- The size of the company

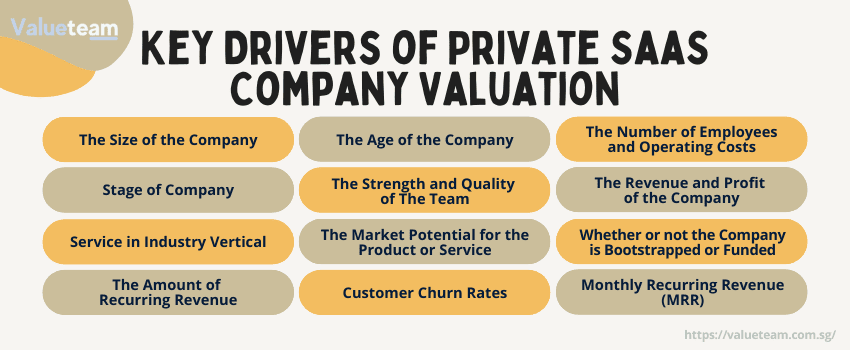

Size is an essential factor because it determines the potential for future growth. The larger the company, the more potential customers it can reach, and the more quickly it can grow. The growth rate is also significant because it indicates how quickly the company is attracting new customers and expanding its reach. The faster the growth rate, the higher the multiple investors are willing to pay. Finally, profitability is a crucial consideration because it demonstrates the company’s ability to generate revenue and convert it into profit. A profitable company is typically valued at a higher multiple than an unprofitable one. The size of the deal is another critical factor to consider when valuing a SaaS company. A minor deal will typically sell for a lower multiple than an enormous deal. The reason for this is that small deals are less likely to have a material impact on the revenue or profitability of the buyer, which in turn impacts the valuation of the private saas company

- Stage of company

The stage of the company is one of the most important factors to consider when valuing a SaaS company. The earlier the stage, the higher the risk and the lower the valuation. A pre-revenue startup will typically be valued at a much lower multiple than a revenue-generating company.

- Service in Industry Vertical

The industry vertical is also an important factor to consider when valuing a SaaS company. Companies that operate in high-growth sectors such as cloud computing, social media, and mobile will typically fetch a higher valuation than companies in more mature industries such as enterprise software. The reason for this is that investors are willing to pay a premium

- The amount of recurring revenue

The most important factors to consider when trying to value a SaaS company are the amount of recurring revenue and the user base. The first consideration is the level of recurring revenue, which is typically generated from subscription fees from users. This kind of revenue model provides financial stability for businesses, as it allows them to forecast and prepare for future cash flow reliably. The size and growth of the user base are also crucial, as this represents a company’s market reach and potential for expansion. Ultimately, both of these metrics indicate how valuable a SaaS business is likely to be, so they should always be a top priority when valuing any company in this industry.

- The age of the company

There are several important factors to consider when valuing a SaaS company. The first is the company’s age, as older companies tend to have more established customer bases and business models. The strength and size of the customer base are also crucial, as this determines how much revenue the company is generating and can help to predict its future growth potential

- The strength and quality of the team

The most important factors to consider when valuing a SaaS company are the strength and quality of the team, the size and growth potential of the market, and the company’s competitive advantages. The team is critical because it will determine the company’s ability to execute its vision. Various indicators link revenues per employee, team coverage of the market, management team, team structure, etc. all have a significant impact on the valuation of the company

- The market potential for the product or service

The first and most important factor is the market potential for the product or service offered by the company. This involves assessing market trends, market growth, and competition to determine whether there is a strong demand for the software being produced. Higher potential and demand will boost the private saas company valuation

- Customer churn rates

Customer churn rates are one of the most important factors to consider when valuing a SaaS company. Churn rates represent the percentage of customers who cancel their subscription or fail to renew it within a given period. A high churn rate indicates that a company is having difficulty retaining customers, leading to financial problems down the road. Additionally, there are two types of churn, revenue churn, and customer churn. The former defines the revenue lost due to the customer churn, while the latter describes the customers who no longer use your services after some time. Therefore, it is essential to analyze customer churn rates when considering the valuation of the saas company. Higher churn will impact private saas company valuation.

- The number of employees and operating costs

The factors that most significantly impact the valuation of a SaaS company are the number of employees and operating costs. The size and strength of a company’s workforce directly influence its value, as more employees equal higher revenue potential. Additionally, operating costs, such as rent or new equipment purchases, can have a significant impact on both bottom-line revenues and private saas company valuation

- The revenue and profit of the company

One of the most important is how the company’s revenue and profits impact its valuation. SaaS companies are typically valued at a multiple of their annual revenue, so a company with solid revenue growth generally is more valuable than one with stagnant or declining revenue. Profitability is also an essential factor, as profitability tends to increase the value of a company. A profitable company is typically valued at a higher multiple of its revenues than a non-profitable company.

- Whether or not the company is bootstrapped or funded

Several essential factors need to be considered when valuing a SaaS company. These include the company’s level of funding, whether it is bootstrapped or investor-backed, and how that funding has impacted its valuation. Bootstrapped company may not have any valuation benchmarks and comparables data, whereas an investor-backed company will have the valuation at each round of funding. This helps to calculate the proper valuation of the company. Ultimately, the value of a SaaS business will depend on its ability to address a real pain point for customers and its potential for future growth and profitability. So if you’re looking to invest in or acquire a SaaS company, it’s essential to consider these factors to make an informed decision carefully.

Before an investor decides on investing in your business or a buyer determines your firm’s value, the MRR is a crucial factor. It defines the monthly revenue that you will receive despite any changes. A high MRR describes that your business is doing okay hence a vast value. Therefore, private SaaS companies’ valuer must focus on achieving a high MRR rate to show their growth.

In conclusion, many different factors go into valuing a SaaS company, and it can be a complex process. Some of the most important considerations include the company’s market share, operational efficiency, customer retention rates, and competitive landscape. In addition, the business’s overall financial health is also vital to take into account when estimating its value.