Many things are included in the patent valuation, such as the patent valuation approaches and the overview of a patent which covers patent priority date, reviewing patent filing date, abstract of patent, the title of the patent, and the countries where it has been granted.

Quick Contact

Need Help?

Please Feel Free To Contact Us. We Will Get Back To You With 1-2 Business Days.

info@valueteam.com.sg

+65 9730 4250

What You Need To Know About Patent Valuation

Patent Risk Assessment

Assessing the risk of a patent granted is focused on given patent claims validation analysis, design around patents possibilities, and potential risks related to infringement lawsuits.

Patent Valuation Procedure

The patent valuation procedure incorporates cash flows, future value forecast, and the net present Value. The estimation of cash flows is done using discounting for assessing the patent risk and patent contribution.

Patent Valuation Approach

There are different factors that a patent valuation approach covers. They include yearly growth rate, the market size, market share, profit margin, per unit price, and feasibility of having the patented product created or made.

Intellectual Property Assets

Like tangible assets such as machines, vehicles, land, and building, intellectual property, a part of intangible assets, is essential. As of this moment, intellectual property is one of the many intangible assets most fortune 500 companies have.

In short, intellectual property, otherwise known as IP, is used for business valuation transactions leverage, fundraising, exit strategy, merging and acquisition, etc. Trades secrets, trademarks, patents, and copyright are portions of intellectual property.

A patent is one of the most beneficial portions of IP in biotech and high-tech companies. Funding the value of a patent becomes essential as there are multiples of transactions in such industries that it is used.

Patents valuation

Some of the ways to fund the value of a patent in a company are:

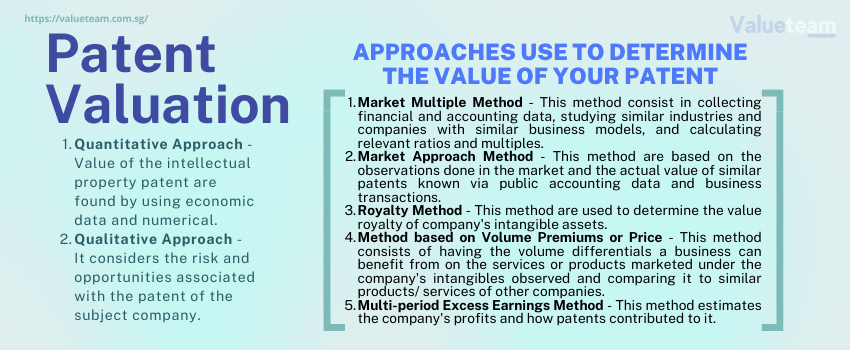

- Quantitative approach

- Qualitative approach

- Quantitative approach – in this approach of patent valuation, economic data and numerical are used to find the value of the intellectual property – patent.

- Qualitative Approach –the future uses of intellectual property – a patent is analyzed. It considers the risk and opportunities associated with the patent of the subject company.

How to apply patent valuation?

A patent valuation can be applied in the following ways:

- The value of a business’s intangible assets in tax planning decisions. There is no need for a company to show their assets – tangible but the intangible assets, too, for tax paying.

- The value is carried out during acquisition, joint ventures, and mergers. The value of a company that invests heavily in intangible assets like patents, copyright, etc., research activities will be influenced. Thus, the value of a company can be measured with the economic value of the assets – intangible.

- For selling and licensing of intellectual property. The value of the intellectual property, such as the price of the patent and deals negotiation with parties, should be known.

- A patent value serves as bank loan security. It is also used in attracting investors and venture capitalists.

- A patentee can recover incurred damages from another party with correct patent value.

- The patent valuation assists in creating patent-protecting strategies. With it, an organization can identify its weakness.

Some of the approaches you can use to determine the value of your patents are:

1. Market multiples method

This method consists in:

a. Collecting financial and accounting data.

b. Studying your industry or similar industries – companies with similar business models and sizes.

c. Calculating relevant ratios and multiples

2. Market approach method

This is another method that can be used to find the value of your company’s patents – intangible assets. It is based on the observations done in the market and the actual value of similar patents known via public accounting data and business transactions.

3. Royalty method

This is the third method that can determine the value royalty of your intangible assets. Before using this method, consider the business, the location, uniqueness, applicability of the patents read more.

4. Method based on volume premiums or price

This method consists of having the volume differentials a business can benefit from on the services or products marketed under the company’s intangibles observed and comparing it to similar products or services of other companies.

5. Multi-period excess earnings method

This method estimates the company’s profits and how patents contributed to it. It assesses income sharing resulting from cash flow and economical over profits or the resulting cash flows. Under this method, value is calculated by analyzing the incremental after-tax cash flows derived from the patent’s asset over its remaining economic life.