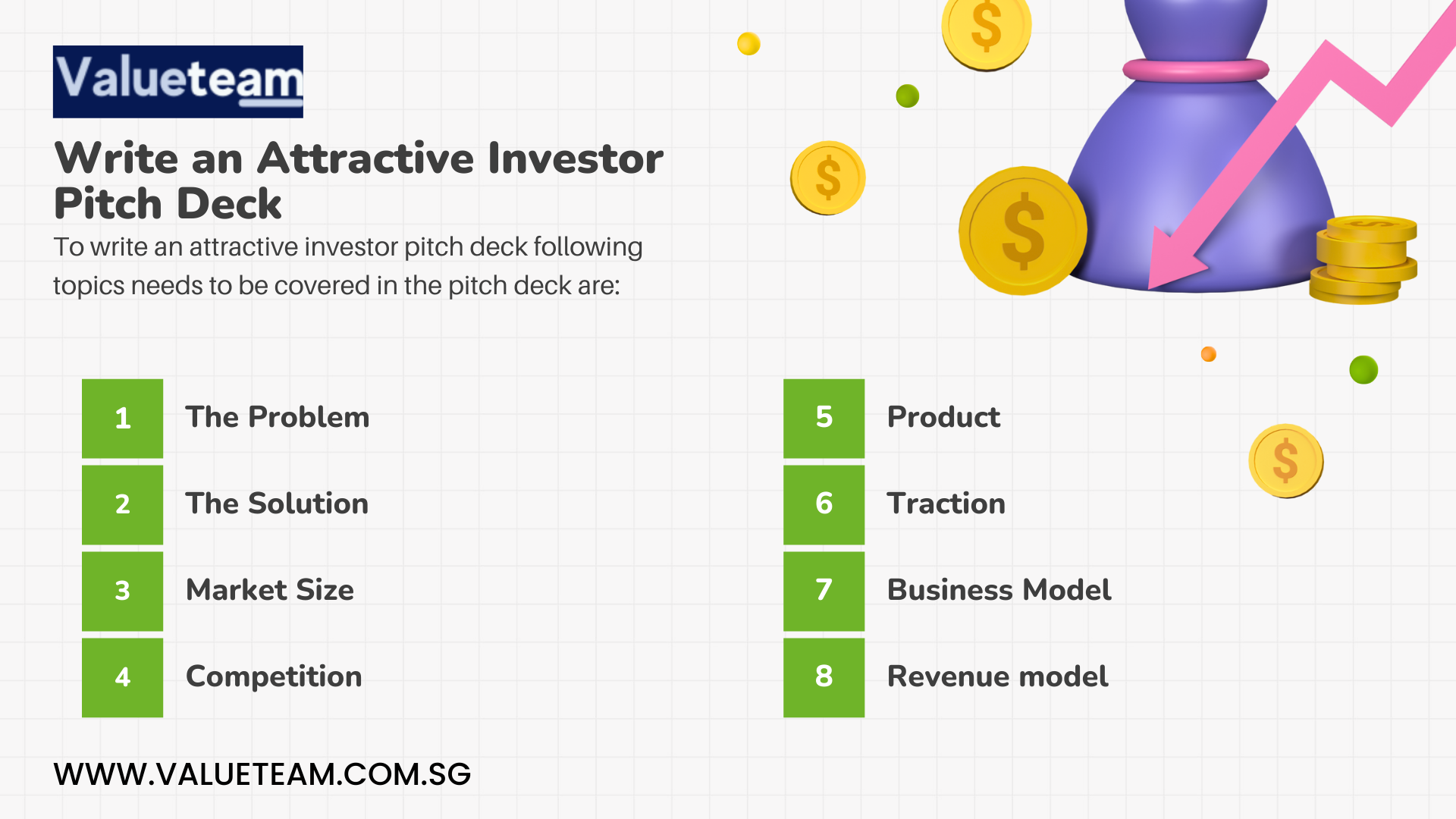

What is Investor Pitch Deck: Many Startups often try to write an attractive investor pitch deck which are about 15-20 PowerPoint presentation slides to present their business to potential business capital investors.

An investor pitch deck is prepared to show the potential venture capital investors the company’s team, technology, and products. It is always easy to prepare a pitch deck. Process to write an attractive investor pitch deck can be overwhelming and time-consuming, especially when you don’t know what an investor pitch deck should content.

Following your investor pitch, you’ll want to have these documents ready.

Creating a pitch deck is only the beginning of preparing a business strategy. A good investor pitch necessitates the preparation of relevant paperwork to back it up. A few papers you should have ready to send after your pitch include the following.

Two- to three-page summaries of your company’s operations are an executive summary or a summary memo. An overview paper that investors may distribute with their partners and other company members to give them an idea of your business valuation company. The executive summary should be a written version of your pitch deck.

If you’re launching a tech or medical startup, you could be requested to offer more information about your technology than usual. As a result, investors in these kinds of enterprises may want more thorough documentation, diagrams, processes, a business valuation checklist, and so on to verify your technical claims.

Your financial estimates for the next three years should be as thorough as possible so that investors can understand your projections’ assumptions.

For example, investors will be interested in your plans for recruiting and employee-related spending, R&D expenses, manufacturing costs, and marketing charges. Sales, profit, and loss forecasts should be included in your presentation. A balance sheet or other financial statement is often required, and you also need to get a business valuation. Whenever feasible, use pictures to convey your facts. In terms of results, it’s shown to be better.

For example, you could be requested to offer further information on your target audience, business valuation model, and the results of any previous market research. In some instances, having this information on hand is unnecessary, but you should be prepared to provide it even if it is. In other words, don’t include this information in your original deck, but have it on hand if someone asks.

People make judgments primarily based on emotions and a small amount of reasoning; thus, it’s essential to appeal to their feelings while making your case. For your presentation, you may use any of the following narrative techniques:

In other words, using the before-after-bridge method.

With a particular issue in mind, begin by creating a fictional universe (before). Next, let’s imagine a world without conflict (after). Tell us about your company’s plan of action (the bridge). In Singapore, you can get most of these techniques from business valuation services Singapore if you are looking to use them.

The problem, Agitate, and Solution is the acronym for this group. This is how it works: you explain an issue (i.e., your target customer’s problem) and then build a solution to that problem (your product or service).

To do this, one must alternate between focusing on what is (the current state of affairs) and what may be possible (the future that could be). When ready, add your company concept as a capstone (the bliss). Regardless of your chosen narrative framework, you must organize your presentation correctly to maintain a constant pace.

Practice and effort are essential if you want to produce an effective presentation. However, your presentations will be outstanding if you know how to avoid mistakes.

Preparation failures, improper topic delivery, and slurred speech are all common blunders in presentations.

Planning ahead of time always pays off. Before you arrive, scope out the location and get a feel for the technical aspects of the setup.

Visual assistance should reflect your content’s clarity and conciseness. To avoid patronizing or confusing your audience, keep your presentation’s pitch appropriate for their level of comprehension.

Always keep in mind that public speaking is a show. To prevent “rapid-fire” delivery, practice speaking effectively at a slower tempo than you usually do. Use body language and gestures that support what you’re saying to keep your audience interested.

An investor pitch decks with a compelling and memorable story and to write an attractive pitch deck all the valuable contents mentioned above will stand over the one that doesn’t have them. For Further Information and help to create an investor pitch deck Contact Us.