Business for Sale Valuation: It is challenging to place value on a business accurately you have built from scratch to potential business buyers. Nevertheless, valuing a company should not be complex or highly overwhelming. You must know the valuation of a business is not a science but an art. If you must learn anything as a buyer, the asking price of a business for sale is not the purchase price. In most cases, the asking price does not remotely represent the company’s actual worth.

In a natural state, the value a buyer places on a business is entirely different from the seller’s value on his business. Every seller has an emotion toward their company and always places its value high. They consider the years they put into building the company as they calculate its worth. Unfortunately, their hard work or years of running the business are not considered a business transaction equation.

As a buyer, have an accurate valuation formulated to give you a good and acceptable ROI (Return on investment).

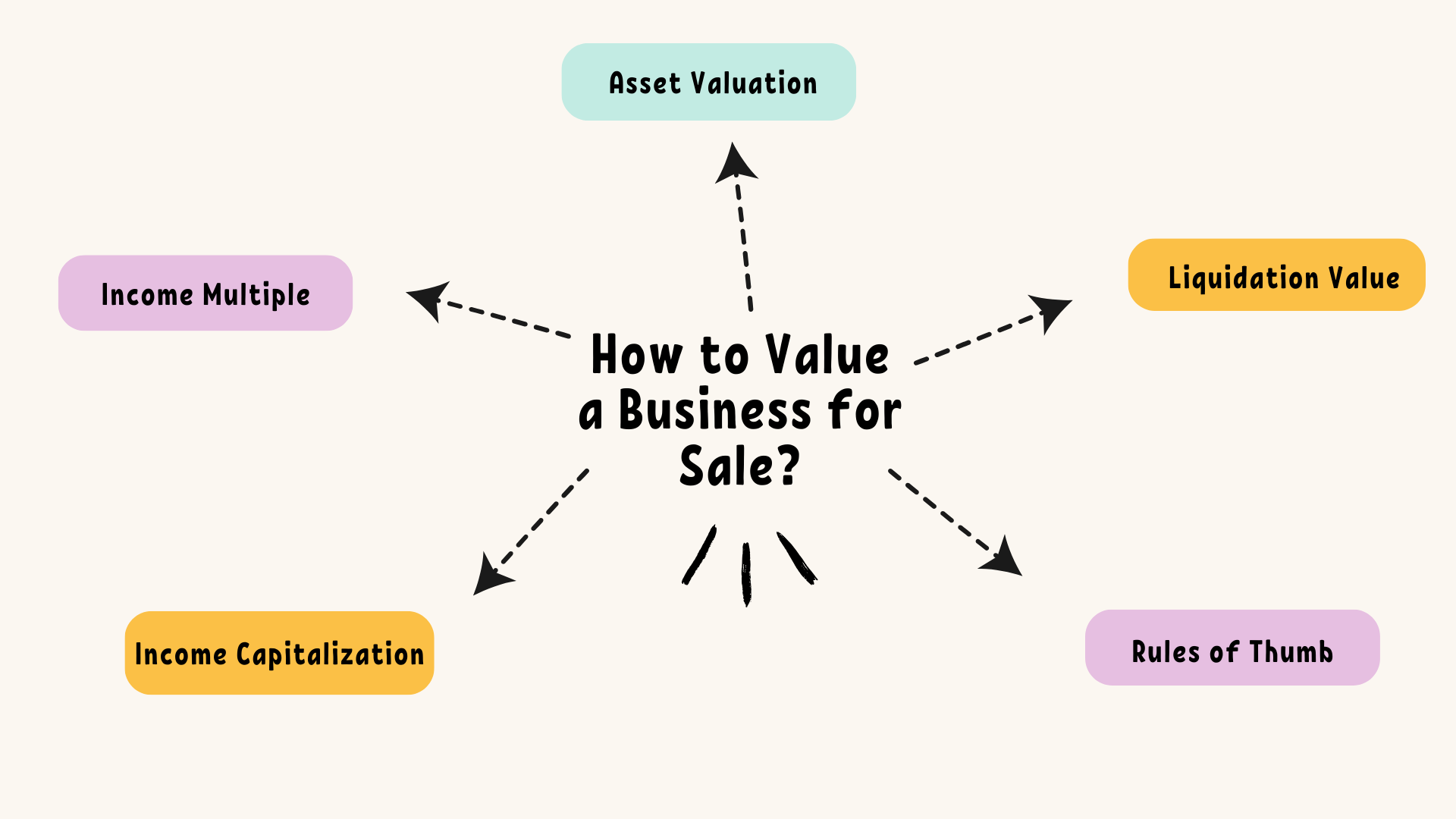

Some of the valuation methods used for business for sale are:

The First Method is Discounted Cash Flow

Discounted cash flow is initialized as DCF and is a valuation method used to estimate the value of a company depending on its anticipated future cash flows. DCF analysis tries to find the value of a current investment or business based on projections of how much funds it can generate in the future. This applies to investors’ decisions in firms or securities like acquiring a business for sale valuation or purchasing a stock. It requires complex adjustments and calculations for arriving at the equity value of the company.

The Second Type is Comparable Company Multiples

Comparable Company Analysis, denoted as CCA, is a process for evaluating the value of a firm using the metrics of other firms of similar size in the same industry. It operates under the assumption that similar companies will have identical valuation multiples, such as EV/EBITDA, P/E, P/B, etc. Analysts use various available statistics for the assessed businesses and calculate the valuation multiples to compare them. Creating a comparable company analysis is hectic as it requires lots of detailed searches, research, and adjustments as per the target company to estimate the value of the company.

The Third Method is Precedent Transaction Multiples

Precedent transaction multiples refer to the company’s valuation by analyzing the M&A transactions concluded in previous years related to the target company business or sectors. This requires a detailed analysis of the transactions and various propriety adjustments before arriving at the value of the company

The Fourth Method is Asset Valuation Method

The tangible and intangible things that belong to your business stated on the company’s balance sheet are your assets. Some assets are vehicles, land, equipment, cash, intellectual property, etc. The value of a company’s assets is assessed in two circumstances business for sale valuation. It can be evaluated as the liquidation or going concerned. Valuation of the business is derived by valuing assets and adjustment of the liabilities in the business.