Gold Valuation: The value of paper currencies has changed over the years, but this is not so with gold which has maintained its value for years. Many traditions and cultures focus more on the beauty of gold and, as such, hold it in high esteem to be an element of wealth but dont understand how gold valuation works.

This is not so with investors. Investors buy gold to prevent inflation of their paper currencies, diversify their portfolios, and a means preventing their money from being devalued. Investing in gold is good, but not everyone knows how the prices of gold are derived nor what affects its prices daily. There gold valuation become very important for investors

The gold rush in 1697 moved gold from Brazil to London, and since then, London has had a hand at the gold price. London Good Delivery List, which is the only accreditation bullion market globally, is managed by the London Bullion Market Association. A process known as “London Gold Fix” is used to set the prices of gold by the five countries that operate the London Gold Market Fixing Company.

Gold futures prices are used for the London Bullion Market Association (LBMA) gold price. There are many factors upon which the gold futures contract price is determined. They include the estimated cost in storing and moving the physical gold, the predicted changes in the demand and supply of the precious metal, the spot price of gold, and the risk-free return rate of those holding the gold. These trades are electronic as the physical gold is not delivered immediately after purchase. They are very risky since the demand and supply factors are unpredictable.

A spot price is the price of gold meant to be delivered as soon as possible. Futures prices are always higher than the spot price of gold in a stock market. However, when physical gold is much demanded, the reverse is the case. That is, the futures price becomes lower than the spot price.

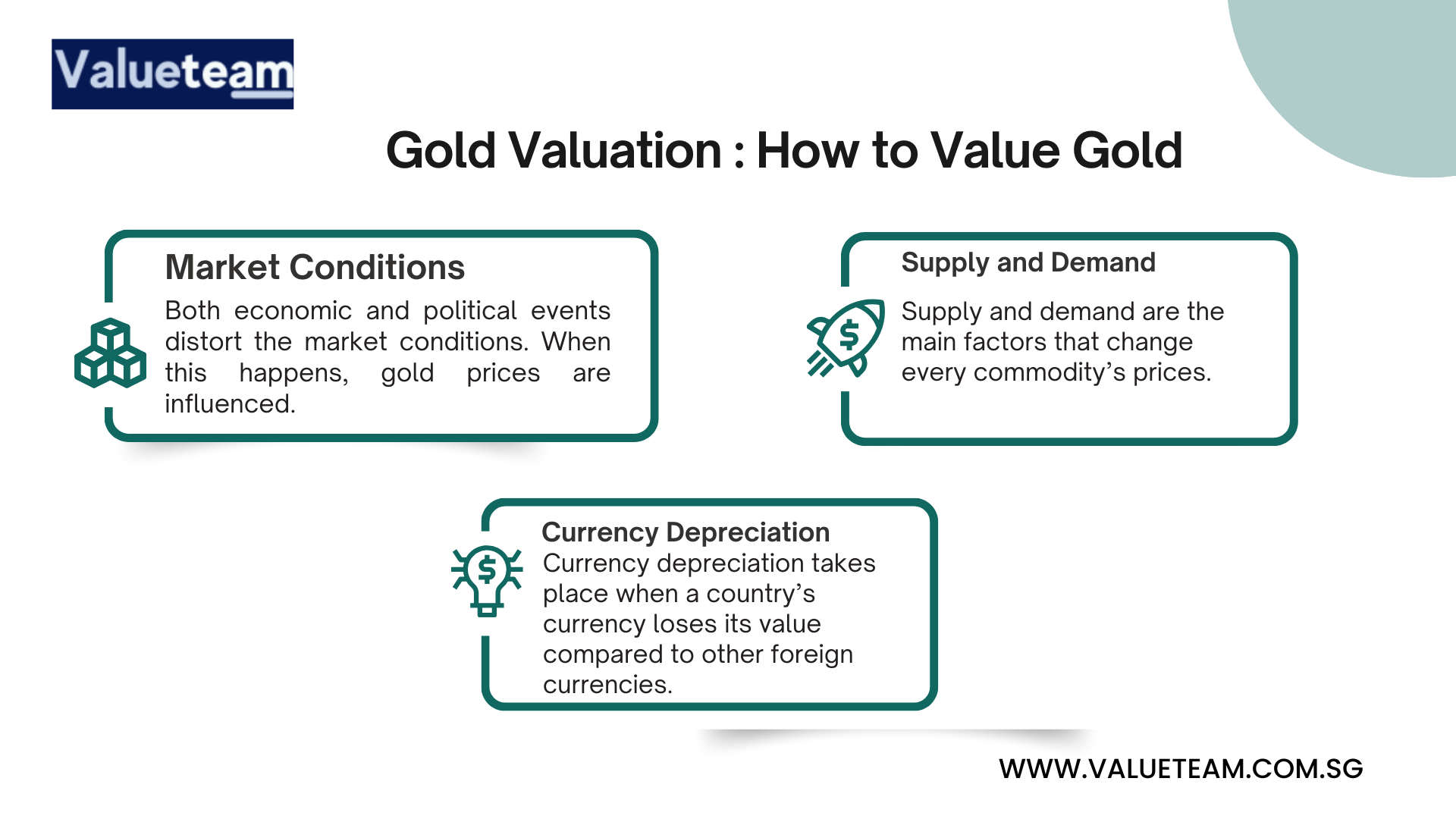

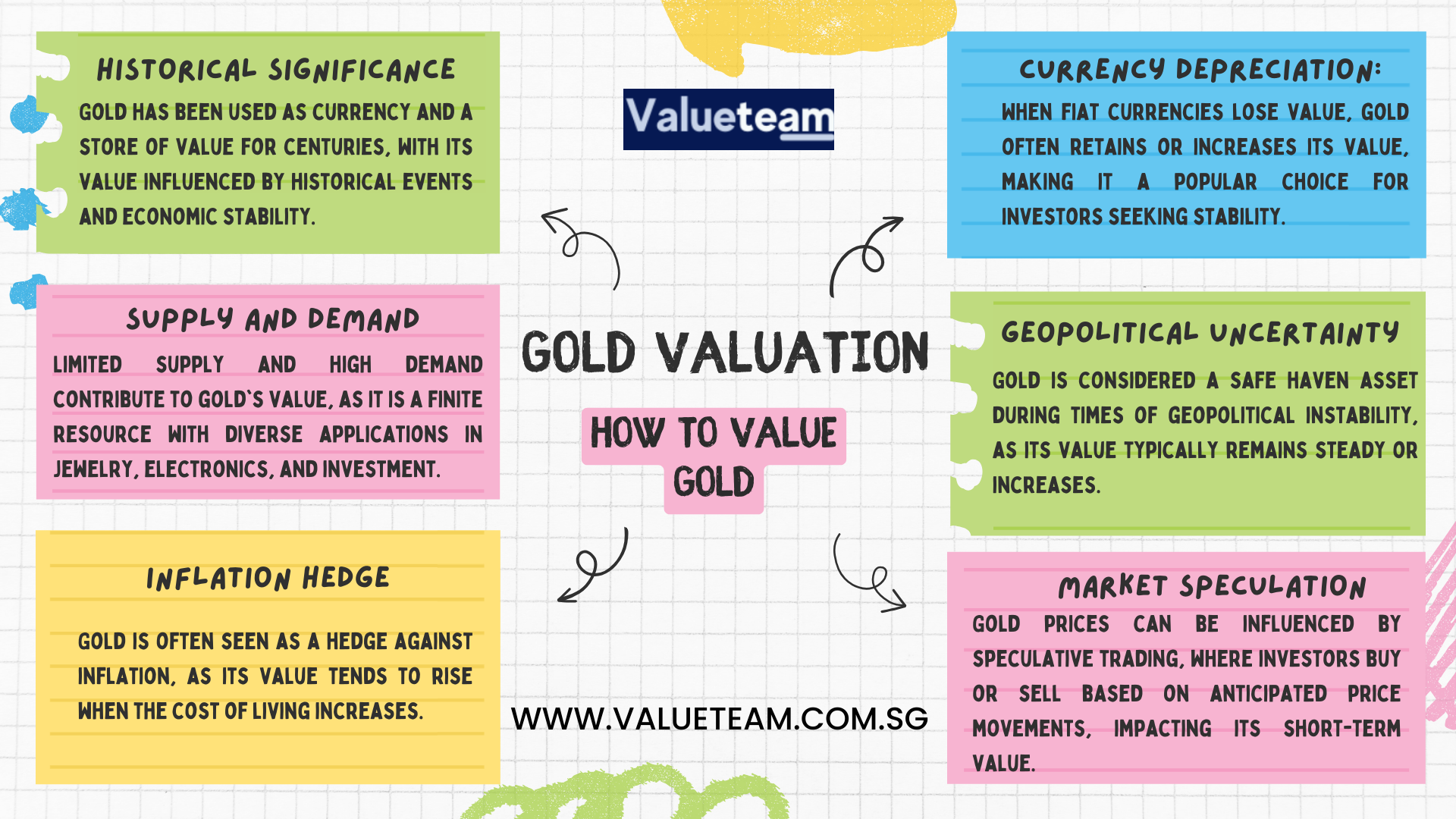

1. Market Conditions

Both economic and political events distort the market conditions. When this happens, gold prices are influenced.

2. Supply and Demand

Supply and demand are the main factors that change every commodity’s prices. The prices of gold will go high when there is high demand for gold with a low supply of precious metals. The prices of gold will be low when there is insufficient demand but high supply.

3. Currency Depreciation

Currency depreciation takes place when a country’s currency loses its value compared to other foreign currencies. The significant causes of currency depreciation are monetary policy like quantitative easing and inflation. Investors will see the gold purchase as an escape when a country’s currency is weak. This will increase the demand and prices of gold.

Aside from being used to produce jewelry and investments, gold is also utilized to manufacture technological and medical products. Over $1,700 per ounce of gold (as of March 2021) was still a considerable increase from under $100 observed 50 years earlier.

Reserves of paper money and gold are kept on hand by central banks. In general, the price of gold increases when the world’s central banks shift their monetary reserves from paper currencies to gold. Gold is the primary currency of several countries across the globe.

Approximately half of the gold demand, or over 4,400 tonnes, was for jewelry in 2019, according to the World Gold Council. Regarding volume, India, China, and the United States are the world’s largest buyers of gold jewelry. A further 7.5 percent of the demand for gold is related to its usage in the fabrication of medical equipment such as stents and precision electronic gadgets such as GPS units.

Supply and demand may thus impact gold prices; if demand for consumer products like jewelry and electronics grows, the cost of gold can rise.

Because gold is priced in US dollars, its value tends to move in the opposite direction of the value of the US dollar. While a stronger dollar tends to keep gold prices lower and more stable, a weaker one is likely to increase gold demand and raise gold prices (because more gold can be purchased when the dollar is more fragile).

This has led to a perception that gold is a haven against inflation. When the dollar’s value drops, prices rise, a condition known as inflation. The cost of gold rises when inflation increases.

People resort to gold as a haven during economic uncertainty, such as during economic downturns. Investors typically turn to gold as a “haven” during times of uncertainty. Gold investment may rise in value when the returns on the business, bonds, stocks, and real estate valuation are lower than projected or actual. Currency depreciation or inflation may be guarded against by purchasing gold. Gold is also said to provide safety during times of political unrest.

Top gold-mining countries include South Africa, China, the United States (including Alaska), Australia (including Western Australia), Russia (including the Urals), and Peru. The quantity of gold mined across the world affects gold’s price.

Mining companies must delve deeper to find quality gold deposits since the “easy gold” has already been extracted. Miners suffer additional dangers and environmental consequences because of the difficulties in getting gold. To put it simply, it takes more money to acquire less gold. These factors increase the price of gold since they increase manufacturing expenses.

Gold has captivated us for a long time and is sure to do so in the future. All these factors contribute to gold’s current high price, fueled by demand, the quantity of gold in central bank reserves, the value of the US dollar, and the desire to keep gold as a currency hedge.