Understanding IFRS 13 Fair Value Measurement

Introduction to Understanding IFRS 13 Fair Value Measurement

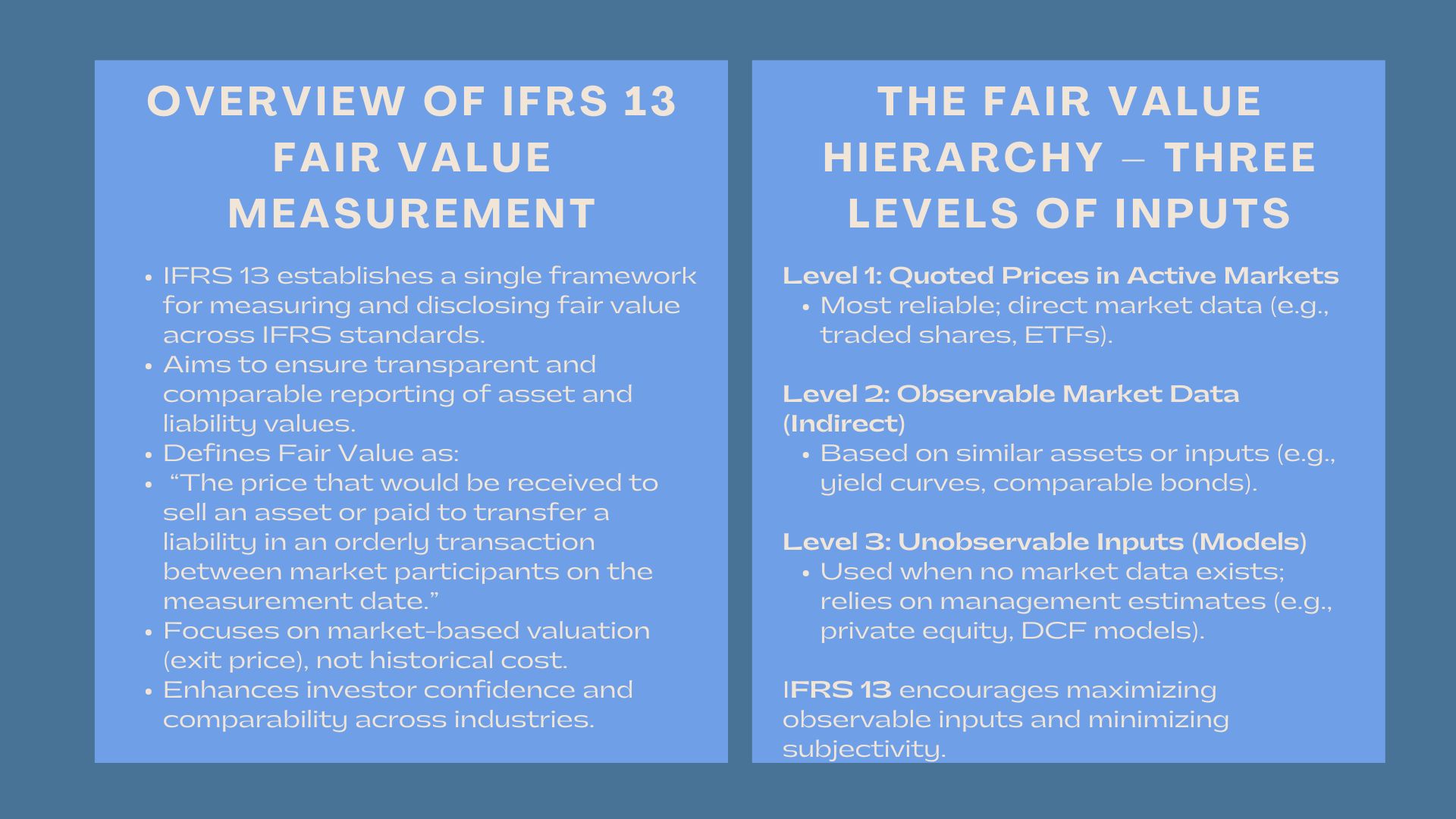

In the contemporary financial reporting, the accurate economic value of an asset is needed to make financial reporting transparent and comparable. The introduction of the International Financial Reporting Standard (IFRS) 13 – Fair Value Measurement – was aimed at creating a common standard of measuring and disclosing fair value of all IFRS standards.

Prior to the IFRS 13, the valuation guidance was inconsistent and it was being interpreted differently according to the asset classes and industries. This standard has become one consistent treatise that creates reliability and transparency among the investors, auditors and financial professionals, especially when applying fair value measurement techniques for convertible instruments IFRS 13 to ensure uniformity across financial reporting practices.

Under IFRS 13: Fair Value Definition.

Under IFRS 13: Fair Value Definition.

The Definition of Fair Value

According to the IFRS 13, the fair value is that which an asset would fetch when sold or a liability would fetch when transferred in an orderly transaction between market participants on the measurement date.

In this definition, the emphasis is placed on measurement of the market rather than entity valuation. Fair value is a viewpoint of independent and informed parties on the market. Significantly, it revolves around an exit price; the price that the asset would fetch today, as opposed to entry price.

To illustrate, when a firm in Singapore has listed shares of its formation that are actively traded on a functional exchange, the fair value of such shares will be the quoted market price of the shares. This is what the firm would realistically get in case it sold such shares in a controlled market operation.

Fair Value and Historical Cost.

Fair value is vastly different to the historical cost where an asset is valued at its purchase price. The historical cost does not show the variations in the market conditions, interest rate or technological developments.

In comparison, fair value assessment incurs that financial statements reflect current real values. An example is a machine that was bought five years back and cost RM1 million but today it is worth much less because of obsolescence. The fair value of measuring it is more reflective on its current value which helps in making better decisions.

This is the basis of the fair value measurement methods of financial reporting under the IFRS 13 where reported figures should reflect the current market value of the asset and not the old book values.

Application in Practice of Fair Value.

The application of fair value measurement in IFRS 13 would be to several types of assets and liability including:

- Financial instruments The equities, bonds, and derivatives were measured by the quoted market prices or observable inputs.

- Investment properties– estimated by using similar market transactions or discounted cash flow.

- Biological assets – biological assets e.g. agricultural produce which are measured at their market prices on the measurement date.

These applications are useful in aligning the values of assets with the actual economic realities so that investors and other stakeholders are provided with the right information that is driven by the markets.

Fair Value Hierarchy Levels for Valuation

One of the key characteristics of IFRS 13 is the fair value hierarchy, according to which the valuation inputs are grouped into three levels in accordance with their reliability and observability. Such a hierarchy enhances transparency and consistency of disclosure of valuation.

Level 1: Active Quoting in Active Markets.

Level 1 inputs are actual market prices on the same assets or liabilities in dynamically operating markets. They are the best fair value indicators as they are actual trading data.

As an example, when a company has 10,000 shares in a listed organization listed on Singapore Exchange, fair value will be the market price at the close times by the number of shares. The price is objective and easily available and there is no elaborate modeling needed.

Level 1 types of inputs would have typical applications:

- Traded securities as well as exchange-traded funds (ETFs).

- The bonds and commodities that are actively traded.

They present the transparentst measure of the fair value and the least subjective.

Level 2: Other input that is observable other than Level 1.

Level 2 inputs are made when the same pricing in the market is not given. These can be seen to be related to the same assets or liabilities. This can be in the form of yield curves, interest rate swaps and quoted prices of similar instruments.

As an example, the value of a corporate bond which trades rarely may be based on market information of other bonds having the same credit rating and maturity dates. Risk or liquidity differences are adjusted.

Level 2 inputs are typical for:

- Off-the-balance sheet (OTC) derivatives

- There are certain fixed income instruments.

- Real estate pegged on similar property sales.

This level provides a compromise between market facts and professional appraisal value.

Level 3: Unobservable (Complex Valuation Models) Inputs.

Level 3 is applied when observable data is absent. They are very dependent on the internal models, the assumptions of the management, and the unobservation data.

This appraisal is done on such assets as private shares of companies, tailor-made derivatives or distinct machinery. Widespread ones are the discounted cash flow (DCF) and option pricing.

Since Level 3 is more subjective, IFRS 13 will entail disclosures of assumptions and sensitivity analysis in detailed disclosures. This is to provide transparency and enable the user to evaluate the impact of changes in estimates on reported values.

As outlined in a practical guide to applying IFRS 13 fair value hierarchy in asset valuation, entities should maximize observable inputs and minimize reliance on unobservable ones to enhance credibility and comparability.

Practical Fair Value Measurement Examples

Measuring Equity Securities at Fair Value

Suppose a company holds listed equity investments. On the reporting date, the market price per share is RM10, and the company owns 60,000 shares.

Fair value = RM10 × 60,000 = RM600,000.

This measurement is based on Level 1 inputs because it uses an active market price. If the market becomes illiquid, Level 2 data—such as comparable securities—might be used instead.

This example illustrates how fair value measurement techniques under IFRS 13 for financial reporting reflect actual market data, ensuring assets are not overstated or understated in the financial statements.

Valuation of Derivatives under IFRS 13

In the case of a company but uses forward exchange contracts to hedge the currency risk, fair value is calculated by relating the contracted exchange rate to the current forward rates, discounted to the present value.

As an example, a Malaysian exporter who has a six-month forward contract to sell USD1 million will calculate his fair value using market observables such as interest rate curves and the spot exchange rate.

Since such data points are perceived and not quoted against the same contracts, the valuation is at the Level 2.

Valuing Complex Assets with Level 3 Inputs.

In Singapore, a proprietary software license belongs to a privately owned technology company. As the similar licenses have no active market, a discounted cash flow (DCF) method is employed:

- The amount of income that will come out of the license in the future.

- Determine the price of risk and cost of capital.

- Discounted future cash flow is brought to the current value.

- Make allowances over uncertainties like obsolescence or competition.

This model relies on internal forecasts hence it qualifies as a Level 3 valuation. Under the IFRS 13, the important assumptions, methodologies, and the possible valuation effects of the changes in inputs are to be disclosed.

Challenges in the application of IFRS 13 in practice.

Although there is structure in IFRS 13, it is a matter of professional judgment. Key challenges include:

- Choosing the right valuation methods of the complex assets.

- Estimating market player assumptions in the case of limited data

- Consistency between periods of reporting.

- Adhering to level 3 assets disclosure requirements

In the case of the companies that are in dynamic industries, including technology, renewable energy, and real estate, these issues necessitate the presence of qualified valuation experts who are capable of making sense of both visible and invisible market indicators.

Conclusion

The IFRS 13 provides a uniform world standard of fair value accounting that provides consistency, transparency and market-based reporting. It improves the plausibility of financial reports by specifying fair value, organizing its inputs into three levels of hierarchy, and offering standards on complex valuations.

Regardless of the type of equity investments, derivatives or intangible assets, the concepts of IFRS 13 will enable organisations to report financial data that best represents the actual market conditions. Since companies in Singapore, Malaysia, and others have continued to develop, the issue of fair value measurement remains crucial to accountants, analysts, and valuation experts who would seek to ensure that the international financial reporting standards are observed.