Convertible Instrument Valuation Under IFRS

Introduction: Why Convertible Instruments Matter Today

In the dynamic landscape of corporate finance, convertible instruments—particularly convertible bonds and convertible preferred shares—have gained renewed relevance as strategic financing tools. These instruments provide companies, especially high-growth startups and capital-intensive businesses, with a hybrid mechanism to attract capital while offering investors the potential upside of equity participation. As the line between equity and debt continues to blur, the accurate valuation and classification of these instruments under International Financial Reporting Standards (IFRS) becomes not just a compliance necessity but also a critical driver of financial transparency, investor confidence, and risk management.

For professionals aiming to learn IFRS financial reporting in Singapore, mastering the treatment of convertible instruments is indispensable. The growing complexity of capital markets and the increasing prevalence of convertible instruments make it essential for financial decision-makers to fully grasp the accounting, valuation, and disclosure requirements outlined under IFRS. Misclassification or incorrect valuation can significantly distort financial statements, potentially leading to audit adjustments, reputational damage, and even legal implications. As such, business valuation training under IFRS guidelines is a key step for those seeking to build technical expertise in this area. This guide serves to demystify the treatment of convertible instruments under IFRS, focusing on key standards such as IAS 32, IFRS 9, IFRS 13, and IFRS 7, and equipping financial professionals with the tools to navigate these technical waters with precision.

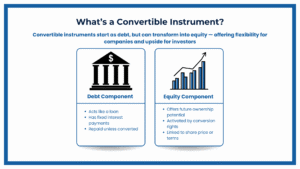

Understanding Convertible Instruments: The Dual Nature

Convertible instruments valuation services in Singapore are unique financial instruments that combine features of both debt and equity, making them hybrid in nature. These instruments are commonly used in corporate financing, especially by early-stage companies or businesses seeking flexible funding arrangements. The most prevalent forms include convertible bonds, convertible notes, and convertible preference shares. What sets these instruments apart from traditional debt is the presence of an embedded derivative—typically a conversion option that allows the holder to convert the instrument into a specified number of equity shares in the issuing company.

This embedded option adds complexity to financial reporting. The conversion feature can be structured in various ways—some fixed, some variable, and some contingent on future events—which can significantly affect how these instruments are valued and presented in financial statements. In most cases, the holder of the instrument has the right, but not the obligation, to convert the debt into equity at a predetermined rate or based on a pricing formula that may include market-based adjustments. This optionality introduces both upside potential and valuation uncertainty.

From an accounting standpoint, especially under International Financial Reporting Standards (IFRS), this dual nature must be clearly recognized. IFRS requires issuers to bifurcate the convertible instrument into two separate components at the time of issuance: a liability component, which reflects the issuer’s contractual obligation to repay principal and interest, and an equity component, which represents the value of the conversion feature granted to the holder.

This bifurcation is not just a formality—it has critical implications. For instance, the interest expense reported on the liability portion is calculated using the effective interest rate method, which can differ from the actual coupon rate. Additionally, the equity component affects diluted earnings per share (EPS), as potential conversion impacts share count. Finally, classification influences how investors and analysts view the company’s capital structure and solvency position. As such, careful assessment and transparent reporting of convertible instruments are essential for maintaining financial integrity and investor confidence.

For professionals seeking to strengthen their analytical capabilities in this area, understanding the best tools used in financial analysis can offer a strong foundation. Additionally, enrolling in a hands-on program like the Riverstone Training Financial Modelling Course in Singapore can provide practical insights into modeling convertible instruments and other hybrid securities under IFRS frameworks.

Key Accounting Standards Applicable to Convertible Instruments

IAS 32: Financial Instruments – Presentation

IAS 32 is the cornerstone standard that determines how financial instruments—especially those with hybrid features—are presented in the financial statements. It lays out the principles that guide whether an instrument should be classified as a financial liability or equity. For instruments like convertible bonds or notes, this becomes particularly crucial due to their dual nature. Under IAS 32, a typical convertible bond is bifurcated into two distinct components:

- Liability component: This represents the present value of contractual cash flows (such as interest and principal payments) discounted using the market rate applicable to similar debt instruments without the conversion feature.

- Equity component: This residual value is essentially the fair value of the holder’s option to convert the bond into equity shares of the issuing entity.

This classification significantly impacts key financial ratios—such as gearing and debt-to-equity ratios—that are often scrutinized by investors, creditors, and regulators. Misclassification can lead to misleading representations of an entity’s financial health and may breach loan covenants. Accountants must therefore interpret the legal terms of the instrument with substance over form in mind, paying attention to contingencies, embedded options, and settlement features.

IFRS 9: Financial Instruments – Recognition and Measurement

Once the components have been accurately classified, IFRS 9 steps in to dictate their subsequent measurement. The liability component is measured at amortised cost using the effective interest rate method. This means the initial liability is gradually increased over time to reflect the interest expense, which is recognized in profit or loss.

In contrast, the equity component is not subsequently remeasured. It remains static on the balance sheet, preserving its original value. However, if the conversion feature fails to meet the criteria for equity classification—often due to contingent settlement provisions or variable exchange terms—it is instead classified as a derivative liability. This derivative must be measured at fair value through profit or loss (FVTPL), potentially introducing significant volatility to earnings. This remeasurement obligation necessitates reliable, consistent valuation techniques and robust internal controls.

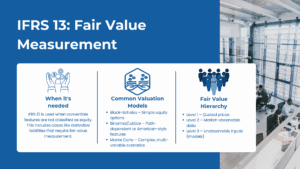

IFRS 13: Fair Value Measurement

IFRS 13 provides the methodological framework for measuring the fair value of financial instruments when such valuation is required. For derivative liabilities or embedded conversion options not classified as equity, fair value measurement becomes essential.

Accepted valuation models include:

- Black-Scholes Model – Ideal for simple equity-style options.

- Binomial or Lattice Models – Suited for instruments with American-style options or path-dependent features.

- Monte Carlo Simulations – Best for complex, scenario-based instruments involving multiple risk variables.

Valuations must reflect market participant assumptions and incorporate credit risk, non-performance risk, and liquidity considerations. IFRS 13 also mandates transparency through the fair value hierarchy, classifying inputs into Level 1 (quoted prices), Level 2 (observable inputs), and Level 3 (unobservable inputs), with corresponding disclosure requirements.

IFRS 7: Financial Instruments – Disclosures

While IAS 32, IFRS 9, and IFRS 13 govern classification and measurement, IFRS 7 ensures stakeholders are provided with detailed and insightful disclosures. For convertible instruments, disclosures should cover:

- The instrument’s contractual terms and economic characteristics

- The accounting treatment and any changes in classification

- Valuation methodologies used, key inputs, and fair value hierarchy levels

- Sensitivity analyses, especially for Level 3 valuations

- Risk exposures, including credit, market, and liquidity risk

Such disclosures are critical for transparency, particularly when convertible instruments can lead to future dilution of equity, sudden shifts in liability valuation, or unpredictable profit and loss impacts. This comprehensive insight helps users of financial statements make more informed decisions regarding the risk profile and financial strategy of the reporting entity.

In sum, the combination of IAS 32, IFRS 9, IFRS 13, and IFRS 7 offers a holistic framework for navigating the complexities of convertible financial instruments—from classification to valuation to disclosure. Accurate application of these standards not only ensures compliance but also strengthens stakeholder confidence in the integrity of the financial reports.

Initial Recognition and Measurement: The Split Accounting Approach

Under IFRS, particularly IAS 32 and IFRS 9, convertible instruments such as bonds or preference shares must be separated into their liability and equity components at initial recognition—a method commonly referred to as split accounting. This approach ensures that each component reflects its respective economic substance, enhancing both transparency and comparability in financial reporting.

At the date of issuance, the liability component is measured first. This involves discounting the future contractual cash flows—typically interest and principal payments—at the market interest rate for a similar instrument without a conversion feature. This yields the present value of the debt-like portion of the convertible instrument.

Once the liability portion is determined, the equity component is calculated residually. It is simply the difference between the total proceeds received and the present value of the liability component. This residual represents the embedded option the investor holds to convert the debt into equity at a future date, which is not remeasured subsequently.

For example, consider a company issuing a $1 million 5-year convertible bond with a 4% coupon rate, convertible into 50,000 shares. The market rate for a similar non-convertible bond is 8%. By discounting the cash flows at 8%, the liability component is determined to be $850,000, and the equity component is the residual $150,000.

This method leads to the recognition of a higher effective interest expense compared to the nominal coupon. Over the bond’s life, the liability increases due to accretion of interest at the effective rate (8%), while the equity component remains unchanged. This accurate separation enhances clarity for stakeholders, particularly in assessing gearing ratios and dilution risk.

Subsequent Measurement and Changes in Convertible Instruments Under IFRS

After the initial recognition of a convertible instrument under IFRS—where it is split into a liability and an equity component—each component follows distinct measurement rules going forward.

1. Liability Component: Amortised Cost Using Effective Interest Method

The liability portion is subsequently measured at amortised cost using the effective interest rate (EIR) method as prescribed by IFRS 9. The effective interest rate is the rate that exactly discounts the estimated future cash payments through the expected life of the instrument to the initially recognized amount of the liability component.

For example, if the liability component of a convertible bond is recorded at $850,000 with an EIR of 8%, then the interest expense recognized in profit or loss each period will be based on this effective rate, not the nominal coupon rate. This results in a gradual accretion of the liability over time. The difference between the actual coupon paid (e.g., 4%) and the effective interest (8%) is added to the carrying amount of the liability, reflecting the increasing financing cost of the debt component.

This approach ensures that the liability reflects a more accurate economic cost of borrowing, accounting for the discount given due to the equity conversion feature.

2. Equity Component: No Subsequent Remeasurement

In contrast, the equity component—recognized at the residual value on initial recognition—is not subsequently remeasured. This aligns with IFRS principles that equity instruments are not subject to revaluation through profit or loss. The equity value recognized represents the value of the conversion option at inception and remains fixed, regardless of changes in the issuer’s share price or market conditions. This fixed treatment is especially relevant in growth equity valuation for private companies in Singapore, where accurate initial recognition of convertible instruments is critical for maintaining investor trust and financial clarity.

3. Changes in Fair Value: Derivative Liabilities

If the instrument contains derivative features that do not meet the definition of equity (for example, if conversion terms are variable or denominated in a foreign currency), those derivatives are classified as financial liabilities under IFRS 9. These must be measured at fair value through profit or loss (FVTPL). Any changes in fair value over time are recognized in the income statement, potentially creating volatility in earnings.

4. Modifications to Contractual Terms

If the contractual terms of a convertible instrument are modified—such as an adjustment to the conversion ratio or interest rate—the issuer must evaluate whether the modification is substantial. Under IFRS 9, a substantial modification typically triggers derecognition of the existing liability and recognition of a new instrument. This can result in a gain or loss in profit or loss based on the difference between the old and new carrying amounts.

Modifications that are not substantial may result in adjustments to the carrying amount, with the impact recognized immediately in profit or loss.

5. Conversion into Equity

Upon conversion of the instrument into shares, the carrying amount of the liability component is derecognized, and the corresponding amount is transferred to equity (e.g., share capital and share premium). If the value of the shares issued differs from the carrying amount of the liability derecognized, the difference may be:

- Recognized in equity (common when there’s no commercial gain or loss),

- Or recognized in profit or loss (if a gain or loss arises from settlement terms).

This depends on the specific facts and substance of the transaction, and professional judgment is often required.

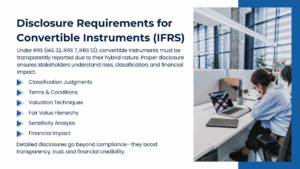

Disclosure and Transparency Requirements for Convertible Instruments

Under the IFRS framework—particularly IAS 32, IFRS 7, and IFRS 13—transparent and comprehensive disclosure is fundamental to ensure that users of financial statements can understand the nature, risks, and financial impacts of convertible instruments. Convertible instruments are inherently complex due to their hybrid nature, which blends features of both liabilities and equity. Thus, financial statement preparers must offer detailed and high-quality disclosures that capture not only the accounting treatment but also the reasoning and estimates behind classification and valuation decisions.

- Judgments in Classification:

One of the most critical areas for disclosure relates to the judgment applied in classifying a financial instrument as either equity, liability, or a compound instrument. Companies must explicitly explain the rationale used to classify a convertible bond or note, particularly if the terms of conversion are contingent or if settlement alternatives exist. For example, if a bond includes a clause that allows settlement in cash or shares at the issuer’s discretion, this may trigger liability classification under IAS 32. Users of financial statements must be able to assess whether these judgments are consistent with IFRS guidance and industry best practices. - Terms and Conditions:

Complete disclosure of the instrument’s key terms—including maturity dates, interest rates, conversion price, conversion ratio, redemption features, and embedded derivatives—is essential. Stakeholders rely on this information to evaluate dilution risk, liquidity implications, and the timing of potential changes in the capital structure. Such terms often have strategic implications for both equity holders and debt holders, and clear presentation of these details helps prevent misinterpretation or oversight. - Valuation Techniques and Assumptions:

IFRS 13 requires that companies disclose the valuation techniques used to measure the fair value of any embedded derivative or separately recognized derivative component. Whether the company applies a discounted cash flow (DCF) model, Black-Scholes, or another pricing methodology, the assumptions behind these models—such as volatility, risk-free interest rates, and credit spreads—must be disclosed. Providing such information enables users to assess the reliability and sensitivity of reported fair values. - Fair Value Hierarchy Classification:

Convertible instruments with embedded derivatives or those designated at fair value must be classified into Levels 1, 2, or 3 of the fair value hierarchy. Most convertible instruments fall under Level 2 or Level 3 due to the use of unobservable or model-derived inputs. Companies are required to disclose the basis of this classification and describe any changes in level during the reporting period. This aids analysts and investors in determining the transparency and comparability of financial information across periods or peers. - Sensitivity Analysis:

For instruments involving Level 3 inputs, IFRS 13 mandates disclosure of how sensitive the valuation is to changes in key assumptions. For example, a small change in expected volatility or discount rate can significantly affect the value of the conversion feature. Sensitivity disclosures provide stakeholders with insight into the estimation uncertainty and risk exposure inherent in such valuations. - Impact on Financial Position and Performance:

Companies should also disclose how convertible instruments impact their key financial metrics, including leverage ratios, earnings per share (EPS), and capital adequacy (for financial institutions). This includes quantifying the potential dilution effect from conversion and reconciling changes in liability and equity components over time.

Ultimately, robust and detailed disclosures on convertible instruments are not just a compliance requirement—they are a strategic communication tool. They enhance trust, reduce information asymmetry, and enable investors, analysts, and regulators to make informed judgments about a company’s financial health and risk exposure. Transparency in convertible instruments reflects not only accounting rigor but also corporate governance quality.

Audit and Documentation Considerations for Convertible Instruments Under IFRS

Auditing convertible instruments under IFRS requires heightened diligence due to their inherently complex nature. These instruments typically involve multiple components—debt and equity, or in some cases, embedded derivatives—each of which must be evaluated carefully during both initial recognition and subsequent measurement. The audit risks primarily relate to classification errors, improper valuation methodologies, and insufficient disclosures. Consequently, auditors often require robust supporting documentation and clear rationale to ensure that the financial statements fairly represent the economic substance of these instruments.

One of the fundamental audit steps involves a detailed review of the contractual terms of the convertible instrument. The exact clauses—such as maturity date, interest or coupon rate, conversion trigger events, conversion ratio, early redemption features, and anti-dilution provisions—must be scrutinized. These contractual features determine whether the embedded conversion option should be classified as equity or as a derivative liability. For example, if the number of shares to be issued upon conversion is variable or if settlement can occur in cash or shares at the discretion of the issuer, the instrument might need to be treated wholly as a liability or contain a derivative component measured at fair value.

Auditors will also examine management’s classification judgment, including how the company concluded whether the instrument is debt, equity, or a compound financial instrument. This includes evaluating whether management has appropriately applied the requirements of IAS 32 and IFRS 9, particularly around concepts like “fixed-for-fixed” conversion terms and whether any contingent settlement provisions exist. It is essential to document not only the final classification decision but also the reasoning and references to specific IFRS provisions.

Valuation models and inputs used for the liability and equity components also come under close scrutiny. Auditors expect to see a present value calculation for the liability component using a market rate for comparable instruments without the conversion feature. The equity component is then determined residually. Where fair value techniques are used—such as Black-Scholes or binomial models for embedded derivatives—detailed documentation of the assumptions (e.g., volatility, risk-free rate, expected life, dividend yield) must be available.

If management uses third-party valuation experts, audit procedures will often include a review of the expert’s qualifications, methodologies, and the relevance of inputs. Any external valuation report must be supported by internal understanding and reviewed for consistency with accounting policies.

Another critical area is ongoing modification and remeasurement. If the terms of the convertible instrument change after initial recognition—such as revised conversion ratios, extended maturity, or waiver of interest—then under IFRS 9, the entity must assess whether this results in derecognition of the original liability and recognition of a new one. This analysis and its impact on profit or loss must be carefully documented and supported by appropriate calculations.

Engaging with auditors early in the lifecycle of the instrument—whether at issuance, during modifications, or approaching conversion—can help ensure alignment and avoid disputes. Proactive communication fosters transparency and allows potential accounting or disclosure issues to be resolved ahead of financial close.

Ultimately, comprehensive documentation is not just a compliance requirement; it is a best practice that enhances credibility and auditability. Proper records provide evidence that management has exercised sound judgment and complied with IFRS standards, thereby reducing the risk of audit qualifications or delays.

Conclusion: Navigating Complexity with Confidence

Accounting for convertible instruments under IFRS extends far beyond regulatory compliance—it holds significant strategic importance for companies navigating today’s competitive capital markets. The way these instruments are classified and measured can substantially impact a company’s key financial indicators, such as the debt-to-equity ratio, interest coverage, return on equity, and diluted earnings per share (EPS). For instance, a misclassification could result in overstated equity or understated liabilities, misleading investors and potentially affecting credit ratings or borrowing costs.

Moreover, convertible instruments often signal management’s expectations about future growth and market performance. Properly accounting for them under IFRS, particularly through the application of IAS 32 and IFRS 9, ensures transparency and comparability, enabling stakeholders to accurately assess financial health and risk exposure. This level of clarity builds trust with both investors and regulators, enhancing the company’s reputation in capital markets.

From a strategic financing perspective, companies that understand and proactively manage the IFRS implications of convertible notes can structure instruments more effectively. They may optimize timing of issuance, tailor conversion terms to align with shareholder interests, or manage potential EPS dilution more efficiently. Furthermore, companies with strong reporting practices and valuation documentation are more likely to avoid audit disputes, regulatory scrutiny, or restatements—each of which could harm investor confidence or delay fundraising efforts.

For CFOs, audit committees, and financial advisors, mastering the accounting and strategic aspects of convertible instruments is becoming a critical competency. As IFRS standards evolve, the bar for transparency and consistency continues to rise. Adopting best practices in classification, fair value measurement, and disclosure is no longer a matter of formality—it is a strategic imperative. By aligning accounting practices with business goals and investor expectations, companies are better positioned to drive sustainable value and maintain competitive advantage in global markets.