Intangible Asset Valuation such as intellectual property (patent, copyright, trademark, trade secrets, goodwill, etc.) may be crucial in determining a company’s value.

What value of these assets often brings business sales disputes between the business owner and the potential buyer or investor? Intangible assets have the capability of driving your business value. However, agreeing to the value of the Intangible Asset Valuation during sales can be challenging.

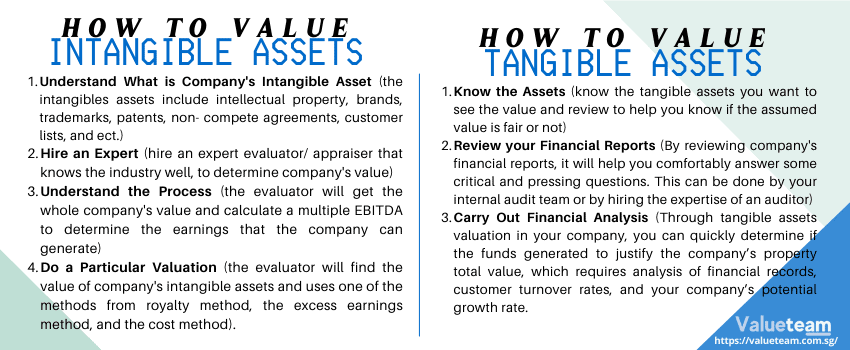

A business’s Intangible Asset Valuation do not exist in a physical form. They are not money and can’t be touched by hands or seen with eyes. The intangible assets include intellectual property, brands, trademarks, patents, non-compete agreements, customer lists, and the rest. These assets are in most times, called goodwill. They are different and separate. You will see them on a company’s balance sheet after buying another company. It can be seen too when a particular intangible asset is purchased separately. To assess overall company value, especially in contrast to these intangibles, businesses often rely on the net tangible asset value formula for businesses, which focuses solely on physical and financial assets minus liabilities.

This is another method that can be used to find the value of your company’s intangible assets. It is based on the observations done in the market and the actual value of similar intangibles valuation known via public accounting data and business transactions.

This is the third method that can be used in determining the value of your intangible assets, in which trademark is one of them. Before using this method, consider the business, the location, and the reputation of the trademark.

This method consists of having the volume differentials a business can benefit from on the services or products marketed under the company’s intangibles observed and comparing it to similar products or services of other companies.

This method estimates the company’s profits and how intangibles contributed to it. It assesses income sharing resulting from cash flow and economical over profits or the resulting cash flows. Under this method, value is calculated by analyzing the incremental after-tax cash flows derived from the intangible asset over its remaining economic life.

Intangible assets such as intellectual property impact the value of a company, although they can’t be seen or touched. So, to get the best value for your company, have an appraiser hired to determine the best price for your business.

Many reasons can prompt one into making a business valuation structure or establishment selling decision. Even though you can choose to sell your business, you will not love to sell it anyhow or below the company’s worth. To know the value of a business is not an easy task. Many things like the value of tangible assets are considered when the value of a company is discussed.

These are physical form properties a company owns. Examples of such tangible assets are equipment in the factory, land, building, inventory, and office equipment. Investments like stocks in other businesses and cash are included as tangible assets.

Some essential methods used for the valuation of tangible assets are

1. Comparison Method

As stated above, this is one of the common methods of determining the value of tangible assets like land, buildings, etc. It is also called the market data approach or sales comparison approach.

It is used commonly in finding the value of properties such as shops, warehouses, houses, offices, and companies. Several property features must be looked into while using this valuation method to find the value of a real estate property.

They include the size, location, and condition of the property. Then look for these features mentioned above in many similar properties and compare them to determine your property’s valuation.

2. Costing method

Under this method, all tangible assets are valued based on the cost incurred to build them. Here, potential buyers should not buy a tangible asset at a higher purchasing price than building or rebuilding another similar property. It is often used for assets built but not sold, such as buildings, factories, machinery, etc

3. Residual Method

In the Residual method, tangible assets are valued for the residue life of the assets. This is generally estimated after the assets have fully depreciated or majority deprecated. Under this method, Tangible assets with limited life are suitable for this method. higher the remaining life of assets more is the value of the assets

Residual Method = Estimated value for the remaining life of assets + Salvage value of the asset at the end +Cost for the maintenance of the assets– cost of asset disposal

A company’s tangible assets are in physical form. They include equipment, land, building, and office machinery. To sell your company to a potential buyer, you need to know the value of your tangible assets as they have a role in the final value of your company. To get the value of your tangible assets, subtract the value of the intangible assets from the value of the total assets. The result is the value of your tangible asset.