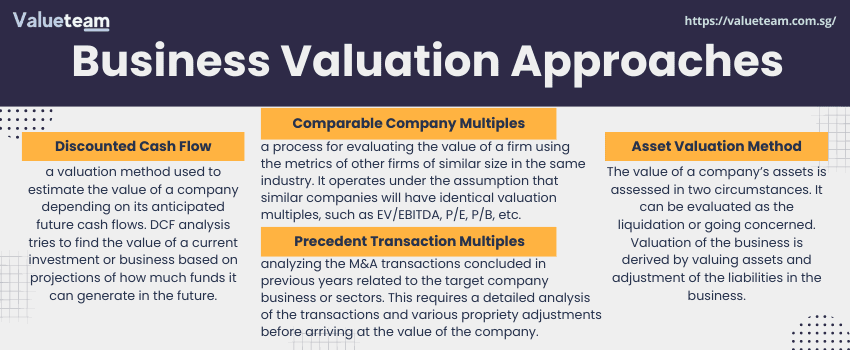

Some of the standard business valuation approaches used include:

The First Method is Discounted Cash Flow

Discounted cash flow is initialized as DCF and is a valuation method used to estimate the value of a company depending on its anticipated future cash flows. DCF analysis tries to find the value of a current investment or business based on projections of how much funds it can generate in the future.

This applies to investors’ decisions in firms or securities like acquiring a business or purchasing a stock. It requires complex adjustments and calculations for arriving at the equity value of the company.

The Second Type is Comparable Company Multiples

Comparable Company Analysis denoted as CCA, is a process for evaluating the value of a firm using the metrics of other firms of similar size in the same industry. It operates under the assumption that similar companies will have identical valuation multiples, such as EV/EBITDA, P/E, P/B, etc.

Analysts use various available statistics for the assessed businesses and calculate the valuation multiples to compare them. Creating a comparable company analysis is hectic as it requires lots of detailed searches, research, and adjustments as per the target company to estimate the value of the company.

The Third Method is Precedent Transaction Multiples

Precedent transaction multiples refer to the company’s valuation by analyzing the M&A transactions concluded in previous years related to the target company business or sectors. This requires a detailed analysis of the transactions and various propriety adjustments before arriving at the value of the company.

The Fourth Method is Asset Valuation Method

The tangible and intangible things that belong to your business stated on the company’s balance sheet are your assets. Some assets are vehicles, land, equipment, cash, intellectual property, etc. The value of a company’s assets is assessed in two circumstances. It can be evaluated as the liquidation or going concerned. Valuation of the business is derived by valuing assets and adjustment of the liabilities in the business.

Valuation is beneficial when reporting tax. It may require a valuation for the purchase of shares, sale, gifting of shares, and other tax-related events of a business that will be taxed based on the company’s value.

Finding out a company’s fair value is considered an art and science. Different formal models can be used for valuation, but selecting the right one after checking the condition on the ground will give a desirable result.

Always have the professionals handle your business valuation. This will save you from selling your business below the fair price or buying it higher than reasonable. In order not to lose, employ the services of a professional.