IFRS 2 Share-Based Payments: Valuation and Fair Value Measurement

Comprehensive IFRS 2 Valuation Course

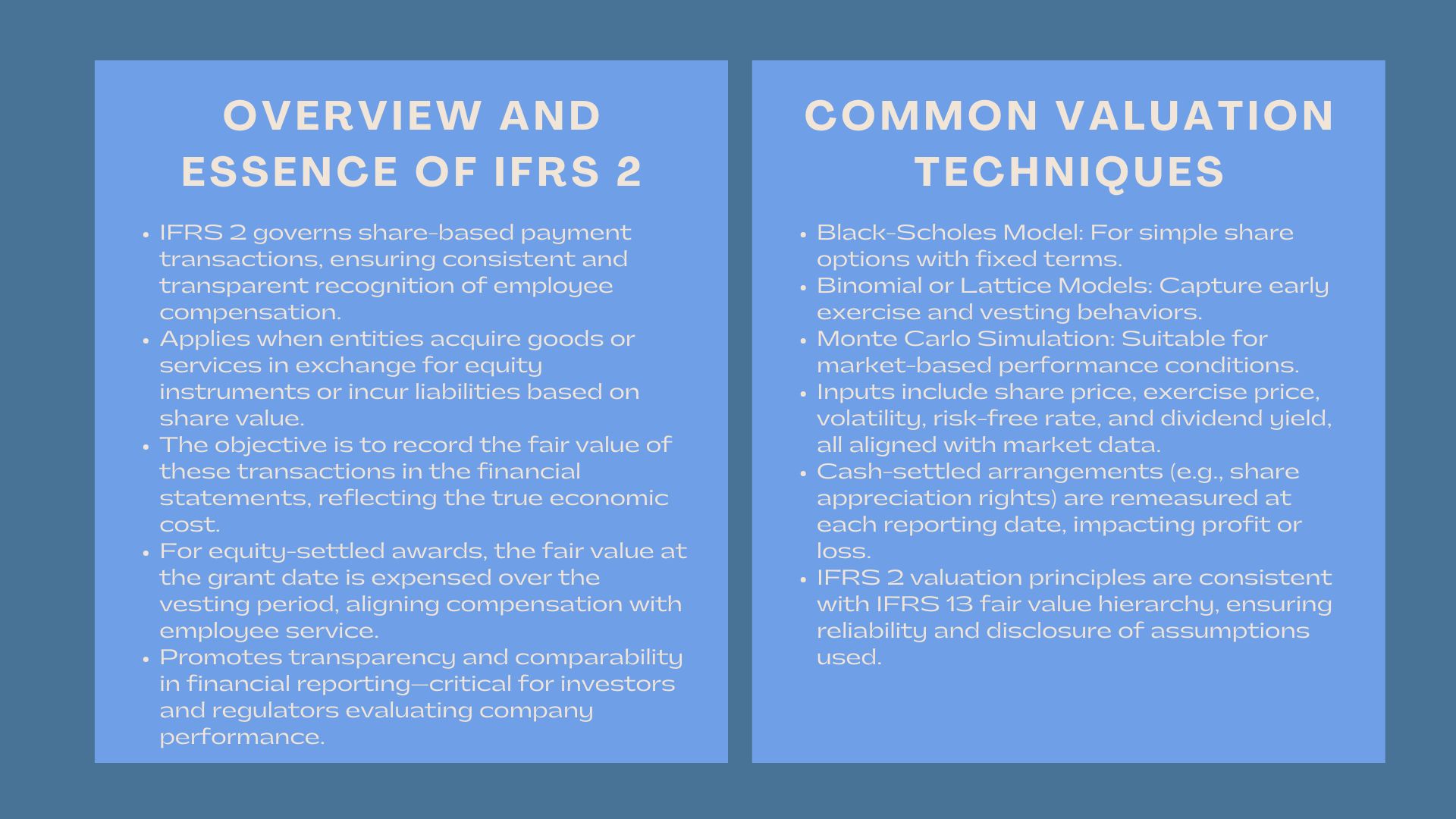

Share-based compensation is an important aspect of the contemporary compensation strategies, especially where the company wants to attract and keep the best talents. These transactions should be measured and reported in fair value under the International Financial Reporting Standard (IFRS) 2 so that the same transactions are transparent and comparable across variations.

The paper examines the role of IFRS 2 in recognizing, measuring, and reporting payments made in shares based on equity, cash-based arrangements and identifying the most prominent fair value measurement methods applied in equity-settled and cash-settled arrangements.

The Essence of IFRS 2

The Essence of IFRS 2

The IFRS 2 is applicable to all transactions of shares-based payments wherein an entity buys goods or services in exchange of equity instruments (shares or options) or incurs liabilities considering the worth of its shares. The essence is to record the cost of these transactions in financial statements and not merely its form in the financial statements.

Under the fair value of the share options, the fair value of the options as it existed at the grant date is charged as expense during the vesting period when the employees are given share options. This will make sure that pay is balanced with the time employed by the workers.

Valuation Approaches under IFRS 2

Measuring Fair Value for Equity-Settled Transactions

For equity-settled share-based payments, companies must determine fair value using market-based valuation techniques. The IFRS 2 valuation of employee share-based payment arrangements often relies on models such as:

- Black-Scholes Model: This is applicable in the case of simple share options with fixed terms

- Binomial or Lattice Models: Flexibility to accommodate behaviour of early exercise and vesting.

- Monte Carlo Simulations: Monte Carlo can be used where performance-based payout is dependent on market conditions (e.g. share price objectives)

Such models include the price of shares, price of exercise, anticipated volatility, the interest rate which is risk-free, and anticipated dividend yield. Although, in some cases, it is not possible to do so, the IFRS 2 stresses that these assumptions should be in line with observable market data.

Accounting of Cash-Settled Transactions.

The cash settled arrangements (e.g., share appreciation rights) require the liability to be measured at fair value at each reporting date until settlement. Fair value change is recorded either in the profit and loss, which would increase the volatility of financial performance.

The value of the liability is determined by the use of the same option pricing models as the equity-settled awards, similar to approaches taught in the Accounting Equation Training Course Singapore, except that they are calculated constantly to account for changes in share prices and other market factors.

The Fair Value Measurement Techniques.

The concepts of fair value measurement under the IFRS 2 have close association with that of IFRS 13. The inputs that entities use need to be the most reliable and the methods and assumptions of valuation adopted need to be disclosed.

For complex share-based compensation plans, the fair value measurement techniques for share-based compensation under IFRS 2 may involve:

- The modification of expected life assumptions to show early exercise behavior.

- Including non-market conditions in the performance estimates in vests.

- Based on market consistent volatility estimates using past data and peer analysis.

These modifications make the reported fair value as a true reflection of the actual economic cost of employee remuneration.

Principles of Accounting and Recognition.

Equity-Settled Awards

The fair value of the equity instruments granted should be realized as an expense within the vesting period.

Charge-in the same in equity (usually “share-based payment reserve”).

Do not make any changes in the amount that has been recognized prior to the vesting date, despite a change in the fair value.

Cash-Settled Awards

- Identify a liability on the goods or services taken.

- Re-evaluate the fair value of the liability at every reporting date to the point of settlement.

- Fair value changes in profit or loss.

These principles provide that such transactions as share-based one can be recognized in the same way regardless of the reporting periods.

Disclosure Requirements under the IFRS 2.

IFRS 2 is based on transparency. Companies must disclose:

- The type and conditions of share-based paying schemes.

- The exercise prices of the options in terms of numbers and weighted averages.

- Techniques and assumptions of fair value estimation.

- The cumulative cost identified and the corresponding equity changes/liability changes.

These types of disclosures assist investors and analysts to comprehend the impact of the share-based payments on the performance of companies as well as dilution of shareholding.

Typical Obstacles and Pre-eminent Practices.

The value of share-based payments may be complicated because of the uncertainties, market uncertainties and performance-related conditions. In order to enhance reliability, compliance:

- Independent valuation experts should be used on complex models.

- Record all the assumptions and their reasons.

- Carry out sensitivity tests to determine how varying key inputs impact on valuation.

- Periodically update the assumptions based on the changing market condition.

Why Choose ValueTeam for the Comprehensive IFRS 2 Valuation Course

ValueTeam is a reputed provider of professional training on valuation and accounting services in the area of IFRS 2 Share-Based Payments. The Comprehensive IFRS 2 Valuation Course of ValueTeam is targeting finance and audit professionals, as well as valuation specialists, to gain extensive knowledge in the area of fair value measurement and accounting treatment of share-based compensation. In contrast to generic training programs, this course will be able to provide both practical case studies and IFRS-compliant valuation methods coupled with the practical use of the option pricing models to make sure that all the participants learn not only the technical material but also the practical knowledge.

ValueTeam has got an advantage in the experience and expertise in the industry. The course is delivered by the qualified experts of the valuation and IFRS specialists with years of professional experience in the fields of financial reporting, corporate valuation, and audit engagements. Their real world insights are used to fill the gap between the theoretical accounting provisions and the actual business implementation so that participants go out with the confidence that they will implement IFRS 2 provisions in their organizations. The course material is also constantly revised to capture the newest interpretations as proposed by the IASB and also the world best practices which makes it a highly relevant course material in the current dynamic financial reporting environment.

Students who attend the Comprehensive IFRS 2 Valuation Course have an excellent knowledge of accounting requirements in equity-settled share-based payments and cash-settled share-based payments. They also discuss the valuation issues that are involved with estimating fair value in different market environments, volatility assumptions and in different vesting arrangements. ValueTeam also includes the demonstration of the valuation models currently employed in the industry, including the Black-Scholes and binomial models, enabling learners to move the theory into practice.

The other motivation that professionals find ValueTeam is its focus on quality and applied learning. The small groups of classes guarantee individual attention, whereas the blended learning model, which allows integrating both instructor-based sessions and interaction workshops, boosts the engagement. When done, the participants are awarded a recognized certificate which attests to the relevant expertise in IFRS 2 valuation, a qualification that is appreciated by employers in the fields of finance, accounting and investment.

In an international market that has required transparency and consistency in the reporting of financial performance, ValueTeam in its Comprehensive IFRS 2 Valuation Course provides its participants with technical competencies, professionalism and confidence to undertake complicated share-based payment valuations in line with international standards.

Conclusion

Under IFRS 2, the shares based payments will be measured at fair value which will add more transparency and comparability in the financial reporting. Proper valuation and effective disclosure enables the stake holders to know the real cost of equity-based compensation.

Through effective valuation methods and following the principles of IFRS 2, the corporations are able to be in compliance and credible that the way they report the incentives to their employees.