Portfolio Valuation: This is a growing part of the valuation. Third-party and independent portfolio valuation services are increasingly used by institutional money managers such as hedge funds and private equity funds. You will know the why, how, what, and of portfolio valuation in this article.

Quick Contact

Need Help?

Please Feel Free To Contact Us. We Will Get Back To You With 1-2 Business Days.

info@valueteam.com.sg

+65 9730 4250

What is Portfolio Valuation?

what is portfolio valuation?

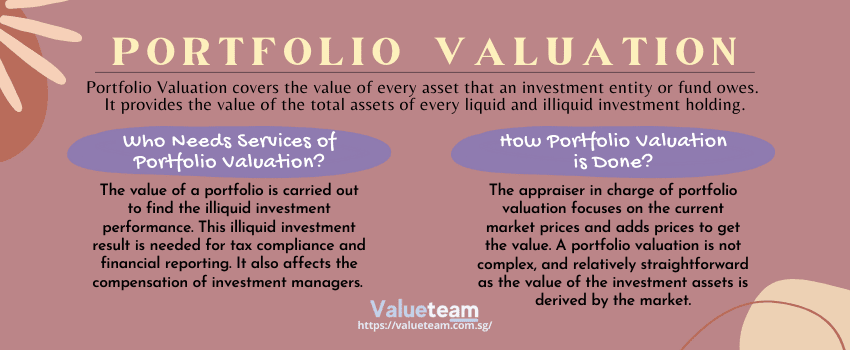

The total assets that an institutional investor, private equity, venture capital, and hedge fund owe are represented in an investment portfolio. An investment portfolio may include real estate property, business, machines, equipment, and other illiquid assets. So, portfolio valuation covers the value of every asset that an investment entity or fund owes. It provides the value of the total assets of every liquid and illiquid investment holding.

who needs services of portfolio valuation?

The value of a portfolio is carried out to find the illiquid investment performance. This illiquid investment result is needed for tax compliance and financial reporting. It also affects the compensation of investment managers. The importance of portfolio investment valuation services has made venture capital funds, hedge funds, equity funds, and pension fund managers seek the expertise of professionals for their business, security, and other illiquid asset valuation.

why is there high demand and use of third-party valuation services?

Private investment ventures own many businesses, properties, and securities. Since they are not public, no stock is traded publicly. There is also no market value to establish every holding market value. Like other privately owned entities, the finances of institutional and private investors are not transparent. A portfolio valuation that is done independently makes sure all assets are valued based on the governing laws and policies of valuation. A portfolio valuation also ensures that the valuation is done based on standard guidelines to prevent underreported or over-reported values.

How portfolio valuation is done?

The appraiser in charge of portfolio valuation focuses on the current market prices and adds prices to get the value. A portfolio valuation is not complex, and relatively straightforward as the value of the investment assets is derived by the market.

Illiquid assets, including real estate, illiquid stocks, business, equipment, and intangible assets like trademarks, patents, and others, are valued separately by the appraiser. The value of each of these assets is calculated with a suitable valuation method, such as cash, market, and income valuation approaches. None of them is the best, as the choice of using any of them depends on the asset to be valued. The market method approach will likely value real estate assets, while the comparable process establishes the asset value.

Final Verdict

Portfolio valuation knows the worth of investment assets of a company. The assets may include real estate, business, equipment, and other illiquid assets. It is carried out for different reasons – business sales, etc. It is from the result that an investor or potential buyer will know if to buy the company or not. Approaches that can be used for portfolio valuation include the market, income, and cash approaches.