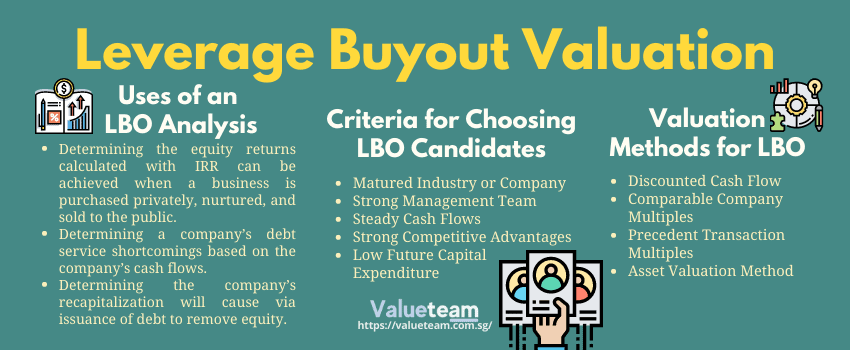

A leveraged buyout is simply acquiring a business held privately or publicly as a part of a big company or a business that stands alone using huge borrowed funds to buy the company. After the business or company has been acquired, a private equity firm arranges the leverage Buyout transaction takes over the ownership. Professionals looking to understand these processes in depth can benefit from private equity and venture capital training, which covers the strategies, financial structures, and valuation techniques behind leveraged buyouts and similar transactions.

The purchase of the business valuation comes from debt instruments, equity capital, and tag-along investors like the management. The generated cash flow in an LBO from the company purchased is used to pay down and service the outstanding debt. This is why companies of different sizes can become the center attraction of LBO transactions.