuation experts and professionals are required. An expert may be able to provide more in-depth assistance in the valuation calculation of a small business.

The value of your firm might help you decide whether to sell and cash out now or to keep expanding for a higher future price. The fun begins here. For example, your company is worth $456,000, but you want to sell it for $750,000. To justify a $750,000 value, you need to go back through the figures and determine what yearly income you have to provide.

This is how the math works out (hypothetical example)

$200000 x 2.28=456,000

$750,000 x 2.28 = $328,947 as a target price for selling

$200,000 is the current income at this time, and you need to aim and improve the income to $328,947

It will be easier to justify your $750,000 value over the next several years if you raise your company’s yearly income by $128,947.