How a Finance Course Can Enhance Your Valuation Career: An In-Depth Look

If you’re pursuing a valuation career, you’ve likely heard that taking a finance course can help propel your career forward. With your busy schedule, you might wonder if it’s worth the time and effort. After all, investing time in a finance program is significant, and you want to make sure it will provide value in the long run. Let’s explore how a finance course can specifically benefit your career in valuation and why it’s a smart investment.

The Importance of a Finance Course in a Valuation Career

As mentioned earlier, we will deeply explore how a finance program helps in a valuation career. So, without much ado, let’s discuss the importance of a finance course in a valuation career.

1. You will understand the business well.

With skills such as financial modeling, you will easily design a comprehensive business evaluation model. You can understand how the company operates, too. The right finance course should equip you with skills revolving around financial models. Only then can you get enhanced insights into business operations and what affects them. With such a great understanding of a business, accuracy in your valuation career is a guarantee.

2. You will understand financial models, too.

Financial models have a crucial role to play when forecasting cash flows, both inflows and outflows. Isn’t that a crucial element when valuing a business? It allows the prediction of the net cash flows necessary for the effective operation of the business. Under such circumstances, choosing between equity or debt as a funding source becomes easy. A financial modeling course should also depict the cash position before paying loans and interest. These models also help in financial management since one can determine the ideal equity funding and assess how well a company can leverage debt.

3. One can quickly mitigate risks.

Financial models forecast how various business decisions could impact the business. This prediction plays a considerable role in determining whether entering a new market would benefit business. It also determines the most appropriate marketing strategy from now on. A company can assess all the associated costs and determine if pursuing any change is good or bad for its survival or growth. A finance course helps you understand even pricing adjustments deeply. You understand the impact of various factors on a business and its operations. Only then can you reduce and effectively manage the company’s risk exposure.

4. Forecasting Cash Flows

Evaluating a business without knowing its cash flows is often challenging, if not impossible. Equally important, the exercise requires you to forecast these cash flows. If these predictions are correct, the valuation will be accurate, and vice versa. That’s why you need a finance program that helps you forecast accurate cash flows. For instance, look for a business valuation course that captures financial modeling. Unless a company’s valuation is fair and accurate, it might do more harm than good.

5. Carrying Out Financial Analysis

The joy of any company is to make as much profit as possible. Financial statement analysis has proven effective in facilitating the maximization of profits. You need the skills that a finance program offers, especially in the analysis of financial statements. Only then can you quickly identify hidden risks, adjust balance sheet items when off, and assess earnings quality. As long as the analysis and interpretation of financial statements are great, rest assured that the valuations will also be accurate. When evaluating a business, you can quickly identify an accounting anomaly or any other red flag.

How Different Financial Programs Help In a Valuation Career

One can pursue various finance courses, and each of them impacts valuation matters. Some of the common ones and their relevance to a valuation career are as follows;

Financial Modeling course

This finance course revolves around building financial models using various software such as Excel. It helps you use historical data to build projections, conduct a cost analysis, and create revenue forecasts. Such a finance program can help your career by accurately estimating a company’s valuation. After all, dynamic models enable forecasting any organization’s financial performance and valuation estimates. Isn’t that what a financial modeling course is about?

Business Valuation course

A business valuation course can also help your valuation career. After all, the finance course covers various valuation methods. You learn about many company valuation techniques, including the popular ones such as asset-based, comparable companies, discounted cash flow (DCF), and precedent transaction valuation methods. Did you know that various circumstances require different company valuation methods? That’s where such a finance program comes in. Since it gives you a deep understanding of these methods, you can identify the most appropriate technique for each scenario.

Project finance course

A project finance course is another finance program that can help your valuation career. In your valuation career, you are expected to deal with large infrastructure projects, including utilities, highways, and airports. Consider this program if you want to advise on financing and evaluating such projects accordingly. After all, that’s its primary focus. Remember the need to focus on long-term effects, given how long these projects take. Fortunately, that’s easy to master if you pursue this finance course. It equips you with the knowledge about the impact the funding mechanisms, government regulation, and project risk have on such infrastructure projects’ valuation. That’s enough to increase your accuracy when valuing various projects, which is excellent for your career.

Credit Course

A valuation career may also require you to pursue this finance program. A credit course facilitates accurate credit analysis and debt instruments valuation. After all, it offers a deep understanding of default probabilities, credit spreads, and yield curves. You learn about tools to enhance accuracy when valuing a company’s price debt securities, assessing its credit risk, and evaluating corporate bonds.

Finance for non-finance course

It is no secret that finance for non-finance is an introductory finance course. Why should you pursue it when a valuation career requires an in-depth understanding of finance? It doesn’t offer much information, but it sets a great foundation for any other finance program you wish to pursue. You will understand fundamental financial concepts, including financial statements, financial ratios, valuation methods, the cost of capital, and the time value of money. You are also confident when making financial decisions and interacting with finance teams.

Due diligence course

A due diligence course is also a financial program worth pursuing if you are interested in pursuing a career in valuation. After all, valuation and transactions are rarely separable. That’s where due diligence comes in when assessing a transaction’s commercial, operational, legal, and financial risks. So, why gain these skills? That’s because accurate assessments and valuation require understanding and mitigating such risks. Common risks worth attention include unrecognized expenses, contingent liabilities, and debt. They significantly impact a business value and hence worth considering during a business valuation.

Company Valuation course

Upon pursuing a company valuation course, there is a high chance of your valuation soaring. After all, the finance course is an excellent foundation for various valuation methods. Besides understanding the primary valuation techniques, you also learn financial modeling. This combination is vital to someone pursuing a valuation career. After all, you must understand valuation methods well to evaluate any company accurately. This course usually covers asset-based, precedent transactions, comparable company analysis, discounted cash flow, and other valuation techniques. Equally important financial

Startup Valuation Course

A startup valuation course will also be crucial to your valuation career. Besides valuation careers, this program is crucial in financial analysis, venture capital, and investment banking. After all, you learn many vital skills from such a course. For instance, you learn early-stage businesses’ uniqueness to help you evaluate any startup accurately. On one side, these are companies with indisputable growth potential.

On the other hand, there is an inconsistency in profits or revenues. Under such circumstances, the valuation methods you choose must factor in that. Without much historical financials, the focus shifts to scalability, customer acquisition costs, and potential market size. Fortunately, you can learn that in depth through such a finance program.

Private Equity and Venture Capital course

Private equity and venture capital often go hand in hand. These two revolve around valuing private companies and startups. Upon pursuing a finance course covering the pair in detail, you understand equity dilution’s impact and the various funding stages. Remember that one can’t afford to get it wrong, given the crucial role valuation findings play in investment decisions and acquisitions. You can boost your accuracy in these matters by pursuing such finance courses. Their primary focus is on private equity and venture capital; hence, it is most suitable if your valuation career will take that direction.

ESG Course

Environmental, social, and governance (ESG) factors usually affect a business’s performance. It explains the need to pursue an ESG investing program for your valuation career. Such a finance course teaches you how to integrate ESG criteria into valuation and investment decisions seamlessly. After all, ESG factors are crucial when assessing a company’s risk profile and long-term sustainability. Aren’t these factors affecting the business valuation? Besides, gone are the days when investors only focused on financial factors.

FAQs

Here are some frequently asked questions on the impact of a finance course on a valuation career and their respective answers. So, check these FAQs out since they can make a huge difference;

What is a valuation career?

Understanding what a valuation career entails helps you discover the skills it requires. Consequently, it becomes easy to identify a finance course that can equip you with these skills. Unless you get it right, it may be hard, if not impossible, for the finance program to help your valuation career. Such a career involves assessing and determining what securities, businesses, or assets are worth. Such information is crucial when making financial decisions. They are often necessary during litigation, financial reporting, investment analysis, mergers, and acquisitions.

Which finance topics should you focus on if you are considering or pursuing a valuation career?

Whereas there are many finance topics, some are more relevant to a valuation career than others. These topics include market valuation techniques, comparable company analysis, discounted cash flow analysis, financial statement analysis, and financial modeling. You will need these techniques when conducting company valuation; thus, they are ideal for the corresponding career.

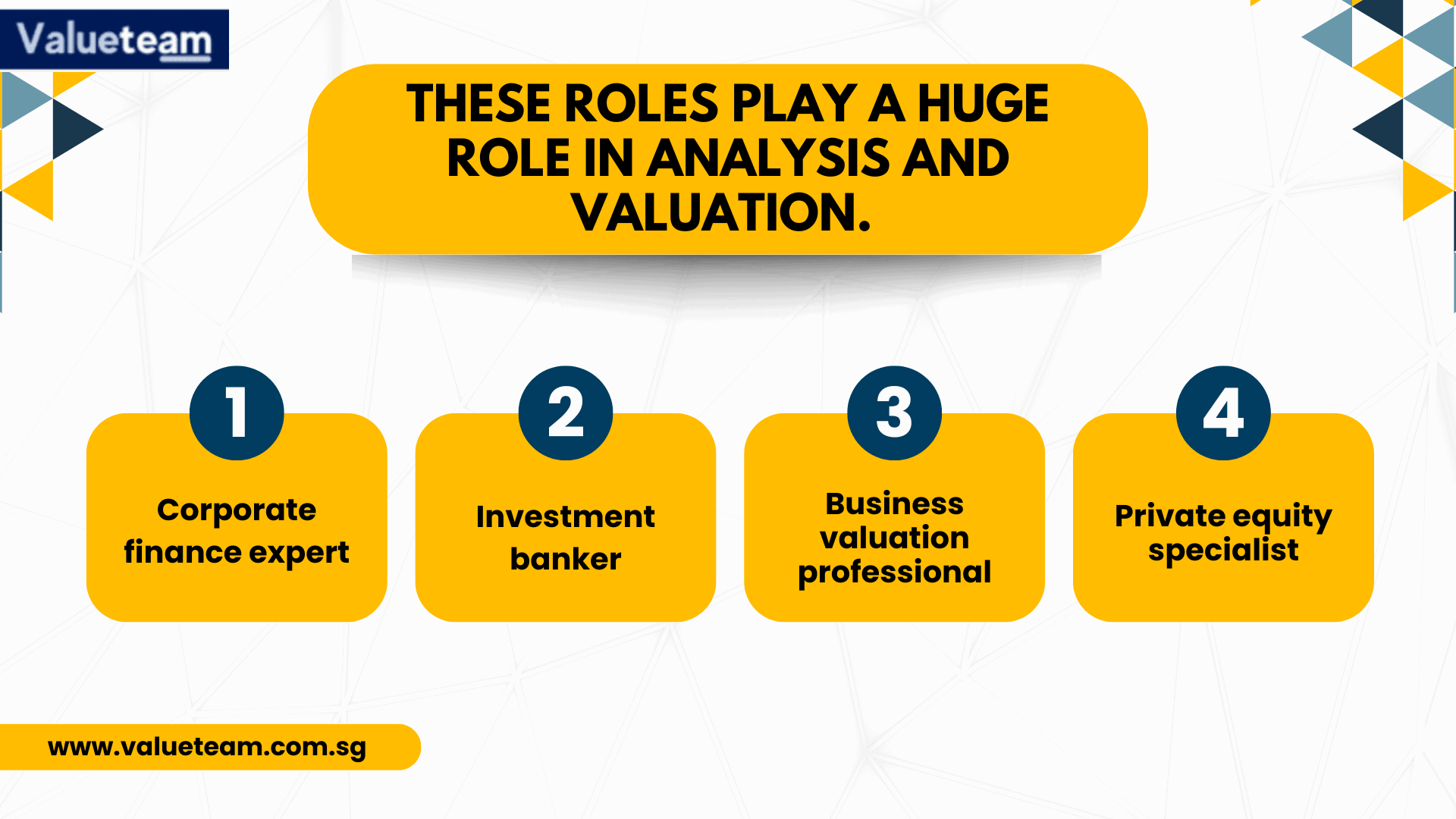

Which valuation job opportunities are available to people who pursue a finance course?

If you undertake a finance course, many career paths revolve around valuation, which you can undertake. These roles play a huge role in analysis and valuation. Some of these career opportunities include;

- Corporate finance expert

- Investment banker

- Business valuation professional

- Private equity specialist

What’s the impact of a finance course on investment banking and M&A Valuation?

It is no secret that valuation is a crucial part of mergers and acquisitions. It helps make decisions surrounding these deals, including the synergy potential, negotiation strategies, and pricing. Its valuations often require precedent transaction analysis when accessing the selling prices of similar companies in that specific industry. If it’s a company valuation for a takeover bid, that also helps you add a control premium. All these steps and decisions require the knowledge that a finance program offers. It includes various Mergers & Accusation valuation techniques, including synergies value assessment, control premiums accounting, and enterprise value determination.

What soft skills do you require in your valuation career that you can get from a finance course?

You will be surprised by the various soft skills that a finance program offers. Some of these skills are useful when pursuing a valuation career. In this case, the major ones include effective communication, problem-solving, and critical thinking. If you need to present your valuation conclusions in ways that convince stakeholders such as clients, these soft skills are a must-have.

Can you learn valuation rules, regulations, and compliance from a finance course?

If you often deal with publicly traded companies, there are rules and regulations to adhere to during their valuation. It doesn’t mean that there aren’t rules, regulations, and compliance requirements for private companies. However, one must admit that there is leniency compared to dealing with their publicly traded counterparts. Your valuation practices should also adhere to specific frameworks. Understanding this knowledge requires you to pursue certain finance programs. Settle for the ones that cover areas such as the role of auditors, financial regulations, and accounting standards such as GAAP and IFRS.