Growth Equity Valuation: Growth equity represents some of the best investment opportunities that every business has throughout its lifecycle. It is also well-known as the expansion capital or the growth capital and is closely related to mature companies.

This investment opportunity occurs when a firm is undergoing a decisive turn of events with the potential to deliver immense growth. Growth equity assists companies to expand their business, entering new markets, or supporting acquisitions projects.

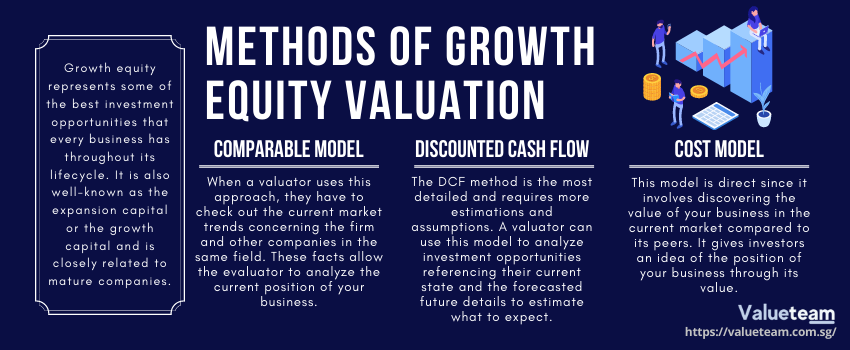

On the other hand, growth equity valuation refers to evaluating the growth equity to determine its potential and its influence on a business. Over the years, the popularity of this valuation process is increasing as people seek ways of ensuring that they exploit all the potential of the investment opportunity.

However, there is limited information about this valuation leaving many people with questions about growth equity valuation. With that in mind, this article highlights all the facts about the valuation and what to expect. Join us to understand the growth equity valuation and some of the critical considerations to keep in mind.