There has been a lot of recent analysis in the investment community about EBIDTA margins and their implication for Valuation. In this post, we want to provide our view on the topic and explain why we think investors should pay attention to EBIDTA margins when assessing a company’s Valuation. We will also share examples of companies that have seen their stock prices decline despite posting solid EBIDTA margins. Finally, we will explain how investors can use EBIDTA margins to find attractively valued stocks.

Quick Contact

Need Help?

Please Feel Free To Contact Us. We Will Get Back To You With 1-2 Business Days.

info@valueteam.com.sg

+65 9730 4250

EBIDTA Margins Implication on Valuation

What is EBITDA?

EBITDA is a financial measure that calculates a company’s earnings before interest, taxes, depreciation, and amortization expenses are deducted. This metric is often used to assess a company’s financial performance and to compare it with other businesses in its industry. EBITDA can analyze a company’s profitability and make investment decisions. However, it is essential to note that EBITDA does not reflect a company’s cash flow or its ability to generate revenue. EBITDA should be mandatory analysis alongside other financial measures when assessing a business.

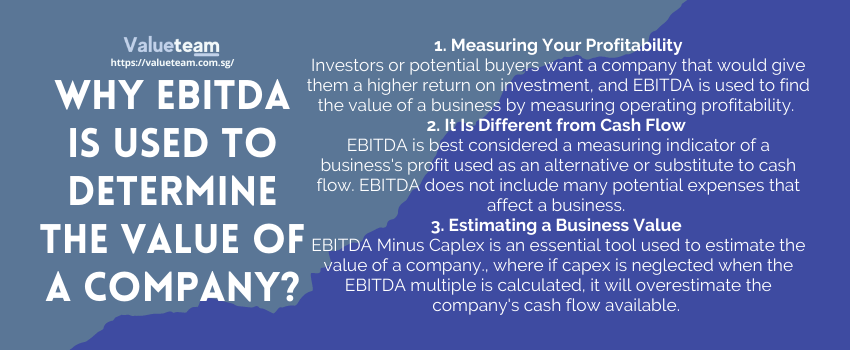

How does EBITDA affect Valuation?

EBITDA is an important metric for assessing a company’s financial health. It means “earnings before interest, taxes, depreciation, and amortization” and indicates a company’s ability to generate cash flow. When valuing a company, analysts use a variety of methods to determine its fair value of a company. One of the most common techniques is to use a multiple of EBITDA in the company valuation, which measures a company’s profitability. Using multiple EBITDA, analysts can arrive at a fair value for the company that considers its profitability. This method is often used when valuing companies in the same industry, as it provides a way to compare companies on the same level. However, it is essential to remember that EBITDA is not an infallible measure of profitability, and other factors should be considered when determining a company’s fair value. This multiple can vary depending on the industry and the specific circumstances of the company, but it provides a good starting point for the Valuation of companies. Generally, companies with higher EBITDA margins will fetch higher valuations than those with lower margins. Therefore, it is essential to understand how EBITDA affects company Valuation to make informed investment decisions.

What is the significance of EBITDA margin?

The EBITDA margin measures a company’s earnings before interest, tax, depreciation, and amortization as a percentage of its revenue. It is a way to gauge how much profit a company generates for every dollar of sales. A high EBITDA margin indicates that a company is efficient at generating a profit and is thus likely to be financially healthy. For this reason, investors often look at EBITDA margin when considering whether to invest in a company. However, please note that the EBITDA margin is not the same as the net profit margin, which measures profitability after considering all expenses.

Is it better to have a higher EBITDA margin?

A high EBITDA margin indicates that a company generates much profit relative to its income. This can mean efficient operations and strong market demand for the company’s products or services. However, a high EBITDA margin can also suggest that a company charges too much for its core business, leading to lost market share or inviting more competitors into the industry. This also means that the company’s Valuation is more than the competitors.

On the other hand, a low EBITDA margin indicates that a company is not generating enough profit relative to its revenue. This could be due to mismanagement in the company’s operations or indicative of weak demand for the company’s products or services, but this impacts the business valuation. Ultimately, there is no one answer regarding whether it is better to have a higher or lower EBITDA margin. The answer will vary on the specific circumstances of each company.

What is considered a good EBITDA margin?

The EBITDA margin is a financial ratio that measures a company’s profitability and valuation. It is calculated by dividing a company’s earnings before interest, taxes, depreciation, and amortization by its revenues. The EBITDA margin is useful for comparing companies within the same industry. It is also helpful in assessing a company’s financial health and ability to generate cash flows. Generally, a higher EBITDA margin indicates a more profitable company hence a higher valuation. Therefore, investors tend to look favorably at companies with high EBITDA margins. A company’s EBITDA margin can be used to compare its profitability to other companies in its industry. Generally, a higher EBITDA margin indicates a more profitable company and a better valuation.

A high EBITDA margin indicates that a company is generating a lot of income relative to its revenue. Generally speaking, a good EBITDA margin is anything above 10%. However, the margin number can vary depending on the industry. For example, companies in the healthcare industry typically have lower margins than companies in the technology sector. Therefore, comparing companies within the same industry is essential when evaluating their financial performance. All things being equal, a higher EBITDA margin is better than a lower one.

There is no definition of a “good” EBITDA margin. However, some experts suggest that a company should aim for an EBITDA margin of at least 10%. Others say that a company’s EBITDA margin should be compared to the average EBITDA margin of companies in its industry to get a more accurate picture of its profitability. Ultimately, it is up to each company to decide what target EBITDA margin it will strive for.