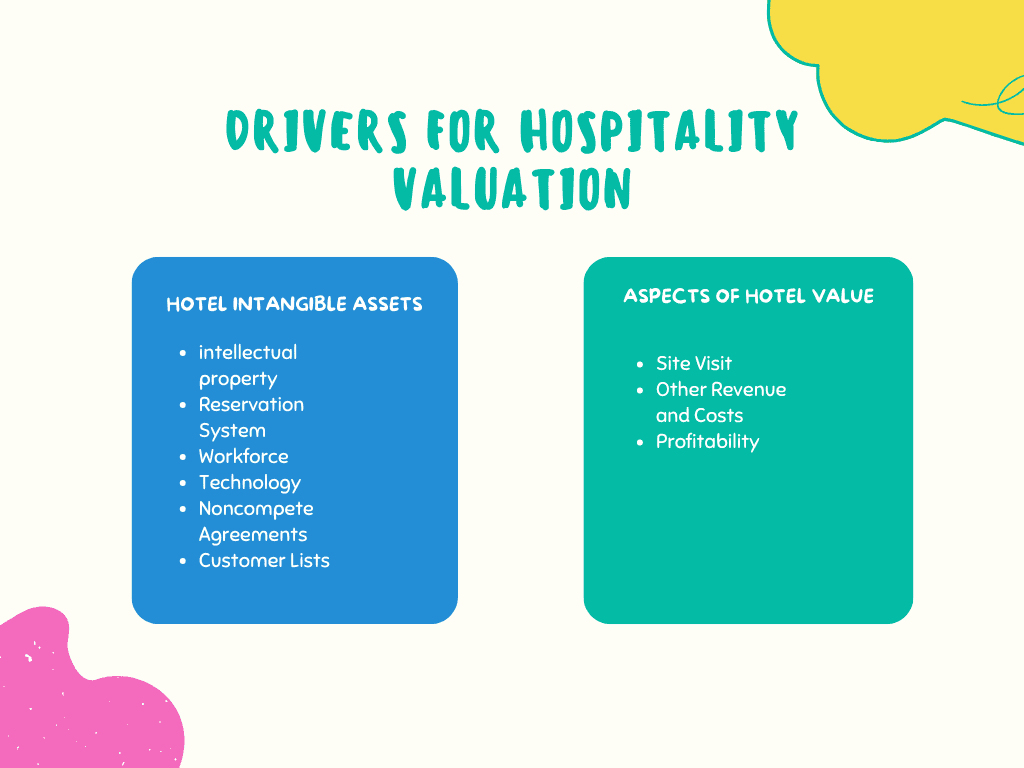

A hotel can be valued in different approaches. The assets a hotel has predominantly affect the value. So, every tangible and intangible transaction should be considered before making a final price.

Hospitality companies are always looking for ways to increase their valuation. While there are many factors that go into a hospitality valuation, understanding the intangible drivers is essential. Noncompete agreements, reservation systems, technology, and intellectual property are all important considerations when trying to place a value on a hospitality company.

Different various valuation methods are generally used to value a hotel or other hospitality business. The most common method used by valuers is the Discounted Cash Flow (DCF) approach, which estimated the hospitality valuation based on the future cash flows generated by the business. The asset valuation method can also be used, which considers the costs of acquiring and developing the hospitality property. Comparables are another standard method, which involves looking at similar properties’ sales in the same market. Ultimately, the choice of valuation method will depend on several factors, including the type of property being valued and the valuation’s purpose.

Please don’t hesitate to reach out if you would like more information on how Valueteam can help with your hospitality valuation or any other related intangible valuation services. We would be happy to explain our various valuation services and our related valuation experience with you and how we can help you to achieve your strategic goals.