They are:

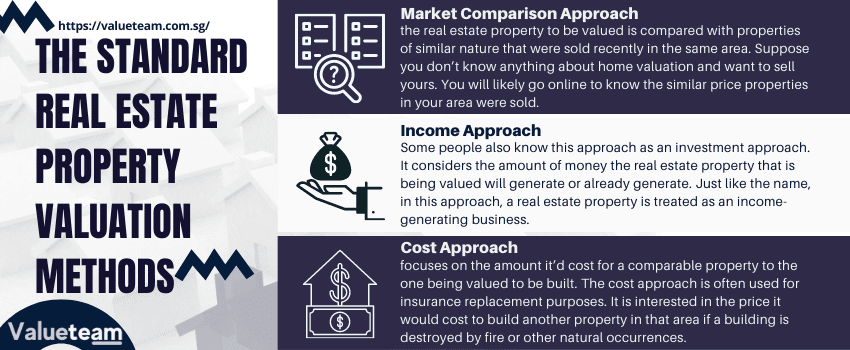

Market Comparison Approach

In this method, the real estate property to be valued is compared with properties of similar nature that were sold recently in the same area. Suppose you don’t know anything about home valuation and want to sell yours. You will likely go online to know the similar price properties in your area were sold. This is just the correct description of a market comparison real estate valuation method.

Income Approach

Some people also know this approach as an investment approach. It considers the amount of money the real estate property that is being valued will generate or already generate. Just like the name, in this approach, a real estate property is treated as an income-generating business.

Cost approach

This is the third standard method of checking the valuation of real estate property that focuses on the amount it’d cost for a comparable property to the one being valued to be built. The cost approach is often used for insurance replacement purposes. To get the picture better: it is interested in the price it would cost to build another property in that area if a building is destroyed by fire or other natural occurrences.

The aforementioned real estate property valuation methods stand on their own. This means a real estate appraiser will use only one approach to determine the worth of one property. An appraiser does not combine two or three of the valuation methods in estimating the value of a property. The result of each real estate property valuation method is different from the others. A valuation method is used depending on the situation on the ground.

In some cases, you will see more than one real estate valuation figure in a report. This is seen primarily on commercial mortgages. Here, bricks and mortar (market comparison) valuation relies on when the building investment valuation changes. An example is when a tenant who pays rent leaves the property, and his leaving causes the income to drop to zero till another paying tenant is found.

This doesn’t mean one approach is better than others. Instead, one system is better used for a particular real estate property than others. Knowing the difference between each property valuation approach is of importance. With this knowledge, you can find out the method an appraiser uses for your investment.