Automotive Business valuation: There are many companies in automotive repair in Singapore which generate lots of money every year. The automotive business is a big industry with many important sectors. A customer has different options when he needs services or when a car breaks down. A customer can either visit the dealership (auto repair facility) where he purchased the vehicle or an entirely different auto repair shop.

These shops have different vehicles they specialize in, such as Japanese, European or domestic vehicles; some deal with tires, collision repair, fast oil changes, mechanical repair, and others.

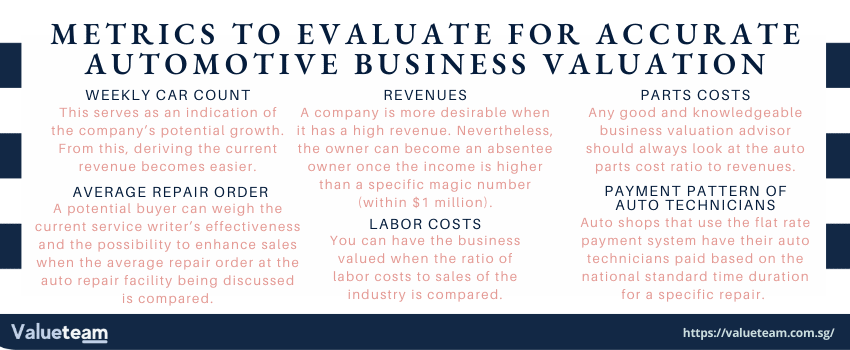

To get a correct business valuation, you need to understand the industry and the auto shop facility’s current performance.

Some of the valuation methods used for automotive business are:

The First Method is Discounted Cash Flow

Discounted cash flow is initialized as DCF and is a valuation method used to estimate the value of a company depending on its anticipated future cash flows. DCF analysis tries to find the value of a current investment or business based on projections of how much funds it can generate in the future. This applies to investors’ decisions in firms or securities like acquiring a business or purchasing a stock. It requires complex adjustments and calculations for arriving at the equity value of the company.

The Second Type is Comparable Company Multiples

Comparable Company Analysis, denoted as CCA, is a process for evaluating the value of a firm using the metrics of other firms of similar size in the same industry. It operates under the assumption that similar companies will have identical valuation multiples, such as EV/EBITDA, P/E, P/B, etc. Analysts use various available statistics for the assessed businesses and calculate the valuation multiples to compare them. Creating a comparable company analysis is hectic as it requires lots of detailed searches, research, and adjustments as per the target company to estimate the value of the company.

The Third Method is Precedent Transaction Multiples

Precedent transaction multiples refer to the company’s valuation by analyzing the M&A transactions concluded in previous years related to the target company business or sectors. This requires a detailed analysis of the transactions and various propriety adjustments before arriving at the value of the company.

The Fourth Method is Asset Valuation Method

The tangible and intangible things that belong to your business stated on the company’s balance sheet are your assets. Some assets are vehicles, land, equipment, cash, intellectual property, etc. The value of a company’s assets is assessed in two circumstances. It can be evaluated as the liquidation or going concerned. Valuation of the business derived by valuing assets and adjustment of the liabilities in the business.